How Bedrock Strengthens BTCFi Security With Chainlink Proof of Reserve and Secure Mint

Security in DeFi can’t depend on trust alone. At Bedrock, we believe every restaked and tokenized asset must be verifiably backed and transparently minted, leaving no blind spots between custody and creation.

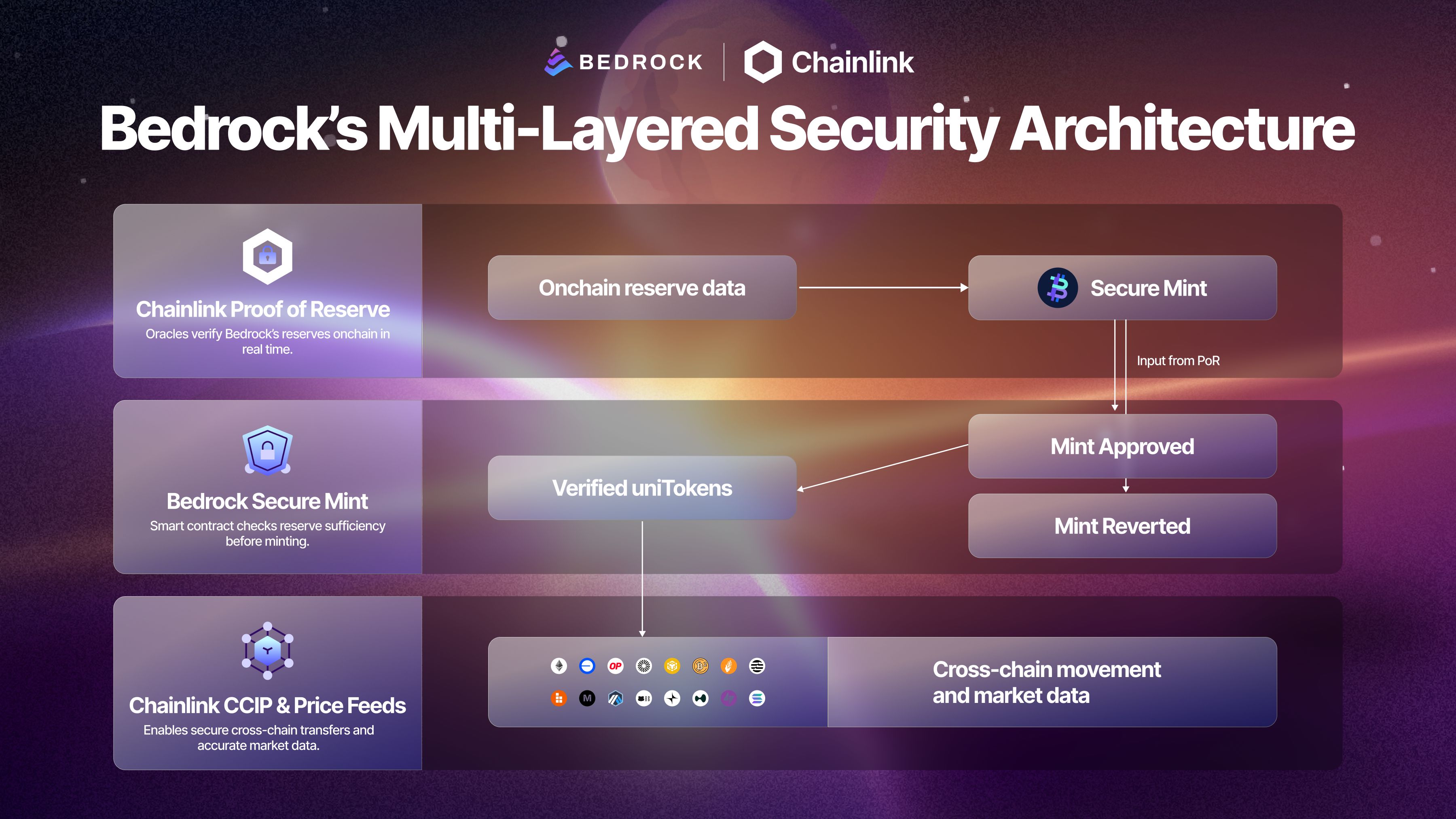

Over the past year, our integration of Chainlink has evolved from on-chain reserve verification to in-mint validation. Today, Bedrock’s BTCFi assets, such as uniBTC, are secured through Chainlink Proof of Reserve and Secure Mint, delivering real-time, on-chain assurance that every asset is fully backed by Bitcoin reserves.Chainlink’s industry-standard oracle platform has a proven security record. According to the documentation, its oracle networks have secured over $100 billion in DeFi value at their peak and enabled $26+ trillion in onchain transaction value. Moreover, its feeds are operated by independent, Sybil-resistant node operators that have demonstrated reliability even during periods of network congestion or volatility.

This makes Chainlink the most trusted partner to secure Bedrock’s collateral-backed assets.

What is Chainlink Secure Mint?

Secure Mint is an advanced capability of Chainlink Proof of Reserve that enhances the minting process for wrapped and tokenized assets. It mitigates the risk of unbacked minting by embedding a verification check directly into the token’s smart contract.

When Bedrock mints new uniBTC, the system programmatically verifies that the total supply, including the amount being minted, is always less than or equal to the verified Bitcoin reserves reported by Proof of Reserve. If reserves fall short, the minting transaction is automatically reverted.

This logic closes the last gap between proof of reserves and proof of issuance, ensuring every minted token is cryptographically linked to verifiable collateral.

How Bedrock’s Security Architecture Works

-

Proof of Reserve

Chainlink’s decentralized oracle networks (DONs) continuously monitor and publish Bedrock’s Bitcoin reserves on-chain. Anyone can verify in real time that the number of BTC held in custody matches or exceeds the total supply of uniBTC. -

Secure Mint

Before any minting action occurs, the smart contract automatically checks reserve sufficiency using the on-chain Proof of Reserve feed. If reserves fall short, the mint transaction reverts. -

Chainlink CCIP and Price Feeds

Alongside Proof of Reserve and Secure Mint, Bedrock also leverages the Chainlink Cross-Chain Interoperability Protocol (CCIP) for secure cross-chain token transfers and Price Feeds to ensure accurate market data across ecosystems, forming a multi-layered security framework for all Bedrock-issued assets.

Together, these layers create a closed verification loop that extends from minting to movement, built entirely on decentralized infrastructure.

Why It Matters

BTCFi is expanding across multiple ecosystems, and security must scale with it. Bedrock’s collaboration with Chainlink helps set a higher standard for asset-backed security, giving users and DeFi protocols confidence that every Bedrock-issued token, including uniBTC, is verifiably collateralized and safely minted.

As more projects adopt tokenized Bitcoin and restaked assets, such verification standards protect both individual users and the stability of the broader DeFi economy.

For integrators and protocols, this verification framework ensures that liquid restaking assets remain trustworthy building blocks for lending, liquidity, and structured yield products across chains.

At Bedrock, we treat security as a continuous process of verification, with every step open to onchain validation. Users can independently monitor Bedrock’s reserves in real time through the Chainlink Proof of Reserve feed, available directly on Chainlink’s data portal and Bedrock’s statistics page.

By combining Chainlink’s real-time reserve verification with Secure Mint validation, Bedrock helps define a new benchmark for asset-backed trust in DeFi and advances a model where verifiability drives confidence.

Experience Chainlink-secured minting with Bedrock. Visit our dApp to mint and stake your uniBTC, earn yield, and keep your assets liquid.

About Bedrock

Bedrock is the first multi-asset liquid restaking protocol, pioneering Bitcoin staking with uniBTC. As the leading BTC liquid staking token, uniBTC enables holders to earn rewards while maintaining liquidity, unlocking new yield opportunities in Bitcoin's $1T market. With a cutting-edge approach to BTCFi 2.0, Bedrock is redefining Bitcoin's role in DeFi, while integrating ETH and DePIN assets into a unified PoSL framework.

Bedrock continues to expand across chains. Following its recent BR deployment to Solana, Bedrock has now brought uniBTC to the network, further broadening access to BTC-backed yield opportunities. This move is part of a wider push to bring Bedrock to more ecosystems in the months ahead.

Official Links

Website | App | Documentation | Blog | X (Twitter) | Discord | Telegram

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Making of a Crypto "Veteran"

The long-term survival game of cryptocurrencies.

Visa Introduces Swift Payments with Dollar-Backed Stablecoins

In Brief Visa launches direct payments via stablecoins for freelancers and digital services. The pilot project aims to improve speed and transparency in global payments. Visa plans global expansion of this payment system by 2026.

Bitcoin Dependency Could Be XRP’s Biggest Weakness

Injective breaks down walls between Ethereum and Cosmos with its EVM