Tether’s Latest Gold Move Mirrors Central Banks

Tether is building a bullion desk like a central bank, signaling a shift toward gold-backed digital reserves amid global de-dollarization.

USDT stablecoin issuer Tether is deepening its exposure to physical gold as global monetary dynamics change. The company reportedly brought in two senior HSBC traders, Vincent Domien and Mathew O’Neill, to oversee its gold operations.

Both have decades of experience in metals trading and are expected to help Tether scale its bullion holdings.

Private Stablecoins, Public Strategy

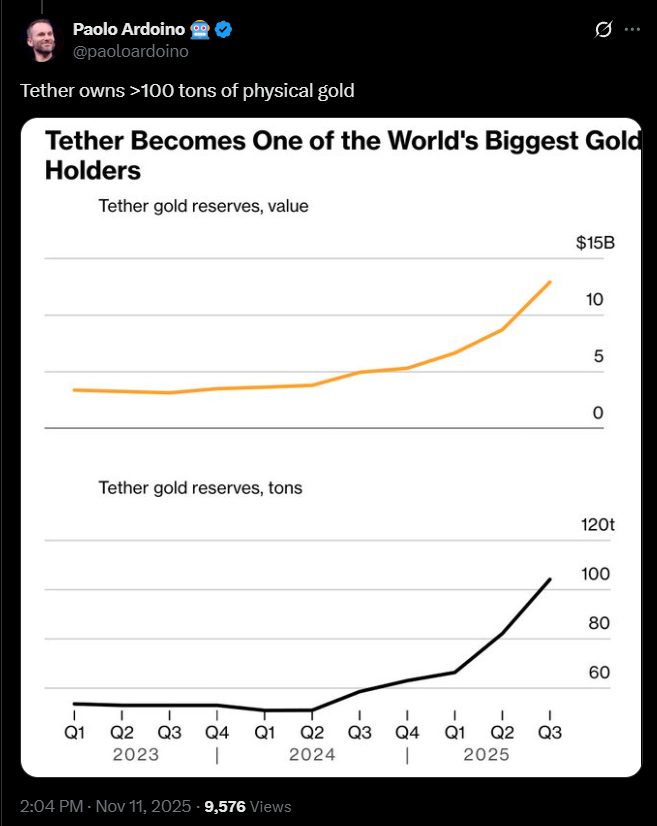

This move follows reports that Tether has already stockpiled billions in physical gold. The company is showing a strong preference for hard assets over fiat-based instruments.

Tweet From Tether CEO

Tweet From Tether CEO

The timing coincides with record central bank purchases of gold and rising global demand for non-dollar reserves.

While central banks diversify away from the US dollar, Tether appears to be following a similar path in the private sector. The company’s shift suggests it views gold as a strategic hedge—both against fiat volatility and regulatory pressure.

Unlike Circle’s USDC, which primarily holds short-term US Treasuries, Tether’s bullion reserves signal a break from dollar dependency.

Also, this divergence highlights a broader divide in stablecoin reserve philosophy: yield generation versus long-term security.

Tether’s bullion buildup could alter the perception of stablecoins from digital cash to privately managed reserve assets.

In effect, Tether is acting less like a payment processor and more like a sovereign wealth fund.

Tether isn’t stacking dollars. They’re stacking gold. $12.9B worth. If this ain’t your wake up call to go long gold I don’t know what is.

— Mr. Uppy (@MisterUppy) November 7, 2025

Tether’s Footsteps Echo of Central Bank Behavior

Central banks purchased more than 1,000 tonnes of gold in 2024, the second-highest annual total on record.

Much of that buying came from emerging economies seeking insulation from dollar-linked volatility. Tether’s accumulation of gold mirrors this pattern.

Tether’s bullion operations also introduce new logistical and security challenges. Managing physical assets within a tokenized framework demands strict custody, audit, and cyber resilience measures.

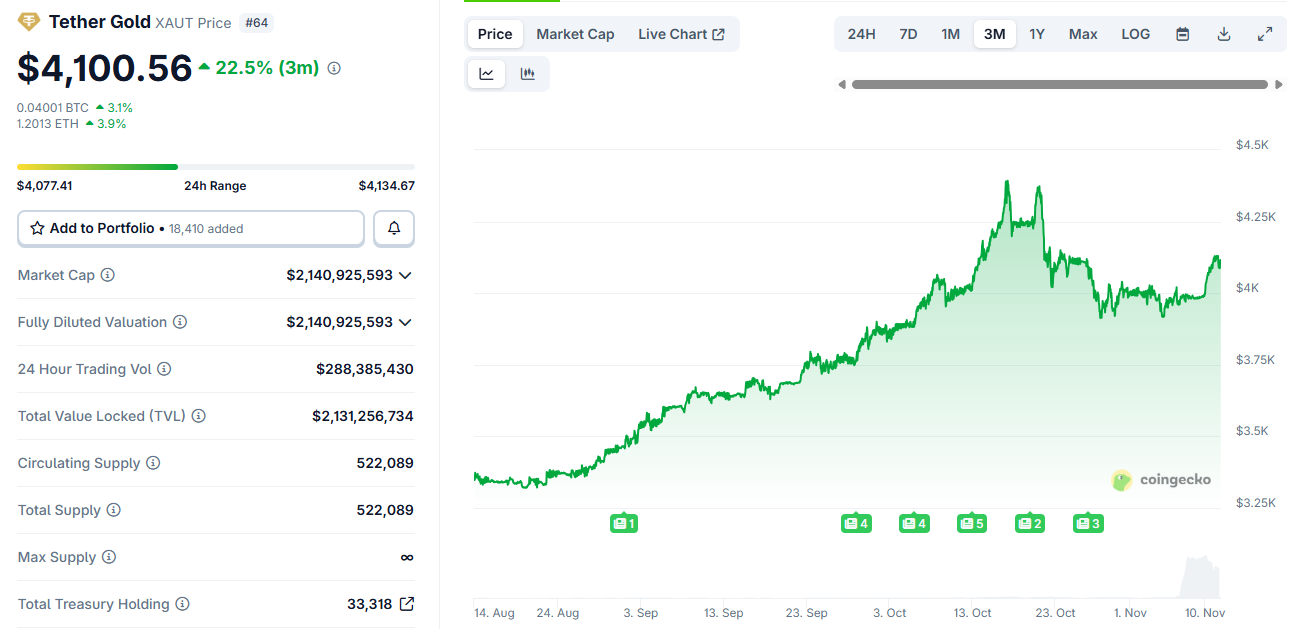

Tether Gold Token Price Chart. Source:

Tether Gold Token Price Chart. Source:

With HSBC veterans now on board, the company appears focused on building that institutional backbone.

However, transparency remains a concern. Critics argue that without frequent independent audits or full reserve disclosure, Tether’s gold strategy could face the same scrutiny that long surrounded its stablecoin reserves.

Overall, the move hints at a coming era where private entities hold diversified, multi-asset reserves rivaling national central banks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating How Vitalik Buterin's Advancements in ZK Technology Are Shaping Blockchain Investment Trends

- Vitalik Buterin's GKR protocol boosts Ethereum's scalability, enabling 43,000 TPS via ZK computation. - Institutional adoption accelerates with ZK-based compliance solutions, attracting BlackRock and Deutsche Bank partnerships. - ZK startups like zkSync and StarkNet secure $55M+ in funding, with market caps surging as infrastructure matures. - Investors target ZK-EVM compatible projects and hybrid models, aligning with Ethereum's 2026 roadmap.

ZK Technology's 2025 Price Increase: Sustained Value Driven by Blockchain Integration and Growing Institutional Engagement

- ZK technology's 2025 price surge stems from on-chain adoption and institutional investments, signaling a structural market shift. - ZK rollups now process 15,000 TPS with $3.3B TVL, driven by infrastructure upgrades and 230% developer engagement growth. - 35+ institutions including Goldman Sachs deploy ZKsync for confidential transactions, while Nike/Sony adopt it for supply-chain transparency. - Market fundamentals project 22.1% CAGR to $7.59B by 2033, validating ZK as blockchain's foundational infrastr

DASH Experiences 150% Price Jump and Growing Institutional Interest: Examining Blockchain’s Strength During Economic Uncertainty

- DASH surged 150% in June 2025 driven by tech upgrades, institutional interest, and favorable policies. - Platform 2.0 enhanced scalability and token support, positioning DASH as a competitive blockchain platform. - Institutional adoption grew in 2025 Q3-Q4 via merchant integrations in emerging markets and decentralized governance. - Macroeconomic factors like Fed policies and M2 growth boosted liquidity, while volatility persisted due to tightening markets. - Future growth depends on 2026 regulatory clar

The Increasing Importance of Stablecoins in Institutional Investment Strategies

- In 2025, U.S. GENIUS Act and EU MiCA regulations drove institutional adoption of USDC as a compliant, transparent stablecoin. - USDC's 98% U.S. Treasury-backed reserves and monthly audits made it preferred over USDT for regulated entities. - Institutions used USDC to reduce settlement delays by 35% and improve Sharpe ratios by 12% through yield-generating strategies. - With $73.7B circulation and $140B Q3 transaction volume, USDC became a 24/7 global liquidity tool for emerging markets.