TRUMP Token Explodes as $2,000 “Dividend” Promise Fuels Hype

The Official Trump (TRUMP) token has rallied sharply in response to renewed attention around Donald Trump’s proposed “tariff dividend” — a plan to send $2,000 checks to low- and middle-income Americans funded by import taxes. While the plan faces significant fiscal scrutiny, the market reaction suggests traders are pricing in the populist appeal and potential momentum such announcements bring to the Trump-themed digital asset space.

What Sparked the Surge

Trump’s weekend post promising a “$2,000 dividend” per American drew instant headlines and controversy. The proposal claims import tariffs would generate enough revenue to fund these payments while paying down national debt — a figure economists have quickly challenged.

According to the Tax Foundation, tariffs have raised about $120 billion so far, while the proposed payouts would cost an estimated $300 billion. Treasury Secretary Scott Bessent later walked back the comment, framing the “dividend” as a reflection of upcoming tax cuts rather than new checks. Still, in the world of meme and political tokens, perception drives price faster than policy. Traders saw the news as another round of populist fuel for TRUMP — a token whose price often mirrors the former president’s media exposure and campaign rhetoric.

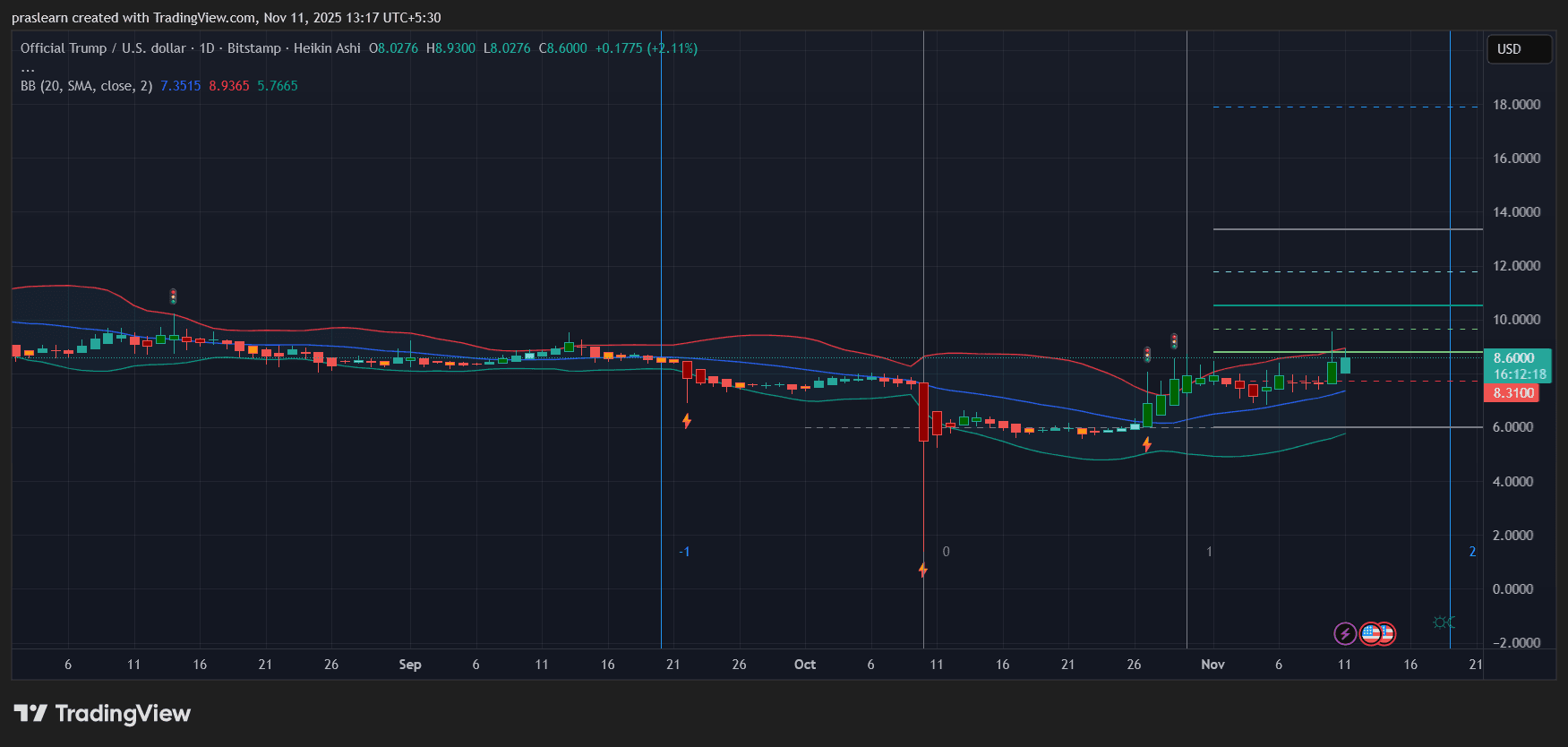

OFFICIAL TRUMP Chart Analysis: TRUMP Breaks Out from Consolidation

TRUMP/USD daily Chart- TradingView

TRUMP/USD daily Chart- TradingView

On the TradingView daily chart, TRUMP price is showing clear signs of renewed bullish strength. The Heikin Ashi candles reveal a decisive breakout above the $8 resistance zone, closing around $8.6 with a 2.11% daily gain. This move follows several weeks of sideways consolidation between $6 and $8.

The Bollinger Bands (20, 2) show widening volatility, with price now testing the upper band near $8.9. The middle band around $7.3 is acting as dynamic support, suggesting buyers are regaining control. The next resistance levels lie around $10, $12, and $14 — all Fibonacci extension targets that could come into play if momentum sustains.

Conversely, the lower band near $5.7 remains a key support level; a daily close below that would invalidate the short-term uptrend.

Momentum and Volume Patterns

The uptick in green candles since late October signals strong buying volume entering the market. The shift from low volatility to expanding Bollinger width often precedes trend acceleration. OFFICIAL TRUMP (TRUMP) price has also reclaimed its 20-day moving average, a critical reversal signal after a multi-month decline from August to October.

Momentum traders are likely eyeing a breakout confirmation above $9 for continuation. If the move holds above $8.5, the next leg could target the $10–$12 zone, while a failure to hold that range could trigger a retest of $7.2.

Political Narrative Meets Speculative Demand

The correlation between Trump’s political statements and the TRUMP token’s market activity remains strong. Each major social post or media appearance tends to trigger short bursts of speculative buying, followed by consolidation. The $2,000 dividend proposal, while economically dubious, taps into the populist narrative that fuels the project’s community.

With the 2025 political season intensifying and debates over tariffs, tax cuts, and economic populism back in the spotlight, the TRUMP token sits at the intersection of politics and speculation — a potent mix for volatility.

TRUMP Price Prediction: Can TRUMP Price Break $10?

If bullish sentiment continues and Bitcoin holds its broader uptrend, $TRUMP could challenge $10–$12 within the next two weeks. The psychological resistance at $10 is likely to see short-term profit-taking, but a close above that level could trigger a rapid move toward $14–$16 based on technical extensions.

However, traders should be cautious. The rally is sentiment-driven and not supported by fundamentals. Any retraction of Trump’s claims or a shift in media focus could pull $TRUMP back toward its $6–$7 base. The probability of a short squeeze remains high given recent low liquidity conditions.

Bottom Line

TRUMP price latest breakout reflects how political narratives continue to move the token more than economics. Whether or not Americans ever see a “tariff dividend,” the announcement has already paid dividends to traders who anticipated a volatility spike.

If the market holds above $8.3 support, momentum could carry TRUMP token toward double digits in the near term. But given its sensitivity to headlines, traders should keep stops tight — because in the TRUMP market, policy promises can fade faster than a campaign tweet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: NFT Conundrum: Rising Number of Buyers Contrasts With Sharp Drop in Sales During Crypto Turmoil

- NFT buyer participation surged 77% to 293,459 in Nov 2025, but sales volumes fell 4.97% to $72.53M, reflecting crypto market turbulence. - Bitcoin dropped below $84,000 and Ethereum fell to $2,785, dragging total crypto market cap down $390B amid macroeconomic pressures. - Analysts attribute the buyer-seller imbalance to investors shifting to safer assets, with NFTs bearing the brunt of leverage unwinds. - Projects like RaveGods and The Lost Tesla Art Car Project aim to redefine NFT utility through real-

Bitcoin News Update: Bitcoin ETFs See $3 Billion Outflow Amid Market Uncertainty and Death Cross Triggered Sell-Off

- Bitcoin ETFs lost $3B in November, with BlackRock's IBIT recording a record $523M single-day outflow amid macroeconomic uncertainty and bearish technical signals. - Bitcoin's price fell below $90K for first time since April, pushing ETF investors underwater as Fed's December rate cut odds dropped below 50% and a "death cross" deepened caution. - Options markets show $2.05B in $80K strike put open interest, while crypto miners face losses as outflows shift capital to altcoins like Solana and XRP . - Analy

Bitcoin News Update: Japan’s Calculated Crypto Initiatives Propel the Country Toward Global Leadership in Digital Assets

- Japan's strategic crypto moves, including SoftBank-PayPay-Binance Japan partnership, aim to boost retail access and institutional confidence. - FSA's reclassification of 105 cryptocurrencies as financial products signals tighter oversight, potentially attracting global capital. - Diplomatic tensions with China, fueled by PM Takaichi's Taiwan remarks, risk indirect impacts on investor sentiment and economic stability. - Bitcoin's recent dip below $90,000 spurs altcoin presales (Bitcoin Munari, XRP Tundra)

Solana Updates Today: The Crypto Dilemma—Solana ETFs Compared to Apeing's Presale Momentum

- Solana (SOL) faces mixed signals: ETF inflows ($476M since Oct 28) contrast with declining futures open interest ($7.2B vs $17B peak), raising breakdown risks below $130. - Avalanche (AVAX) shows muted 5.47% growth projections, diverting capital to high-risk presales like Apeing, which targets $0.001 listing price from $0.0001 with audit-first structure. - Apeing's presale attracts speculative traders seeking explosive returns, leveraging low entry barriers and social media hype amid bearish pressures on