On November 11, a governance proposal named "UNIfication" shook the entire crypto world. For the first time, Uniswap endowed its token with real cash flow and deflationary expectations, causing the UNI token to soar by more than 50% and igniting the entire DeFi sector.

The "UNIfication" governance proposal, jointly released by Uniswap Labs and the Uniswap Foundation, plans to activate the protocol fee mechanism and implement token burning.

This move has been interpreted by the market as a key turning point for the UNI token, shifting from a pure governance token to a productive asset supported by cash flow, and setting a new standard for value capture across the DeFi industry.

I. Breaking the Deadlock: The Core Breakthroughs of the UNIfication Proposal

After years of debate in the DeFi world over the "fee switch," Uniswap has finally proposed a comprehensive and systematic value capture solution, fundamentally changing the basic attributes of the UNI token.

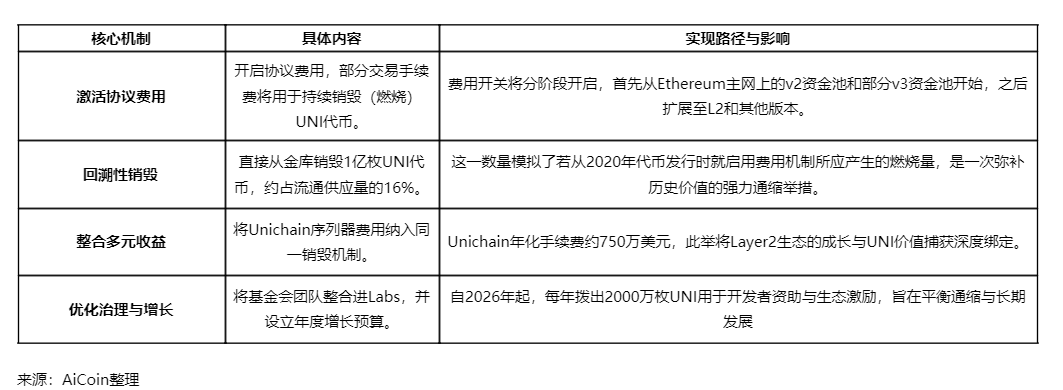

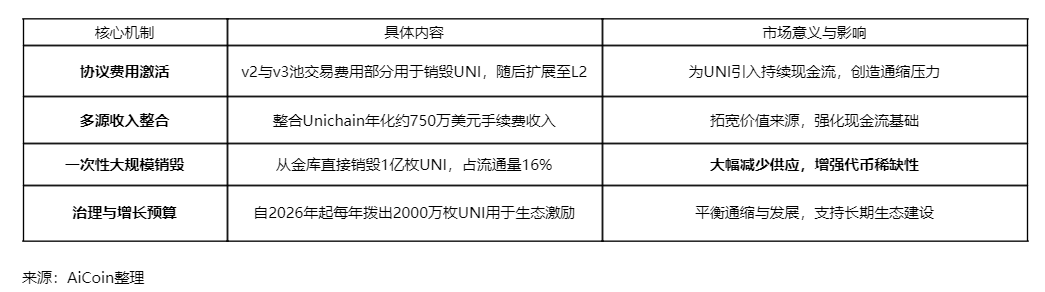

● The "UNIfication" proposal introduces real cash flow and deflationary expectations for UNI through multiple approaches. The core of the proposal is to activate protocol-level fee distribution, directing a portion of trading fees to the UNI burn pool, continuously reducing the token's circulating supply.

● This mechanism will first be implemented in v2 and v3 pools, then expanded to L2 and future versions, building a complete value support system for UNI. The one-time retroactive burn of 100 million UNI (about 16% of circulating supply) is a major move to demonstrate determination to the market, simulating the amount that would have been burned if the fee mechanism had been in place since 2020.

In addition to the core measures above, the proposal also introduces two ingenious mechanisms to enhance the protocol's revenue capacity:

● Protocol Fee Discount Auction: Users can bid for the right to "trade without protocol fees." This mechanism not only brings new capital inflows to the burn pool but also helps the protocol internalize MEV revenue, thereby increasing returns for liquidity providers.

● Aggregator Hooks: In Uniswap v4, the protocol will be upgraded to an on-chain aggregator, able to collect fees from external liquidity sources and execute token burn logic, further expanding the potential scope of protocol revenue.

II. Mechanism Analysis: Four-Dimensional Value Reshaping

The UNIfication proposal, through the design of four key mechanisms, constructs a complete token economic system, bringing fundamental value reshaping to UNI and the entire DeFi sector.

The table below provides a detailed analysis of the core measures and expected impacts of the proposal:

● Uniswap can use approximately $460 million in annual fees to buy back and burn UNI, with an annualized deflation rate of about 5%. This data points to UNI becoming the first "valued token" among DeFi blue chips, with valuation metrics of approximately 21x P/E and 3.5x P/S.

III. Market Reaction: Sector Resonance and Value Discovery

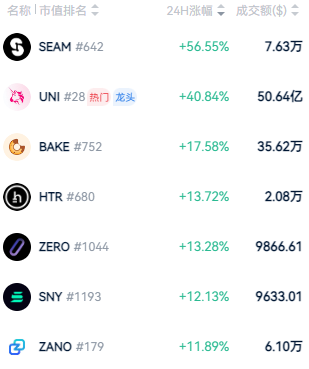

After the release of the UNIfication proposal, the market reacted swiftly and strongly.

● The UNI token surged more than 50% within 24 hours, breaking through $10, with a market cap surpassing $6 billion, re-entering the top 30 crypto assets. This market performance far exceeds that of ordinary positive events, reflecting investors' strong recognition of UNI's value re-rating.

● More importantly, UNI's strong performance triggered resonance across the entire DeFi sector. Decentralized exchange tracks and DeFi tokens with similar value capture potential have generally attracted capital attention, showing the market's high recognition of the "cash flow + deflation" model for DeFi projects.

This sector-wide linkage in market performance suggests that DeFi may be transitioning from the era of pure "governance tokens" to the era of "cash flow tokens."

IV. A New Era for DeFi: From Infrastructure to Economic Entity

This transformation by Uniswap marks the beginning of DeFi protocols evolving from "public infrastructure" to "sustainable economic entities," a significance that far exceeds the upgrade of a single project. This transformation coincides with the overall trend of DeFi development in 2025.

● DeFi infrastructure has become mature, and regulatory frameworks are gradually becoming clearer, creating the conditions for protocols to undergo such fundamental economic model changes.

● Uniswap founder Hayden Adams pointed out: "In the past few years, we have gone through a harsh regulatory cycle and paid a huge price. Now the environment is starting to improve. UNIfication marks a new stage for Uniswap, realigning the token, protocol, and community."

● From a broader industry perspective, power is shifting from centralized exchanges to transparent, code-driven platforms. When the next wave of market liquidity arrives, decentralized entities are expected to capture most of the value.

V. Coexistence of Challenges and Opportunities

Although the UNIfication proposal brings huge positive changes to Uniswap and the entire DeFi sector, the future is still full of challenges. The proposal still needs to be approved through Uniswap DAO's community governance vote before it can be implemented, and this process carries uncertainties.

● Even if the proposal passes smoothly, balancing the deflationary mechanism with funding for ecosystem development remains a major challenge. The proposal plans to allocate 20 million UNI annually from 2026 onwards for developer grants and ecosystem incentives, which will partially offset the deflationary effect of the burn.

● From a market competition perspective, as the leading DEX with cumulative trading volume exceeding $4 trillion, Uniswap's move will undoubtedly set a new standard for the entire DeFi industry. Other mainstream DeFi projects are likely to follow suit, launching similar token economic models and driving the industry toward greater sustainability.

The table below compares the structural advantages of DeFi and CeFi, showcasing the future prospects of decentralized trading:

With the launch of the "UNIfication" proposal, DeFi is moving from the farming era reliant on inflationary incentives to a value era based on cash flow. The surge in UNI's price is not just a reaction to a single event, but a recognition of the evolution of DeFi's fundamental value model.

When Uniswap founder Hayden Adams says "UNIfication marks a new stage for Uniswap," he is pointing to a much grander future—DeFi is no longer just an imitator of traditional finance, but a new generation financial ecosystem that is self-sustaining and continuously evolving.