Is the x402 Crypto Ecosystem Losing Steam? What the Data Shows

The AI-powered x402 network faces a sharp activity slowdown, yet new Chainlink and Bio Protocol integrations have kept adoption rising and pushed its market cap above $12 billion.

The x402 ecosystem has experienced a significant decline in activity, with its 30-day trading volume plummeting by nearly 90% and transaction counts falling in tandem.

The drop raises broader concerns about whether the crypto meta may finally be losing momentum.

Sharp Decline in Trading Activity Signals Waning Interest in x402

x402 is an internet payment protocol built to enable autonomous AI agents to execute verifiable, automated on-chain payments through standard web infrastructure.

BeInCrypto previously reported that the ecosystem gained significant traction in October, drawing widespread attention from the crypto community. In fact, many low-cap coins within the x402 ecosystem saw their values quadruple amid the surge in interest.

However, the latest data from x402scan highlights a modest downturn in ecosystem activity. On November 3, the protocol processed about 3 million transactions alongside $2.8 million in daily trading volume.

The latest snapshot shows the transaction counts slipped to 1.3 million, marking a 56% decrease. Meanwhile, the trading volume has also dropped to around ₹329,000. Coinbase accounted for most of the ecosystem activity, handling more than 873,500 requests and $306,730 in volume in the last day.

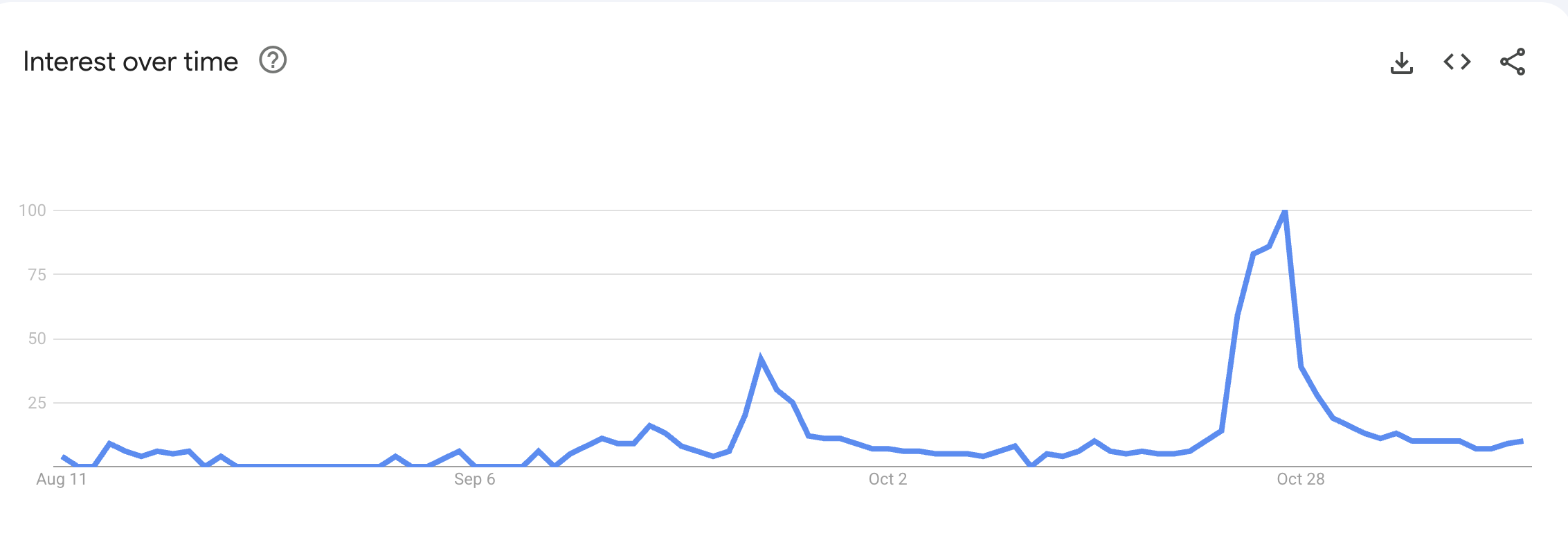

The contraction has also been echoed in retail sentiment. Google Trends shows that global search interest in “x402” dropped from a peak score of 100 to 10, signaling a decline in public attention.

x402 Retail Interest. Source:

Google Trends

x402 Retail Interest. Source:

Google Trends

Ecosystem Growth Remains Strong

Despite this, the x402 protocol has continued to build institutional credibility. Last week, Chainlink (LINK) integrated an X402 endpoint into its Chainlink Runtime Environment (CRE).

Through this update, autonomous agents can now discover CRE workflows, verify outcomes using Chainlink, and settle directly on-chain. Furthermore, it allows workflow creators to earn per use.

“This integration also unlocks programmatic payouts and a reusable workflow marketplace. For example, an insurer covering farmers against drought can verify rainfall through CRE and route instant onchain payouts all without a claim filed,” Coinbase posted.

In parallel, Bio Protocol (BIO), one of the notable projects in Decentralized Science (DeSci), revealed that its agents now use X402 and embedded wallets to enable instant USDC micropayments on Base, a clear sign of growing real-world adoption across emerging decentralized sectors.

“What this unlocks: Hypothesis review marketplaces, AI agents pay each other and human researchers for specialized analysis, Pay-per-query instead of subscriptions, On-demand access to premium datasets,” the team noted.

With these integrations, the total market capitalization of the X402 ecosystem has increased to over $12 billion from just $800 million in late October — a gain of more than 1,300% in approximately two weeks.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SUI News Today: SUI’s Contrasting Sides: Real Estate Reliability Versus Cryptocurrency Fluctuations

- Sun Communities (SUI) reported strong Q4 earnings but faces insider selling and a -4.51% ROE, while Sui blockchain's Grayscale trust (GSUI) expands crypto access via OTCQX. - Analysts raised SUI's price targets to $143, yet dual market exposure creates volatility risks as real estate stability contrasts with crypto's speculative nature. - GSUI's regulated structure offers crypto exposure but carries premium/discount risks, complicating investor sentiment amid diverging narratives for the SUI ticker.

WLFI's Buyback Blitz: Boosting Confidence or Hiding Market Concerns?

- Trump-backed WLFI accelerated $10M token buybacks, repurchasing 59M tokens in six hours, boosting prices over 5% via Strategic Reserve address activity. - On-chain buybacks contrast with WLFI's weak stock performance (ALT5) - $191M market cap vs $1.1B token holdings, highlighting investor sentiment disconnect. - Trump family's crypto entanglements, including executive pardons and industry partnerships, raise regulatory scrutiny despite project's compliance claims. - Analysts question long-term viability

HBAR's Surge Falls Short of Technical Benchmarks as Crucial Thresholds Shape Its Outcome

- HBAR's 26% price rebound from $0.12 lacks sustained bullish momentum, with key technical indicators signaling potential reversal risks. - The cup-and-handle pattern on the 4-hour chart is unraveling, as the declining Bull Bear Power (BBP) indicator suggests weakening buyer control despite a 4% 24-hour gain. - HBAR remains trapped in a falling channel, with the Chaikin Money Flow (CMF) below zero since November, highlighting absent institutional support for the rally. - Traders now monitor critical levels

Ethereum Update: Institutions Accumulate ETH as Price Nears $3K and ETFs Experience Inflows

- Ethereum nears $3,000 resistance as institutions accumulate 300,000+ ETH and ETFs see $93M inflows. - Technical indicators show mixed signals: bearish death cross risks vs. bullish RSI/MACD divergence. - Fed's December rate cut (81% expected) could boost ETH, but liquidity constraints may prolong bearish phase. - Upcoming Fusaka upgrade with PeerDAS drives ETH/BTC ratio to record highs, outperforming Bitcoin for first time in months.