Monad Faces Community Backlash After Unveiling Tokenomics

Layer 1 blockchain Monad has revealed plans for a public offering of its native token on Coinbase’s new token sale platform, with 7.5% of the total MON supply offered at a $2.5 billion valuation, implying a $187 million raise if fully subscribed.

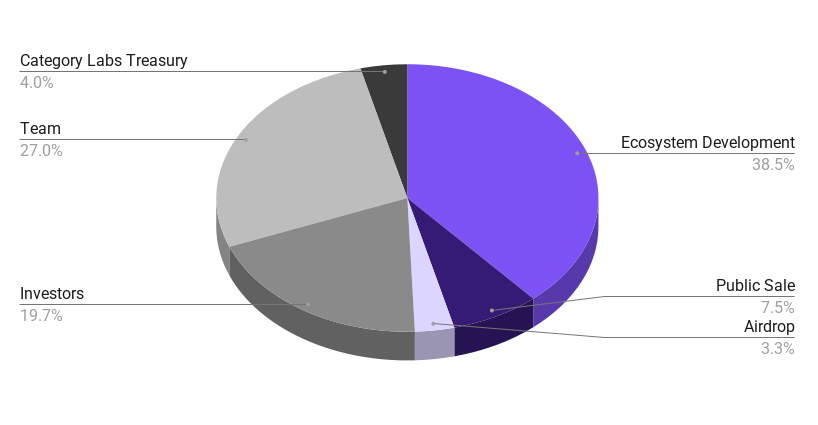

Alongside the announcement, Monad also unveiled its tokenomics, which have left users and community members fuming. Just 3.3% of the total MON supply will be airdropped, with another 7.5% distributed during the public offering, meaning only 10.8% of the total supply will be available to the average retail user.

Meanwhile, investor, team, and treasury allocations account for more than 50% of the total supply.

While the MON pre-market on Hyperliquid trades at a $6 billion valuation, community members are calling out Monad after the upcoming Layer 1 spent years preaching about how its community would be rewarded during the token generation event (TGE), only to disappoint.

Auri, a longstanding member of the Monad community with one of the exclusive “Mon” roles in the Discord, expressed frustration on X, saying, “I gotta say though this is not 'community first' tokenomics. For the first time with Monad, I feel the familiar sour taste of betrayal.”

Investors are voicing concerns as well. One user known as Monkey Rothschild, who invested on behalf of the Wassiverse NFT collection at a $600 million valuation, took to X to unleash a slew of tweets criticizing investors’ vesting compared to the public offering’s 100% unlocks, and the tiny airdrop allocation.

Rothschild said in one post, “3 years, 3%. Not sure how else to spin it, but that's just dirty work lmfao,” alluding to the fact that many users had been active in the Monad Discord for more than 3 years to receive only a 3.3% airdrop allocation.

It is also worth noting that the airdrop distribution is not exclusive to the Monad community but is shared with general EVM users, whether or not they have ever interacted with Monad.

Despite the broad pushback from community members and onlookers, some market participants welcomed today’s announcements.

“Coinbase offering + full tokenomics have made me more bullish monad tbh,” investor Cryptopathic posted today. He continued in the comments thread, insinuating that the MON token’s low circulating supply and its status as the first-ever Coinbase token offering bode well for its price action.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AI's Growing Demand for Power Pushes the Energy Industry Into an Intense Sustainability Competition

- Energy and tech sectors collaborate to address AI's surging energy demands through sustainable computing infrastructure and efficient GPU solutions. - Devon Energy and Alliant Energy boost capital spending on grid modernization and storage, aligning with AI-driven power needs while maintaining shareholder returns. - NVIDIA advances open-source GPU efficiency via Nova driver, yet faces market volatility as AI sector grapples with financial risks and regulatory pressures. - Industry challenges include bala

ZEC drops 11.51% over 24 hours, Large Holder Movements and Accumulation Patterns Indicate Market Fluctuations

- ZEC fell 11.51% in 24 hours as a major whale liquidated 30,000 ZEC ($960K), facing 46% unrealized losses and a $420 liquidation price. - Binance saw $30M ZEC accumulation via coordinated whale buys, while the largest short position (0xd47) reduced losses to $10.87M amid ongoing bearish bets. - Zcash’s November 2025 halving will cut block rewards by 50%, boosting scarcity, while Grayscale’s $137M Zcash Trust highlights growing institutional interest. - Privacy-focused Zcash gains regulatory clarity under

Bitcoin News Update: Short Sellers Hit Hard as $341M in Crypto Liquidations Sparks Volatility Spike

- Bitcoin's $106,000 surge triggered $341.85M in crypto liquidations, with short sellers losing $106.75M as leverage-driven volatility spiked. - Senate's shutdown resolution boosted Bitcoin 3.93% in 24 hours, alleviating regulatory uncertainty and injecting market optimism. - Hyperliquid's $18.96M single liquidation highlighted risks of 1,001:1 leverage, as platforms amplified price swings through stop-loss mechanisms. - November's $20B in crypto derivatives liquidations revealed systemic fragility, with E

XRP News Today: XRP ETFs: Wall Street's Pathway to a $6 Trillion Ambition

- U.S. regulators fast-track XRP ETF approvals, with 21Shares, Franklin Templeton, and Canary Capital nearing launches by late November. - Analysts predict XRP could surge to $100–$1,000 if multiple ETFs debut simultaneously, potentially pushing its market cap to $6 trillion. - Ripple's $4B funding round and SEC court rulings validate XRP's utility in cross-border payments, signaling institutional adoption. - Risks persist, including regulatory delays and unmet adoption targets, though ETFs could normalize