Rumble's $767 Million Agreement with Northern Data Drives Growth in AI Infrastructure

- Rumble agreed to acquire Northern Data in a $767M all-stock deal to expand AI infrastructure and cloud computing. - Tether , owning 48% of Rumble, committed $250M in GPU services and advertising to support the merged entity. - The transaction requires regulatory approval and includes potential $200M cash payment if Northern Data sells a Texas data center. - Shareholders controlling 72% of Northern Data agreed to the 15% discounted stock exchange ratio, with 30.4% ownership in the combined company. - Rumb

Rumble Inc. (NASDAQ: RUM) has reached an agreement to purchase Northern Data AG (ETR: NB2), a German-based data center company, through an all-stock transaction valued at $767 million, signaling a significant move into AI infrastructure and cloud services. According to the deal,

This agreement is backed by

Following the news, Rumble’s shares jumped more than 25% in pre-market trading, indicating strong investor confidence in the company’s shift toward AI and cloud technology

The completion of the deal is contingent on regulatory clearance and an independent review of VAT-related issues associated with Northern Data’s offer documents

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

'Cryptoqueen' facing sentencing over $6.5B Bitcoin stash

Astar (ASTR) Price Rally: On-Chain Usage Growth and DeFi Cross-Chain Innovations Fuel Upward Trend

- Astar (ASTR) surged to $1.26 in late 2025 after Binance's CZ bought $2M in tokens, but ecosystem upgrades drove sustained momentum. - Q3 2025 saw 20% active wallet growth, $3.16M whale accumulation, and $2.38M TVL resilience amid broader DeFi declines. - Astar 2.0's 150,000 TPS cross-chain hub and partnerships with Casio/Mazda bridged Web2/Web3, enhancing DeFi interoperability. - Whale activity showed mixed signals, but strategic upgrades and $0.80–$1.20 2030 price targets highlight long-term investment

Hyperliquid News Today: The Reason 2025 Crypto Presales Focus on Practical Use Rather Than Hype

- 2025 crypto presales prioritize utility-driven projects like Noomez ($NNZ), Bonk ($BONK), and Floki ($FLOKI) with structured tokenomics and transparency. - Noomez employs a 28-stage BNB Chain price ladder, liquidity locks, and token burns to create scarcity, currently at $0.0000151 in Stage 3. - Bonk transitions from meme coin to utility-focused Solana project with DeFi integrations, while Floki combines meme appeal with metaverse and staking tools. - Presales offer early-stage advantages over listed tok

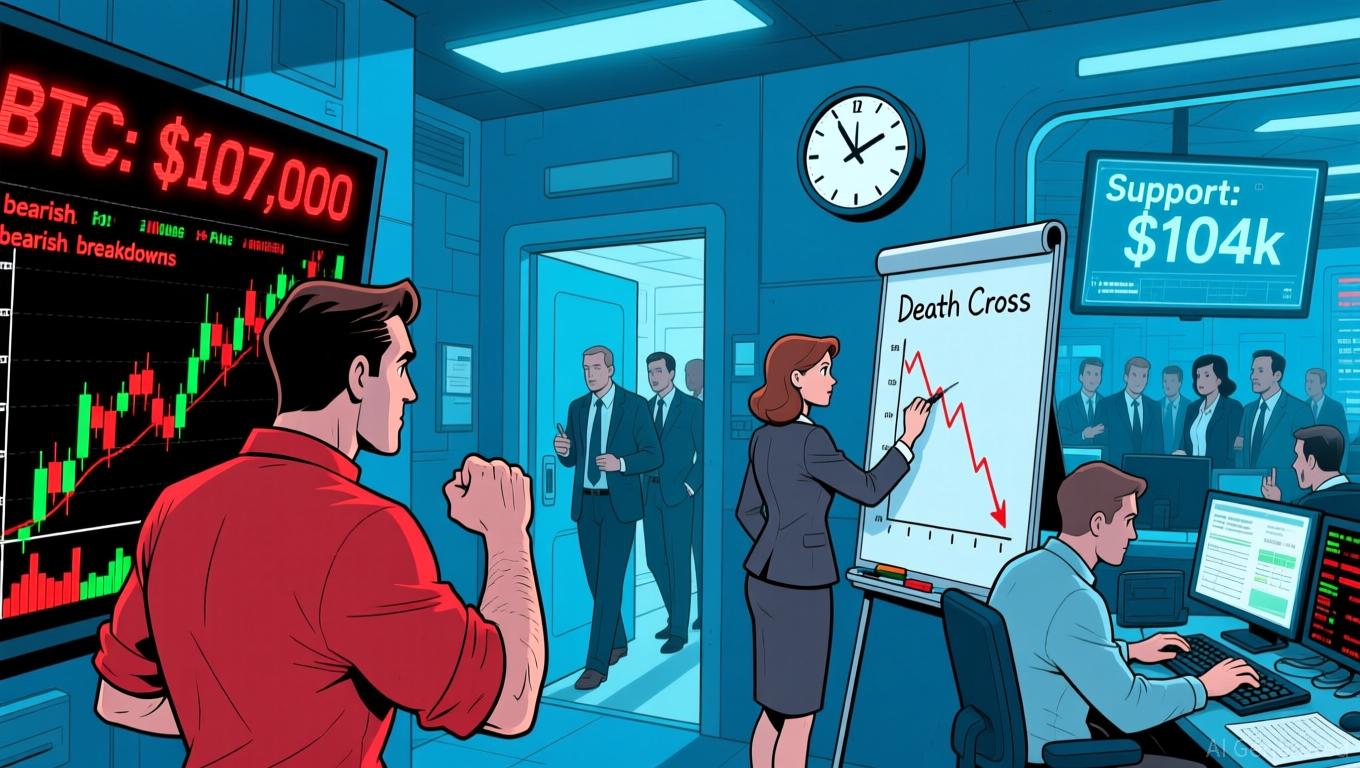

Bitcoin News Update: Bitcoin’s $100,000 Support Falters Amid Rising Death Cross and Increased Miner Sell-Off

- Bitcoin's failed $107,000 breakout triggered a "death cross" bearish pattern as 50-day SMA fell below 200-day SMA, signaling prolonged downward pressure. - Key support at $104,000 becomes critical for stabilizing BTC, with CME futures gaps potentially enabling bounces if buyers intervene. - Institutional panic selling risks accelerating declines below $100,000, with ETF liquidity "air pockets" at $93,000 amplifying volatility concerns. - Miner selling and weak ETF inflows constrain recovery attempts, whi