Biopharma raises $100M for crypto treasury to back cancer treatment

Australia-based Propanc Biopharma has announced that it has secured $100 million from a crypto-focused family office to launch a crypto treasury — a move its CEO described as “transformative” as its cancer therapy product enters human trials next year.

The private placement, structured through convertible preferred stock, provides Propanc with an initial $1 million investment and up to $99 million in follow-on funding over the next 12 months from Hexstone Capital, a family office that invests in several crypto treasury companies.

The cancer-treating biotech company stated that the proceeds will be used to build a digital asset treasury and accelerate the development of its lead cancer therapy, PRP, which aims to enter first-in-human trials in the second half of 2026.

Propanc CEO James Nathanielsz said the crypto treasury would assist a “transformative phase” for the company by strengthening its balance sheet and advancing its proenzyme-based oncology platform.

“We can target not only patients suffering from metastatic cancer from solid tumors, but several chronic diseases based upon the mechanism of action of proenzyme therapy.”

While Propanc didn’t say which digital assets it plans to buy for its crypto treasury, Hexstone’s clients have invested in everything from Bitcoin (BTC), Ether (ETH), Solana (SOL), Injective (INJ) as well as some lesser-known cryptocurrencies.

Biotech companies adopting a crypto strategy

Propanc joins Sonnet BioTherapeutics, Sharps Technology and other biotech companies that have turned to crypto to reignite investor interest.

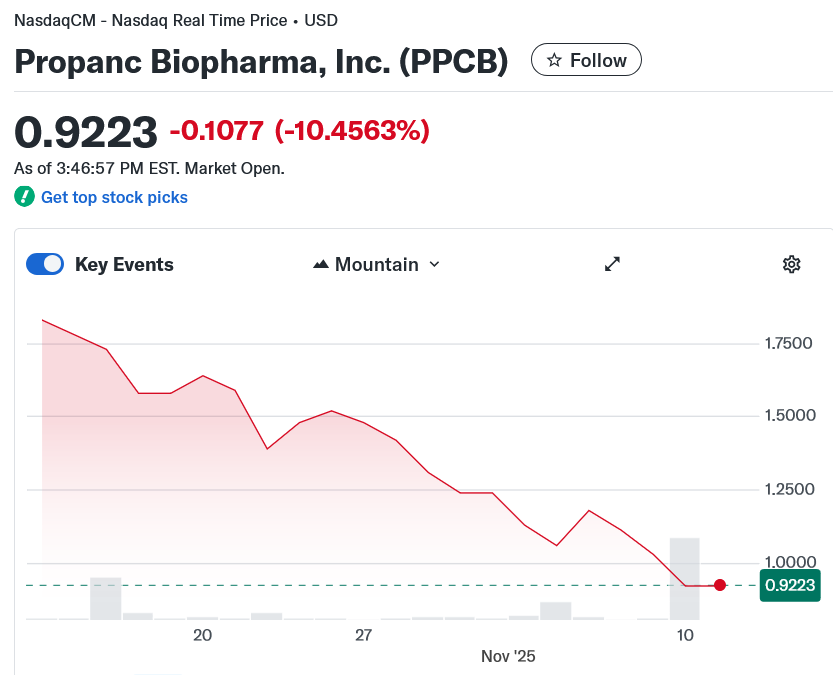

However, Propanc’s move was not received well by its investors, with PPCB shares diving 10.5% on the Nasdaq on Monday, according to Yahoo Finance data.

Crypto treasury strategies haven’t fared well lately

Bitcoin treasury holding companies have lost some of their sheen over the last few months as more companies flood into the space.

Related: ‘Most hated bull run ever?’ 5 things to know in Bitcoin this week

Even Strategy, the largest corporate Bitcoin holder, has seen its market cap slide over 43% from $122.1 billion in July to $69.1 billion today.

Metaplanet, one of the best-performing stocks on the Tokyo Stock Exchange to start the year, has been hit even harder, falling around 55% since late June, while other Bitcoin treasury companies have even had to offload some of their BTC holdings to pay outstanding debt.

Magazine: Bitcoin OG Kyle Chassé is one strike away from a YouTube permaban

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bipartisan Legislation Assigns Crypto Regulation to CFTC to Clarify Oversight Uncertainty

- U.S. lawmakers propose shifting crypto regulation from SEC to CFTC via a bipartisan bill, reclassifying most digital assets as commodities. - The draft aims to resolve regulatory ambiguity stifling innovation, building on stalled House CLARITY Act efforts during the 38-day government shutdown. - Market optimism surged as shutdown relief pushed Bitcoin above $105k, with ETF outflows persisting amid anticipation of clearer CFTC-led oversight. - Critics warn of CFTC resource constraints, while proponents hi

Solana News Update: DevvStream Invests in SOL Despite $11.8M Deficit, Shows Strong Confidence in Sustainable Blockchain Prospects

- DevvStream Corp. (DEVS) disclosed holding 12,185 SOL and 22.229 BTC, staking SOL for 6.29% annualized yield amid a $11.8M fiscal 2025 loss. - The company launched a digital asset treasury via BitGo/FRNT Financial, securing $10M liquidity from a $300M convertible note facility. - Plans include a 2026 tokenization platform for carbon credits and Solana staking, aligning with its de-SPAC/Nasdaq listing strategy. - Despite crypto market outflows, DevvStream's staked SOL attracted inflows, contrasting broader

ALGO Falls by 2.28% Over 24 Hours as Short- and Long-Term Performance Shows Mixed Results

- ALGO dropped 2.28% in 24 hours to $0.1844, contrasting with 17.29% weekly and 4% monthly gains but a 44.84% annual decline. - Traders monitor ALGO's resilience amid macroeconomic shifts, though long-term bearish trends highlight structural challenges. - Key support at $0.18 could trigger bullish momentum if held, while breakdown risks further declines toward $0.15. - A backtest analyzing 15% single-day spikes aims to assess ALGO's potential for sustained gains or pullbacks post-rallies.

BCH Gains 1.24% Following Banco de Chile’s Announcement of Bylaw Changes

- Banco de Chile (BCH) announced bylaw amendments on Nov 10, 2025, to strengthen corporate governance and align with regulatory standards. - The announcement coincided with a 10.81% 7-day stock surge, contrasting with a 2.07% monthly decline but supporting a 20.6% annual gain. - Investors viewed governance reforms positively, as such changes often signal improved transparency and accountability in regulated markets.