Will Political Calm Push ETH Price Toward $4,000?

The crypto market just caught a break. News that the U.S. government shutdown might finally end has revived risk sentiment across global markets — and cryptocurrencies are responding fast. Ethereum has jumped over 3% in the past 24 hours, trading around $3,600 after weeks of sliding. Let’s unpack what this political development means for Ethereum’s short-term outlook and where the charts suggest the price could be headed next.

Why the U.S. Shutdown Deal Matters for Crypto

Markets thrive on certainty, and for the past 40 days, uncertainty was all anyone had. The U.S. government shutdown choked liquidity, disrupted funding flows, and drained risk appetite. The Senate’s 60–40 vote to advance a bipartisan deal marks the first real step toward reopening — and traders are celebrating.

Analysts point out that the shutdown had tightened overnight funding markets, amplifying volatility. With a deal now in sight, investors are repositioning toward risk assets like crypto, anticipating looser monetary conditions and renewed fiscal spending ahead of the midterm election year.

This combination — easing political pressure, expectations of fiscal stimulus, and a softer dollar — tends to create an ideal setup for assets like Ethereum, which often tracks risk sentiment and liquidity cycles.

Ethereum Price Prediction: Signs of a Short-Term Reversal

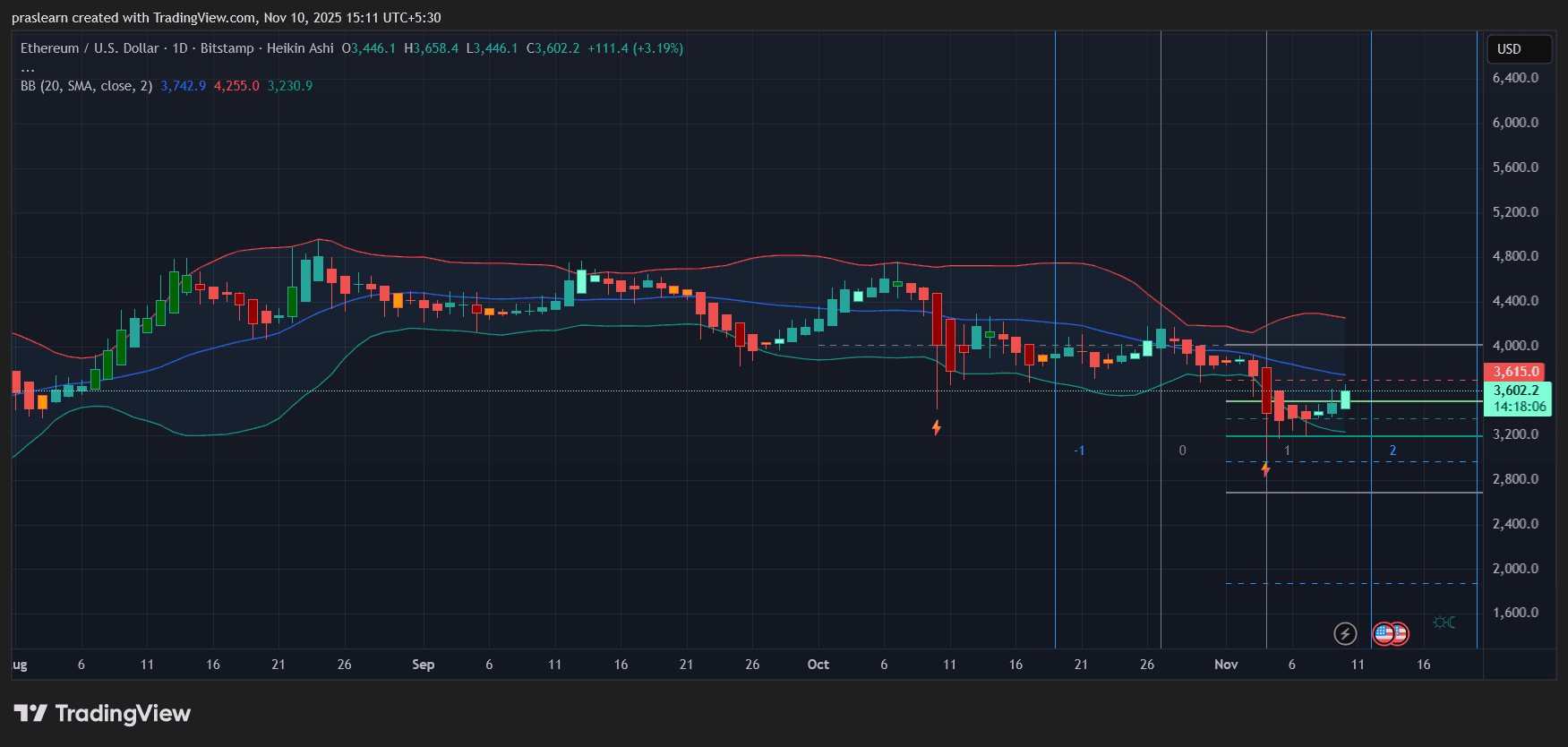

ETH/USD Daily Chart- TradingView

ETH/USD Daily Chart- TradingView

The daily Heikin Ashi chart shows Ethereum bouncing strongly from near $3,230 — the lower Bollinger Band support. The current candle is green with a long body and minimal wick, signaling sustained bullish momentum after a prolonged correction phase.

Ethereum price has reclaimed the mid-band region near $3,600, suggesting a potential reversal pattern forming after the recent low. The next technical test lies around the upper Bollinger Band at $4,255, which aligns closely with a psychological resistance near $4,200.

The 20-day simple moving average (SMA) sits around $3,742, acting as the first short-term resistance. A decisive daily close above that level would confirm a breakout and likely attract momentum buyers aiming for the $4,000–$4,200 range.

If the move fails, immediate support remains at $3,230, with a deeper retracement possibly finding footing near $3,000 — a critical round-number and Fibonacci support level from previous swing lows.

Market Psychology and Momentum Outlook

The Heikin Ashi trend reversal coincides with a potential volatility squeeze on Bollinger Bands, a pattern often preceding sharp directional moves. The last time Ethereum price compressed this tightly, it staged a 20% breakout within days.

Volume has also started to pick up, hinting at renewed participation from sidelined traders. With broader macro sentiment improving and a political resolution in sight, Ethereum could see a wave of short-covering that fuels this rebound.

However, traders should stay mindful: any setback in the shutdown negotiations or procedural delays in the House could trigger profit-taking. Crypto markets remain hypersensitive to macro headlines, especially when liquidity expectations shift.

Ethereum Price Prediction: What Could Happen Next Week

If the Senate deal passes smoothly and the House follows without disruption, Ethereum could sustain momentum toward the $3,850–$4,000 zone by midweek. In that scenario, the market narrative would pivot from fear to optimism — with Ethereum potentially testing its 100-day SMA as the next resistance cluster.

Conversely, if political friction resurfaces or the vote stalls, ETH price could quickly revisit the $3,300–$3,250 support region , where buyers are likely to defend their positions.

For now, the bias remains cautiously bullish. The combination of macro optimism, technical recovery, and improved market liquidity sets Ethereum on track for a short-term rally — but traders should watch $3,742 closely. That’s the line between recovery and relapse.

Ethereum’s latest surge isn’t just another crypto bounce — it’s a reflection of shifting macro tides. With political gridlock easing and risk appetite returning, ETH price is positioned to reclaim higher ground if it can close decisively above $3,742. The next 48 hours of U.S. political developments could determine whether Ethereum extends this move toward $4,200 or pauses for consolidation.

If the government officially reopens this week, expect $ETH narrative to flip from defensive to opportunistic — and $4,000 could come into play sooner than most expect.

📈 Want to Trade ETH?

Start now on Bitget: Sign Up Here

Check Live ETH Chart: ETH/USDT on Bitget

or You an check the Crypto Exchange Comparison.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

First U.S. Spot XRP ETFs May Launch Next Week

DTCC lists five spot XRP ETFs from top firms, signaling a potential U.S. launch next week.Who’s Behind the XRP ETF Proposals?What This Means for the Crypto Industry

MoonBull Draws Crypto Whale Attention as 1,900 Holders Spark Frenzy – Best Crypto to Invest in 2025 While CRO & ADA Price Climb

MoonBull surges as the best crypto to invest in 2025, while CRO and ADA show strong momentum. Join the $MOBU presale now and ride the early gains.Cronos (CRO) Price Updates and Latest NewsCardano (ADA) Latest Price and ForecastConclusionFAQs about the Best Crypto to Invest in 2025

Elon Musk Makes Crypto News With a $1 Trillion Package From Tesla, but the True Explosive Headlines Might Come From DeepSnitch AI

Elon Musk's new $1 trillion package from Tesla is making crypto news, but the crypto that might turn out to generate explosive headlines is DeepSnitch AIElon Musk’s $1 trillion package sparks crypto frenzyCryptos that Elon Musk would invest inConclusionFAQs

Bitcoin Opens CME Gap at $104K–$105K Range

Bitcoin creates a CME gap between $104K–$105K, sparking talks of a future price retest. Here's what traders need to watch.Why This Gap MattersWhat Traders Should Watch For