Trump's "Bitcoin Superpower" Plan: America's Monetary Hegemony Is Entering a New Crypto Phase

In a public speech in Miami, Trump announced a historically significant national vision:

“Make America the Bitcoin superpower, the global crypto capital, and the undisputed leader in artificial intelligence.”

This is not just a political slogan, but a national-level strategic shift in currency and technology.

The United States is attempting to redefine its core position in the future financial system through Bitcoin reserves, AI empowerment, and stablecoin legislation.

1. Crypto from “crackdown” to “embrace”: A complete reversal in policy tone

During Biden’s era, U.S. crypto regulation became increasingly strict,

from SEC lawsuits to CBDC experiments, the market was long shrouded in the shadow of “policy risk.”

Now, Trump has made it clear:

“The war on crypto is over. No CBDC, no national coin, only innovation driven by the free market.”

This means—the U.S. has officially chosen to support private crypto systems and to re-embrace open finance.

2. Bitcoin reserves: The government will no longer sell, but “hoard” coins

The Trump administration announced the establishment of the U.S. Bitcoin Reserve,

meaning the U.S. will no longer sell BTC seized by law enforcement, but will hold it long-term.

This move carries great symbolic significance:

Bitcoin has officially been included in the category of national strategic assets, moving beyond being a “speculative asset.”

It not only strengthens the anti-inflation reserve logic under the dollar system, but also establishes sovereign endorsement for “digital gold.”

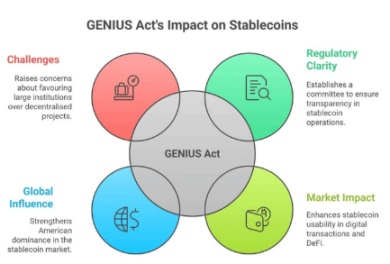

3. The GENIUS Act: Stablecoins enter the federal legal framework

As a core part of crypto policy, Trump signed the first federal stablecoin bill—the GENIUS Act.

The act clearly stipulates:

Dollar-backed stablecoins (USDT, USDC) are incorporated into the U.S. regulatory system;

Overseas issuance will be restricted, and global liquidity will flow back to the U.S. system;

Stablecoin issuers must maintain 100% dollar reserves and undergo audits.

In other words:

The U.S. will continue to export financial hegemony through the “digitalization of the dollar.”

When the world settles with USDT, it is essentially “using a digitalized dollar.”

4. Short-term impact: Capital returns, mining revival, financial openness

The direct results of the policy shift are already evident:

Crypto companies are returning to the U.S. from offshore locations;

Mining capital is expanding again, and energy states are becoming new centers;

Banks and on-chain finance collaborations are increasing, and compliance bridges are gradually being established.

The relationship between the dollar and Bitcoin is shifting from competition to symbiosis.

This is the first time the U.S. has attempted to let fiat currency and the crypto system prosper together.

5. Long-term vision: The “crypto reinvention” of the dollar’s soft power

Trump’s real goal is not simply to support crypto speculation,

but to build a “new dollar empire” through stablecoins + Bitcoin reserves.

Stablecoins become the digital extension of the dollar,

Bitcoin becomes America’s “strategic reserve,”

Together, they form a kind of financial dominance that requires no force—

“Maintaining the global status of the dollar with code, not sanctions.”

6. Artificial intelligence: The intelligent engine of crypto finance

Trump has also included AI in the national strategy, making it complementary to blockchain:

AI drives on-chain data analysis, anti-fraud, and automated finance;

Blockchain provides the foundational layer for data security and transparency;

The combination of the two forms a decentralized and intelligent economic system.

The U.S. hopes to simultaneously lead the future of algorithms and currency in this dual revolution of “smart economy + digital currency.”

7. This is not a slogan, but the beginning of a redefinition of the global order

Trump’s “Bitcoin superpower” strategy

represents America’s proactive reconstruction in the post-dollar era:

No longer maintaining hegemony through money printing, but reshaping trust through the integration of technology and capital.

Bitcoin reserves, AI synergy, stablecoin legislation—

these three together form the new framework for America’s future monetary system.

Conclusion:

The U.S. crypto pivot is not just a relaxation of regulatory policy,

but a reboot of the monetary system and geopolitical strategy.

Trump’s plan is redefining the global financial landscape:

Let the dollar and Bitcoin coexist, let AI become the intelligence layer of currency,

and let America regain economic leadership through open source and code.

If the financial hegemony of the past came from Wall Street,

then the next era of hegemony—

will come from blockchain, computing power, and Bitcoin reserves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The former legendary project ORE returns: new economic model launched, surging over 30 times in a single month

Solana co-founder Toly retweeted a post to highlight the advantages of ORE, including continuous miner incentives, staking rewards coming from protocol revenue rather than inflation, and fees being fed back into the ecosystem.

The Trillion-Dollar Battle: Musk vs. Ethereum, Who Should Win?

It is not a contest between "personal heroism" and "technical protocols", but a competition between "equity option returns" and "network adoption rate".

US Government Shutdown Ends + Cash Handouts, Will Crypto See a Liquidity Boom?

According to Polymarket data, the market estimates a 55% probability that the U.S. government shutdown will end between November 12 and 15.

The once-mythical ORE makes a comeback, surging 30 times in a single month this time

The mining protocol that caused congestion on the Solana network has returned to the stage with a brand new economic model after a year of silence.