Coretime + Elastic Scaling: Building a Productized and Sustainable Web3 Business Logic for Polkadot!

If you observe the current Web3 market, most projects’ “business models” look like this:

Issue a token → do several rounds of airdrops → create a price surge → attract speculative traffic → team and VCs cash out → project goes to zero.

This may sound pessimistic, but it is precisely the mainstream operational logic of Web3 in recent years.

Airdrops have replaced user growth, TVL has replaced product retention, and KOL promotion has replaced market validation.

The problem is, this model is not a business logic, but an incentive loop. It cannot be sustained, let alone scaled.

True business logic should be:

The project provides clear product value to a certain type of user → users are willing to pay for it → the project earns revenue → reinvests resources to optimize the product → forms a positive cycle

As an “infrastructure revolution,” Web3 can certainly have such business logic.

But what we want to say today is: most L1/L2 projects have not truly achieved this logic yet.

Most token projects cannot achieve this because:

- Tokens are not tied to real services (no product available)

- No revenue model (no one pays to use the token, pure speculation)

- No token consumption mechanism (inflation + uselessness = empty cycle)

- No governance value (DAO is just for show, voters have no responsibility)

So they can only rely on “price volatility,” not “service revenue.”

However, exceptions are starting to appear.

Polkadot, with its Coretime mechanism and elastic scaling path, is building a rare, productized, structured, and sustainable Web3 business logic path.

Before elaborating on this path, I’d like to offer some preliminary thoughts on business logic.

What is “business logic”?

From first principles, business logic is:

Solving real problems for a certain type of user and forming a sustainable value exchange and feedback loop.

It includes the following five key elements:

- Real pain points: not pseudo-demands, but problems that people truly care about and are willing to solve;

- Willingness to pay: not relying on airdrops, but users willing to pay for products or services;

- Deliverability: having the technology, the team, and the ability to deliver stable products;

- Revenue closed loop: the project can sustain itself, not endlessly relying on subsidies;

- Scalability: clear growth path, with marginal cost not rising linearly with users.

So, does the Web3 industry really have business logic?

My answer is: Web3’s “potential business logic” is valid, but many projects have not truly achieved this logic yet.

Let’s look at it from the following aspects:

First principles: What is the core value of Web3?

Web3 usually promises:

- Decentralized trust mechanisms (no intermediaries required)

- User sovereignty (control over assets, identity, and data)

- Composable open systems (anyone can build and participate)

If these values can solve real-world problems, and do so better, cheaper, and more efficiently, then they have business logic.

But in reality, the problems we encounter are:

1. Many projects do not clearly solve whose problem or what problem

- “We are an on-chain social platform”—but users don’t come, and no one pays

- “We are the next-generation asset issuance platform”—but no one is really raising funds/trading on it

- We solve more “industry narratives,” not “user pain points”

2. The model relies on speculation and subsidies, not a self-consistent revenue model

- Tokenomics is designed as “issue tokens → attract traffic → subsidize market making → exit on price increase”

- Lack of real revenue, cash flow, and retained users

3. The business cycle is broken

- No users → cannot validate product → cannot collect real data → no positive feedback

- When the money runs out, the entire ecosystem collapses

So, are there any established business logics in Web3 right now?

There are some.

- DeFi: provides real financial tools, meeting users’ needs for leverage, liquidity, and cross-border settlement (although highly financialized and risky, the business logic is clear)

- Infrastructure: wallets, cross-chain bridges, oracles, development frameworks, etc., providing “water and electricity” for other applications, with clear customers and service value

- On-chain games/content platforms (if done well): bring new forms of creation and monetization through composable assets and on-chain identity

- L2/Appchain/Rollup-as-a-Service: if they can lower the developer threshold and help build differentiated on-chain experiences, they also have business logic

- Tokenization of real-world assets (RWA): once regulations and technology are feasible, on-chain programmable assets and automatic settlement will completely change traditional financial efficiency

So, to sum up: Web3 has business logic, but it is not “automatically established.” It must start from solving real problems, not imagining a bubble closed loop around tokens.

Projects that truly achieve business logic do not just shout Web3 concepts, but use Web3 tools to solve real-world problems, forming a closed loop of “product → user → revenue → reinvestment.”

The Real Dilemma of Web3: The Proliferation of Token-Driven “Pseudo-Businesses”

Theoretically, the Web3 industry can have business logic, and for an industry to develop in the long term, it must form its own business logic. But we have to face this reality: the growth of the Web3 industry in the past has mainly relied on token incentives.

- Attract users with airdrops, who leave after claiming rewards;

- Create hype to attract attention, price crashes after the pump;

- Pretend to grow with TVL, but have no DAU or usage scenarios.

The fundamental problem with these models is: lack of real value exchange between product and market. Once incentives stop, everything goes to zero.

So, can projects that issue tokens develop a real business model?

The premise is that their token is an intrinsic part of the product’s functionality, not just a financing tool or short-term incentive.

If you only rely on token price fluctuations, that’s not a business model, it’s a speculation system.

But if a project can make users have to use the token to obtain service value, then it can become a native Web3 business system.

Therefore, for Web3 to become a real economic system, it must build products that “users are willing to pay for.”

So, at what stage is Polkadot in terms of business logic?

Financial Narrative (2019 – 2021)

Features: Token issuance, lock-up auctions, DOT investment returns.

Polkadot’s manifestation:

- Parachain slot auctions (Crowdloan) attracted billions of dollars in DOT lock-up

- Teams and developers flocked in to build various parachains

Limitations:

- Highly dependent on speculative sentiment and DOT price

- Problems with development threshold and economic mechanisms of parachains gradually emerged

Infrastructure Narrative (2022 – 2023)

Features: Rethinking Polkadot’s limitations from the ground up, emphasizing modularity, economic and technical flexibility, and cross-chain interoperability.

Polkadot’s manifestation:

- XCM became the standard for cross-chain communication

- FRAME and Substrate enabled highly modular chain development

- Slot auction model was canceled, Coretime model proposed

- Fully transitioned to OpenGov governance

Real Economy Narrative (2024 – ?)

Features: Gradually productizing computing resources, serving real scenarios, with real revenue and product closed loops.

Polkadot’s current progress:

1. Infrastructure entering the stage of real customer usage:

- Coretime is live, elastic scaling will launch at the end of August this year, and projects like Mythical Games, peaq, Hyperbridge, Hydration are ready to expand chain resources based on Coretime

- PDP one-click deployment portal is being launched, making chain deployment as accessible as SaaS products

- JAM and PolkaVM are making Polkadot’s computing resources even more powerful

2. On-chain governance becomes public service infrastructure:

- OpenGov has funded hundreds of projects in RWA, education, government, developer incentives, and other areas

3. But there are not many real users at the application layer, DAU is low, and there is a lack of “killer on-chain experiences”

- Compared to Solana’s consumer-grade NFTs and mobile wallets, Polkadot’s end products lack exposure

- The Rollup model has not yet reached end consumers (still B2B)

So, does Polkadot have business logic?

As mentioned earlier, for Web3 to truly scale, it must transition from a “token-driven incentive loop” to a “product-driven value closed loop.” The problem is, most projects are still stuck in the former stage.

But Polkadot is taking a path that few have taken, but one with greater long-term vitality.

It does not rely on a hot narrative or FOMO-driven price surges, but gradually builds one of the few real business models in the Web3 world through a set of systematic product designs. The core of this model lies in two key mechanisms:

1. Coretime: Commoditizing “blockchain operating rights”

- Coretime is “chain-level computing resources” on Polkadot, just like AWS rents out CPUs, Polkadot packages and sells its main chain core time for other projects to deploy Appchains or Rollups.

- Project teams no longer need to bid for slots or stake 100,000 DOT, but can buy computing resources by the hour, on demand, with flexible leasing.

- All resource usage must be paid for with DOT.

This means: DOT is tied to on-chain resources, resources equal revenue, revenue equals use cases, forming a positive cycle.

2. Elastic Scaling: Making resource growth an elastic product

- Any chain can start with 1 core and scale up as business grows.

- Multiple projects such as Mythical Games, peaq, Hydration, Mandala have already stated they will run production chains under the Coretime model.

The significance of this mechanism is:

Web3 resource usage can finally form a “billable / scalable / controllable” product experience, just like Web2 cloud services.

Latest news: Elastic scaling will go live at the end of August or early September! But several teams have already expressed their intention to purchase multiple cores for their own business expansion!

PDP: Productized delivery interface

The Polkadot Deployment Portal (PDP) is the landing interface for all this, providing:

- One-click Rollup deployment

- Automatic Coretime renewal

- Status monitoring, chain offline tools

The emergence of PDP marks that Polkadot is no longer a “developer’s toy,” but is truly beginning to deliver product services to Web2 teams.

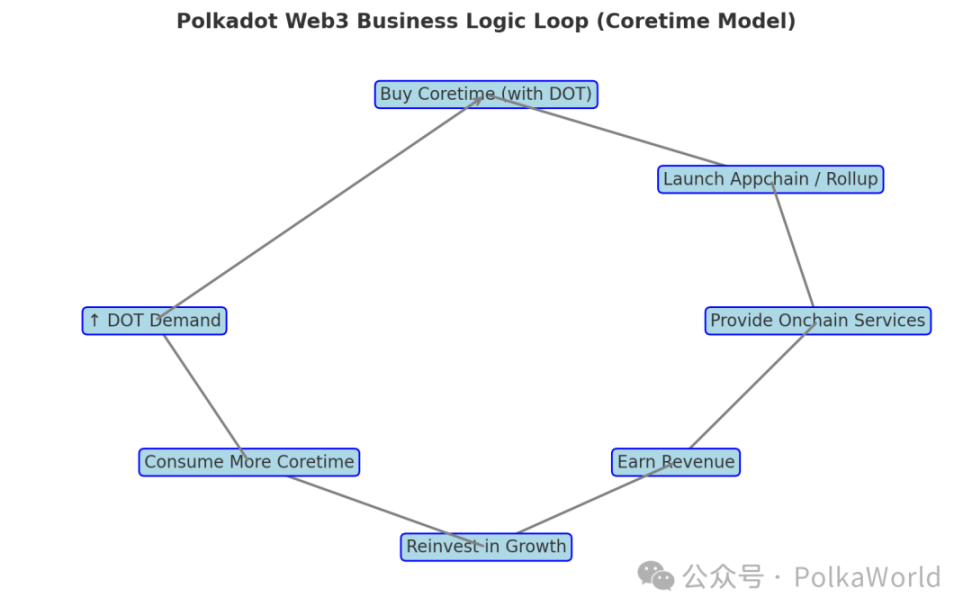

Therefore, as of now, we can clearly see the transformation of Polkadot’s model. The complete closed loop of this business logic is:

DOT → purchase Coretime → launch Appchain → provide on-chain services → reinvest revenue → increase resource consumption → increase DOT demand

Instead of:

Issue token → airdrop → create hype → exit → project dies

The difference between these two paths determines whether an ecosystem heads toward a bubble or toward infrastructure.

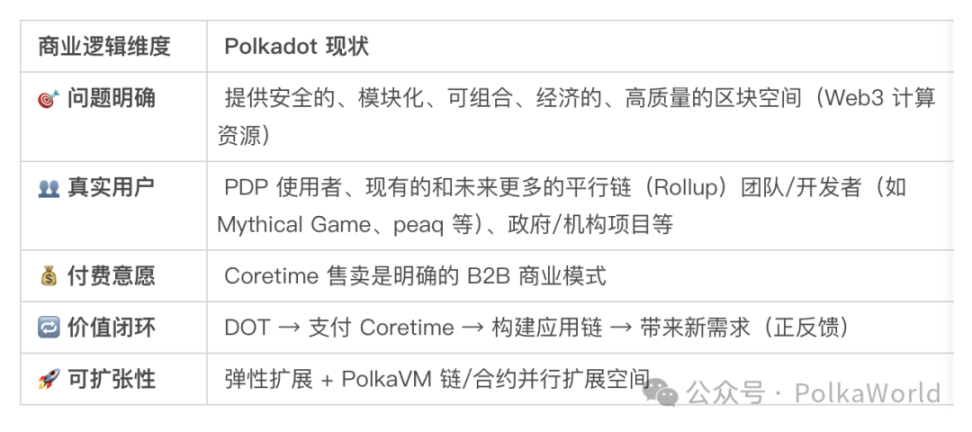

So, looking at the “five elements of business logic” discussed earlier, Polkadot is already relatively complete at the infrastructure layer:

It’s not about who moves fastest, but who achieves “sustainability” first

Polkadot’s path is not the simplest, nor is it the easiest to tell a story about, but it is the one with the most “productization + commercialization” potential.

The market mechanism of Coretime + product delivery of PDP + governance coordination of OpenGov gives it the ability to build a “real on-chain economic system.”

When more and more teams are no longer launching chains for speculation, but to serve users, build businesses, and deploy real systems by renting Coretime!

That will be the moment when Web3 truly enters the business era.

And Polkadot is laying the foundation for this!

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This year's hottest cryptocurrency trade suddenly collapses—should investors cut their losses or buy the dip?

The cryptocurrency boom has cooled rapidly, and the leveraged nature of treasury stocks has amplified losses, causing the market value of the giant whale Strategy to nearly halve. Well-known short sellers have closed out their positions and exited, while some investors are buying the dip.

Showcasing portfolios, following top influencers, one-click copy trading: When investment communities become the new financial infrastructure

The platforms building this layer of infrastructure are creating a permanent market architecture tailored to the way retail investors operate.

Ripple raised another $500 million—are investors buying $XRP at a discount?

The company raised funds at a valuation of $40 billions, but it already holds $80 billions worth of $XRP.

CoinShares: Net outflow of $1.17 billion from digital asset investment products last week.