Altcoin season signals hide in 'many weeks' of bearish BTC dominance: Analyst

The recent volatility in Bitcoin’s dominance could be a signal that altcoin season is approaching sooner than many traders expect, according to a crypto analyst.

“The reason why you should have confidence in the altcoin price action is because the BTC Dominance chart looks bearish and has looked bearish for many weeks,” crypto analyst Matthew Hyland said in an X post on Friday.

“The downtrend is favorable to continue; therefore, this relief rally has been a dead cat bounce in a downtrend,” Hyland said. In a separate video on Saturday, Hyland said that the recent volatility in Bitcoin’s (BTC) price may have been orchestrated by traditional finance giants.

“Over the past month, I’ve kind of just maintained the view that a lot of this was really just manipulation, essentially for Wall Street to set themselves up,” he claimed.

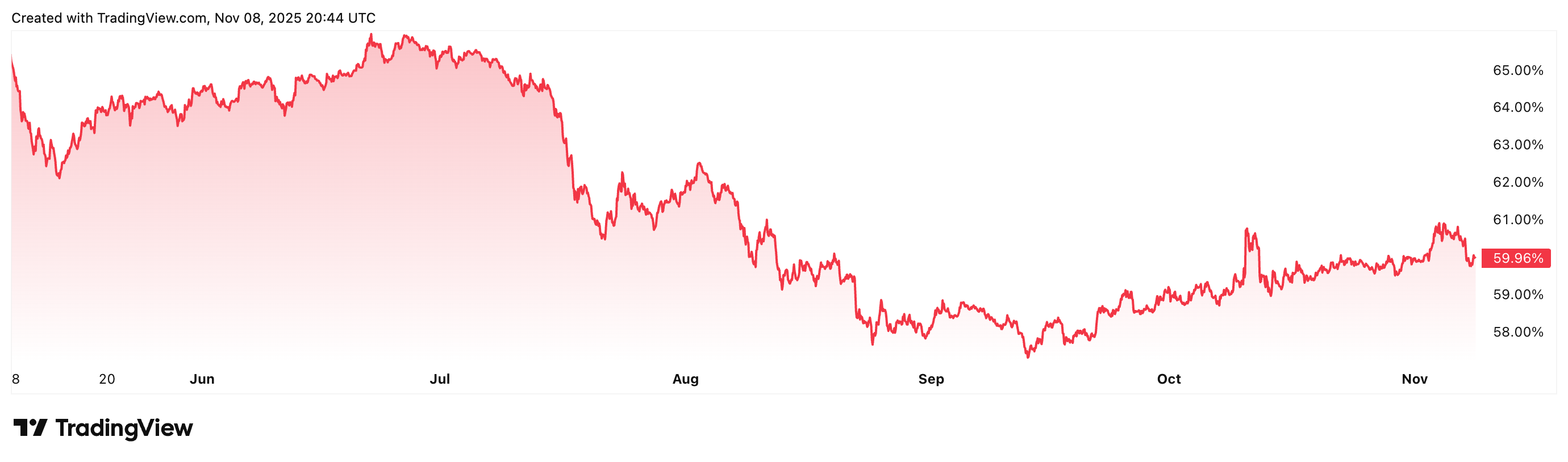

Bitcoin dominance has dropped 5% since May

Bitcoin’s dominance, which measures Bitcoin’s overall market share, is down 5.13% over the past 6 months, and holding 59.90% at the time of publication, according to TradingView.

It was only on Nov. 4 that Bitcoin slipped below the $100,000 price level for the first time in four months, leading to broader market concerns about where the asset’s price will go next.

Bitcoin is trading at $102,090 at the time of publication, according to CoinMarketCap.

While Hyland speculated that the altcoin market may gain momentum soon, other indicators, however, continue to point to a market centered around Bitcoin.

CoinMarketCap’s Altcoin Season Index currently sits at 28 out of 100, well within “Bitcoin Season” territory.

Altcoin season may be different from previous cycles

The last time the indicator signaled “Altcoin Season” was on Oct. 8, just days after Bitcoin hit a new all-time high of $125,100, when traders appeared to anticipate a rotation of capital further up the risk curve.

However, the indicator quickly plunged to risk-off mode after the Oct. 10 market crash which saw around $19 billion in leveraged positions wiped out of the crypto market.

Some crypto executives expect the next altcoin season to be more selective and concentrated than in previous market cycles.

Maen Ftouni, CEO of CoinQuant, a company that produces algorithmic trading tools, recently said that older cryptocurrencies with an exchange-traded fund (ETF) or expected to receive an ETF will soak up much of the capital deployed during the next altcoin season.

“Not every single coin is going to have massive returns; the liquidity is going to be concentrated into certain places, dinosaurs being one of them, of course,” Ftouni said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin Faces $103k Impasse as Bearish Signals Clash with Bullish Expectations

- Bitcoin fell near $103,000 on Nov. 8, 2025, amid Fed rate-cut uncertainty, trading in a $99,376–$103,956 range as technical indicators showed bearish consolidation. - Analysts highlighted key support at $98,900 and resistance at $104,000, with bullish sentiment driven by Cathie Wood’s $1M price target and Eric Trump’s “world-class asset” endorsement. - Strategy expanded its STRE offering to €620M to fund BTC purchases, holding 3.05% of circulating supply despite Bitcoin’s dip below $100,000. - Market cau

Ethereum Update: Validator Departures Point to a Streamlined and More Effective Network Ahead

- Ethereum's validator count fell below 1 million in November 2024, signaling structural shifts in staking dynamics and raising network security concerns. - Exit queues now take 37 days for withdrawals, driven by large-scale exits from Lido, Kiln, and leveraged staking unprofitability due to 2.9% annualized yields. - Experts predict consolidation toward professional operators, accelerated by Ethereum's Pectra upgrade allowing 2,048 ETH per validator. - Despite validator declines, Ethereum hosts $201B in to

ZEC Value Jumps 4.8% on NOV 12 2025 as Institutions Embrace and Privacy Advances Emerge

- Zcash (ZEC) surged 4.8% on Nov 12, 2025, to $464.06, with a 725.75% annual gain despite recent volatility. - Institutional adoption, including Grayscale's $137M ZCSH investment, and U.S. regulatory clarity via the Clarity and Genius Acts boosted ZEC's legitimacy. - DeFi integration via zenZEC and 30% shielded pool adoption highlight Zcash's privacy-driven appeal, supported by Electric Coin Company's ecosystem upgrades. - Whale activity and $500 support level analysis suggest potential for a $1,500 price

BCH Shares Rise 0.55% Today Following Governance and Earnings Announcements

- BCH stock rose 0.55% in 24 hours amid governance reforms approved at an Extraordinary Shareholders’ Meeting on Nov 10, 2025. - The bank reported slower growth due to reduced inflation-adjusted income and subdued loan expansion, with over 60% revenue from net interest income. - Governance amendments aim to enhance oversight, but technical analysis highlights risks from interest income reliance and macroeconomic exposure. - A backtest error occurred due to zero-price data, with three recovery options propo