The Great Korean Pivot: From Memecoins to Machine Chips

For years, South Korea was the global heartbeat of crypto speculation. It became the place where digital coins traded at a premium, and where retail investors moved markets overnight. The “Kimchi Premium” became shorthand for a national obsession: Rampant and frenetic trading activity unrivaled by any region across the globe.

But by late 2025, the story has reversed. The same traders who once hunted for the next altcoin gem on Upbit are now glued to Korean stock exchange tickers, swapping meme tokens for memory chips and high-bandwidth semiconductors. The crypto charts have gone quiet — and a new speculative engine has taken their place.

A market gone silent

Upbit, once the undisputed hub of Korean crypto mania, now trades at a fraction of its former pace. Average daily volumes have dropped nearly 80% from a year ago, slipping from roughly $9 billion in late 2024 to just $1.8 billion by November 2025. Bithumb, Korea’s second-largest exchange, has suffered a similar fate, losing more than two-thirds of its liquidity over the same period, according to reporting from Wu Blockchain.

What was once a nightly national pastime, the endless churn of small-cap coins and chatroom rumors, has evaporated. Even volatility itself has collapsed. Where daily volumes once swung wildly between $5 billion and $27 billion, 2025’s trading bands have flattened to a muted $2 to $4 billion range.

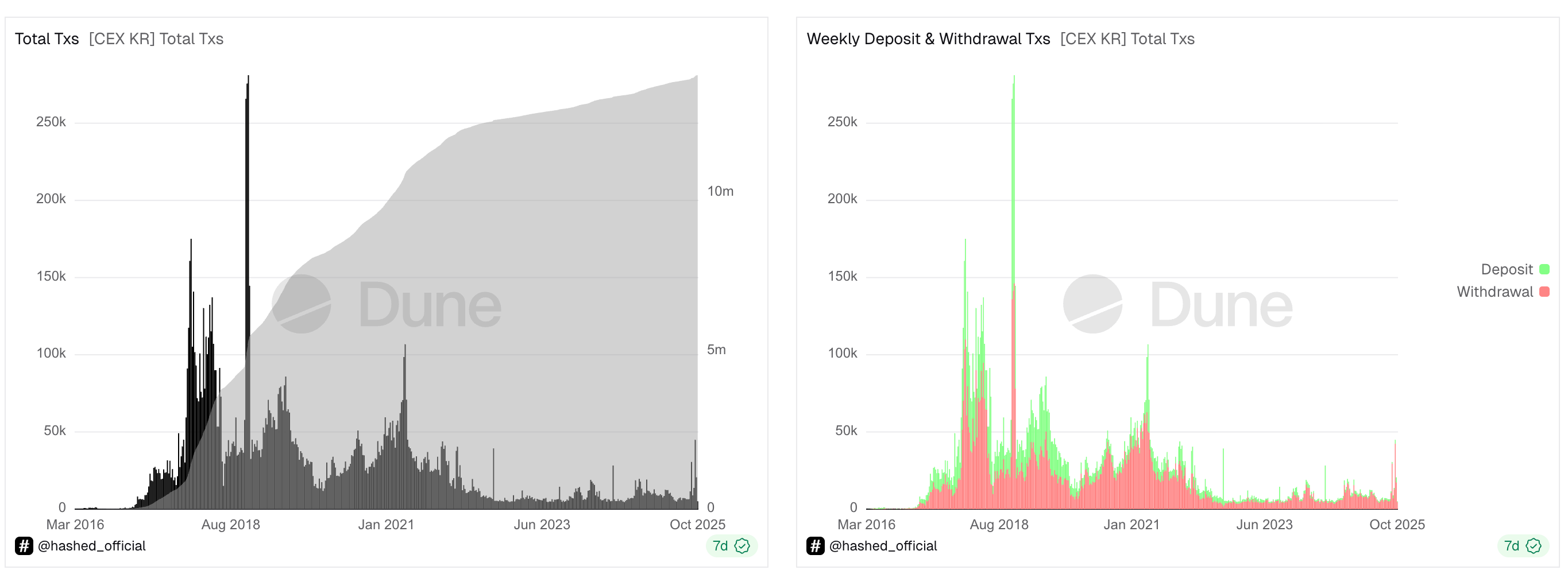

Data from analytics provider Dune shows that the drop in activity is compounded when compared to 2018, when at the mania's peak Korean exchanges facilitated 280,000 deposits per day; the daily figure hasn’t exceeded 50,000 since 2021.

The rise of a new obsession

The vacuum left by crypto didn’t last long. Retail investors simply migrated to a different table — the Korean stock market, which has staged one of the most explosive rallies in its history.

The KOSPI index has surged more than 70% year-to-date, setting a number of record highs. In October alone, it posted its strongest monthly gain since 2001, climbing 21% and logging 17 new intraday records. The frenzy has been led by AI-linked giants like Samsung Electronics and SK hynix, whose combined daily turnover now makes up more than a quarter of the entire exchange.

In a country that once traded crypto as a kind of collective hobby, the psychology feels familiar. The same spirit of retail speculation has resurfaced, only this time it’s wearing a suit of semiconductor stocks.Data reported by the Korea Times showed the amount of active trading accounts in the nation jumped from 86.57 million at the turn of the year to 95.33 million as of Oct. 31.

Retail euphoria spills over into equities

Unlike the meme-driven altcoin rallies of old, Korea’s equity boom has a more tangible backbone. AI is the global growth narrative of the decade, and Korea happens to control one of its most critical supply chains.

As Nvidia and AMD fuel much of the world’s demand for AI hardware, Korean firms like SK hynix and Samsung have become indispensable. Their dominance in high-bandwidth memory (HBM), a key component for AI training, has turned them into national champions.

Add to that a government keen on revitalizing domestic markets, and you get what some analysts call a “policy-backed bull run.” President Yoon Suk Yeol’s administration has pushed reforms to reduce the long-standing “Korea Discount,” encouraging higher dividends, tighter governance and incentives for retail and institutional investment at home.

Same spirit, different casino

Speculation in the Korean crypto community was never about restraint; it was about rhythm and speed. That hasn’t changed. Margin lending is booming again, leveraged ETFs are flying off the shelves and retail participation has doubled in just a year. According to Bloomberg data, leveraged retail positions now make up nearly 30% of total holdings, with younger traders leading the charge.

In other words, the migration from crypto to equities isn’t a retreat, it’s a reallocation of risk appetite. Koreans haven’t abandoned speculation; they’ve just found a venue where the leverage feels legitimate and the upside patriotic.

But this shift has consequences. Without Korean retail as a liquidity anchor, global crypto markets have lost one of their most consistent buyers. Memecoin rallies that once lit up Korean chatrooms now fizzle faster. And the wider market in general is in need of a spark; bitcoin currently trades around $100,000 despite recording an all-time high one month ago, while several altcoins lost upwards of 20% over the past month.

Waiting for the next spark

Crypto’s “Kimchi traders” may have stepped away, but history suggests they won’t be gone forever. When the AI trade cools, which analysts are suggesting may be on the near horizon, or when the next major crypto narrative arrives, the same traders could come roaring back, armed with new capital and sharper reflexes.

For now, Korea’s retail traders have swapped blockchains for circuit boards, chasing the same rush in a different arena.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash (ZEC) Experiences Price Rally in Late 2025: Privacy-Focused Cryptocurrencies Return as Macro Safe-Haven Choices

- Zcash (ZEC) surged 750% in late 2025, outperforming Bitcoin and Ethereum amid growing demand for privacy-focused crypto assets. - Network upgrades by Electric Coin Company enhanced privacy via ephemeral addresses and zk-SNARKs, while Japan's crypto-friendly regulations boosted institutional adoption. - Institutional interest in Zcash's shielded transactions and low correlation with traditional crypto assets positions it as a strategic hedge against surveillance and volatility. - Regulatory clarity in Jap

Ethereum News Update: Major Ethereum Holders Invest $1.37B During Market Dip, Indicating Potential Rise to $10K

- Ethereum whales spent $1.37B buying 394,682 ETH during November 2025's 12% price drop, signaling strong bullish conviction. - Aave whale leveraged $270M loans to acquire 257,543 ETH ($896M), using a high-leverage borrowing-swapping cycle to expand holdings. - Institutional buyers like Bitmine Immersion added $139.6M ETH, joining coordinated accumulation as exchange reserves hit 2016 lows. - Market fundamentals show negative MVRV readings and $3,400 ETH stabilization, with analysts projecting $4,800–$10,0

UAE Executes Its Inaugural Digital Dirham Transaction: A Key Step Toward Shaping the Worldwide Digital Economy

- UAE executed first government transaction using Digital Dirham CBDC via mBridge platform in under two minutes. - The pilot involved Dubai Finance and Ministry of Finance, demonstrating blockchain-driven efficiency in public sector payments. - mBridge collaboration includes BIS, CBUAE, and regional partners, with Saudi Arabia joining in 2024 to expand cross-border capabilities. - UAE leaders called the initiative a "strategic pillar" for digital economy growth, aligning with global financial modernization

Visa’s Stablecoin Express Lane: Seamless, Real-Time Global Payments for Freelancers

- Visa launches stablecoin pilot for instant global payouts to gig workers, bypassing traditional banking infrastructure. - Program uses USD-backed stablecoins to address currency volatility and limited banking access in underbanked regions. - Initiative aligns with blockchain integration strategy, supported by regulatory clarity from the GENIUS Act and Visa's tokenized asset platform. - Pilot complements Visa's legal settlement negotiations with merchants and positions the company to maintain leadership i