HBAR Price Continues To Survive, Holds Above Month-Long Support

Hedera’s HBAR remains resilient above critical support levels, but weak inflows and bearish momentum suggest continued consolidation until investor participation strengthens.

Hedera’s native token, HBAR, has shown remarkable resilience despite enduring repeated market crashes and failed recovery attempts.

The altcoin continues to hold above a key support level, maintaining investor confidence even as bearish market sentiment persists. However, questions remain about how long HBAR can sustain this stability.

Hedera Needs Stronger Market Support

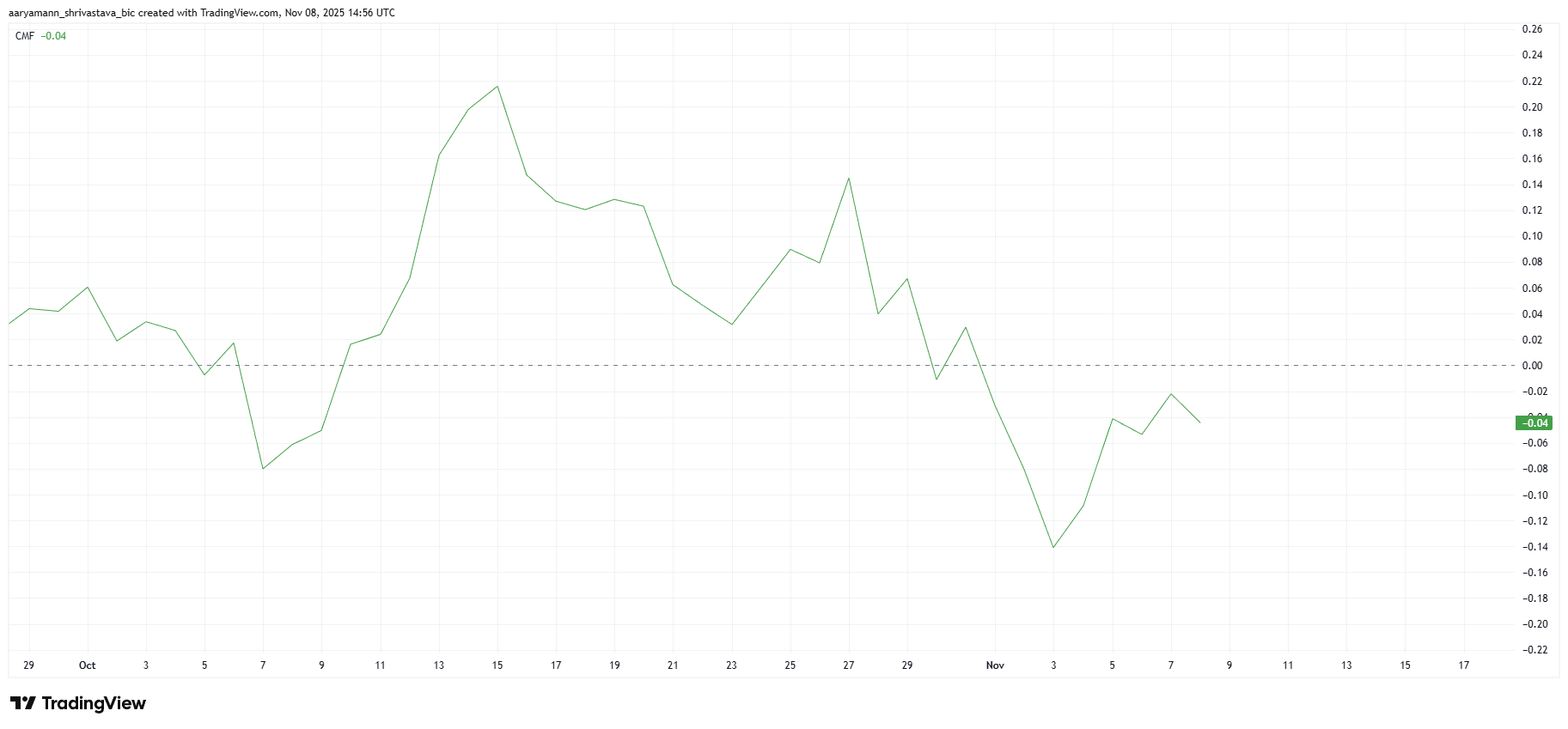

The Chaikin Money Flow (CMF) indicator shows HBAR sitting in the bearish zone below the zero line, reflecting ongoing outflows. Although there has been a modest uptick recently, inflows are still insufficient to reverse the trend. This suggests that sellers maintain control of the market.

Until consistent inflows surpass outflows, the HBAR price will likely remain under pressure. The gradual increase in inflows indicates that investor interest is slowly returning, but it is not yet strong enough to dictate price direction.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

HBAR CMF. Source:

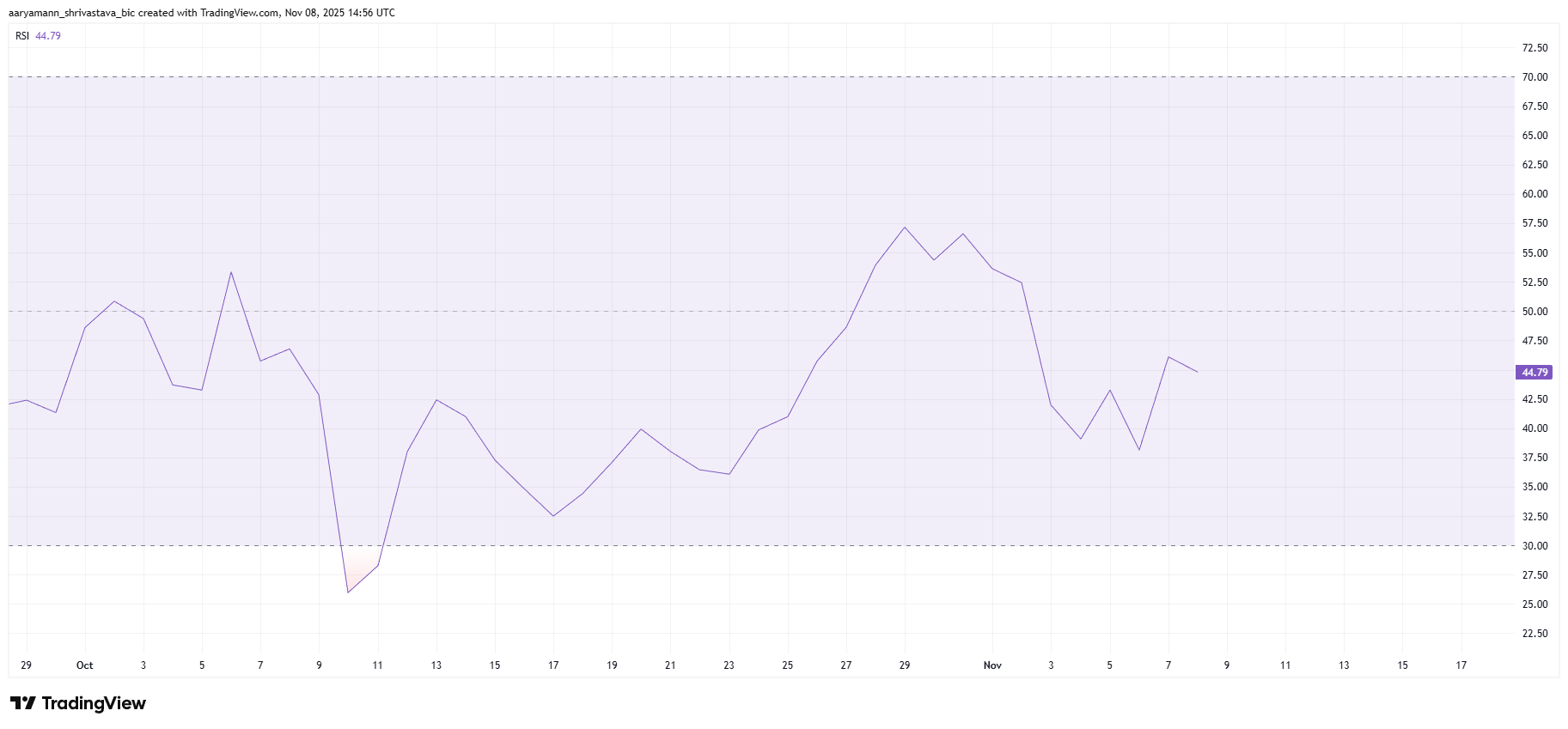

The Relative Strength Index (RSI) reinforces this bearish sentiment. Currently positioned below the neutral 50.0 mark, the RSI signals that market conditions are not favorable for recovery.

The lack of upward momentum reflects broader market weakness and hesitancy among traders to re-enter bullish positions.

This bearish momentum poses a challenge for HBAR’s price performance. Without support from the overall market, any potential bounce could be limited or short-lived. For HBAR to regain strength, the RSI must rise toward neutral levels.

HBAR RSI. Source:

HBAR RSI. Source:

HBAR RSI. Source:

HBAR RSI. Source:

HBAR Price May Remain Consolidated

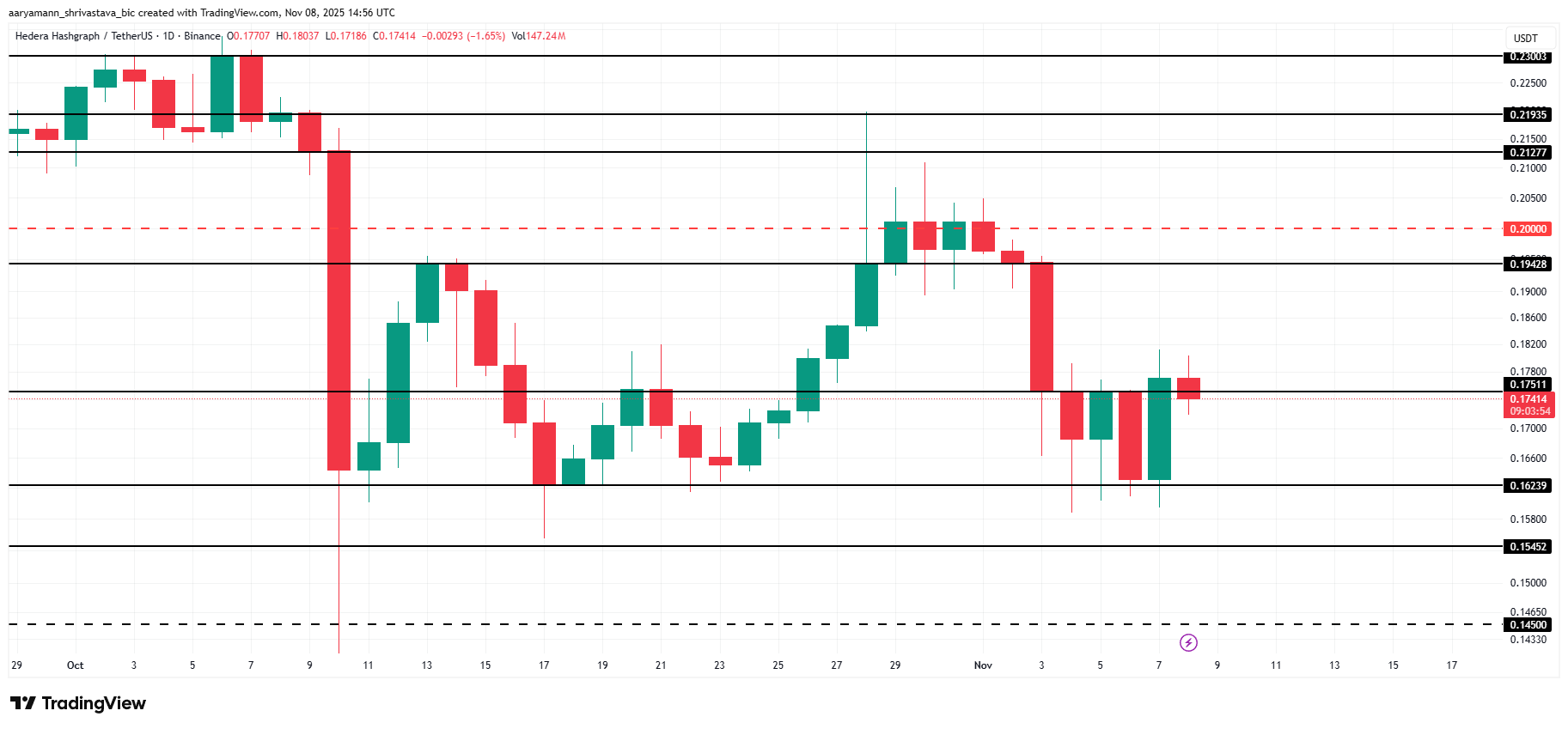

HBAR is trading at $0.174 at the time of writing, hovering just below the $0.175 resistance level. Despite several setbacks, the token has managed to hold above its critical $0.162 support level, showcasing its resilience.

This support has been pivotal for HBAR over the past month, preventing a deeper decline toward $0.154. Even under current bearish conditions, the token will likely continue consolidating above this zone, providing a stable base for potential recovery.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

If broader market conditions improve and inflows strengthen, HBAR could flip the $0.175 resistance into support. This could trigger a rally toward $0.194, paving the way for another attempt to breach $0.200 and potentially invalidate the bearish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What Factors Are Fueling the Rapid Popularity of Hyperliquid, the Emerging Trading Platform?

- Hyperliquid captured 73% of decentralized perpetual trading volume in Q3 2025, driven by $303B in trading volume and $5B TVL growth. - Retail demand fueled by 20x leverage on BTC/XRP and HIP-3 protocol optimization boosted $47B weekly volumes and $15B open interest. - Strategic partnerships like Felix HAUS agreement and 21Shares ETF filing expanded HYPE token utility while rejecting VC funding reinforced decentralization. - $10.8B HYPE token unlock poses 45% supply dilution risk, while competitors like A

PENGU Token's Latest Price Rally and Chart Patterns: A Brief Momentum Opportunity Among New Memecoins

- PENGU token surged 12.8% in 24 hours amid crypto rebound, driven by Bitcoin's 4.3% rise to $106,100. - Short-term bullish momentum emerged with 33% volume spike to $202M, but long-term bearish indicators persist via declining OBV and converging MACD. - Whale inflows ($157K) and a 13.69% token burn boosted optimism , though $7.68M in leveraged short positions highlight market volatility. - PENGU's price action reflects memecoin dynamics, balancing Bitcoin-linked risks with speculative potential from real-

UAE’s Digital Dirham: Shaping a Diverse Future for International Finance

- UAE completes first government transaction using Digital Dirham CBDC via mBridge platform, settling in under two minutes. - Pilot by UAE Ministry of Finance and Dubai Department of Finance validates cross-border and domestic payment capabilities without intermediaries. - Officials highlight CBDC's role in enhancing financial transparency, reducing settlement times, and advancing UAE's fintech leadership goals. - Global CBDC adoption grows with 137 countries exploring digital currencies, as UAE plans phas

Yen-backed Stablecoin Initiative May Challenge the Dollar’s Leading Role in Digital Finance

- JPYC, Japan's yen-pegged stablecoin issuer, plans to allocate 80% of 10-trillion-yen token proceeds to JGBs, aiming to fill gaps left by BOJ's stimulus tapering. - The strategy could reshape Japan's bond market as BOJ reduces its 50% JGB ownership stake, with JPYC CEO predicting global adoption of stablecoin-driven government bond demand. - Japan's FSA supports innovation through sandbox programs, including a pilot with major banks , while regulators warn stablecoins might divert funds from traditional b