New SEC Filing Shows Trump Media’s Total Bitcoin Holdings

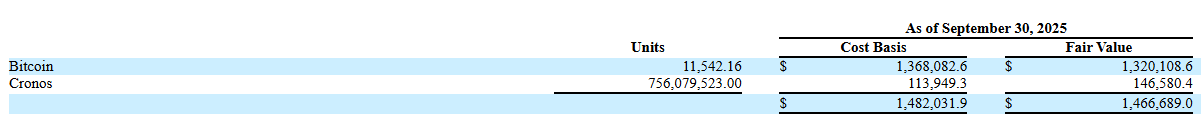

Trump Media and Technology Group (TMTG), the media company associated with US President Donald Trump, now holds more than 11,500 Bitcoin, valued at over $1.3 billion.

The disclosure marks the company’s largest confirmed allocation to date and places it among the biggest public-sector corporate holders of Bitcoin.

TMTG Bitcoin Holdings Fail to Yield Gains

TMTG accelerated its pivot earlier this year when it formally adopted Bitcoin as a core reserve asset.

At the time, TMTG said the company turned to BTC to protect itself from what he described as harassment and discriminatory treatment by financial institutions.

That argument tied Trump Media’s strategy to a wider corporate trend in which firms use Bitcoin to limit perceived dependence on banks that can freeze, slow, or scrutinize accounts.

Meanwhile, the company’s holdings extend beyond Bitcoin. TMTG reported owning roughly 756 million Cronos (CRO) tokens, worth approximately $110 million.

The position reflects the company’s growing alignment with Crypto.com, a relationship that has already produced several crypto-focused initiatives, including exchange-traded products and promotional tie-ins.

These initiatives helped position TMTG as a more active participant in the crypto economy, even though they have not reversed the firm’s financial challenges.

TMTG posted a $54.8 million net loss in the third quarter of 2025, extending its stretch of multi-million-dollar quarterly losses.

This suggests that the company’s crypto-heavy strategy has therefore served more as a political and operational statement than a source of near-term financial relief.

Trump’s Family Crypto Holdings Surge

As TMTG increased its exposure, other Trump-connected ventures expanded theirs as well, creating a broader cluster of politically adjacent crypto holdings.

Data from Arkham Intelligence indicates that several affiliated entities now hold substantial balances.

Other notable Trump Family entities:

— Arkham (@arkham) November 8, 2025

Donald Trump: holds $861K in crypto

World Liberty Fi: holds $5.76B in crypto

Official Trump Meme: holds $6.30B in crypto

Official Melania Meme: holds $19.65M in crypto

Trump Cards: holds $29.72K in crypto pic.twitter.com/T12F6yP4Oh

Trump personally holds about $861,000 worth of digital assets, while World Liberty Financial, one of the largest Trump-associated projects, controls more than $5.7 billion in crypto.

Additional holdings include $6.3 billion tied to Official Trump Meme, $19.65 million linked to Official Melania Meme, and nearly $30,000 associated with the Trump Cards collection.

These positions grew as the White House intensified its pro-crypto messaging, which shaped both the political environment and the commercial incentives for Trump-aligned ventures to deepen their involvement.

Taken together, the holdings show a coordinated embrace of digital assets across Trump-linked entities. They also reflect the administration’s broader effort to position crypto as both a strategic asset and a policy priority.

The post New SEC Filing Shows Trump Media’s Total Bitcoin Holdings appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ZK Atlas Enhancement: Driving Blockchain Expansion and Attracting Institutional Investments

- ZKsync's Atlas Upgrade (Oct 8, 2025) breaks scalability barriers with 15,000+ TPS, near-zero fees, and ZK proofs enhancing Ethereum's Layer 2 performance. - Innovations like Airbender proof system (40% lower overhead) and multi-VM compatibility enable seamless DeFi interoperability, attracting institutional capital seeking secure, scalable infrastructure. - Post-upgrade ZK token surged 50%, reflecting investor confidence, while partnerships like Grvt's $19M funding signal active institutional adoption of

Astar (ASTR) Experiences Price Rally in Late October 2025: Institutional Interest in Blockchain Interoperability Rises

- Astar (ASTR) price surged in late October 2025 as institutional interest in blockchain interoperability solutions intensified. - Astar's migration of DOT functionalities to its Asset Center improved cross-chain efficiency, attracting institutional trust. - Partnerships with Bitget, Startale Group, and Japan's Web3 leaders strengthened Astar's role as a bridge between traditional finance and decentralized ecosystems. - EURAU stablecoin's CCIP expansion highlighted growing institutional consensus on intero

DASH Aster DEX Listing: Driving DeFi Advancement and Broadening Liquidity

- Aster DEX's 2025 listing bridges centralized and decentralized markets via HTX/Binance.US integration, boosting DeFi accessibility through multi-chain support on BNB Chain, Ethereum , and Solana . - Its yield-collateral model offers 5-7% returns on assets like asBNB while trading, combined with 1001x leverage in "Simple Mode," disrupting traditional DeFi's yield-trading dichotomy. - TVL surged to $17.35B post-listing, driven by institutional/retail confidence in cross-chain efficiency, though $151M 24-ho