Will Shiba Inu coin reach $1? It’s the question that refuses to fade from every crypto forum. The dream sounds simple: hold a few million SHIB and wait for that magical dollar, but the math tells a harsh truth.

With its total supply, Shiba Inu would need a market cap larger than Bitcoin, Ethereum, and the entire stock market combined. Yet, hope lingers.

Noomez is quietly building a realistic path toward that same milestone, powered by deflation, insane staking rewards, and a supply model that actually makes $1 achievable.

The Numbers Don’t Lie – Why SHIB Can’t Hit $1

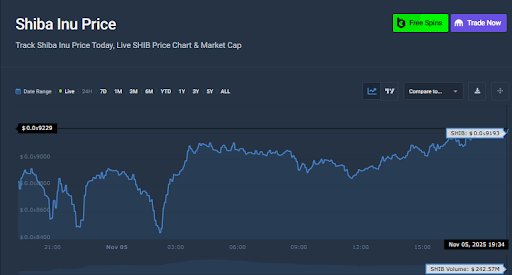

When traders ask, “can Shiba Inu reach $1?”, the answer comes down to basic math. SHIB currently trades around $0.000009009, and even bullish forecasts only project it toward $0.00001505 by 2030, a modest 60% increase in nearly five years.

With a total supply of 589.5T tokens, reaching $1 would require a $589T market cap, over 500× the entire crypto market combined. Even aggressive token burns barely dent that number.

The truth is, Shiba Inu’s community remains passionate, but the token’s economics simply don’t scale. So, analysts view it as a speculative meme coin, enjoyable for short-term gains but unlikely to reach $1 without significant changes.

Long-Term Shiba Inu Price Forecast (2025-2030)

So, will Shiba Inu coin reach $1 in 10 years? Based on current projections, not even close.

Analysts estimate Shiba Inu could trade between $0.00001043 and $0.00001505 by 2030, reflecting steady but limited growth. Technical indicators show bearish sentiment at 75%, with RSI hovering around 31.6 (neutral) and most moving averages flashing sell.

Even under the best conditions, these figures only suggest modest returns, not life-changing ones. Shiba Inu may remain a recognized brand, but its momentum largely relies on hype and temporary volume spikes.

Without major changes, SHIB’s long-term outlook is flat, pushing traders to look for projects with real growth potential.

Tokenomics Reality Check – Supply, Burns & Hype

It’s fair to ask, will Shiba reach 1 dollar if its community keeps burning tokens? Unfortunately, even that strategy barely scratches the surface.

While SHIB’s burn portal and occasional whale-led burns remove billions of tokens, it’s a drop in the ocean.

The coin’s tokenomics simply weren’t built for upward mobility, no vesting controls, no emission curves, and no structured scarcity.

Most of its gains come from short bursts of hype rather than fundamental growth. That’s the fatal flaw in most meme tokens: perception drives price until the hype fades.

Real, lasting value comes from mathematical scarcity and controlled token flow, exactly the framework that Noomez uses to fuel organic price momentum and sustainable growth.

How Noomez ($NNZ) Creates Real Price Momentum

While meme tokens like SHIB depend on hype, Noomez ($NNZ) is designed to move through structure, not speculation.

Each stage has a transparent Noom Gauge tracker showing live progress and burns in real time. The project is KYC-verified and audited, while 15% of the total supply is locked forever for liquidity stability.

Beyond that, the Noom Engine introduces staking with up to 66% APY, and long-term holders benefit from it, where emission rates shrink as supply decreases.

The result is a deflationary ecosystem where price movement is mathematically engineered, not left to chance. That’s why investors are calling Noomez one of 2025’s most realistic paths to sustained growth.

Why Noomez Has a Real Path Toward $1.00

Unlike Shiba Inu, Noomez ($NNZ) has a solid mathematical foundation behind its potential. The total supply is fixed at 280 billion tokens, not trillions, and each presale stage raises the price automatically from $0.00001 to $0.0028, a built-in 280× curve before launch.

Afterward, staking through the engine and the five-Arc vesting model continue to reduce supply while rewarding long-term holders. Because liquidity is permanently locked and emissions decline each Arc, circulating tokens become scarcer with time.

It’s a structure where every mechanic compounds value instead of diluting it, making $1 not a fantasy, but a measurable long-term target if growth persists.

<iframe width=”560″ height=”315″ src=”https://www.youtube.com/embed/MZNple28X3k?si=MIdo0Cq60xIu-qv7″ title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen></iframe>

Pro Tip: If you’re new to crypto investing, always start by studying tokenomics, it is the math behind a coin’s price potential. Look for supply limits, vesting schedules, and transparent audits before buying in.