Pi Network Rolls Out New Upgrade as Token Drops Another 10%

Pi Network’s new Pi Node update improves speed, rewards, and accessibility, yet low mainnet engagement and falling PI prices reveal deeper challenges facing the project’s growth and developer confidence.

The Pi Network has rolled out Pi Node version 0.5.4. The update introduces performance enhancements, refined reward calculations, and an improved user experience.

Despite these technical advances, the ecosystem is facing challenges. Mainnet activity remains low, and developer confidence is declining. Furthermore, Pi Coin’s price is also under pressure, having dropped nearly 10% over the past week.

Pi Network Introduces New Technical Enhancements

The Pi Core Team announced the release of Pi Node version 0.5.4 on November 6. The application was also renamed “Pi Desktop” to reflect broader functionality. Users can now access the Node, mining app, and Pi App Studio through a unified interface.

The update introduces several key enhancements, including fixes for community-reported issues related to Node mining rewards, automatic updates, and block container creation. It also introduces a new open port verification system to ensure accurate Node bonus calculations.

Furthermore, Pi Desktop now allows approved external links, letting users access blogs and resources directly from the mining app and Pi App Studio. These improvements collectively boost performance and the overall user experience for Pi Node operators.

“As announced in the recent update, Pi App Studio is now directly accessible from the top navigation bar in Pi Desktop, positioned alongside the Pi mining app and Node. An App Studio display issue where deployed apps were not displaying previews correctly has been resolved,” the team wrote.

This release builds on the OpenMind pilot project that demonstrated Pi Network’s capacity for decentralized AI training. OpenMind reported that more than 350,000 active nodes participated in the proof-of-concept, completing image recognition workloads.

Moreover, this partnership marked Pi Network Ventures’ first investment, signaling a shift toward real-world blockchain uses.

Pi Network Faces Pressure

However, this progress contrasts with the network’s current on-chain reality. Despite OpenMind’s large-scale participation, PiScan data shows only 296 active mainnet nodes and three validators at present.

Furthermore, developers have also expressed discontent with the network. This came after WorkforcePool, the first Pi Network Hackathon winner and a decentralized freelance marketplace, announced that it is up for sale. This drew criticism, with developers citing high operational costs, lack of team support, and slow progress.

The Pi Network launched its Open Network in February. This move was intended to improve accessibility and support dApp development. However, the speed of app development and mainnet migration has disappointed stakeholders, contributing to frustration among community members.

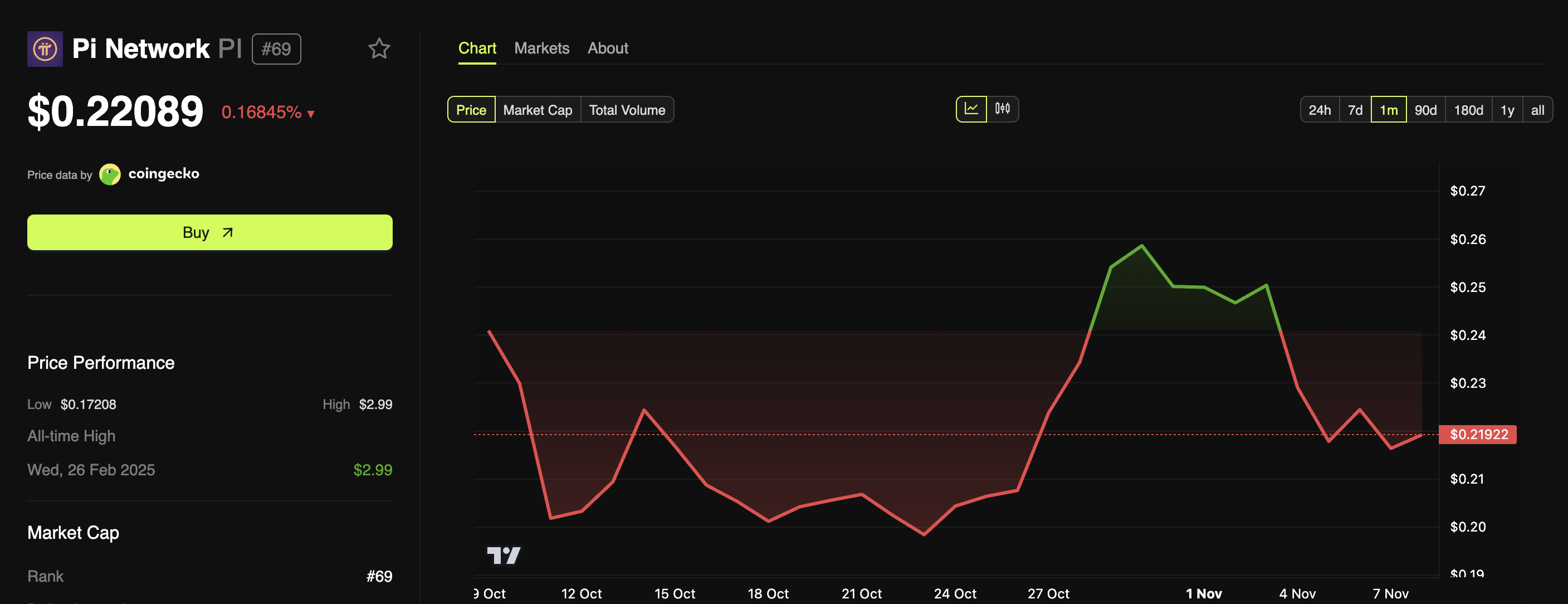

Lastly, the price performance has not helped Pi Network’s case. After the initial hype faded, Pi Coin has continued to show weakness. While PI rose briefly in late October, it slipped again shortly after.

Pi Network Price Performance. Source:

Pi Network

Pi Network Price Performance. Source:

Pi Network

Pi Coin has declined by approximately 10% over the past week amid broader market pressure. At the time of writing, it traded at $0.22, down 0.168% over the past day.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Short-Term Holders Increase Holdings While Long-Term Holders Realize Gains—$100K Becomes Key Level

- Bitcoin fell below $100,000 as Coinbase premium hit a seven-month low, reflecting weak U.S. demand and ETF outflows. - On-chain data shows short-term holders (STHs) accumulating Bitcoin while long-term holders (LTHs) moved 363,000 BTC to STHs, signaling mixed market dynamics. - Analysts highlight a "mid-bull phase" with STHs absorbing selling pressure, and a $113,000 support level critical for potential rallies to $160,000–$200,000 by late 2025. - The Fear and Greed Index entered "Extreme Fear," and exch

Bitcoin Update: Large Holders Depart and Economic Instability Push Bitcoin Under $100K

- Bitcoin fell below $100,000 as OG whales BitcoinOG and Owen Gunden moved $1.8B BTC to exchanges, signaling bearish bets. - $260M in long positions liquidated amid SOPR spikes, while Trump's crypto policies and China's $20.7B BTC holdings added macro risks. - Bit Digital staked 86% of ETH holdings for 2.93% yield, while Coinbase's negative premium highlighted waning U.S. buyer demand. - Analysts warn consolidation phases often follow whale profit-taking, with geopolitical tensions and derivatives volatili

Aster DEX's Latest Protocol Enhancement and What It Means for DeFi Liquidity Providers

- Aster DEX upgraded its protocol on Nov 5, 2025, enabling ASTER token holders to use their assets as 80% margin collateral for leveraged trading and receive 5% fee discounts. - Binance's CZ triggered a 30% ASTER price surge and $2B trading volume spike via a $2M token purchase three days prior, highlighting market speculation and utility convergence. - The platform introduced a "Trade & Earn" model allowing yield-generating assets like asBNB and USDF to be used as trading margin, enhancing capital efficie

XRP Update: Digitap's Practical Applications Put XRP's Delayed Ambitions to the Test

- Digitap ($TAP) raised $1.4M in November 2025, outpacing rivals like Bitcoin Hyper and Pepenode with an 80% early investor discount. - The project combines crypto and fiat banking via a live app, Visa cards, and deflationary tokenomics, positioning it as XRP's real-world competitor. - $TAP's fixed 2B token supply and transaction-burning model create scarcity, with analysts projecting 50x-70x price growth by late 2026. - Digitap's 124% APR staking rewards and privacy-focused features like offshore-shielded