October BTC Mining: High Costs, Tight Margins, and AI Transformation

October 2025 marked a turning point for Bitcoin mining, with rising production costs and record network difficulty driving a strategic shift toward AI data infrastructure. Industry leaders are evolving to survive in a high-cost, competitive landscape.

In October 2025, the global top-tier Bitcoin miners slightly increased production, overall costs, and network difficulty reached new all-time highs. At the same time, several mining firms began shifting their strategic focus toward AI-related data infrastructure.

This shift aimed to diversify revenue streams and reduce dependence on Bitcoin price volatility.

Slight Drop in Bitcoin Production, Growing Trend of BTC Sales

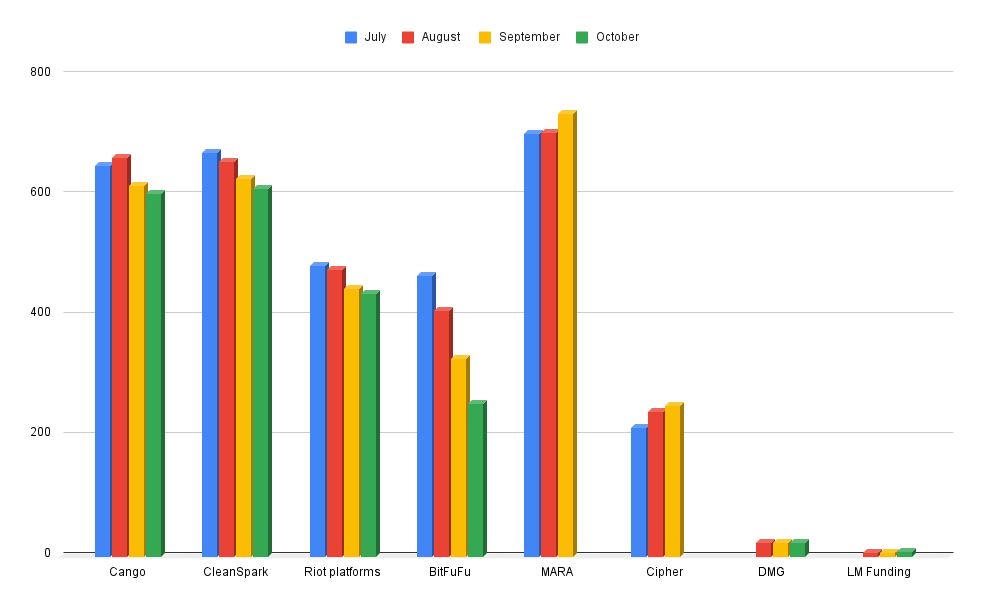

Compared to September, overall Bitcoin (BTC) mining output declined slightly, primarily due to higher mining difficulty and unstable power supplies across several North American regions.

Specifically, Cango Inc. mined approximately 602.6 BTC in October, bringing its total Bitcoin holdings to 6,412.6 BTC. CleanSpark reported a similar output to September, producing 612 BTC during the month.

Riot Platforms mined 437 BTC, down from 445 BTC in the previous month. Its total Bitcoin holdings reached 19,324 BTC, up 37 BTC from the last month. However, given the production volume, the data suggest that the company likely sold part of its mined Bitcoin to manage its cash flow.

BitFuFu produced 253 BTC, bringing total holdings to 1,953 BTC, suggesting potential BTC liquidation to optimize capital.

Among smaller miners, DMG Blockchain mined 23 BTC, raising its total holdings to 359 BTC, while LM Funding America maintained stable production levels. Despite their modest scale, these smaller entities help maintain Bitcoin’s decentralization by distributing global hashrate more evenly.

October Bitcoin mining output by some public companies. Source: BeInCrypto

October Bitcoin mining output by some public companies. Source: BeInCrypto

Marathon Digital Holdings (MARA) and Cipher Mining have not yet disclosed their October Bitcoin production data. However, both companies released positive Q3 2025 financial results, signaling operational resilience despite a weaker September.

Marathon maintained its industry leadership with a record-breaking $123 million profit in the third quarter of 2025. On-chain data shows that MARA’s mining address transferred 2,348 BTC (approximately $236 million) within 12 hours, likely profit-taking following Bitcoin’s recent price rally.

Cipher Mining also reported solid quarterly results with $72 million in revenue and announced a $1.4 billion high-yield bond issuance to fund a Google-linked data center project.

Similarly, TeraWulf expects third-quarter 2025 revenue to be between $48 million and $52 million. The company raised $3.2 billion in senior secured notes to expand its US-based infrastructure. These large-scale financing moves underscore a broader industry trend. Major miners are repositioning themselves as providers of digital infrastructure, bridging Bitcoin mining with AI-driven high-performance computing (HPC).

Production Costs Hit Record High, Intensifying Industry Competition

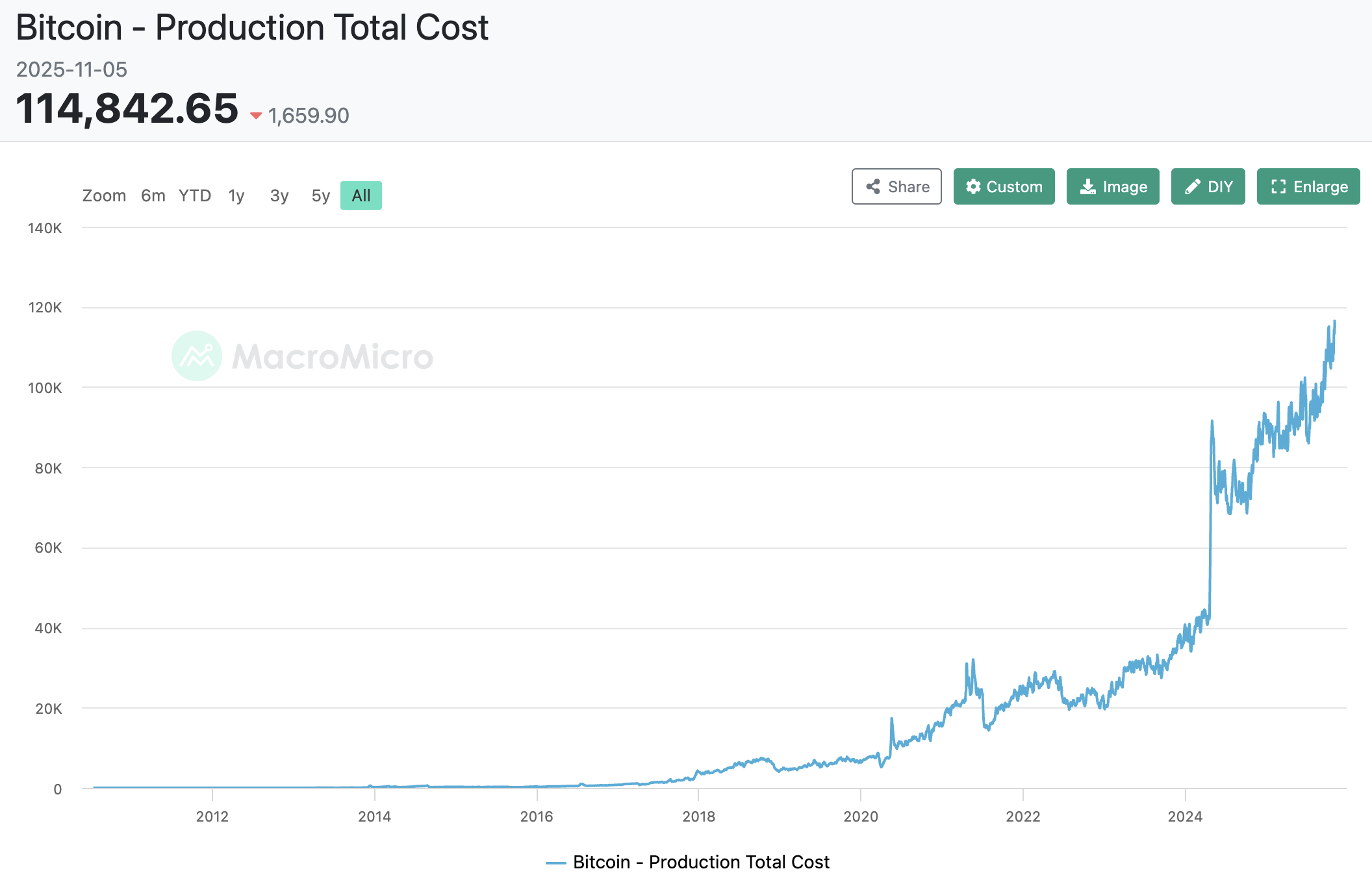

According to MacroMicro, the average cost to produce 1 BTC surged to $114,842, marking the highest level in history. Meanwhile, Bitcoin’s mining difficulty rose by 6.31% to 155.97T, setting a new all-time high for the network. With Bitcoin’s market price hovering around $102,000, the widening gap between market value and breakeven cost is squeezing profit margins, especially for smaller operators.

Average production cost per BTC. Source:

MacroMicro

Average production cost per BTC. Source:

MacroMicro

In response, miners are being compelled to enhance energy efficiency, invest in next-generation ASICs, and scale their operations to safeguard profitability. Industry leaders such as Cipher, TeraWulf, and CleanSpark are experimenting with hybrid models combining Bitcoin mining and HPC for AI workloads, a strategy increasingly seen as inevitable amid mounting cost pressures.

Simultaneously, governments and sovereign investment funds are entering the Bitcoin mining sector to enhance their control over strategic energy and data assets. This growing “nationalization” of mining could reshape the global power structure, as some nations leverage surplus energy resources to mine Bitcoin more efficiently, thereby reducing reliance on private-sector operators.

October 2025 marks the beginning of a profound structural transformation within the Bitcoin mining industry. Only firms with strong technology capabilities, financial stability, and long-term vision are likely to endure.

As energy costs and mining difficulty continue to rise, 2026 could see the most significant wave of mergers and consolidations in the industry’s history, paving the way for a global hybrid model integrating Bitcoin mining with AI data computation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Transforms Capital Movement by Integrating Conventional and Digital Markets

- Bitget launches $2M interest-free loan program for altcoin market makers, slashing qualification requirements by 50% to boost liquidity in smaller-cap tokens. - The exchange partners with Fasanara Capital to pioneer hybrid liquidity models, merging blockchain and institutional finance for real-time cross-border capital flow. - Bitget slashes stock futures fees by 90%, attracting $300M+ daily volume and surpassing $1B cumulative trading since September 2025 launch. - Through multi-chain integration and 20

Zcash Halving and Its Impact on the Market: Price Movements After Halving and Investor Sentiment

- Zcash's 2025 halving triggered a 750% price surge to $400+, driven by privacy-focused demand and technical upgrades. - Unlike Bitcoin's stagnant $103k price, Zcash's 28% shielded supply reflects growing demand for privacy amid regulatory scrutiny. - Investor psychology shifted toward privacy coins, with Zcash outperforming Bitcoin as capital rotated during market volatility. - Analysts predict Zcash could reach $580 if it breaks $500 resistance, contrasting Bitcoin's deflationary model with utility-drive

IPO Genie's commitment to compliance opens up private market investing to a wider audience

- IPO Genie's $IPO airdrop attracts 300,000+ participants via tiered pricing and compliance-first blockchain infrastructure. - Platform combines AI-driven deal analysis, CertiK-audited smart contracts, and Fireblocks custody to address crypto market risks. - Token holders gain 32% staking yields and DAO governance, while $500M in tokenized assets bridges retail access to private markets. - Structured vesting schedules and 18-24 month cliffs aim to stabilize value, contrasting past failures like FTX through

ICP Sees 30% Price Jump in Late October 2025: Institutional Interest and Web3 Goals Ignite Fresh Bullish Momentum

- ICP token surged 30% in late October 2025, driven by institutional partnerships and Web3 AI advancements. - Coelacanth Energy's partnership with ICP Securities and biopharma trial boosted demand through acronym confusion. - ICP's AI integration in smart contracts highlights innovation but lags behind competitors in brand recognition. - Lack of on-chain data complicates analysis, leaving speculation about genuine user activity vs. institutional hype. - The surge may signal a new bullish cycle if ICP clari