Massive $5.4 Billion Options Expiry: Traders Double Down Despite End-of-Cycle Warnings

More than $5.4 billion in Bitcoin and Ethereum options expire today on Deribit, marking one of the year’s largest expiries. Traders remain cautiously bullish despite structural warnings, with Bitcoin’s max pain at $107,000 and Ethereum near $3,800. Short volatility bets dominate, setting the stage for major market swings.

Over $5.4 billion in Bitcoin and Ethereum options are set to expire today on Deribit at 08:00 UTC. Bitcoin trades near $102,159, with open interest clustered at critical strike levels. Market volatility is likely ahead as traders brace for key outcomes.

This significant expiry occurs as analysts caution about structural fragility and potential end-of-cycle signals. Traders, meanwhile, persist in shorting volatility despite rising risks, maintaining complex positions to manage exposure.

Bitcoin Options Market Shows Cautious Optimism

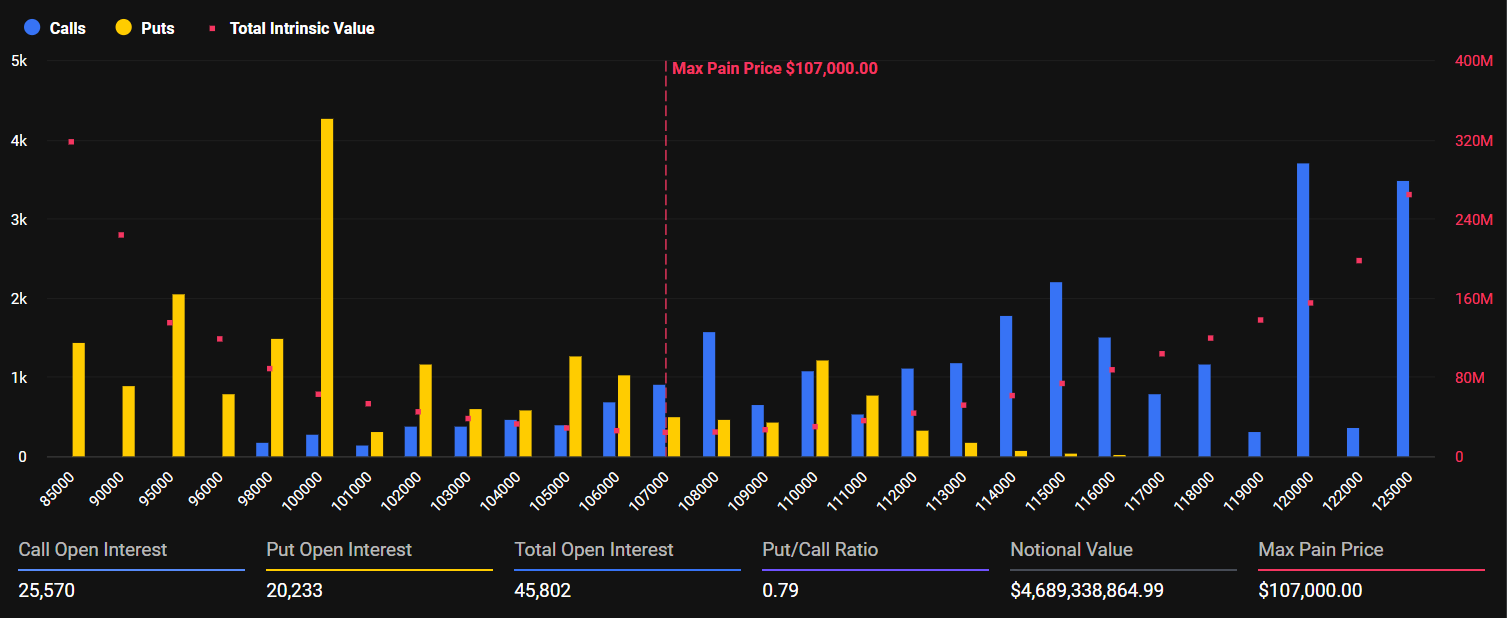

Bitcoin options positioning highlights renewed caution after the recent drop below $100,000. Data on Deribit shows that the maximum pain sits at $107,000. This is where most traders tend to suffer the most losses as the options near expiration.

Expiring Bitcoin Options. Source:

Deribit

Expiring Bitcoin Options. Source:

Deribit

Meanwhile, the Put-to-Call ratio (PCR) is 0.79, showing cautious optimism as traders lean slightly bullish, or at least do not see a major crash ahead, despite recent volatility.

It suggests active hedging, rather than panic, with open interest concentrated near $100,000 puts (yellow vertical bar) and $120,000–$125,000 calls (blue vertical bars), making them key battlegrounds as expiration nears.

Total open interest stands at 45,802 contracts, with calls (25,570) outnumbering puts (20,233). The notional value exceeds $4.6 billion, reflecting the magnitude of this expiry.

Open interest clustering near key strikes indicates a market awaiting decisive direction. Bitcoin has stabilized above $100,000, suggesting traders are cautiously optimistic.

Ethereum’s Defensive Positioning Signals Caution

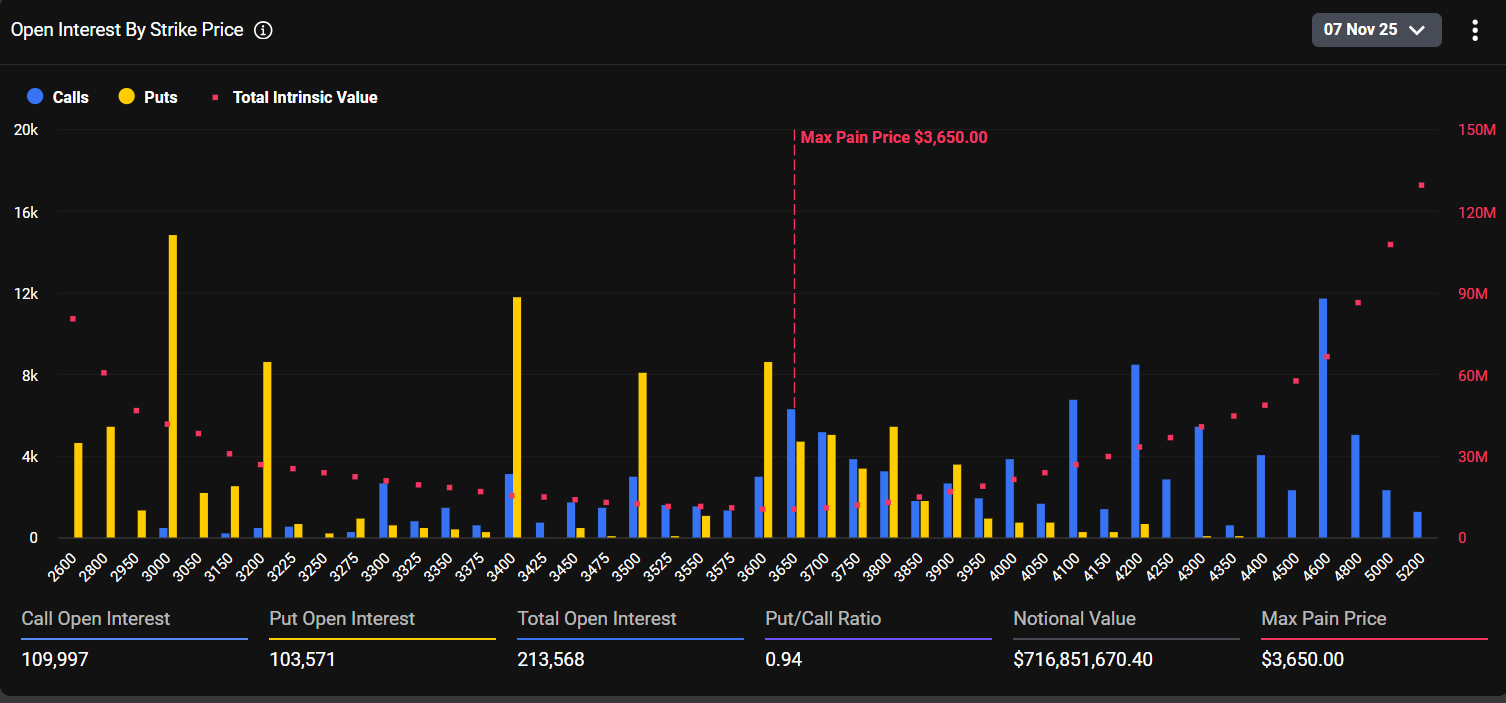

Ethereum options maintain a defensive stance, trading near $3,347 as of this writing, with max pain close to $3,800. The put/call ratio is approximately 0.9, suggesting balanced yet defensive positioning. Open interest focuses on $3,500 puts and $4,200 calls, indicating key levels for near-term price action.

Expiring Ethereum Options. Source:

Deribit

Expiring Ethereum Options. Source:

Deribit

Deribit’s Ethereum data indicates that open interest is skewed toward calls, at 109,997 versus 103,571 puts, resulting in a put/call ratio of 0.94. Notional value stands at $716.85 million.

Traders favor defensive structures like calendar spreads, diagonal spreads, risk reversals, and straddles. These strategies aim to protect against downside while keeping upside exposure.

Short Volatility Bets Persist Despite Structural Warnings

Even as Greeks.live and other analysts warn of end-of-cycle risks and market fragility, many traders are selling options aggressively.

Worries center on levels like BTC $105,000, $102,000, and $97,000, plus ETH $3,650 and $3,400, fueling debate about possible downside or ongoing choppiness.

“Despite widespread bearish sentiment and warnings that ‘cycles over’ with ‘end of cycle events’ occurring in recent weeks, traders continue aggressively selling options, particularly ETH 3650P, 3400P, and 3800C strikes,” wrote analysts at Greeks.live.

The post highlights a pattern of traders doubling down on short volatility positions, hoping to recover losses. This approach often precedes sharp market moves.

Greeks.live highlights trader sentiment that “downside is overestimated” and maintained short put exposure after prior losses, even selling calls for bets on sideways action.

While such strategies profit if the market stays calm, they can lead to severe losses if prices break key levels. With open interest clustered near pivotal strikes, today’s expiry could provoke significant moves, especially if Bitcoin or Ethereum breach important thresholds.

Macroeconomic headwinds also remain in view. Deribit noted that recent CPI data and comments from Federal Reserve Chair Jerome Powell reduced ETF inflows. Yet, overall open interest remains high, indicating that traders are still engaged but cautious about volatility.

“CPI and Powell’s comments have dampened ETF inflows, yet overall OI remains high,” they wrote.

As $5.4 billion in options expire, the next few hours will test whether traders’ short volatility strategies hold up or market fragility drives sharp reversals.

Since many strikes are near current prices, even modest moves could have a significant impact on settlement results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Behind the x402 Craze: How ERC-8004 Builds the Trust Foundation for AI Agents

If x402 is the “currency” of the machine economy, then what ERC-8004 provides is the “passport” and “credit report.”

JP Morgan Forecasts BTC At $170K Amid Market Doubts

Bitcoin Loses Ground To Stablecoins, Says Cathie Wood

Japanese Regulators Back Major Banks’ Push to Issue Yen-Backed Stablecoins