How to Participate in Circle's Native Chain Arc Testnet Interaction?

The tutorial covers topics such as Testnet Coins, NFT Minting with Domain, Contract Deployment, and more, making it easy to understand and follow.

Original Title: "Circle's Stablecoin Public Chain Arc Testnet Interaction Guide"

Original Author: Asher, Odaily Planet Daily

Last week, Circle's stablecoin Layer 1 project Arc announced on X platform that its public testnet is now live. Below, Odaily Planet Daily takes you through a "zero-cost" participation in the Arc testnet interaction to receive a token airdrop.

Arc: A Layer 1 Dedicated to Stablecoins Launched by Circle

Arc is a next-generation EVM-compatible Layer 1 blockchain launched by the "first stock of stablecoins," Circle, aiming to build the economic operating system of the internet, deeply integrating programmable stablecoins with on-chain financial innovation. Arc is designed for financial applications, focusing on global payments, forex, lending, and capital markets, with the goal of providing a secure, low-cost, compliant, and scalable foundational settlement layer for the internet's programmable money.

Arc aims to address the three major pain points faced by existing public chains in enterprise and institutional-grade financial applications: inadequate high-frequency transaction performance, lack of privacy and compliance support, and excessive transaction fee volatility. By optimizing its architecture and introducing a stable fee model, Arc will achieve efficient financial-grade transaction experiences and drive stablecoins from being just a "digital dollar" towards becoming the core infrastructure for global payments, lending, forex, and capital markets.

Arc Testnet Interaction Guide

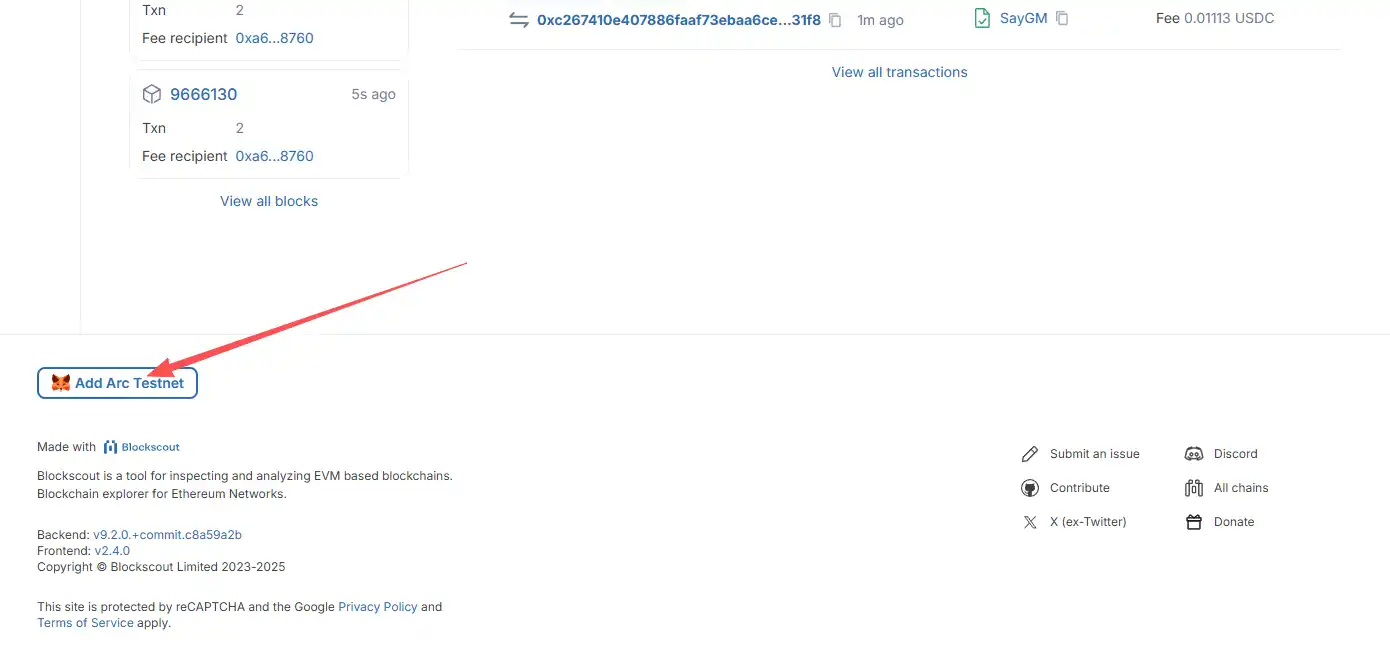

STEP 1. Add the Arc test network in your wallet, scroll to the bottom of the page, click on Add Arc Testnet in the bottom left corner, and confirm in your wallet popup.

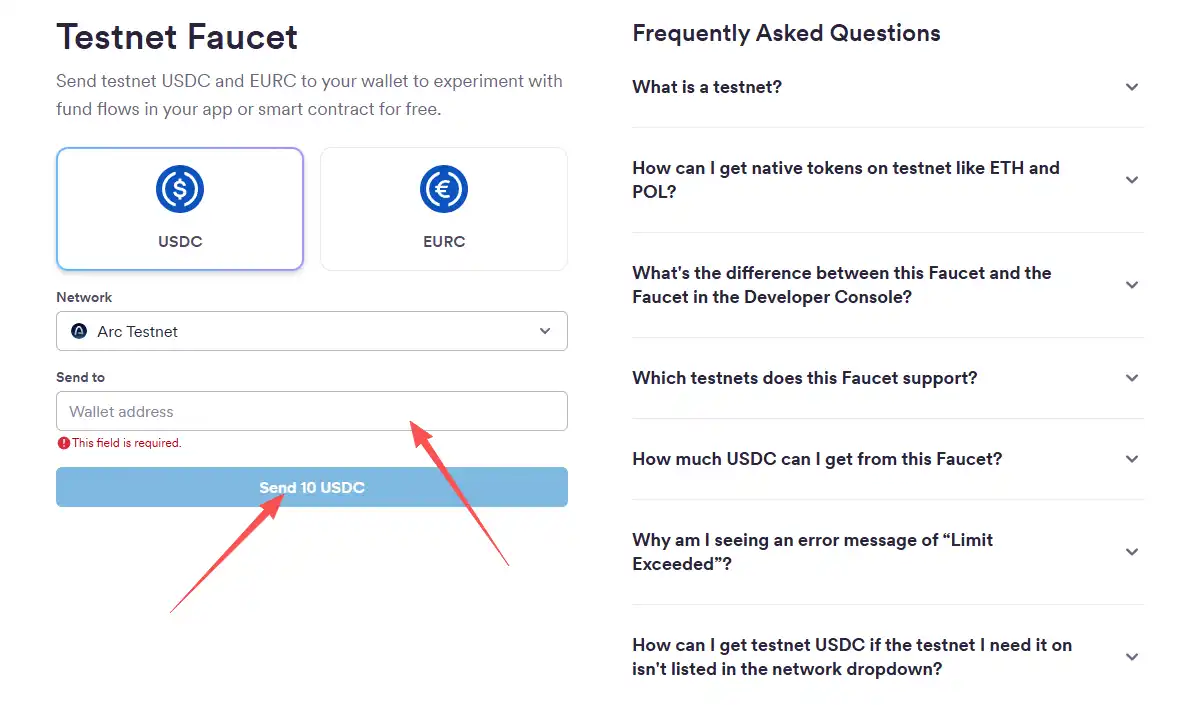

STEP 2. Claim testnet test coins, receive both USDC and EURC.

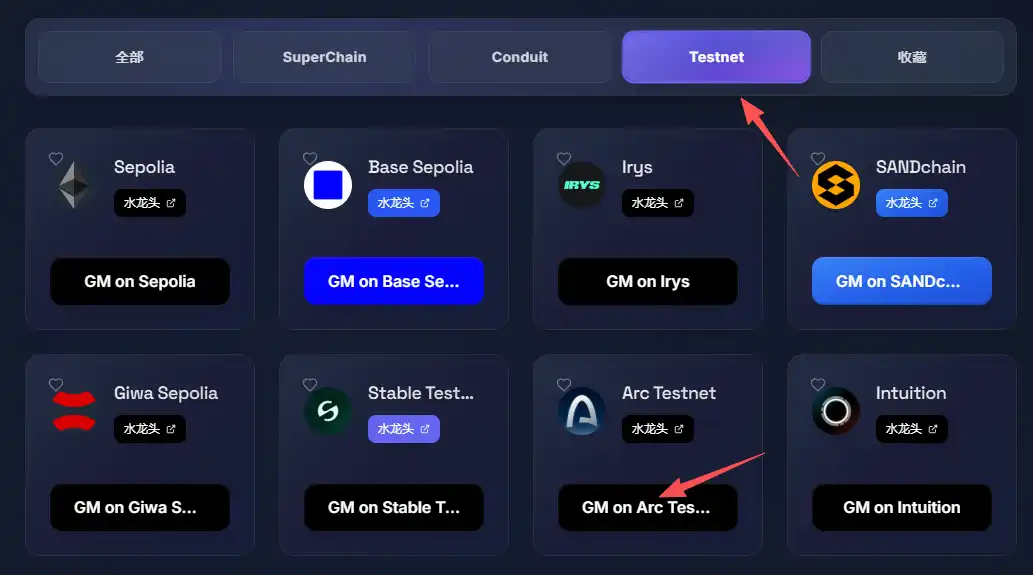

STEP 3. Send GM on the Arc testnet, connect your wallet, then find GM on Arc Testnet and click to confirm in your wallet popup.

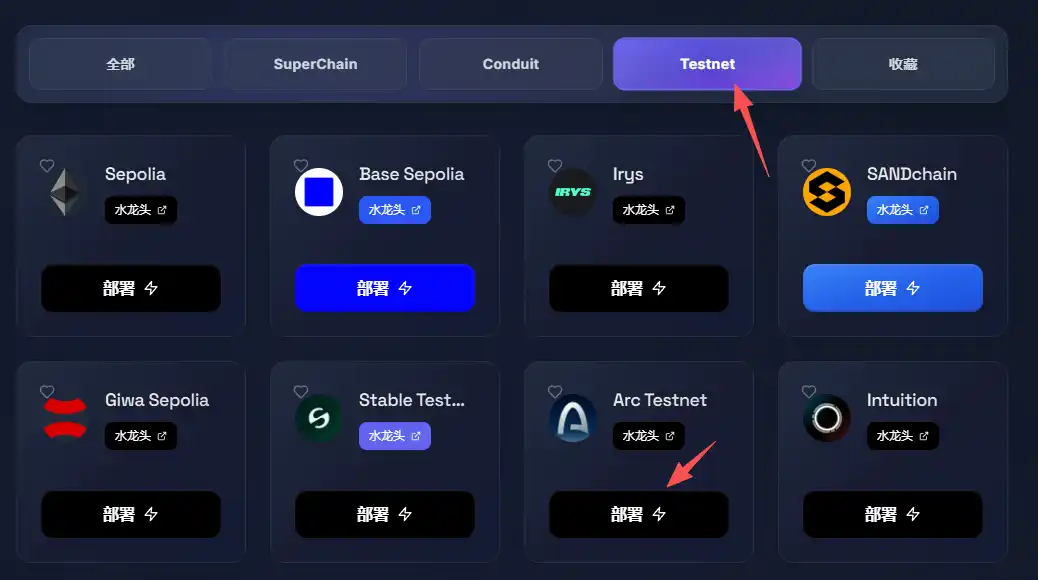

STEP 4. Deploy Contract on Arc Testnet, find Arc Testnet, click Deploy and confirm in the wallet popup.

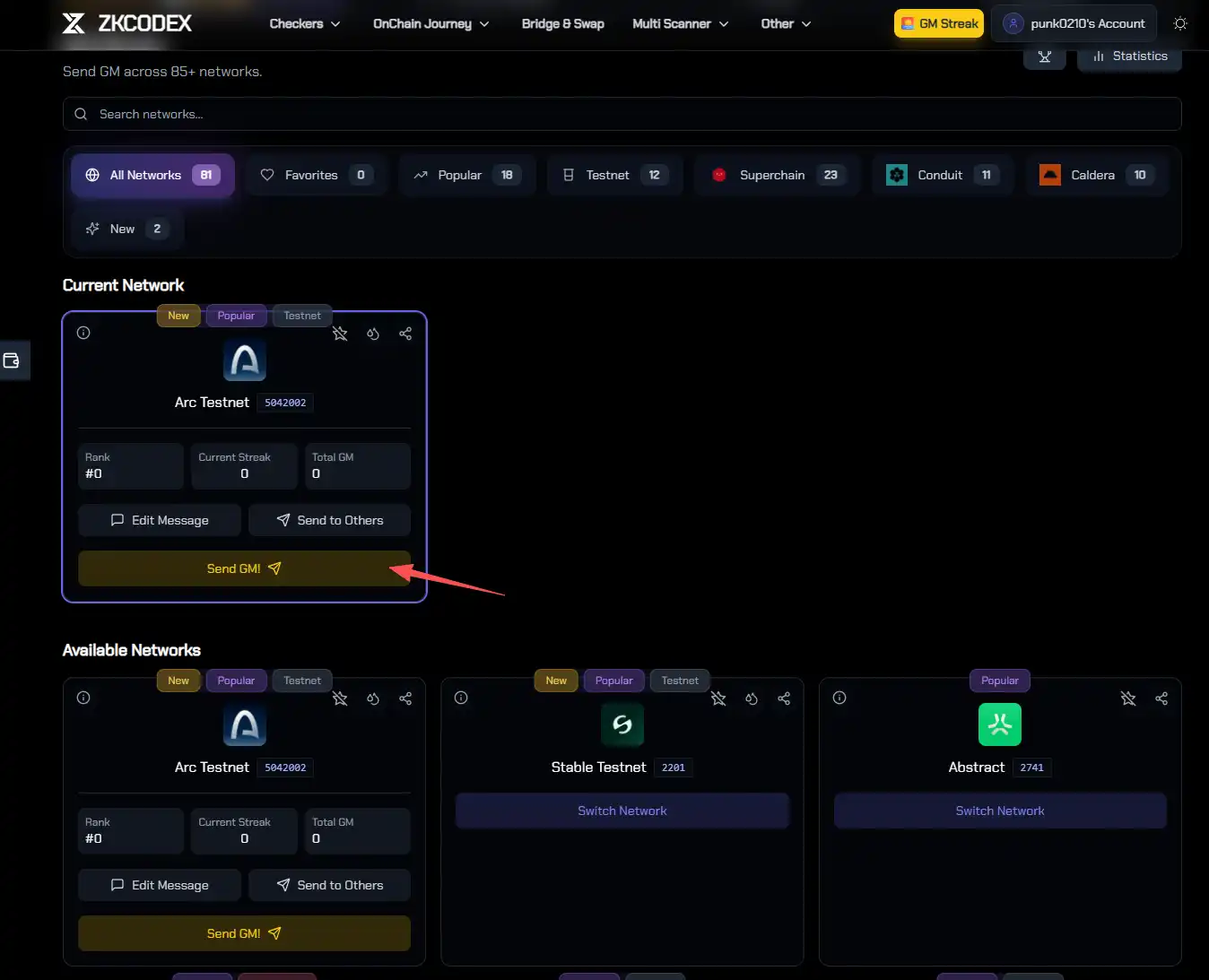

STEP 5. Send GM on Arc Testnet in ZKCODEX Platform, connect wallet, find Arc Testnet, click Send GM, and confirm in the wallet popup.

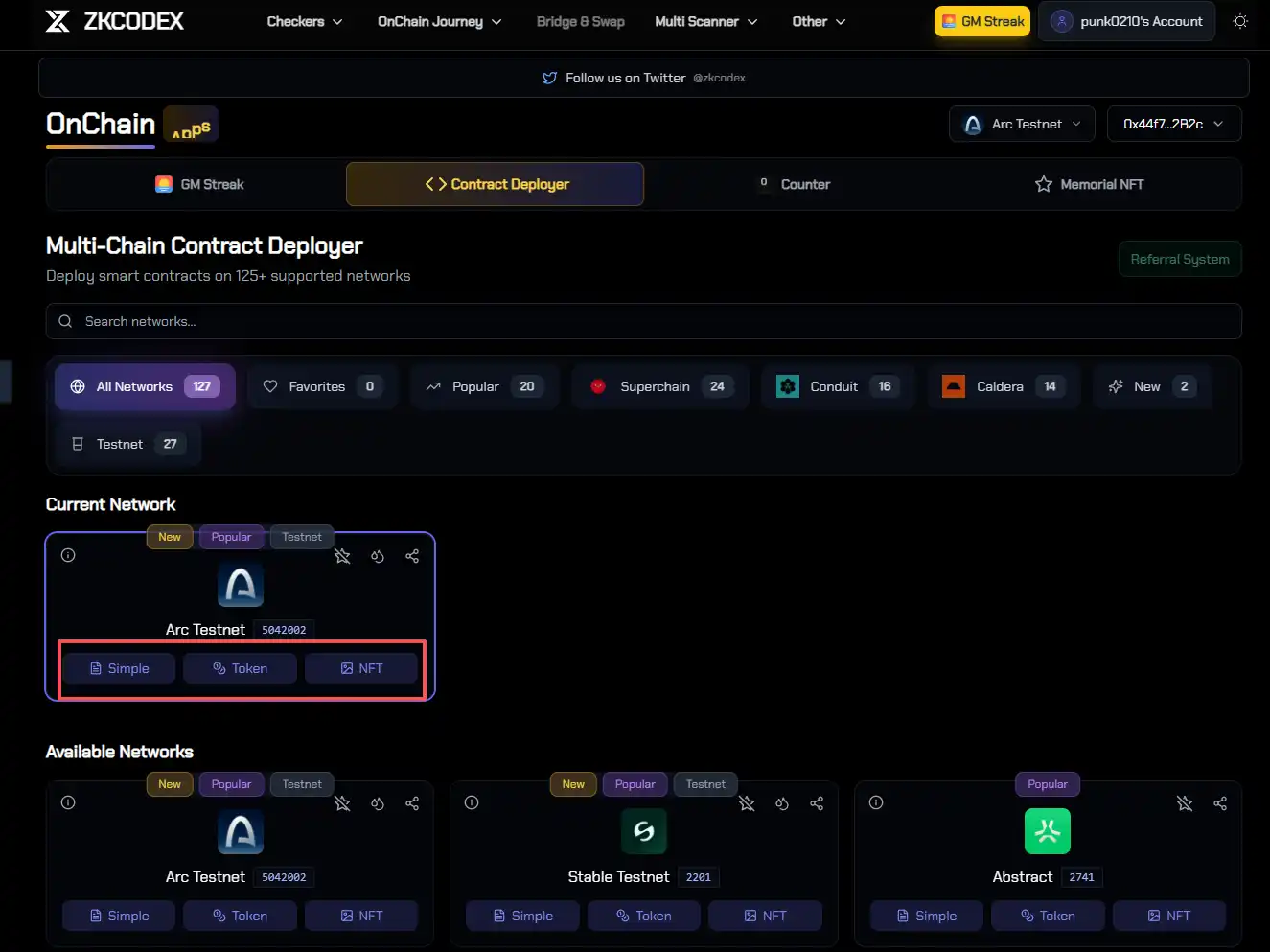

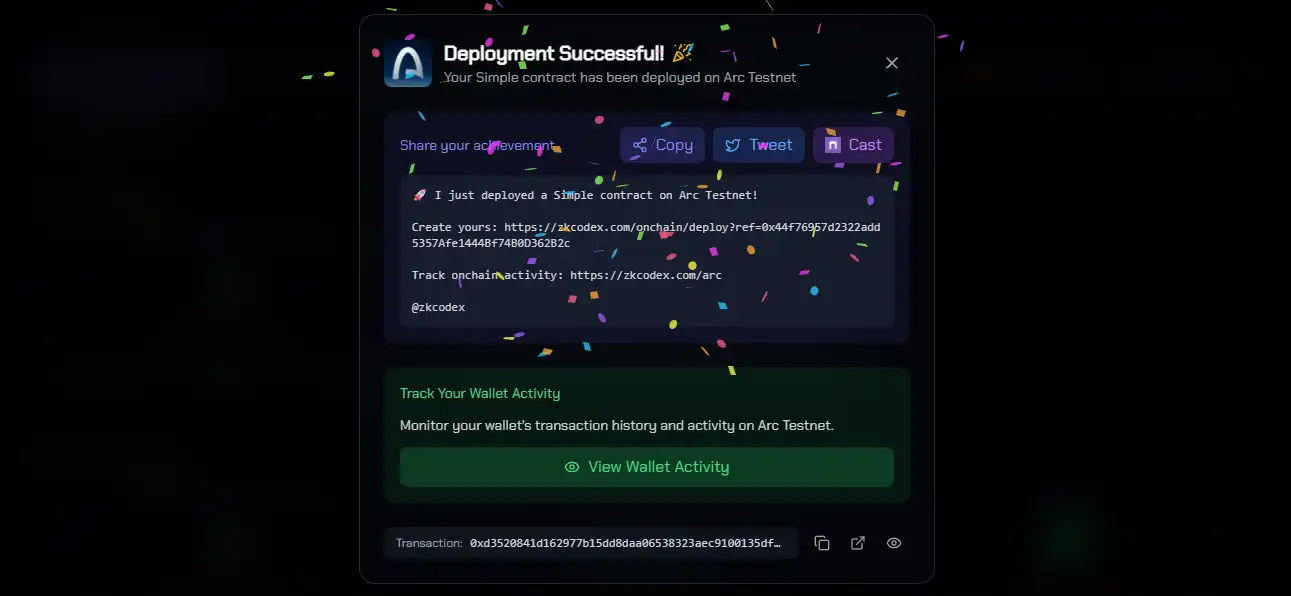

STEP 6. In ZKCODEX Platform, choose Arc Testnet, connect wallet, find Arc Testnet, click Simple Deploy, Token Deploy, NFT Deploy, and confirm in wallet popup.

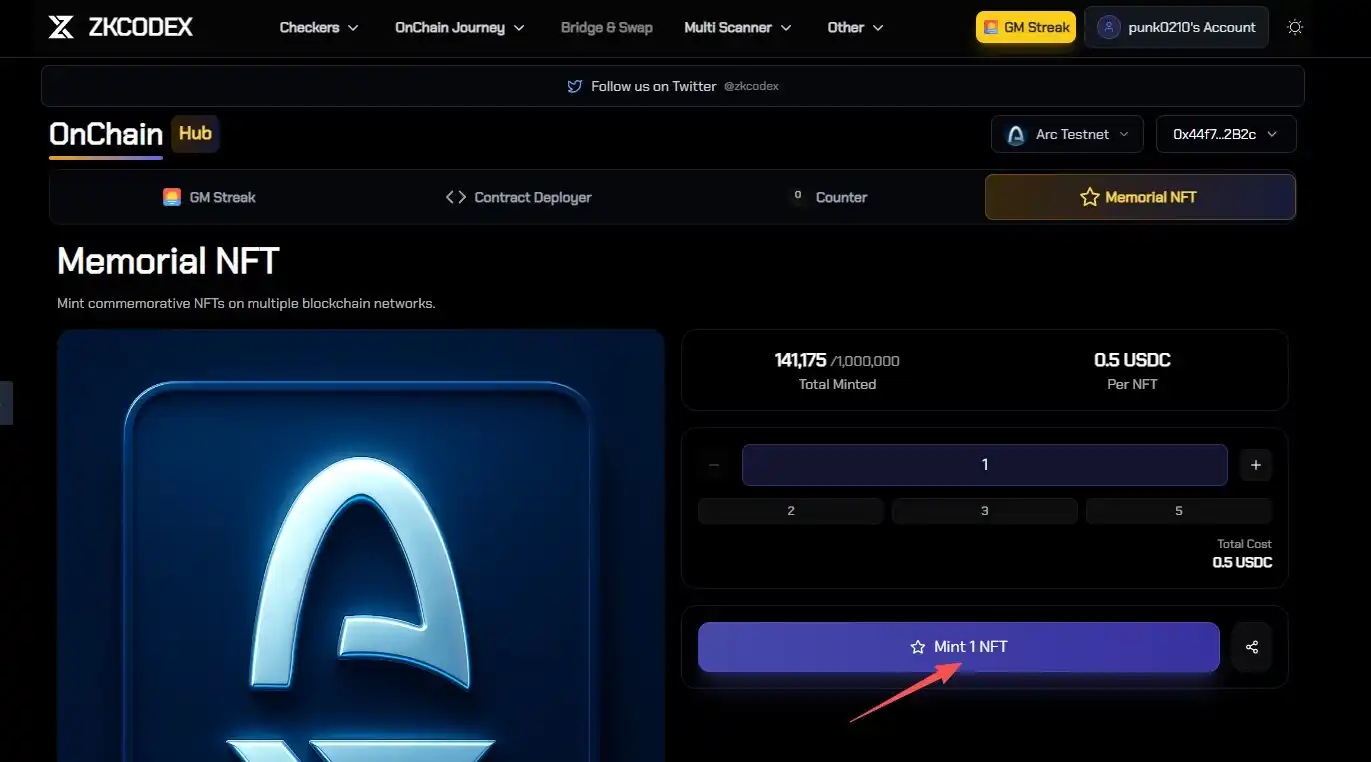

STEP 7. In ZKCODEX Platform, choose Arc Testnet to mint another NFT, click Mint 1 NFT, and confirm in the wallet popup.

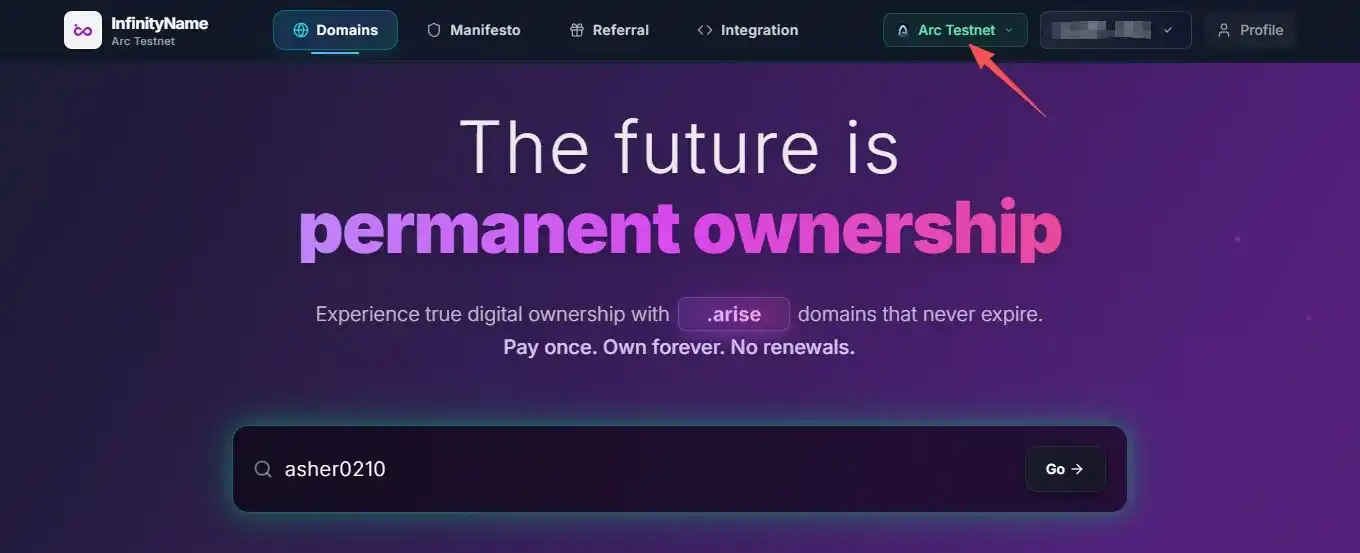

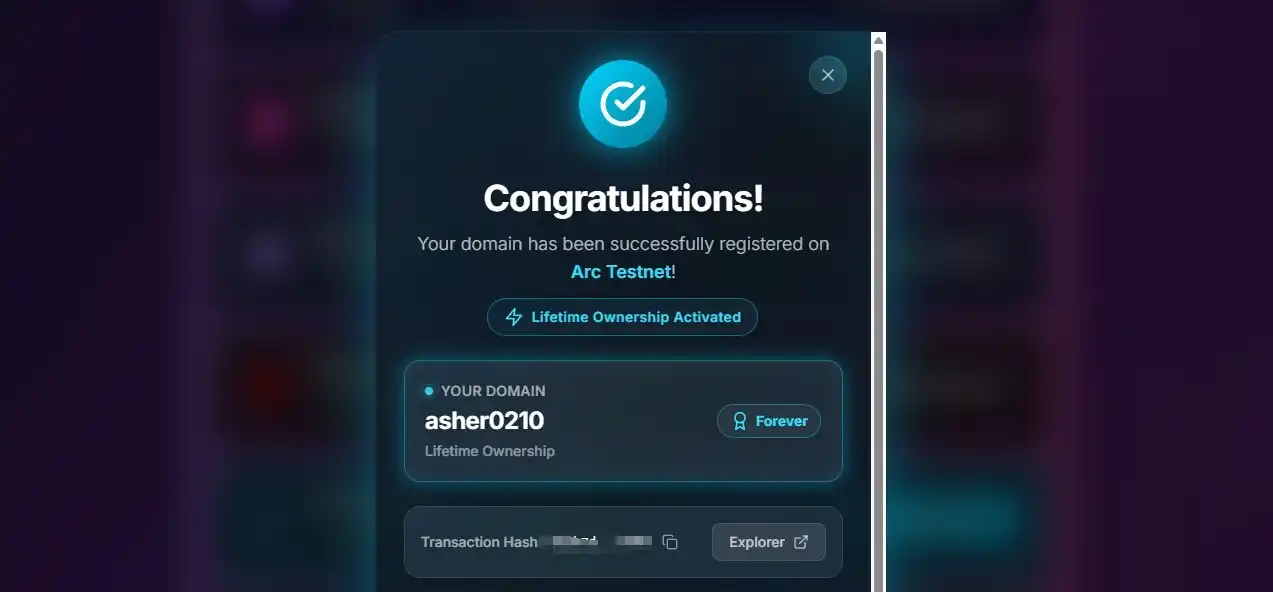

STEP 8. Register a .arc domain on InfinityName Platform, connect wallet, enter desired domain name, find Arc Testnet Registration, and confirm in the wallet popup.

Above is the complete tutorial on interacting with the Arc testnet. If there are any upcoming testnet incentive activities, Odaily Weekly will also be updated as soon as possible.

In addition, on October 30, Arc released the first batch of 11 projects built on the public testnet, which are also worth paying attention to, namely: on-chain stablecoin-related protocol ZKP2P, universal encrypted trading platform Sequence, intelligent agent solution interconnection platform Superface, stablecoin wallet infrastructure Blockradar, stablecoin banking service Copperx, crypto API development company Crossmint, cross-border fund sending and management program Hurupay, wallet infrastructure Para, personalized finance platform CFi, zero-knowledge proof-based wallet Hinkal, cross-chain infrastructure Axelar Network.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: XRP's Death Cross and BTC Short Positions Trigger Bearish Market Downturn

- A major crypto trader linked to Roobet/Stake.com closed a $945K XRP short and expanded BTC shorts to 2,222 BTC ($224.5M), intensifying market volatility. - XRP fell 6% to $2.25 amid broader crypto weakness, with technical indicators warning of potential decline toward $1.72 if key support breaks. - OKX introduced a 10% price cap for RWA token indices to stabilize trading, though high-leverage shorts and macro risks threaten BTC's $90K-$95K support zone. - XRP's "death cross" pattern and Bitcoin's rising

Trust Wallet Token (TWT) Price Trends: Key Drivers and Institutional Indicators After October 2025

- Trust Wallet's TWT token transitioned to a multifaceted utility token in Q4 2025, driven by product innovations like Trust Premium and FlexGas cross-chain swaps. - Institutional interest grew through partnerships with Ondo Finance (RWAs) and Binance co-founder CZ's endorsement, boosting TWT's price 50% within hours. - Price rebounded from $0.7 to $1.6 by October 2025, with analysts projecting $3 by 2025 and $15 by 2030 if adoption and regulatory clarity improve. - Risks include regulatory scrutiny of RWA

TWT's Updated Tokenomics: The Impact of Trust Premium on Investor Confidence and Ecosystem Expansion

- Trust Wallet launched Trust Premium in 2025, transforming TWT from a governance token to a tiered rewards system tied to user engagement. - The program accelerates TWT value through gas discounts, exclusive airdrops, and early feature access, creating a flywheel effect for ecosystem growth. - While lacking explicit APY adjustments, Trust Premium prioritizes utility-driven incentives over yield, attracting stability-focused investors amid volatile crypto markets. - By aligning tokenomics with user behavio

Dogecoin Holds Steady Above $0.153 as Golden Crossover Confirms Channel Breakout