Top CEOs Warn of Overvalued Markets as Bitcoin Weakens Against S&P 500 | US Crypto News

Wall Street leaders are warning that U.S. stocks look stretched, with a 10–15% correction likely on the horizon. As valuations climb, Bitcoin’s weakness against the S&P 500 adds to caution across markets — hinting that a quiet, broad-based reset could already be underway.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as markets buzz with mixed signals. Wall Street’s biggest names are cautioning that stocks look stretched, while Bitcoin’s momentum against major indices is fading, leaving investors wondering if a quiet reset is already underway.

Crypto News of the Day: Wall Street Sees “Full, Not Cheap” Valuations as a 10–15% Correction Looms

Wall Street’s biggest names are sounding the alarm on overheated markets. Bloomberg reports that Goldman Sachs’ David Solomon, Morgan Stanley’s Ted Pick, and Citadel’s Ken Griffin all expect a 10–15% equity correction in the next 12–24 months. In their opinion, this would be a “healthy” adjustment after an extended rally.

Capital Group CEO Mike Gitlin struck a similar tone, saying that while corporate earnings remain strong, valuations have reached “full, not cheap” territory.

“What’s challenging are valuations,” he told a Hong Kong financial summit organized by the city’s Monetary Authority.

Gitlin noted that the S&P 500 currently trades at 23 times forward earnings, well above its 5-year average of 20x. He says this signals that risk premiums have compressed even as policy uncertainty lingers.

Gitlin added that most investors would agree the market is “somewhere between fair and full,” but few would say it’s “between cheap and fair.” Credit spreads are showing the same pattern, with pricing strength, but offer little cushion against shocks.

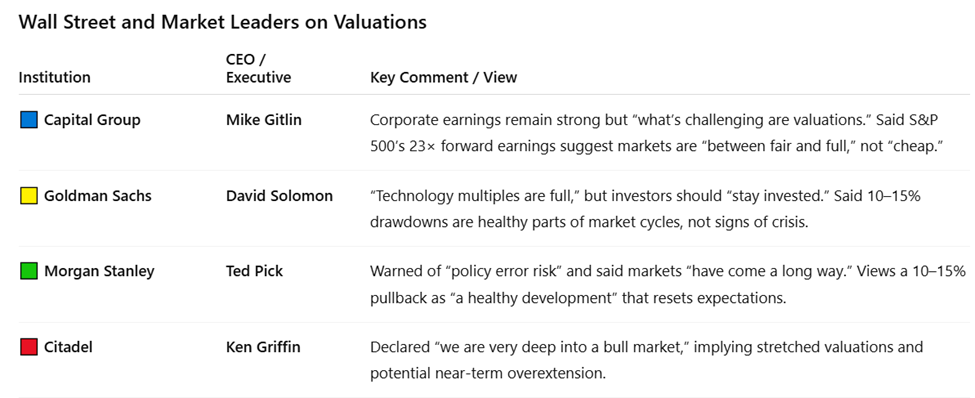

Wall Street Top CEOs on Valuations.

Wall Street Top CEOs on Valuations.

Crypto Mirrors the Macro: Bitcoin Weakens Against S&P 500

The caution on Wall Street is also being felt in crypto markets, where Bitcoin’s relative weakness against the S&P 500 (BTC/SPX) is drawing comparisons to previous late-cycle behavior.

Crypto analyst Brett noted that BTC/SPX is printing its third consecutive candle below the 50-week simple moving average, a level that has historically supported the asset during bull runs.

“In the prior cycle, Bitcoin began showing weakness against the SPX near the end of the cycle,” he said, warning that losing this level could foreshadow a broader risk-off rotation.

Brett also observed that in the past three cycles, when Bitcoin peaked, the S&P 500 entered a prolonged 750–850-day chop phase, often retesting its pre-peak price before resuming its upward trend. If history repeats itself, equity markets may be approaching a similar inflection point.

Meanwhile, Bitwise CEO Hunter Horsley suggests that expectations of a 2026 bear market may have already “pulled forward” much of the downside risk.

“What if we’ve actually been in the bear market for much of this year? Crazier things have happened. The market is changing,” he posed.

As equities flirt with record valuations and Bitcoin’s momentum wavers against traditional indices, both markets appear to be approaching a phase of price normalization rather than collapse.

Based on the top CEO’s projections, Wall Street’s tone is cautious but not panicked. This suggests that while risk appetites remain high, investors may soon favor fundamentals over euphoria.

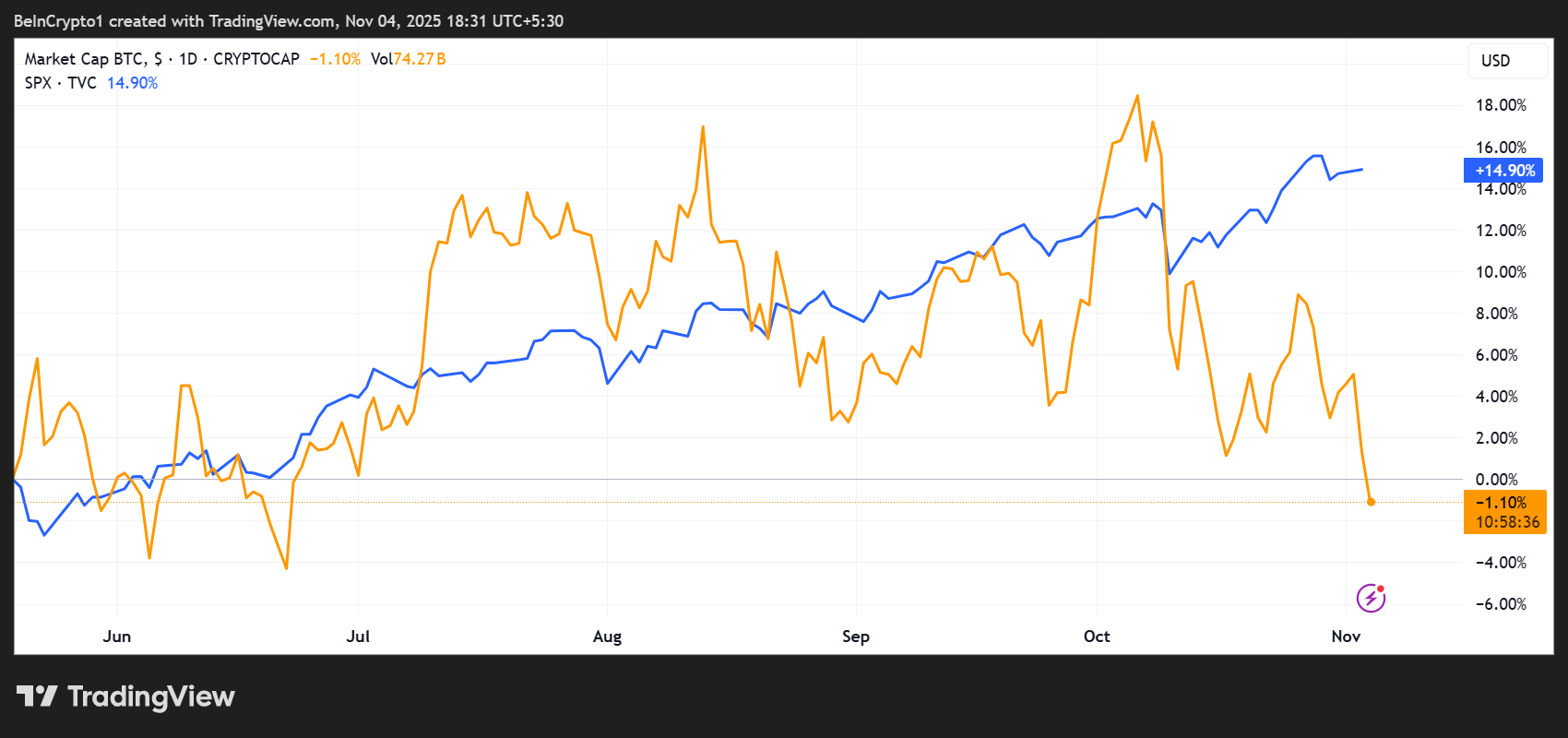

Chart of the Day

Bitcoin vs S&P 500. Source:

TradingView

Bitcoin vs S&P 500. Source:

TradingView

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- More money, lower prices: The liquidity–Bitcoin disconnect explained.

- Investors turn to this altcoin after missing out on the ZEC and DASH rally.

- Strategy unveils first Euro-denominated perpetual preferred stock to fund Bitcoin growth.

- Is Pi coin preparing for a 47% rally? This pattern says it might be.

- Bitcoin breakdown begins — on-chain signals say brace for $104,000.

- Michael Burry, Warren Buffett flash red warnings for November as markets overheat.

- Ripple makes another key acquisition while XRP extends 15% weekly slide.

Crypto Equities Pre-Market Overview

| Company | At the Close of November 3 | Pre-Market Overview |

| Strategy (MSTR) | $264.67 | $257.25 (-2.80%) |

| Coinbase (COIN) | $330.42 | $319.75 (-3.23%) |

| Galaxy Digital Holdings (GLXY) | $34.88 | $33.22 (-4.76%) |

| MARA Holdings (MARA) | $17.81 | $17.44 (-2.08%) |

| Riot Platforms (RIOT) | $20.72 | $20.00 (-3.47%) |

| Core Scientific (CORZ) | $22.90 | $22.11 (-3.45%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polymarket's 25% Fake Volume Poses a Risk to the Trustworthiness of Prediction Markets

- Columbia researchers found 25% of Polymarket's trading volume is artificially inflated via wash trading, peaking at 60% in December 2024. - The study attributes this to Polymarket's fee-free model and pseudonymous wallets enabling linked accounts to manipulate volume metrics. - Sports markets showed 45% artificial activity, raising concerns about prediction markets' reliability as public sentiment indicators. - Polymarket's planned U.S. re-entry under CFTC regulation faces scrutiny amid claims that 48% o

Zcash Latest Updates: ZEC Reaches Highest Level in 7 Years as $18.8M Gets Liquidated, Yet Derivatives Indicate Weakness

- Zcash (ZEC) surged to a $586 seven-year high, driven by institutional interest and 30.41% shielded pool adoption. - $18.8M in ZEC perpetual futures liquidations highlight market volatility, with a $14.5M short loss on Hyperliquid. - Derivatives data shows $713M open interest and $30.27M long liquidation risks, signaling fragile bullish momentum. - Analysts warn of potential correction below $450 despite strong privacy-driven adoption and spot wallet inflows.

BTC breaks $102,000

Bitcoin News Today: Bitcoin’s $106K Floor Turns Into Key Battle Zone Between Bulls and Bears Amid Diverging Derivatives

- Bitcoin fluctuates near $100K as price drops 2.7% in 24 hours, with 14% decline from its $126K all-time high. - Derivatives data shows 62.6% higher trading volume but falling open interest, signaling short-term uncertainty and position closures. - Binance's CVD indicator drops to 0.777 from 0.91, suggesting waning demand from large traders despite stable BTC prices. - Technical indicators highlight $106K support and $111K resistance, with risks of stagnation if CVD falls below 0.70. - Institutional deman