CleanSpark: October mining yielded 612 BTC, increasing Bitcoin holdings to 13,033.

CleanSpark, a bitcoin mining company listed on Nasdaq, has released its latest unaudited production and operations update report, revealing that it mined 612 BTC in October. As of October 31st, its bitcoin holdings have increased to 13,033 BTC (including 5,444 BTC held as collateral or accounts receivable).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin Latest Updates: DOGE ETF Approval Approaches Amid Price Drop—Will Institutional Investors Halt the Decline?

- Bitwise files 8(a) form for DOGE ETF, triggering 20-day SEC approval countdown as of Nov 7, 2025. - Proposed "BWOW" ETF could institutionalize meme coin exposure but Dogecoin trades near $0.165 below key support. - Analysts warn of $0.10 price target by 2025 due to broken support and trapped sell pressure, contrasting with Ripple's $1B buyback. - SEC's crypto ETF framework and industry competition (Grayscale, Osprey) accelerate adoption despite DOGE's speculative fundamentals. - Market remains divided: E

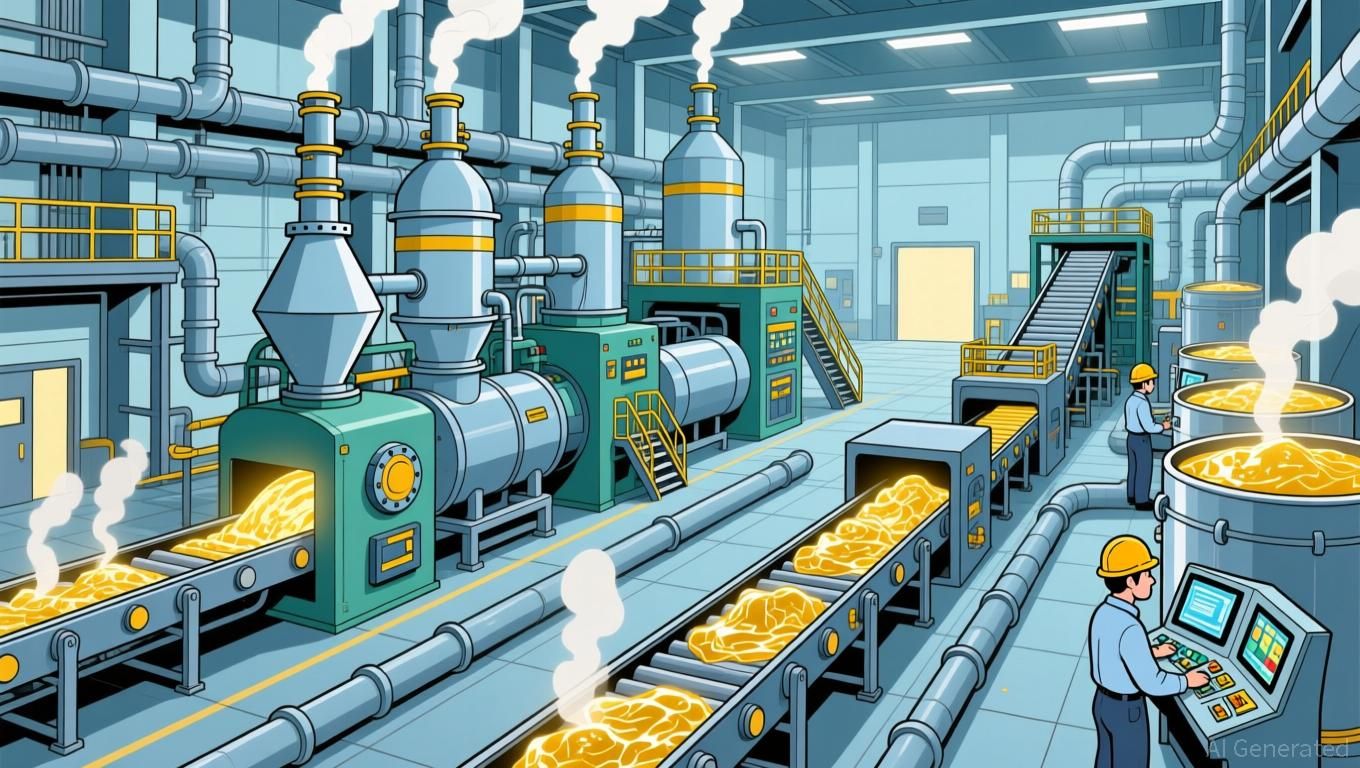

TRX News Today: TRX Gold's Cutting-Edge Technology Boosts Output and Prolongs Mine Operations

- TRX Gold accelerates Buckreef Gold Project expansion in Tanzania, targeting 3,000+ TPD throughput and 62,000-ounce annual gold production by 2027. - The $30M dual-circuit upgrade employs advanced tech to concentrate 87-90% of gold into 15% of processed mass, enhancing recovery rates and cost stability. - Analysts raised price targets (up to $1.20) citing execution capability, ESG focus, and phased internal financing reducing external risks. - Risks include equipment delays and recovery targets, but prior

Quantum Computing and the Critical Need for Quantum-Resistant Infrastructure: A Strategic Priority for Investment

- Quantum computing threatens global encryption systems, with "harvest now, decrypt later" risks accelerating as cybercriminals stockpile data for future decryption. - Experts warn telecom networks face urgent vulnerabilities, requiring immediate adoption of quantum-safe measures to prevent decade-long decryption risks. - Pioneers like Michelle Simmons advance atomic-scale quantum solutions, while PQC markets surge from $1.15B to $7.82B by 2030, driven by NIST standards and critical infrastructure demands.

Bitcoin News Update: Cryptocurrency Market Navigates Regulatory Challenges and Price Fluctuations Amid Approaching Highs

- Mike Novogratz claims the crypto market cycle hasn't peaked, citing liquidity injections, regulatory shifts, and institutional adoption as key drivers. - Despite Fed liquidity measures, crypto sentiment remains bearish (Fear & Greed Index at 21), with Bitcoin/ether trading in a $105k–$115k range amid macroeconomic uncertainty. - The CLARITY Act's progress and Morgan Stanley's "Overweight" Galaxy Digital rating highlight regulatory clarity and AI-driven infrastructure as potential catalysts for institutio