Why the Crypto Market Isn’t Rallying Despite the Fed’s $37 Billion Liquidity Injection

The Federal Reserve’s biggest liquidity boost in years has failed to lift crypto markets—offset by reverse repos and fear, the sector remains trapped in a volatile tug-of-war.

The Federal Reserve has injected an estimated $37 billion into the US banking system since last Friday.

Despite this influx of capital, investor sentiment in cryptocurrency markets has plunged to levels of extreme fear. Major assets are posting sharp declines, and the sector’s total capitalization has slipped 6.11% this month.

Liquidity In, Prices Down: The Fed–Crypto Disconnect Explained

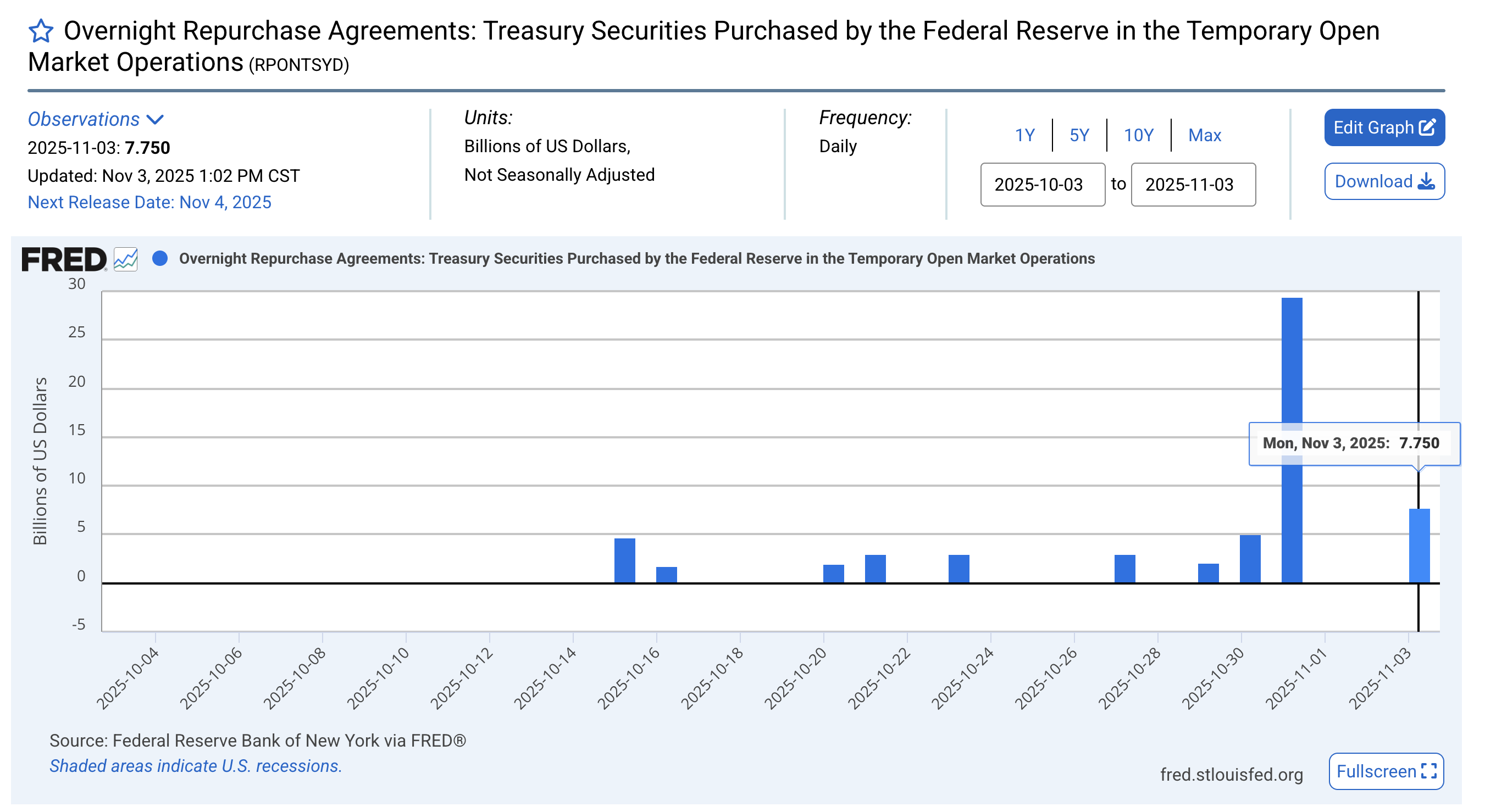

According to the latest data, on November 3, the Federal Reserve carried out an additional $7.75 billion in repo operations. The move came shortly after the Fed added $29.4 billion to the banking system on Friday.

Federal Repo Agreements. Source:

FRED Economic Data

Federal Repo Agreements. Source:

FRED Economic Data

This marked the largest single-day liquidity boost since the dot-com era. In addition, the total liquidity injections have amounted to around $37 billion.

“This is the biggest money printing event of the last 5 years. The crypto market is about to go parabolic,” Alex Mason wrote.

In addition to Treasuries, the Fed also injected $14.25 billion in liquidity through repo operations backed by mortgage-backed securities that same day.

🚨 BREAKING 🚨🇺🇸 The Fed injected another $22 billion in liquidity today.Fed pivot has already started.

— Max Crypto

When the Federal Reserve injects liquidity, it means there’s more cash circulating in the financial system. Banks and institutions now have additional capital to deploy, which can flow into riskier assets, such as stocks and cryptocurrencies. In theory, this extra liquidity supports prices.

“Everyone is calling bear market at the worst possible time. Global liquidity is about to ramp: Fed repo inflows, TGA floodgates, Asia stimulus wave, Credit easing coming. This entire cycle ran on no liquidity. That’s why only Bitcoin made new highs. When liquidity returns, altcoins move. The macro setup is loaded,” Merlijn The Trader remarked.

Yet despite the recent liquidity boost, crypto markets have yet to benefit. In fact, sentiment has turned sharply negative.

The Crypto Fear and Greed Index has dropped to 21, signaling “Extreme Fear.” This marks the lowest reading since April 2025, down from a neutral 50 just a week earlier.

Furthermore, asset prices are also down. Bitcoin (BTC) has declined by nearly 5% so far in November, while Ethereum (ETH) has dropped by almost 9% over the same period.

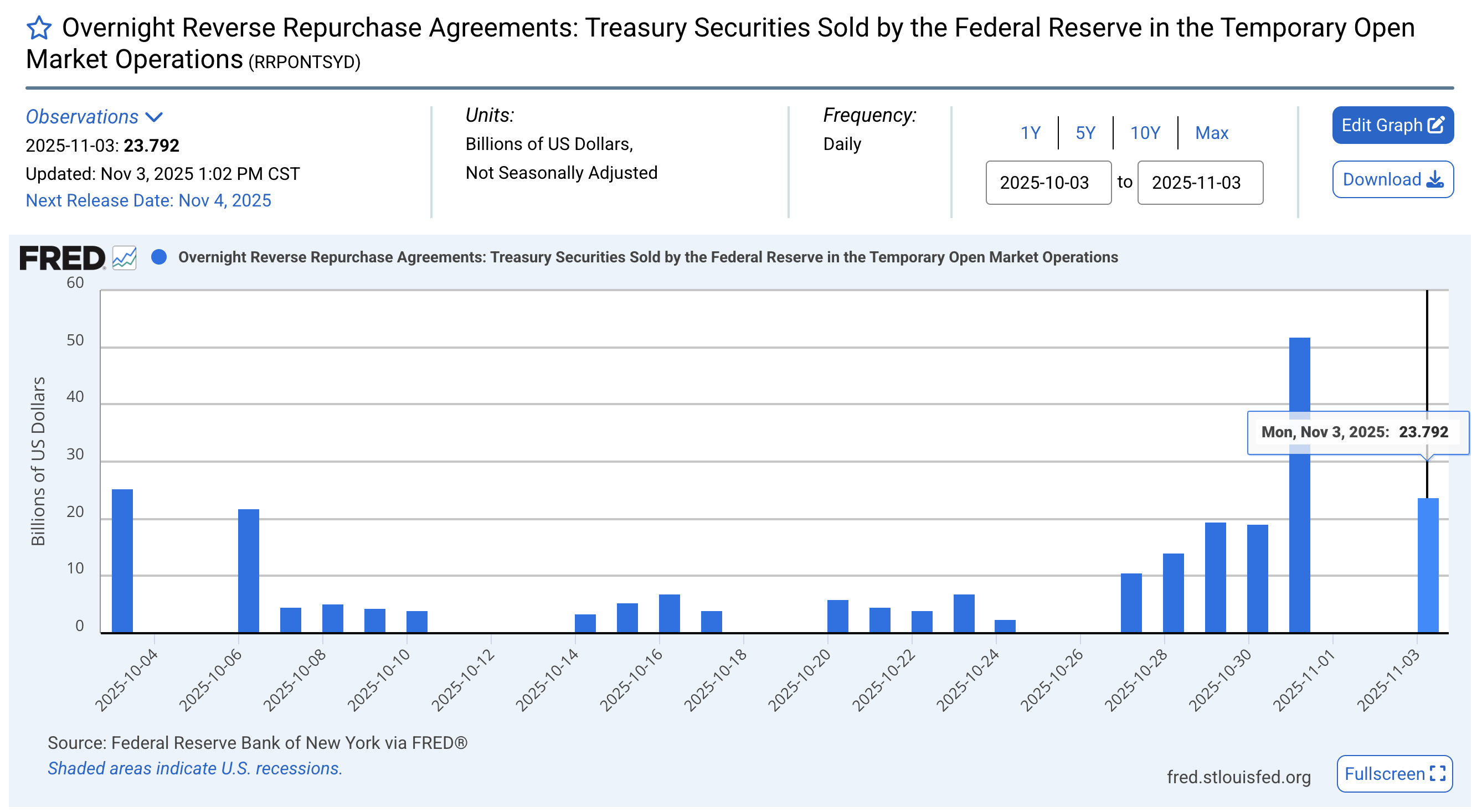

This disconnect may stem from the Fed’s reverse repo operations. According to the latest data, the central bank has conducted over $75 billion in reverse repos since last Friday — including nearly $24 billion on November 3 alone.

Federal Reverse Repo Agreements. Source:

FRED Economic Data

Federal Reverse Repo Agreements. Source:

FRED Economic Data

Unlike repo operations, which inject liquidity into the financial system, reverse repos drain cash. In these transactions, the Fed borrows money from banks and money-market funds in exchange for Treasuries as collateral. This effectively pulls liquidity out of circulation, tightening short-term funding conditions.

The sharp rise in reverse repo usage suggests that financial institutions are seeking safety and parking excess cash with the Fed instead of deploying it in the market. The mixed signals, injections through repos but simultaneous liquidity absorption through reverse repos, highlight uncertainty in the financial system.

For risk assets like crypto, this push-and-pull dynamic helps explain why markets remain volatile: despite fresh liquidity inflows, overall conditions still feel tight, keeping investor sentiment on edge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report November 4, 2025

1️⃣ Ebunker ETH staking yield: 3.32% 2️⃣ stETH (Lido) 7-day average annualized yield...

XRP price flashes classic ‘hidden bullish divergence.’ Is $5 still in play?

Bitcoin falls under $101K: Analysts say BTC is ‘underpriced’ based on fundamentals

The Secret Script of the Crypto Market: How Whales Manipulate 90% of Traders, and How You Can Stop Being "Liquidity"