Altcoins Collapse: Less Than 5% Beat Bitcoin as BTC Dominance Hits 60%+

Bitcoin is reclaiming control of the crypto market as altcoins “bleed,” with dominance soaring above 60% for the first time in years. Analysts warn that 2025 may favor Bitcoin and high-quality sectors like DeFi and RWA, leaving speculative altcoins behind.

After more than two months of weakness, Bitcoin is reasserting its dominance. The Bitcoin Dominance Index surpasses the 60% mark, the highest level since mid-2021.

Meanwhile, most altcoins have plunged, with fewer than 5% of the top 55 tokens outperforming BTC. As institutional inflows continue to favor Bitcoin, a clear “risk-off” sentiment is spreading across the market, firmly placing crypto in a new “Bitcoin Season.”

Bitcoin Consolidates Power as Altcoins Lose Ground

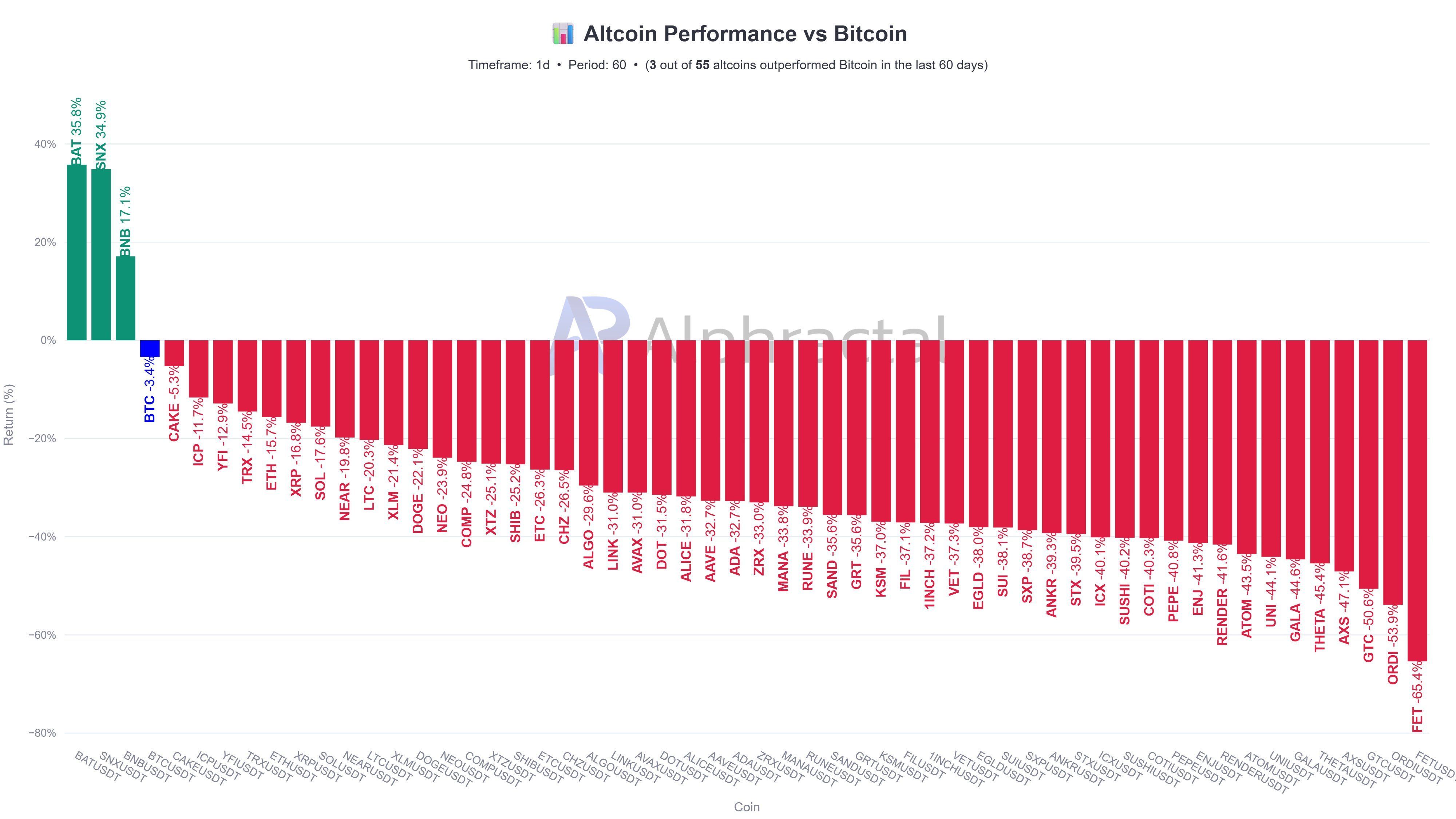

According to data from Alphractal, only 3 out of 55 major altcoins have outperformed Bitcoin (BTC) over the past 60 days, while the rest have lost between 20% and 80% of their value. The broader altcoin market remains deeply in the red, as reflected in the Altcoin Season Index, which currently hovers around 25-29, indicating that the market is in a Bitcoin Season.

Altcoin performance vs Bitcoin. Source:

Alphractal

Altcoin performance vs Bitcoin. Source:

Alphractal

On the Bitcoin Dominance (BTC.D) chart, the index reached 60.74%, up from 59% at the end of September, marking the highest level over two years. This signals that capital rotates out of riskier assets and back into Bitcoin. Analysts, such as Benjamin, forecast that altcoins could drop another 30% against Bitcoin in the coming weeks if Bitcoin’s uptrend continues.

BTC.D chart. Source:

TradingView

BTC.D chart. Source:

TradingView

Selling pressure across the altcoin market has intensified after several analysts noted that the structure established following the October crash is now breaking down. If this selling momentum persists, altcoins could enter a deeper downside phase.

Still, some traders remain optimistic about the broader market structure over the next three to six months. Bitcoin continues to hold above its 50-week EMA, with liquidity rising and expectations growing for a potential Fed rate cut in December. According to one trader, altcoins will eventually follow as long as BTC maintains its trend.

“Ignore fear, follow structure,” the user emphasized.

At this stage, we may witness a familiar liquidity rotation, capital flowing out of altcoins to reinforce Bitcoin’s dominance. As long as BTC remains strong on the weekly timeframe and institutional capital continues to enter the market, altcoins are unlikely to break out independently. This environment favors a defensive strategy, prioritizing BTC and stablecoins over speculative assets.

Recovery Signs May Emerge, but Not for All

Despite the short-term bearish outlook for altcoin performance vs Bitcoin, several analysts highlight the possibility of a technical bounce soon. According to another X user, the “Others vs BTC” chart just closed its monthly candle with a long wick to the downside, a pattern that has historically preceded short-term rebounds as markets “fill gap” in subsequent sessions.

Others/BTC chart. Source:

Bitcoinsensus

Others/BTC chart. Source:

Bitcoinsensus

While Bitcoin holds the upper hand, any pause or pullback in BTC’s momentum could allow altcoins to stage a selective recovery. This would enable speculative capital to flow back into smaller-cap tokens.

In summary, while a short-term recovery is possible, only a few market segments are likely to benefit, particularly projects with strong fundamentals and tangible applications, such as RWA, DeFi, or AI-linked tokens. The market is becoming increasingly selective, leaving little room for narrative-driven altcoins with weak fundamentals. Therefore, late 2025 may not bring a broad-based “altseason,” but rather a selective mini-altseason defined by quality over hype.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Central Bank Issues Historic Penalty: Adhering to Crypto Regulations Is Now Essential

- Ireland's Central Bank fined Coinbase Europe €21.5M for AML/CFT failures, marking its first crypto enforcement action. - Systemic flaws allowed 30M unmonitored transactions (€176B) due to software errors and governance gaps. - Regulators emphasized crypto compliance urgency, citing MiCA regulations and law enforcement collaboration risks. - Coinbase acknowledged technical errors but faced reduced penalties via early settlement under regulatory programs. - Case highlights EU's intensified crypto oversight

Fed's Balancing Act: Navigating Inflation and Employment in the 2025 Interest Rate Challenge

- The Fed debates 2025 rate cuts to balance 3% inflation control with a cooling labor market, as policymakers like Jefferson advocate a slow easing approach. - Mixed signals persist: U.S.-China trade deal eased volatility but left businesses cautious, while Matson's 12.8% China service decline highlights lingering tensions. - Market expects 25-basis-point December cut, but Powell warns uncertainty remains, compounded by government shutdown limiting key data access. - Rate-cut expectations boosted municipal

Bitcoin News Update: Institutions Pour In Funds Despite Bitcoin Downturn: ETFs Draw $240M During Market Turbulence

- Bitcoin ETFs saw $240M net inflows on Nov 6, ending a six-day outflow streak led by BlackRock's IBIT and Fidelity's FBTC. - Despite Bitcoin's 9% weekly price drop to $100,768, institutional confidence grew in regulated, low-fee ETF products amid market volatility. - Altcoin ETFs gained traction while total crypto ETPs faced $246.6M outflows, highlighting diverging investor priorities. - Analysts attribute Bitcoin's decline to internal dynamics, not ETFs, as on-chain data shows easing sell-pressure and st

Hyperliquid's 2025 Boom: Blockchain-Based Liquidity and Shifting Retail Trading Trends

- Hyperliquid's TVL surged to $5B in Q3 2025, capturing 73% of decentralized perpetual trading volume via on-chain liquidity and retail demand. - Technological innovations like HyperEVM and strategic partnerships drove $15B open interest, outpacing centralized rivals' combined liquidity. - Retail traders executed extreme leverage (20x BTC/XRP shorts) and $47B weekly volumes, highlighting both platform appeal and liquidation risks. - Institutional interest (21Shares ETF application) and deflationary tokenom