Balancer Hack Cascading Effect: Why Did XUSD Break the Buck?

The long-standing issues around leverage, oracle building, and PoR transparency have once again come to the forefront.

Original Article Author: Omer Goldberg, Chaos Labs

Original Article Translation: DeepTech TechFlow

Summary

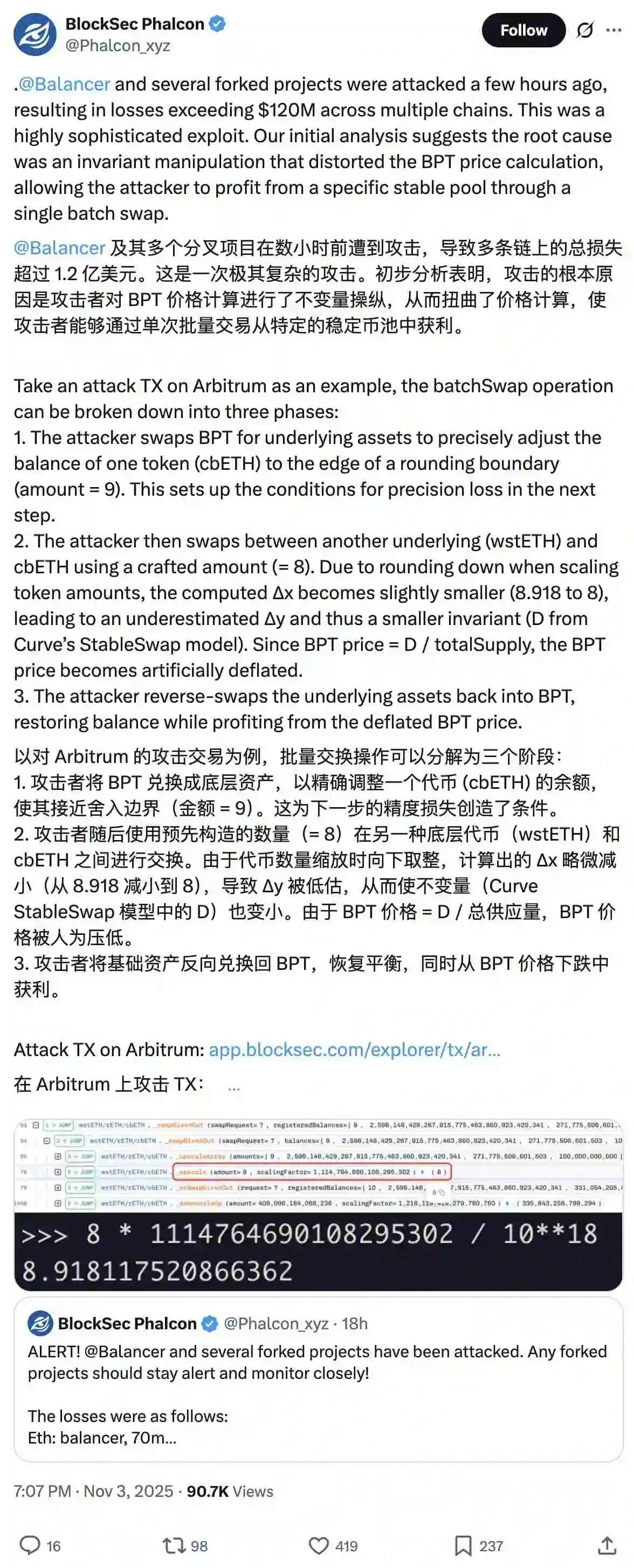

Several hours after the DeFi space experienced widespread uncertainty due to a vulnerability attack on the multi-chain platform @Balancer, @berachain performed an emergency hard fork, and @SonicLabs froze the attacker's wallet.

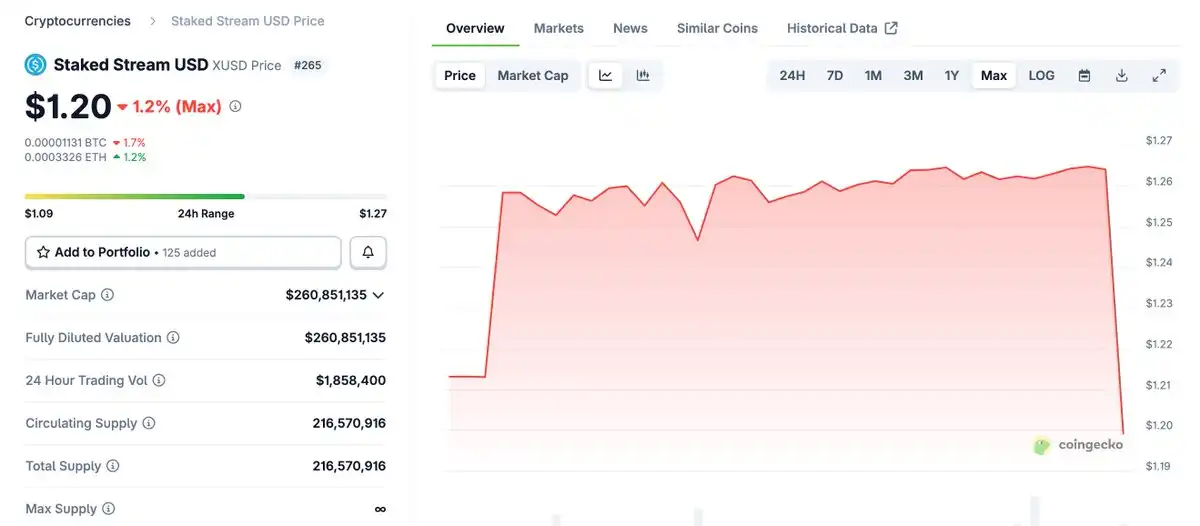

Subsequently, the price of Stream Finance's xUSD stablecoin significantly deviated from its target range, exhibiting a clear de-pegging event.

Long-Standing Issues Resurface

The long-standing controversies surrounding leverage, oracle reliance, and Proof of Reserves (PoR) transparency once again took center stage.

This is precisely the case of a typical "reflexivity stress event" outlined in our "DeFi's Black Box/Treasury" article last Friday.

What Happened? / Background

The Balancer v2 vulnerability emerged across multiple chains, and for a considerable amount of time, it was unclear which pools were affected, which networks or integrated protocols were directly exposed to risk.

Capital Panic in an Information Vacuum

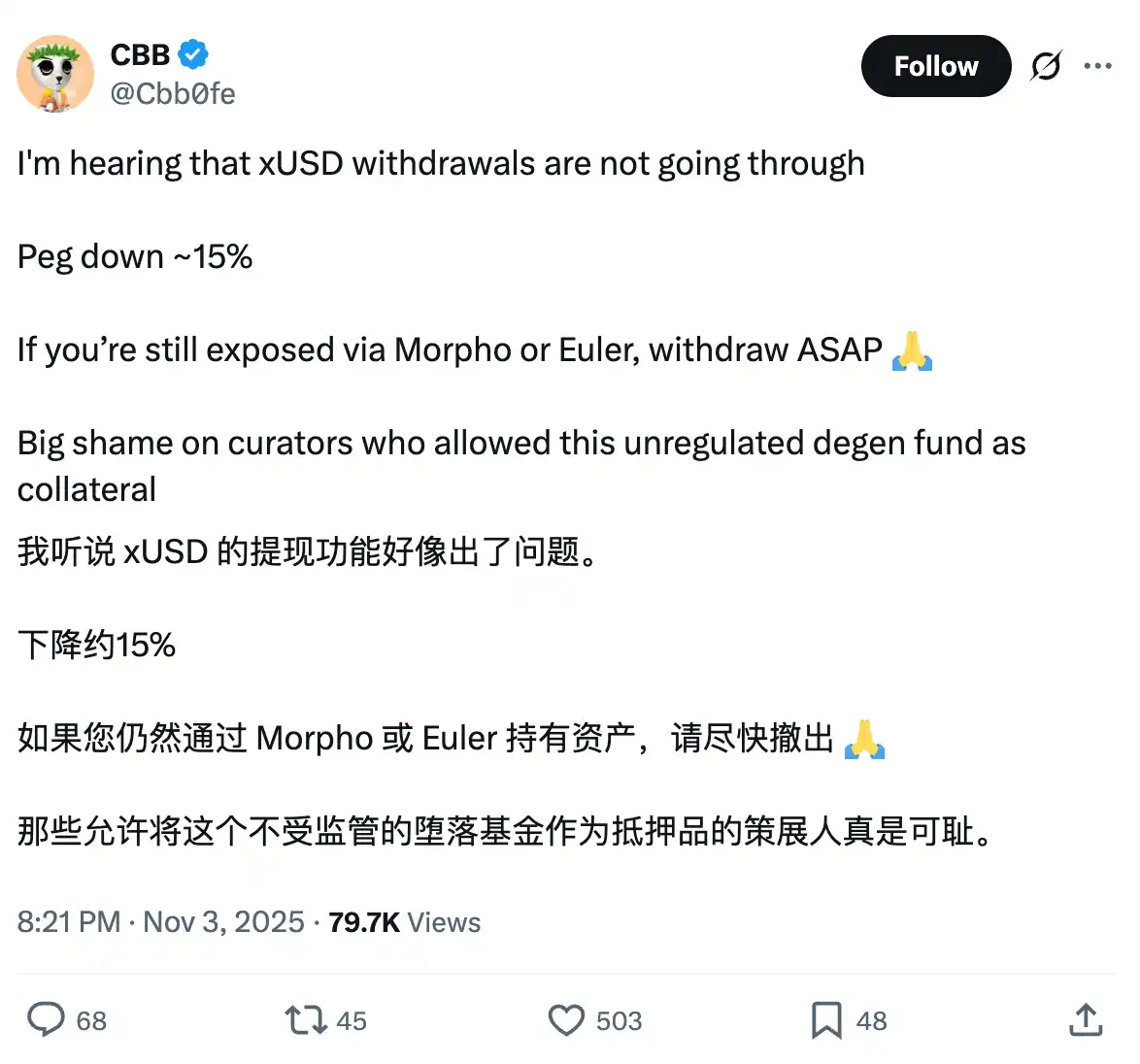

In the information vacuum, capital's response was as expected: depositors rushed to withdraw liquidity from anywhere they perceived to be potentially impacted directly or indirectly, including Stream Finance.

Transparency Dispute

Stream Finance currently does not maintain a comprehensive transparency dashboard or Proof of Reserve; however, it does provide a link to the Debank Bundle to display its on-chain positions.

However, following the vulnerability outbreak, these modest disclosures failed to definitively address the risk exposure issue: the price of xUSD (Stream's yield-bearing USD product) dropped from the target price of $1.26 to $1.15, currently rebounding to $1.20, while users reported withdrawal suspensions.

Risks and Controversies of Stream Finance

Stream is an on-chain capital allocation platform that utilizes user funds to implement high-yield, high-risk investment strategies.

Its portfolio construction involves significant leverage to make the system more resilient under pressure. However, the protocol has recently come under public scrutiny due to controversies surrounding a recursive minting mechanism.

While the current situation does not directly indicate a liquidity crisis, it unveils the market's high sensitivity. When negative news emerges and confidence is questioned, the shift from "probably fine" to "immediately redeem" often occurs swiftly.

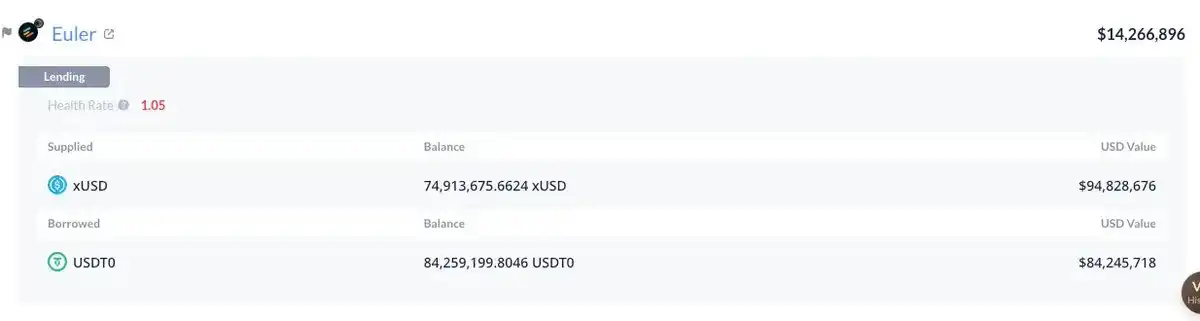

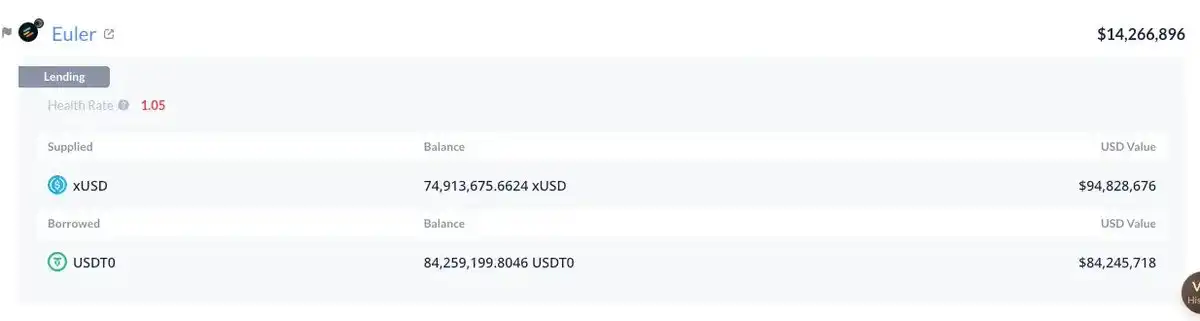

xUSD is used as collateral distributed across curated markets on multiple chains, including Euler, Morpho, and Silo, spanning ecosystems like Plasma, Arbitrum, and Plume.

The protocol itself carries significant risk exposure in these markets, with the largest exposure being $84 million USDT borrowed against xUSD collateral on Plasma.

Collateralization Mechanism and Risk Buffering

When the market price of xUSD falls below its book value, relevant positions are not immediately liquidated. This is because many markets do not peg the collateral's value to the spot AMM price but rely on hardcoded or "base value" oracle feeds that track assets' reported backing rather than current secondary market prices.

During calm periods, this design can help mitigate tail risk liquidation due to short-term volatility, especially in stable products. This is also why DeFi protocols outperformed centralized platforms during the liquidation wave on October 10.

However, this design can also swiftly turn price discovery into trust discovery: selecting a base (or hardcoded) oracle requires thorough due diligence, including the authenticity, stability, and risk characteristics of the asset backing.

In short, this mechanism only applies when full Proof of Reserve is available and redemption can be completed in a reasonable time frame. Otherwise, the risk is that the lender or depositor may ultimately bear the consequences of default.

Stress Test on Arbitrum

Using Arbitrum as an example, the current market price of the MEV Capital Curated xUSD Morpho Market has fallen below the LLTV (Minimum Loan-to-Value). If the anchoring price of xUSD cannot recover, in a scenario where the utilization reaches 100% and the borrowing rate soars to 88%, the market may further deteriorate.

We are not against base layer oracles; on the contrary, they play a crucial role in preventing unfair liquidations caused by short-term fluctuations. Similarly, we are not against tokenization or even centralized yield-bearing assets. However, we advocate for basic transparency and the adoption of modern, systematic, and professional risk management when deploying currency markets around these assets.

Curated Markets can be an engine for responsible growth, but they should not devolve into a race to sacrifice security and rationality for the sake of chasing yields.

If what is built is a "domino-like" complex structure, then the collapse should not be surprising when the first gust of wind blows. As the industry professionalizes and some yield products become more structured (but potentially more opaque to end-users), risk stakeholders must raise the bar.

Although we hope to eventually resolve the issues for affected users properly, this incident should serve as a wake-up call for the entire industry.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price gets $92K target as new buyers enter 'capitulation' mode

Full statement from the Reserve Bank of Australia: Interest rates remain unchanged, inflation expectations raised

The committee believes that caution should be maintained, and that outlook assessments should be continuously updated as data changes. There remains a high level of concern regarding the uncertainty of the outlook, regardless of its direction.