BlackRock and 30 other companies participate in GDF tokenized money market fund collateral simulation

Jinse Finance reported that the Global Digital Finance (GDF) organization has released a report stating that a working group composed of 70 companies has completed a legal study on tokenized collateral of European money market funds. Among them, 30 companies participated in simulation tests, including BlackRock, State Street, UBS, Deutsche Bank, HSBC, and others. The report points out that currently, 68% of collateral is still delivered in cash, and the tokenization of money market funds can improve collateral liquidity and alleviate the pressure of asset liquidation seen in crises such as the 2022 UK government bond crisis. The research focuses on the legal frameworks of the UK, Ireland, and Luxembourg, assessing the impact of tokenization on fund availability, operations, and regulatory risks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Standard Chartered: Bitcoin and Ethereum custody services to be launched in Hong Kong next year

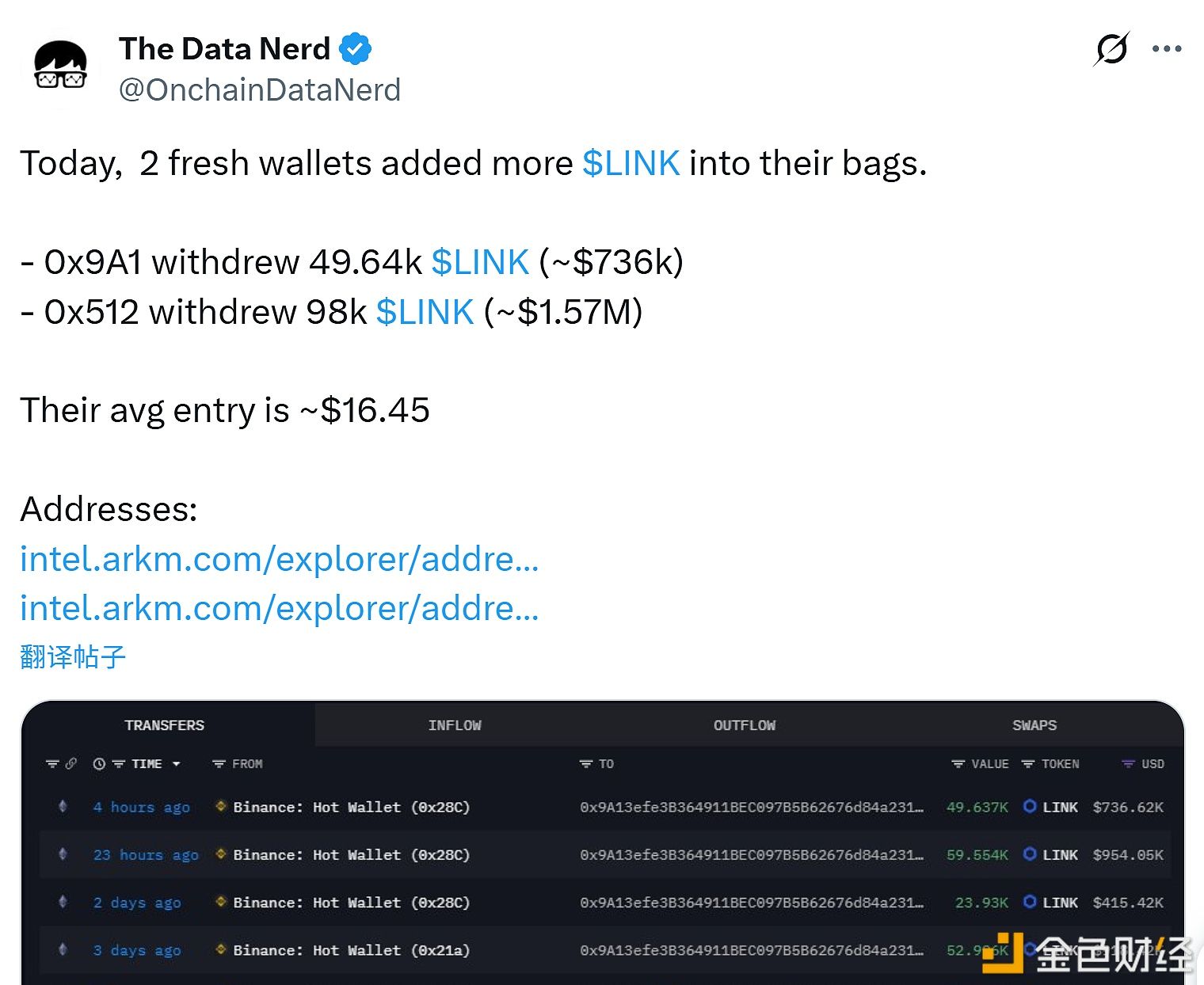

Two new wallets accumulated LINK tokens worth $2.3 million today.

Two new addresses have accumulated over $2.3 million worth of LINK, with an average purchase price of $16.45.