BasePerp To Enable Creation of Perpetual Futures Markets on Base

November 3, 2025 – Singapore, Singapore

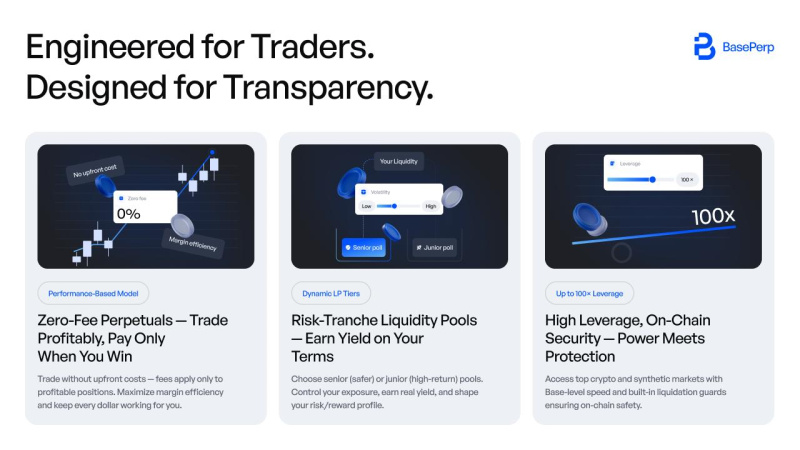

BasePerp has announced the launch of the first native perpetual DEX (decentralized exchange) built on the Base blockchain.

The platform is designed to deliver high-performance derivatives trading within one of the fastest-growing ecosystems in 2025, combining scalability, security and deep liquidity to support both retail and institutional participants.

Perpetual DEXs have become the main narrative in 2025, driving substantial liquidity growth and increased institutional participation across major blockchain networks.

New-generation perpetual trading platforms illustrate how the derivatives market can enhance ecosystem adoption and TVL (total value locked) through greater speed, liquidity depth and diverse trading options.

The perpetual futures market now represents a dominant liquidity driver in the crypto sector, attracting institutional capital, market makers and high-frequency traders.

Strong perpetual markets enhance a blockchain’s financial relevance, often surpassing spot trading and yield-farming activity in both scale and engagement.

Perpetual DEXs he new frontier of DeFi power

The perpetual futures market now represents a dominant liquidity driver in crypto.

Platforms across the sector have proved that perpetual derivatives can outpace spot market growth, bringing attention from institutional capital, market makers and high-frequency traders.

The success of perpetual DEXs causes the growth of deep liquidity pools and new high-volume DeFi ecosystems.

The explosive growth of next-gen perp DEXs proves that institutional capital and funds participate in high-performance trading infrastructures.

Derivatives traders and LP users influence TVL growth and the development of DeFi systems.

Strong perpetual markets make a chain financially relevant, outperforming spot trading and yield-farming activity.

BasePerp he first perpetual DEX launching on Base blockchain

Base has become one of the fastest-growing ecosystems by this year, overtaking Optimism in TVL, and continues to show strong user and developer interest.

Recent network inflation spikes and massive user migration can boost the chain’s rapidly increasing usage.

BasePerp , with its release, can become a cornerstone of perpetual trading for Base investors and traders. It can boost TVL to $100 billion and 25 million users, according to analyst data.

Reports indicate over 25,000 developers are building on Base, and BasePerp can become a driver that will enter the entire Base ecosystem, encouraging DeFi protocols and accumulating migration from networks where perpetual trading is already saturated.

Perpetual DEXs already dominate volume metrics, and BasePerp has strong upside potential. It can leverage the Base infrastructure and offer fresh liquidity options, scaling derivative capital inflow.

About

Based on Base’s scalability and security, BasePerp is positioned to become the first native perpetual DEX on Base, offering high-performance trading.

Attracting the interest of retailers and institutional investors, it has the potential to become a fundamental component of the Base ecosystem, boosting the DeFi market and liquidity.

Website

Contact

Mark , BasePerp

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blockchain Connects Traditional Finance as UBS Achieves Tokenized Fund Breakthrough

- UBS AG executed its first tokenized fund transaction via Chainlink's blockchain infrastructure, marking traditional finance's integration with decentralized technology. - Chainlink's DataLink service enabled real-time, tamper-proof data feeds for UBS's tokenized funds, enhancing transparency through institutional-grade market data integration. - The milestone follows UBS's $3.25B bond issuance and HSBC price upgrade, reflecting its strategic shift toward blockchain-driven solutions amid regulatory scruti

Democratizing Blockchain Profits: Mevolaxy’s Application Facilitates $3.6 Million in Distributions

- Mevolaxy, a U.S. mevstake platform, launched a mobile app and reported $3.6M in Q3 payouts, surpassing its previous record. - Its Mevstake system democratizes MEV strategies by pooling liquidity, offering fee-free staking with reduced market risk through locked terms. - The app emphasizes real-time tracking and user-friendly design, aligning with the platform's mission to make blockchain earnings accessible to all users. - Backed by experienced blockchain engineers and DeFi specialists, Mevolaxy's growth

Ethereum Updates Today: Large Holders Increase Holdings, Offsetting Ethereum's $3,400 Liquidation Risk

- Ethereum faces $3,400 liquidation risks amid $3,600 breakout threats, with $807M short and $564M long liquidations at key levels. - Institutional accumulation (82,000 ETH by BitMine) and whale treasury holdings counter short-term weakness, while U.S. outflows contrast Asian inflows. - Layer-2 platforms maintain $20B TVL despite price declines, and projects like Remittix secure $27.8M to capitalize on market recovery. - Analysts project $4,000-$4,500 medium-term recovery if macroeconomic clarity and stabl

Community First, Not Investors: UnifAI's Tokenomics Redefine DeFi Standards

- UnifAI introduces a tokenomics model allocating 13.33% to community/ecosystem, challenging DeFi norms prioritizing investors. - This contrasts traditional models, emphasizing decentralized governance and user-driven growth through staking, voting, and revenue sharing. - 7% liquidity allocation and 20.75% foundation funds ensure stability, while 15% team incentives align long-term success with stakeholders. - Analysts highlight the 13.33% community focus as a strategic differentiator, mirroring institutio