Date: Mon, Nov 03, 2025 | 05:15 PM GMT

The cryptocurrency market is once again witnessing heightened volatility at the start of the week, erasing about 4% from the total market cap today. Both Bitcoin (BTC) and Ethereum (ETH) saw sharp declines of 3% and 6%, respectively, contributing to a staggering $1.16 billion in total liquidations — with over $1.06 billion coming from long positions.

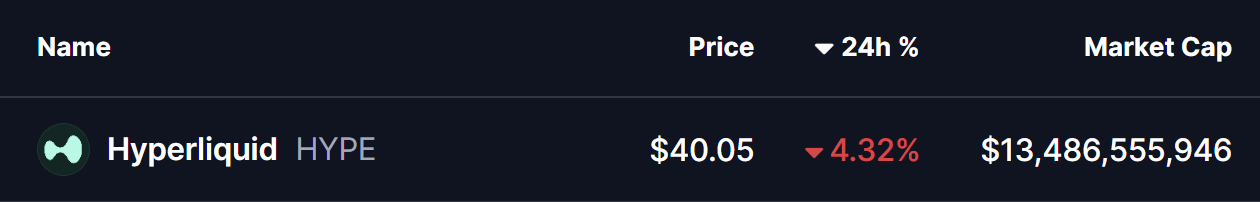

Major altcoins are following the same trend, and one standout among them is Hyperliquid (HYPE). The decentralized exchange (DEX) token has dropped over 4% in the last 24 hours. However, what’s more crucial is that HYPE is now retesting a key breakout zone, which could determine whether the token rebounds or continues sliding lower.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting Descending Broadening Wedge

As shown in the daily chart, HYPE had been consolidating within a descending broadening wedge — a bullish reversal structure that often precedes sharp trend changes.

Recently, the token broke above the wedge’s descending resistance line near $42.11, confirming a technical breakout that sparked a rally toward a local high of $50.16. However, profit-taking at that level quickly cooled momentum, pulling HYPE back toward its breakout zone for retesting.

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview)

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview)

At the time of writing, HYPE trades around $40.0, right above the 200-day moving average ($39.17) — a dynamic support that could play a crucial role in maintaining the bullish structure. This confluence of the moving average and the retest zone has become the battleground between bulls and bears, as both sides fight for directional control.

What’s Next for HYPE?

If HYPE successfully holds above both the 200-day MA and the breakout trendline, the bullish case remains intact. A rebound from this level could send prices back toward $50.16, and a breakout above that resistance could pave the way for the next target near $71.38, the projected measured move from the wedge pattern — representing an impressive 78% upside from current levels.

On the other hand, failure to defend the breakout tremldine could see the token fall back inside the wedge structure, invalidating the breakout and potentially delaying any major bullish momentum.

For now, HYPE’s retest phase is critical — and how it reacts at this key confluence zone will likely set the tone for the rest of November’s price action.