Crypto Funds Bleed $360 Million After Powell Speech — Except Solana

Digital asset investment products faced $360 million in weekly outflows after Fed Chair Jerome Powell signaled a cautious stance on rate cuts, warning that premature easing could threaten inflation control.

Digital asset investment products saw $360 million in outflows last week after Federal Reserve Chair Jerome Powell signaled hesitation on future interest rate cuts.

Bitcoin ETFs took the hardest hit, losing $946 million, while Solana attracted a record $421 million in inflows.

Powell’s Hawkish Stance Rattles Markets

Outflows followed comments from Powell indicating another rate cut in December was not assured. He warned that loosening policy too quickly could threaten progress on inflation, while slow action might weigh on economic growth.

Investors viewed his remarks as hawkish, dampening hopes for swift monetary easing. These signals triggered withdrawals from digital asset products, especially in the US. US investors led outflows, pulling $439 million from crypto products.

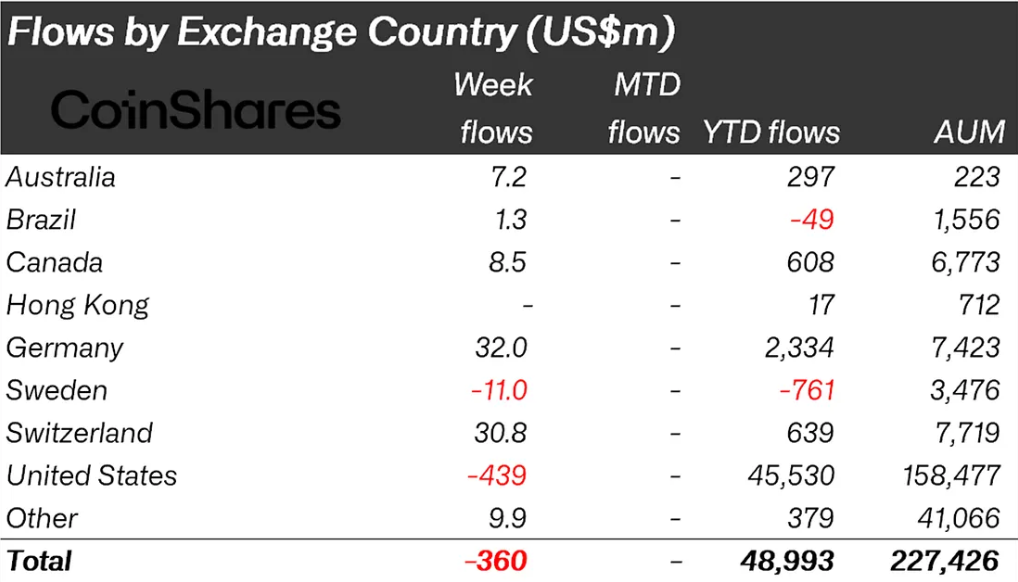

Crypto Outflows By Country. Source:

CoinShares Report

Crypto Outflows By Country. Source:

CoinShares Report

While US investors exited, Germany and Switzerland recorded modest inflows of $32 million and $30.8 million, showing ongoing regional confidence. Additionally, the lack of major US economic data releases contributed to market uncertainty through the week.

Bitcoin products posted the largest declines, losing $946 million over the week. This made Bitcoin the most exposed asset to monetary policy shifts.

The timing coincided with a broader risk-off period, as market participants reconsidered their hopes for aggressive rate cuts.

Solana Bucks the Trend with Record Institutional Demand

Amid retreat elsewhere, Solana stood out. The blockchain platform received $421 million in inflows, the second-highest weekly total for the asset.

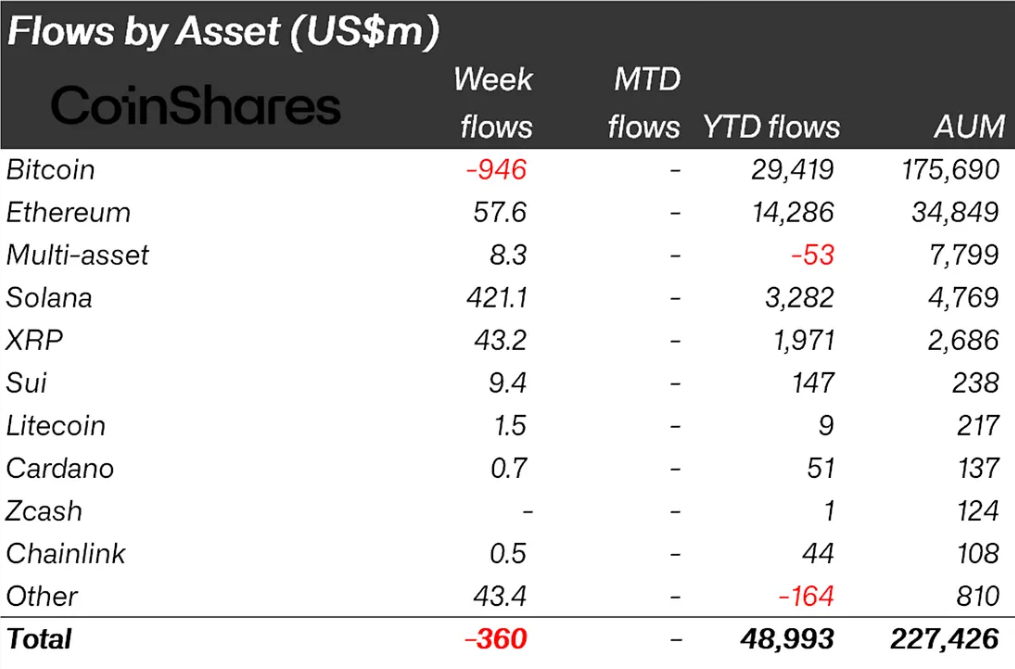

Crypto Outflows By Asset. Source: CoinShares

Crypto Outflows By Asset. Source: CoinShares

This increase was primarily driven by the launch of newly launched US Solana ETFs, including Bitwise’s BSOL, which drew record inflows during its first trading week.

SoSoValue reported that Solana ETFs recorded four consecutive days of net inflows totalling $200 million after their launch.

According to SoSoValue ETFs Dashboard, since the launch of the Bitwise Solana Staking ETF ($BSOL) and Grayscale Solana ETF ($GSOL) on Oct 28 & 29:$SOL ETFs have seen 4 consecutive days of net inflows, totaling $200 million.$BTC & $ETH Spot ETFs have simultaneously recorded net… pic.twitter.com/CrKgogePA5

— SoSoValue (@SoSoValueCrypto) November 3, 2025

At the same time, Bitcoin and Ethereum Spot ETFs saw outflows, reinforcing Solana’s contrarian momentum. This suggests institutional investors now view Solana as an attractive, differentiated asset.

The launch of Solana ETFs marks a key moment for institutional access to the network, praised for transaction speed and low fees.

Grayscale’s GSOL, which launched on NYSE Arca on October 29, offers direct SOL exposure alongside possible staking rewards, aligning with Solana’s proof-of-stake approach. These features set Solana ETFs apart from traditional Bitcoin products and appeal to yield-seeking investors.

Year-to-date, Solana inflows have reached $3.3 billion, confirming its status as one of the fastest-growing digital assets among institutions.

Sustained demand shows confidence in the platform’s technical strengths and ecosystem expansion, even as broad market headwinds persist.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Goldman Sachs predicts that the "U.S. government shutdown" will end within two weeks, making a Federal Reserve rate cut in December "more justified"?

Goldman Sachs predicts that the government shutdown is "most likely to end around the second week of November," but also warns that key economic data will be delayed.

I traded perpetual contracts for a month: from dreaming of getting rich overnight to a sobering reality.

Find a group of people who are doing the same thing as you, preferably those who are smarter than you.

Solana Consolidates Above $177 Support as Market Watches $200 Breakout Level

BTC Dominance Faces 60% Barrier Before Next Halving Cycle