I. Project Introduction

Kite AI is an EVM-compatible Layer 1 blockchain specifically designed for the agentic internet, aiming to provide infrastructure for autonomous AI agents for authentication, transactions, and independent operations. Through real-time payments, programmable governance, cryptographic identity, and verifiable attribution, it promotes efficient collaboration of AI agents in real-world scenarios. The project adopts a modular architecture, deeply integrating the x402 protocol to standardize intent authorization and payments for AI agents. Unlike traditional general-purpose blockchains, Kite AI is optimized for machine workloads, building a low-cost, high-throughput native payment system that avoids human-centric design bottlenecks.

Core technologies include a three-layer identity architecture (covering user root permissions, agent delegation, and session temporary permissions using BIP-32 hierarchical derivation), Proof of AI consensus mechanism, KiteVM execution environment, and SDK tools. It supports agent passports (cryptographic identity), programmable permissions, native stablecoin access, and cross-chain AI transactions with modular service deployment. KITE serves as the platform token, used for transaction fees, staking, governance, and module locking. Ecosystem incentive allocation accounts for up to 48%, and tokens generated from AI services are repurchased to create a positive value loop and enhance economic sustainability.

Currently, Kite AI’s main products include:

Kite AI Agent App Store: AI builders can list and monetize AI agents, models, and data.

Kite Passport: Provides AI agents with programmable smart contract governance and identity management.

Kite SDK: Allows developers to build AI agents using platform services.

Testnet Products: Offers a no-code user experience for interacting with AI agents.

II. Project Highlights

Positioning and Vision: Focused on decentralized AI economic infrastructure. Kite AI aims to build blockchain infrastructure for AI intelligent agents, addressing pain points in payments, identity verification, and interaction, empowering them as “first-principle economic participants.” With high-frequency, micro, and automated payment capabilities, it supports scalable AI economies and advances Web3 toward an autonomous AI foundation layer.

According to the Kite AI whitepaper, current infrastructure fails in three areas for agent intelligence: identity authentication and authorization mechanisms are not suitable for agent scenarios; payment infrastructure is incompatible with micro-payment flows and machine-to-machine transaction modes; and it lacks “verifiable trust,” meaning autonomous agent behavior is not auditable or programmatically constrained.

Kite AI Solutions Include:

Technical Innovation: EVM-compatible L1 with x402 protocol integration The project adopts a modular PoS Layer 1 design fully integrated with the x402 protocol, enabling AI agents to perform micro-payments via USDC without API keys, supporting automated M2M settlement and greatly enhancing transaction efficiency and programmability in AI economic scenarios.

New Identity and Payment Mechanism: Agent Passport System Kite AI introduces the agent passport system, assigning cryptographic identities to AI models, agents, datasets, and digital services. This strengthens verifiable digital identity, programmable governance, and secure payments, ensuring trustworthy and autonomous operation of AI in the network and forming the basis of a high-trust, high-security decentralized AI economy.

III. Market Valuation Expectation

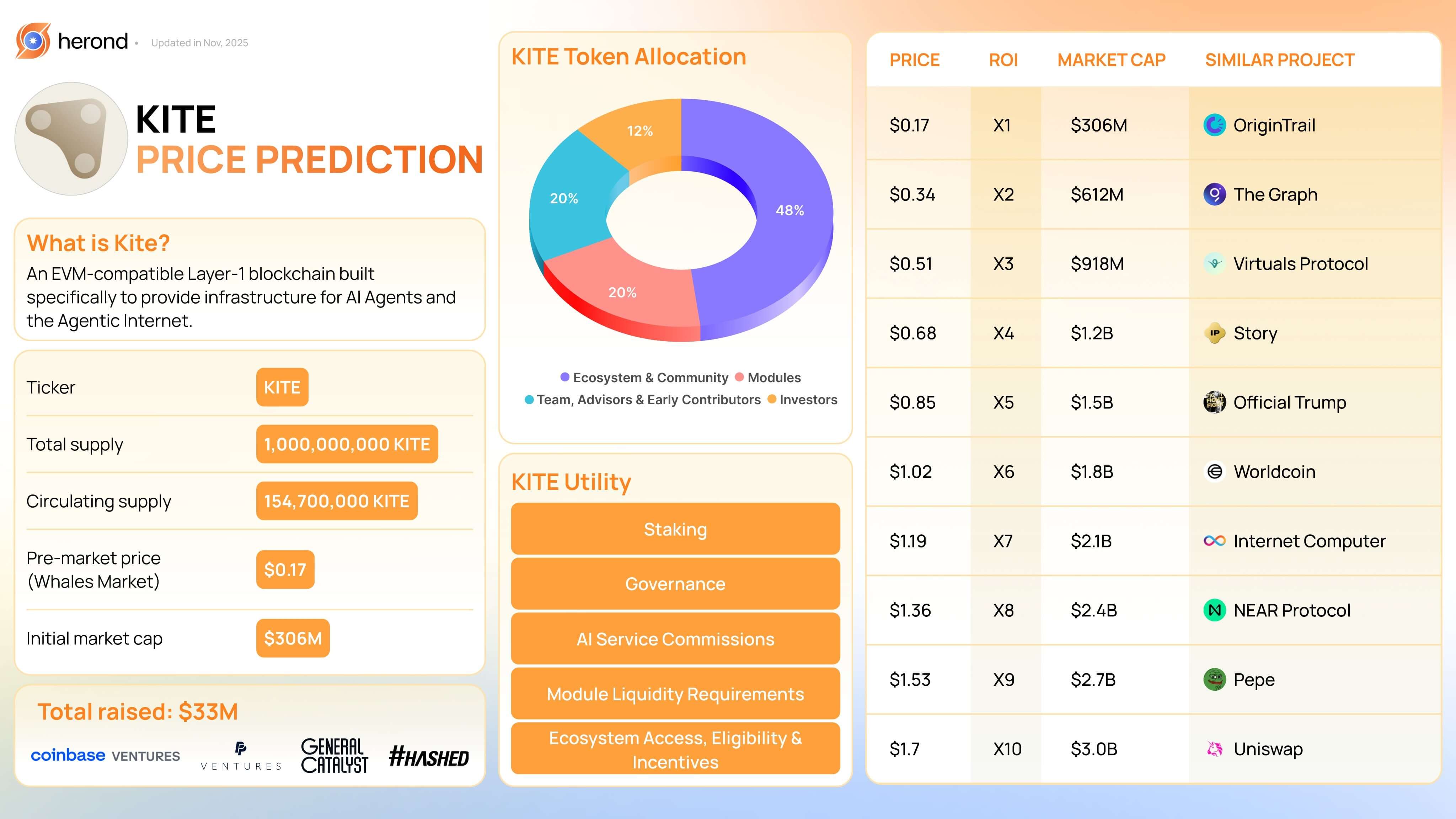

Leveraging the autonomous AI agent payment system centered on the x402 protocol, Kite AI has a clear path to implementation and initial network effects. The project has raised over $33 million, with a current estimated valuation around $600 million, and a circulating supply of 1.8 billion tokens. The stablecoin payment system supports global adaptability and scalability. Third-party valuation expectations are as follows:

Source: Herond Browser

IV. Economic Model

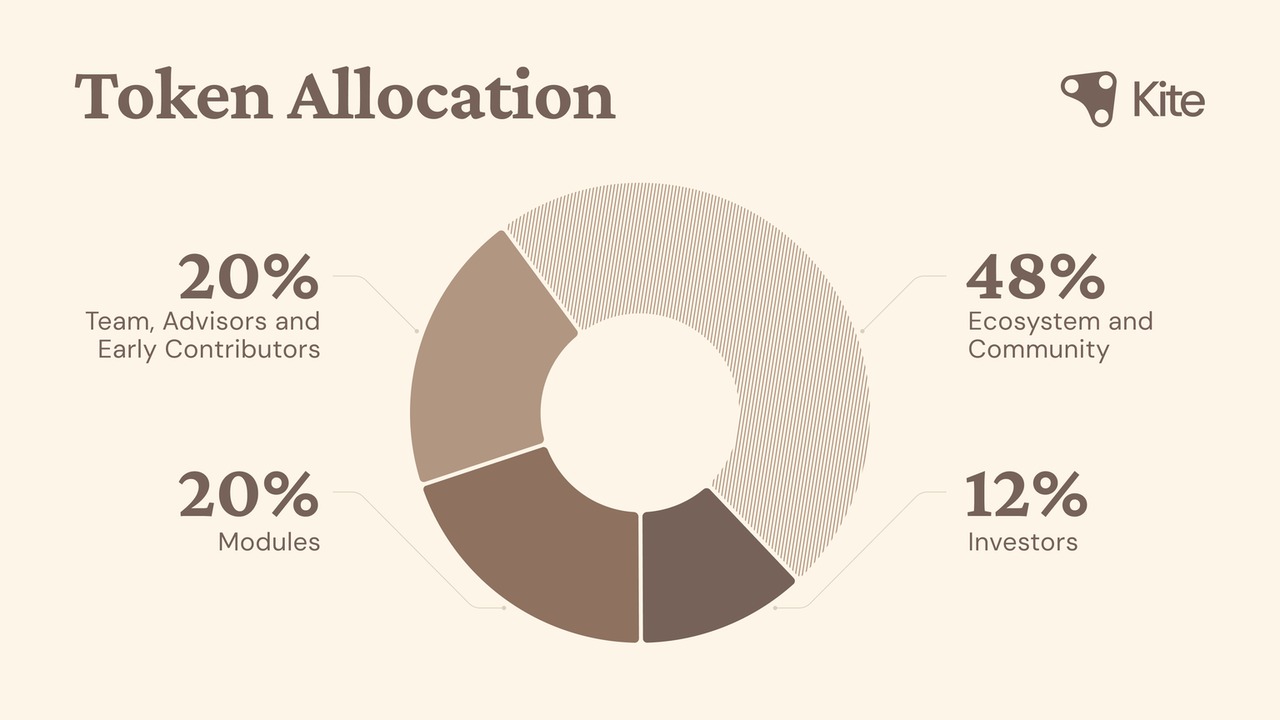

Token Distribution

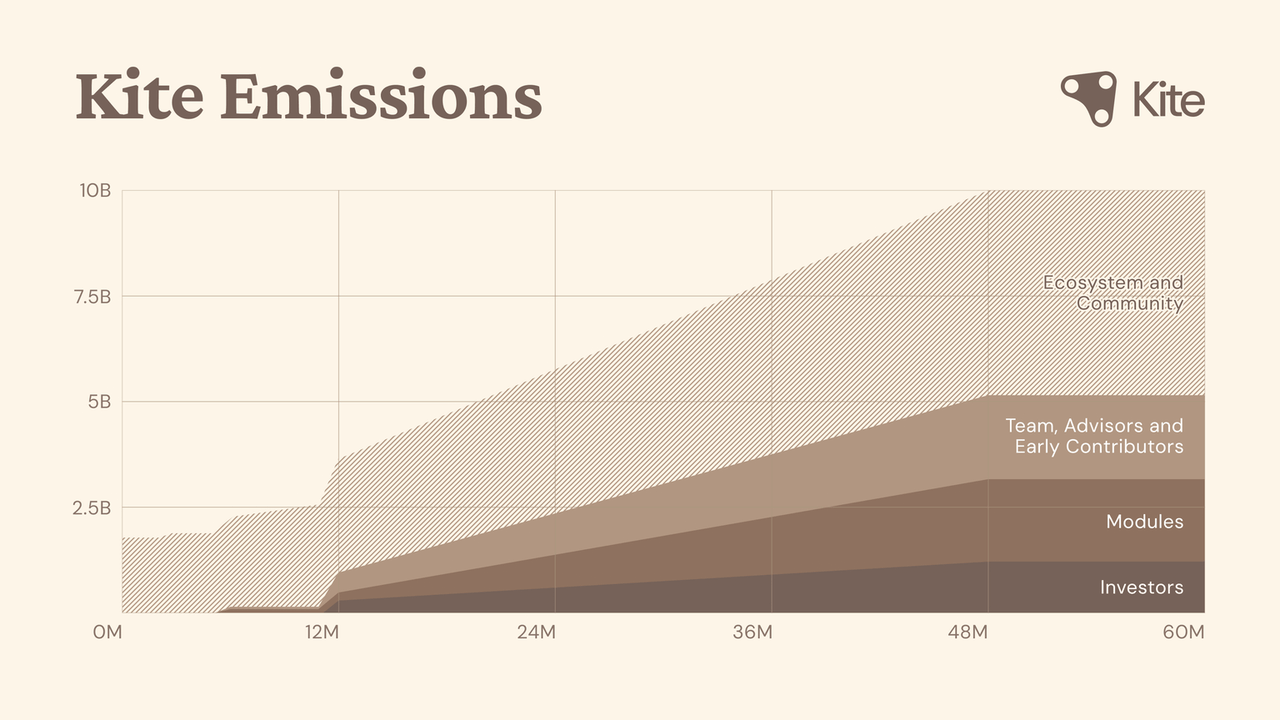

Total KITE supply: 1,000,000,000 tokens:

Ecosystem and Community: 50%, TGE 33%, Cliff 0, 48-month linear vesting

Module: 20%, mainly for ecosystem partners and airdrops, TGE 100%

Investors: 15%, TGE 0%, 12-month Cliff, 48-month vesting

Team: 15%, TGE 0%, 12-month Cliff, 48-month vesting

Token use cases include AI agent payments, module incentives, governance and staking, ecosystem development, and developer funds. Revenue generated by AI agents is directly converted into $KITE, creating a self-evolving and value-reinforcing loop.

Token Utility

Agent-native payments: KITE is designed as the native token for autonomous transactions and settlements between machines, agents, and service providers.

Governance: KITE can be used for protocol-level voting, governance rule-setting, and agent authorization mechanisms.

Staking / Network Security & Incentives: Holders can participate in staking, node validation, module support, and governance voting.

Ecosystem incentives & Developer fund: KITE supports developers, module providers, data/model contributors, and AI agent creators.

Identity / Authorization for agents: Integrated with identity authorization, agent wallets, and session keys to support authentication and transaction authorization in the agent economy.

V. Team and Financing Information

Team Information

The team is composed of co-founders Chi Zhang (张驰), Scott, and other members with AI and blockchain infrastructure development experience, with backgrounds from Uber, Square, Databricks, UC Berkeley, OpenAI, and Scale AI.

Chi Zhang (张驰) — Co-founder & CEO: UC Berkeley academic background, previously worked at Databricks on AI and distributed systems, serves as Kite CEO.

Scott Shi — Co-founder & CTO: Previously worked at Uber building/extending internal AI/data teams and at Salesforce, now serves as CTO.

Other contributors include:

Zerui Cheng — Research collaborator (Princeton)

Chen Xi — Research collaborator, previously associated with Uber

Yi Huang — Associated with crypto.com collaborations

Lyon Li — Technical staff at Kite

Uddhav Marwaha — Listed as “Head of Payment, Coinbase,” contributor/advisor for payment design

David Weber — Listed as “Head of PyUSD, PayPal,” contributor/advisor

Financing Information

Kite has raised a total of $33 million from investors including PayPal, General Catalyst, Samsung Next, HashKey, Temasek, SBI Holdings, Avalanche Foundation, and GSR.

Seed Round (Feb 2022): $4M, led by 8VC, followed by Essence VC and Dispersion Capital. Post-money valuation: $22M; token FDV: $88M.

Pre-A Round (Aug 2023): $11M, led by General Catalyst, followed by Samsung Next, Hashed, HashKey, Alchemy Ventures. Post-money equity valuation: $85M; token FDV: $170M.

A Round (2025): $17.5M, co-led by PayPal and General Catalyst, with strategic investors including Temasek, SBI Holdings, Avalanche Foundation, and GSR. Post-money equity valuation: $150M; token FDV: $300M.

VI. Potential Risk Warnings

1)There is a risk of price fluctuation during the initial token launch.

2)The initial circulating supply accounts for 36%, including ecosystem and community airdrops, which may result in early selling pressure.

VII. Official Links

Disclaimer: This report is AI-generated, with human verification of information only. It does not constitute any investment advice.