Key Market Information Discrepancy on November 3rd - A Must-Read! | Alpha Morning Report

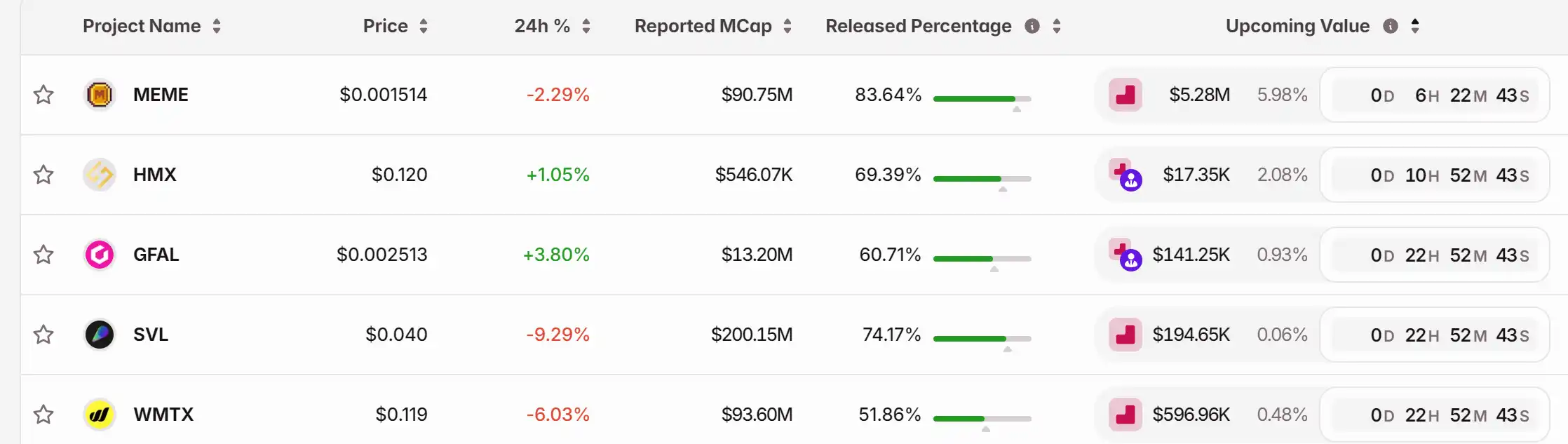

1. Top News: Less than 24 Hours Left Until Monad Airdrop Claim Period Ends 2. Token Unlock: $MEME, $HMX, $GFAL, $SVL, $WMTX

Featured News

1. Less Than 24 Hours Left Until the End of the Monad Airdrop Claim Period

2. ASTER Surges Over 17% in a Short Period, CZ Previously Tweeted About Buying ASTER Today

3. Pump.fun Has Repurchased PUMP Tokens Worth Over $160 Million in Total

4. ZK Surges Above $0.075 Briefly Before Retracing, Up Over 94% in 24 Hours

5. Driven by ZKsync's Surge, Tokens in the ZK and L2 Sectors Show Significant 24-Hour Gains

Articles & Threads

1. "Q3 Earnings Report: While Crypto Prices Cooled Off, Coinbase's Money-Making Machine Heated Up"

On October 31, 2025, Coinbase released its Q3 earnings report, which came at just the right time, injecting a dose of optimism into the liquidity-starved crypto industry. Total revenue was $1.87 billion, up 55% year-over-year and 25% quarter-over-quarter. Net profit reached $433 million, compared to just $75.5 million in the same period last year. Earnings per share were $1.50, surpassing analyst expectations by 45%.

2. "Smart Payments: The Evolutionary Path of the Next-Generation Payment System"

We are standing at a new inflection point. Agentic Payments are reshaping the fundamental logic of transactions. From in-chat GPT settlements to micro-payments between agents, and onto a new order of the web where machines pay for content—the picture of the "Agent Economy" is gradually emerging. If you care about the convergence of AI and blockchain, the practical path of next-gen payment protocols, or are pondering the automation trends of future business, this article is worth your time to read.

Market Data

Daily Market Overall Funding Heatmap (reflected by funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hidden Leverage and External Party Risks Lead to XUSD Downfall

- Stream Finance's XUSD stablecoin collapsed to $0.30, freezing $160M in user funds after a $93M loss linked to an external fund manager. - The crisis followed a $100M exploit at Balancer Protocol, amplifying DeFi market anxiety and triggering rapid fund withdrawals. - Stream's high-leverage model and hidden $520M TVL vs. $160M actual deposits raised red flags about risky third-party fund usage. - XUSD's collapse exposed DeFi vulnerabilities, reigniting debates on third-party risks and urging audits for pr

Bitcoin News Today: Sequans Revamps Treasury Strategy—From Bitcoin Collateral to Reducing Debt—to Enhance Shareholder Returns

- Sequans Communications sold 970 BTC to cut convertible debt by 50%, reducing total debt to $94.5M and lowering debt-to-Bitcoin NAV ratio to 39%. - Remaining 1,294 BTC collateralized outstanding debt, while the sale supported its ADS buyback program to boost Bitcoin per share metrics. - CEO Georges Karam called the move a "tactical value unlock," enabling strategic initiatives despite a $11M non-IFRS net loss in Q3 2025. - Enhanced liquidity now allows capital market initiatives like preferred share issua

MYX News Update: The Integration of Energy, Grid, and DeFi Drives MYX Finance Toward 2030 Growth

- MYX Finance emerges as a key player in crypto-driven growth, leveraging energy infrastructure and DeFi trends for 2030 expansion. - Grid modernization and uranium sector advancements via ISR technology create indirect tailwinds for MYX's token valuation potential. - Strategic partnerships with energy firms and DeFi platforms could unlock cross-sector synergies through tokenized asset offerings and fee-sharing models. - Institutional confidence in DeFi and targeted capital mechanisms position MYX to capit

ARK Invest Makes Major Move Toward Regulated Crypto Infrastructure, Moving Away from Conventional Tech Leaders

- ARK Invest added $12M in Bullish shares across three ETFs, boosting total holdings to $114M in the regulated crypto exchange. - Bullish secured New York licenses and expanded U.S. trading, processing $1.5T in volume since 2021 with institutional clients. - ARK's crypto ETFs now allocate 17.7%-29% to blockchain infrastructure, shifting focus from traditional tech stocks like Palantir . - The firm's strategy includes leveraging market dips, exemplified by its $172M Bullish investment post-NYSE IPO to capit