Ethereum Now Holds $165B in ‘Digital Dollars’ — Bigger Than Singapore & India’s FX Reserves

Ethereum stablecoins total US$183 billion amid falling ETH prices below US$4,000, while investors track institutional flows and on-chain metrics, weighing the potential for renewed momentum and the token’s macro reserve narrative.

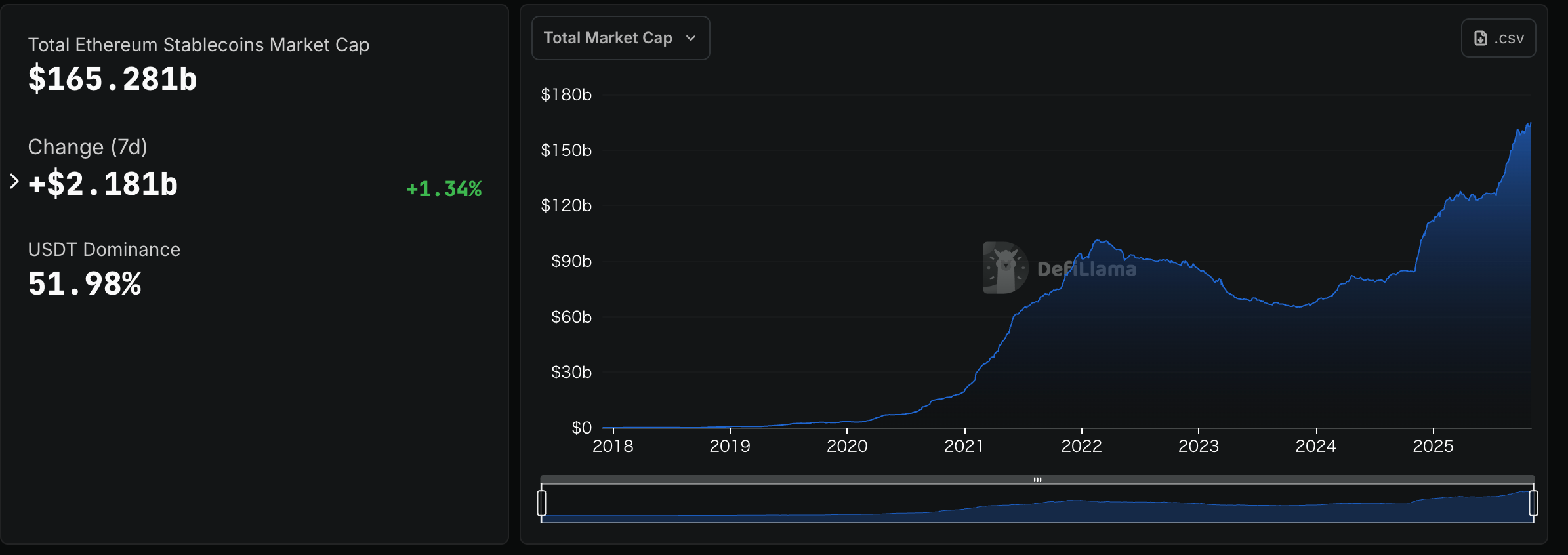

Ethereum’s ecosystem continues to draw attention as stablecoins on its blockchain reach approximately $165 billion in reserves, positioning it among the world’s largest.

However, ETH’s spot price has softened, dropping below $4,000, reflecting cautious investor sentiment. Market participants are closely watching institutional positioning and on-chain metrics. They want to see if Ethereum’s role as a macro-scale digital reserve can drive renewed price momentum soon.

Global Reserve Role for Ethereum-Based Stablecoins

Stablecoins issued on the Ethereum blockchain have now aggregated around $165 billion in reserves, ranking roughly 22nd among global foreign-exchange holdings. This exceeds some national reserve pools, including Singapore and India, underscoring Ethereum’s evolving role beyond a decentralized smart-contract platform.

Total Ethereum Stablecoins Market Cap:

DefiLama

Total Ethereum Stablecoins Market Cap:

DefiLama

Analysts say the development shows structural maturation of the Ethereum ecosystem. Stablecoins are increasingly used as collateral, settlement assets, or digital reserve instruments rather than purely speculative tokens.

“When you really look at this and realize how much $ETH is integrated into stablecoins, you have to be bullish. According to the data, $ETH stablecoins rank among the 20 largest FX reserves, just behind the US,” a crypto investor, BigBob, noted on X.

When you really look at this and realize, how big not only stablecoin’s are but how much $ETH is being integrated into stablecoin’s. You have to be fucking bullish, according to the website I linked, $ETH stablecoin’s are the 20th largest FX reserve. Behind the US BFF 💀…

— bigbob (@bigbobinvests) October 28, 2025

The reserve accumulation illustrates growing confidence in Ethereum’s underlying infrastructure as a foundational component of digital finance.

Institutional and Trader Positioning Signals

On-chain data and trading activity indicate that institutional participants and large traders strategically positioned for potential ETH rebounds. Long positions have increased, reflecting investor interest in spot exposure and stablecoin-linked liquidity. For example, specific whale wallets hold roughly 39,000 ETH ($150 million) as long-term positions, signaling significant accumulation by major market participants.

Market observers note that these trends resemble traditional reserve asset behavior, highlighting Ethereum’s potential as a macro-level instrument for capital allocation. Investor confidence is growing, but execution remains critical. Tokenomics, staking yields, regulatory clarity, and network performance will determine whether Ethereum can sustain its reserve-level narrative.

In the derivatives market, funding rates have recently turned negative, suggesting a balance between long and short positions and indicating potential for short-term price squeezes. This dynamic, combined with institutional inflows and stablecoin issuance, will likely shape ETH’s trajectory in the coming weeks and months.

ETH Price Trends and Outlook

Amid these developments, Ethereum’s spot price has shown weakness. On October 29, ETH fell below US$4,000; at the time of writing, it stood at $3,912.90. The market appears to be waiting for confirmation of macro narratives, including continued stablecoin flows and increased network activity, before accelerating upward.

Investors remain cautious, with price consolidation reflecting both short-term profit-taking and broader market sentiment. While on-chain metrics suggest accumulation is ongoing, further catalysts—such as institutional inflows or regulatory clarity—may be required to restore upward momentum. Analysts note that if Ethereum continues to prove real-world utility and stablecoin integration, it could reinforce its role as a digital reserve. This may support a price recovery toward $4,200–4,500 in the medium term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

6-7: Gen Alpha's Linguistic Time Capsule for 2025

- Dictionary.com named "6-7" its 2025 Word of the Year, a Gen Alpha slang born from a 2024 rap song and TikTok trends. - The phrase functions as an ambivalent interjection, spawning variations like "six-sendy" and disrupting classrooms with 67-word essay penalties. - Lexicographers describe it as "brainrot slang" reflecting internet absurdity, with Dictionary.com reporting 600% search spikes in October 2025. - Educators and experts note its role as a generational in-group marker, blending humor, rebellion,

DeFi’s High-Stakes Rehypothecation: $284M Turmoil Reveals Deep-Rooted Systemic Weakness

- Stream Finance's collapse exposed $284M in DeFi loans and stablecoin risks via rehypothecated collateral across platforms like Euler and Silo. - Key counterparties include Elixir ($68M), TelosC ($123.6M), and MEV Capital ($25.4M), highlighting systemic fragility in interconnected DeFi markets. - xUSD stablecoin faces liquidity crunches as rehypothecated assets amplify contagion risks across Arbitrum and Plume chains. - Recent exploits at Balancer and Moonwell erased $222M, prompting calls for regulatory

DeFi’s Pursuit of High Returns Exposes Fundamental Issues of Trust and Openness

- DeFi sleuths traced $284M in interconnected loans to Stream Finance, destabilized by Balancer v2's vulnerability exploit. - Stream's xUSD stablecoin depegged to $1.15 amid panic, exposing hardcoded oracle flaws and leveraged position risks. - Recursive minting and opaque Proof of Reserve practices amplified contagion risks, eroding user confidence during withdrawals. - The crisis highlights systemic DeFi challenges: balancing high-yield strategies with transparency and robust risk governance frameworks.

Solana News Today: "While Zcash Surges, Ghostware Quietly Advances Scalable Solutions on Solana"

- Privacy-focused crypto tokens like $GHOST and $EYE gain traction amid market volatility, driven by demand for verifiable infrastructure and scalable solutions. - A major whale's $16.7M investment in $GHOST and GhostwareOS's Solana-based privacy modules highlight growing institutional confidence in the ecosystem. - Solana ETFs attract $421M in inflows, contrasting broader crypto outflows, while $EYE's renewable energy-AI hybrid model offers tangible asset-backed returns. - Zcash's 1,000% surge underscores