Key Notes

- ZKsync price surged 120% after Vitalik Buterin praised the project’s contributions to Ethereum scalability.

- The rally followed ZKsync’s “Atlas” upgrade announcement introducing faster, more interoperable institutional-grade payments.

- ZKsync confirmed over 30 major institutions joined as observers for its new privacy-focused “Prividium” layer.

ZKsync price rallied 120% to hit $0.74 on Sunday after Ethereum co-founder Vitalik Buterin’s endorsement triggered intense market optimism. The move began on Friday when ZKsync founder Alex Gluchowski, announced the launch of the Atlas upgrade , citing institutional-grade scalability, interoperability, and transaction speeds as key features.

Gluchowski stated that the new update enables Layer-2 protocols to rely on Ethereum for liquidity and new institutional capital flows when deployed for cross-chain transactions and asset tokenization.

ZKsync has been doing a lot of underrated and valuable work in the ethereum ecosystem. Excited to see this come from them! https://t.co/coZKCfsb8h

— vitalik.eth (@VitalikButerin) November 1, 2025

Vitalik Buterin reacted positively, posting on X that ZKsync has been doing a lot of underrated work in the Ethereum ecosystem.

The bullish post sparked instant market reaction. ZKsync was trading around $0.03 when Vitalik issued his first comment on Gluchowski’s post. By close of trading on Saturday, Zksyn price soared 50% to hit $0.055 before extending gains to $0.74 in the early hours of Sunday.

Earlier in October, ZKsync also unveiled Prividium, an Ethereum-anchored, private, permissioned L2 solution promising to merge institutional privacy with public verifiability.

The financial industry requires private, incorruptible systems connected as one global network.

Citi, Deutsche Bank, Mastercard, and 30+ top global institutions joined us to explore the power of Prividiums.

Unveiling The Prividium Breakthrough Initiative. pic.twitter.com/GUbwRaWa3Q

— ZKsync (@zksync) October 13, 2025

The project’s features include instant cross-border settlement , zero liquidity fragmentation, and atomic transactions running at over 15,000 TPS with one-second latency, according to the product details.

ZKsync confirmed that over 30 leading institutions, including Citi, Deutsche Bank, and Mastercard, had joined as observers to explore Prividium’s capabilities.

ZKsync price rallies 120% on Sunday, Nov 2, fuelled by bullish comments from Vitalik Buterin | Source: CoinmarketCap

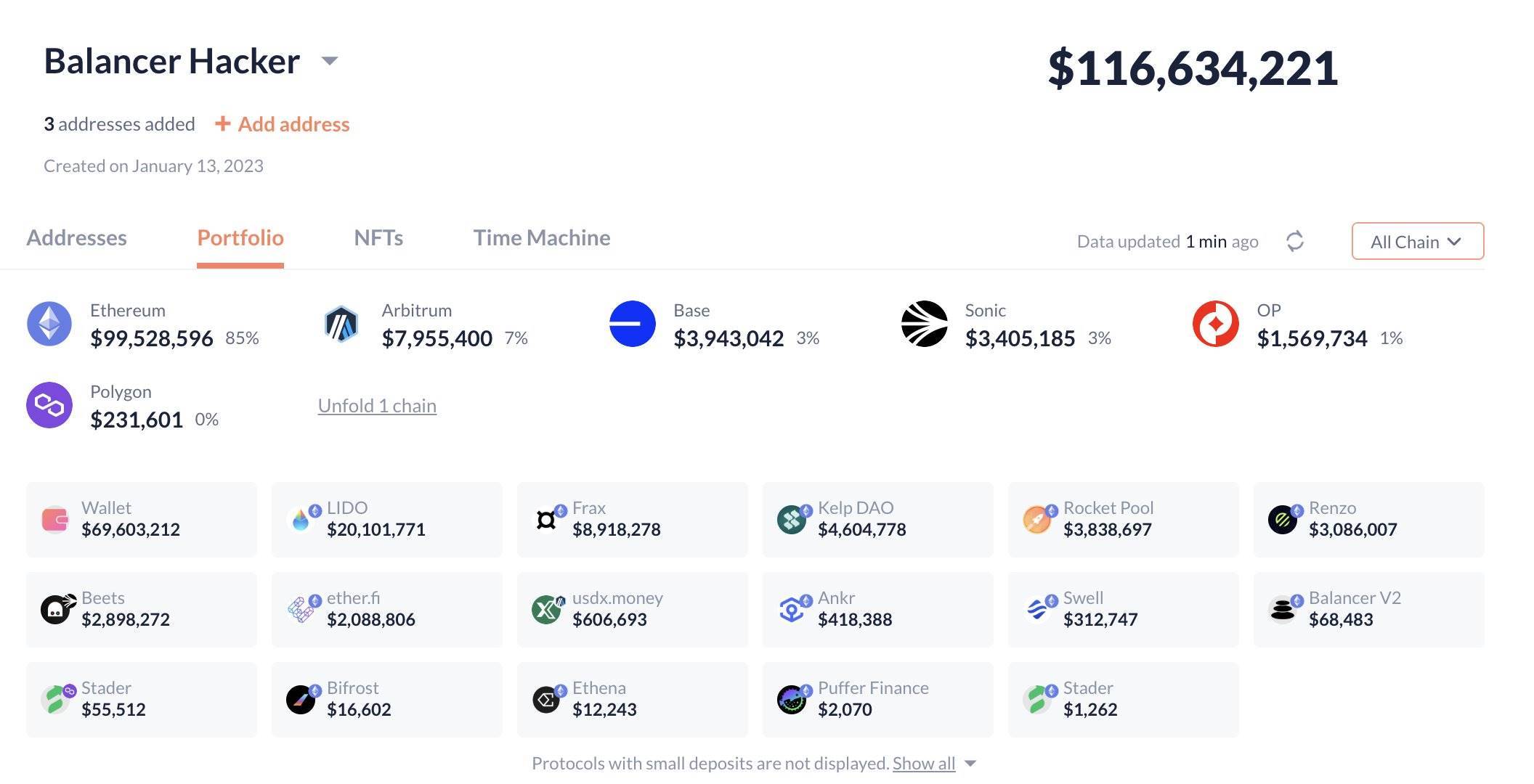

Following Buterin’s remarks and the Atlas upgrade, ZKsync’s market cap surged toward $600 million, its highest point since May 2025. According to Coinmarketcap data , Zksync trading volume has also skyrocketed 1,500%, confirming the 122.4% price rally was primarily driven by events unfolding in the last 24 hours.

ZKsync Price Forecast: Falling Wedge Breakout Validates $0.085 Target

ZKsync price action has confirmed the long-term falling wedge breakout above $0.70, which initially failed during the October 10 market crash.

At first glance, the Aroon indicator shows the Aroon-Up line pegged at 100%, while the Aroon-Down sits around 78.57%. This crossover confirms that a new uptrend cycle is underway after weeks of downward exhaustion.

Beyond that, the daily candle shows a decisive breakout above all major moving averages, the 50-day, 100-day, and 200-day SMAs all clustered around $0.056. This convergence implies the majority of recent Zksync buyers are currently in profitable positions.

ZKsync Price Forecast, Nov 2, 2025 | Source: TradingView

The Relative Strength Index (RSI) has spiked to 76.13, entering overbought territory. Traders said this indicates strong momentum but warned of short-term exhaustion if profit-taking begins near the $0.072–$0.075 resistance range. With the rest of the crypto market still held back by uncertain macro sentiment, there’s less incentive for Zksync holders to exit their positions.

Looking ahead, ZKsync could extend gains to $0.0085, given the persistent inflow of new orders shown in the 1,200% trading volume, as bulls absorb downside pressure from short-term profit-taking.

On the downside, failure to hold above $0.056 (the 100-day SMA) could trigger a brief retracement toward the $0.045 supply zone at $0.045 marked by the 200-day MA.

next