$33,000,000,000 in 6 Hours Gained by Crypto Market in Massive Reversal

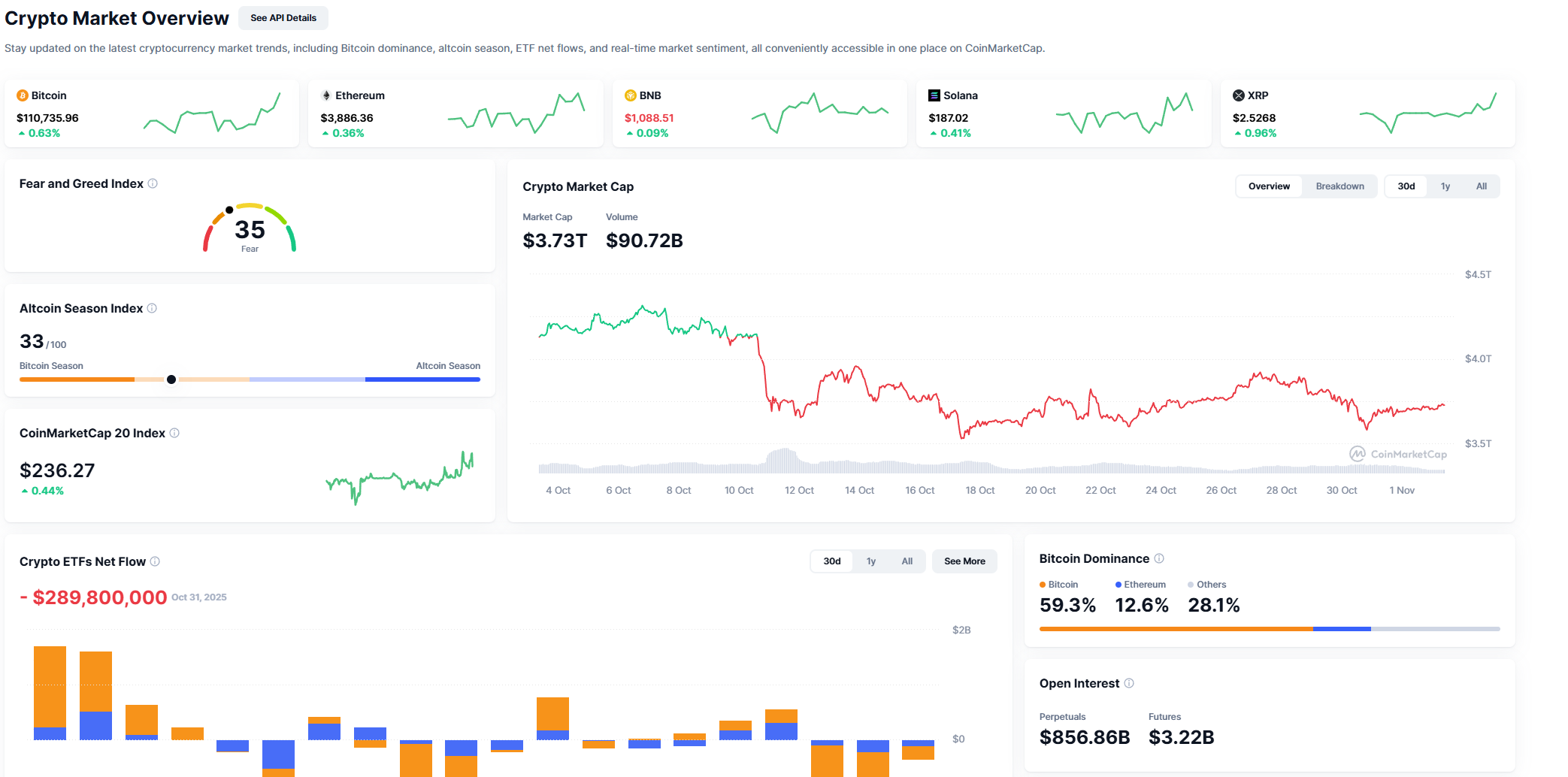

The cryptocurrency market experienced an abrupt surge of bullish momentum, adding over $33 billion in total capitalization in just six hours, indicating a short-term shift in traders’ risk-on stance. Bitcoin, Ethereum and XRP led the charge as the rally propelled almost all significant assets into the green.

Massive market growth

Bitcoin increased 0.67% to approximately $110,700, while Ethereum (ETH) increased 1.22% to regain the $3,850 mark, according to market data. Following closely behind, XRP saw a daily gain of 11%, which was sufficient to overtake BNB and reclaim the fourth-largest cryptocurrency position by market capitalization.

At $152.2 billion, XRP’s total market capitalization is now ahead of BNB’s $150.4 billion, a slight but significant lead that indicates a resurgence of investor interest. Solana (+1.04%), Cardano (+0.62%) and Dogecoin (+0.61%) are all included in the sea of green that is the overall market heat map.

Staying positive

As Bitcoin’s stable position above its 200-day moving average restored some confidence, buying pressure briefly increased even for smaller-cap assets. The technical setup for Bitcoin is still cautiously optimistic, it is still above the crucial $108,000 support zone, and the next resistance cluster is forming close to $113,800-$114,000, which is in line with the 100-day moving average.

Ahead of significant macro data releases, the timing of the rally points to aggressive short liquidations and updated institutional positioning. Although most large caps’ RSI levels are still neutral, this move might be more of a relief rally than the beginning of a full-scale bull run.

Right now, all eyes are on XRP, whose return to the fourth spot may spark new conversations about its long-term potential in payments and remittances. The general lesson, however, is obvious: traders are back in action, liquidity is returning, and the cryptocurrency market has just served as a reminder to everyone of how quickly momentum can change.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins: The Foundation for a Decentralized Financial Tomorrow

- Stablecoins are driving DeFi growth, projected to support $2 trillion in tokenized assets by 2028, with $1.5 trillion in tokenized funds and equities expected. - Stripe and Paradigm’s Tempo blockchain, handling 100,000 transactions/second, aims to streamline cross-border payments and integrate on-chain/off-chain systems. - Regulatory challenges around AML compliance and digital dollarization risks persist, but stablecoins are reshaping global finance by reducing costs and expanding inclusion. - Fintechs

Hyperliquid News Update: With HYPE Stumbling, Major Investor Profits Spark Concerns Over Insider Trading

- Hyperliquid whale amasses $3.6M HYPE gains via 5x leverage, with trades aligning suspiciously to major crypto announcements. - Holds $8.22M XPL (10x leverage) and $500K PURR despite 70% losses, raising questions about non-public information use. - HYPE struggles above $50 resistance amid bearish indicators, with $22M long positions at risk if price dips to $46. - Aggressive accumulation contrasts with declining Hyperliquid fees and regulatory scrutiny following MEXC's $3.15M fund freeze case.

BlockDAG's community-focused, institution-level approach emerges as the leading crypto model for 2025

- BlockDAG (BDAG) emerges as a top 2025 crypto contender with a $435M presale and alleged Coinbase/Kraken partnerships, signaling institutional confidence. - Its hybrid DAG + PoW architecture (15,000 TPS) and community-driven model differentiate it from speculative assets like Pudgy Penguins (PENGU) and Near Protocol (NEAR). - PENGU and NEAR face bearish trends and volatility, highlighting risks for projects reliant on VC funding or speculative demand. - BDAG's retail-focused presale (312K holders) and tra