Columbia Business professor casts doubt on tokenized bank deposits

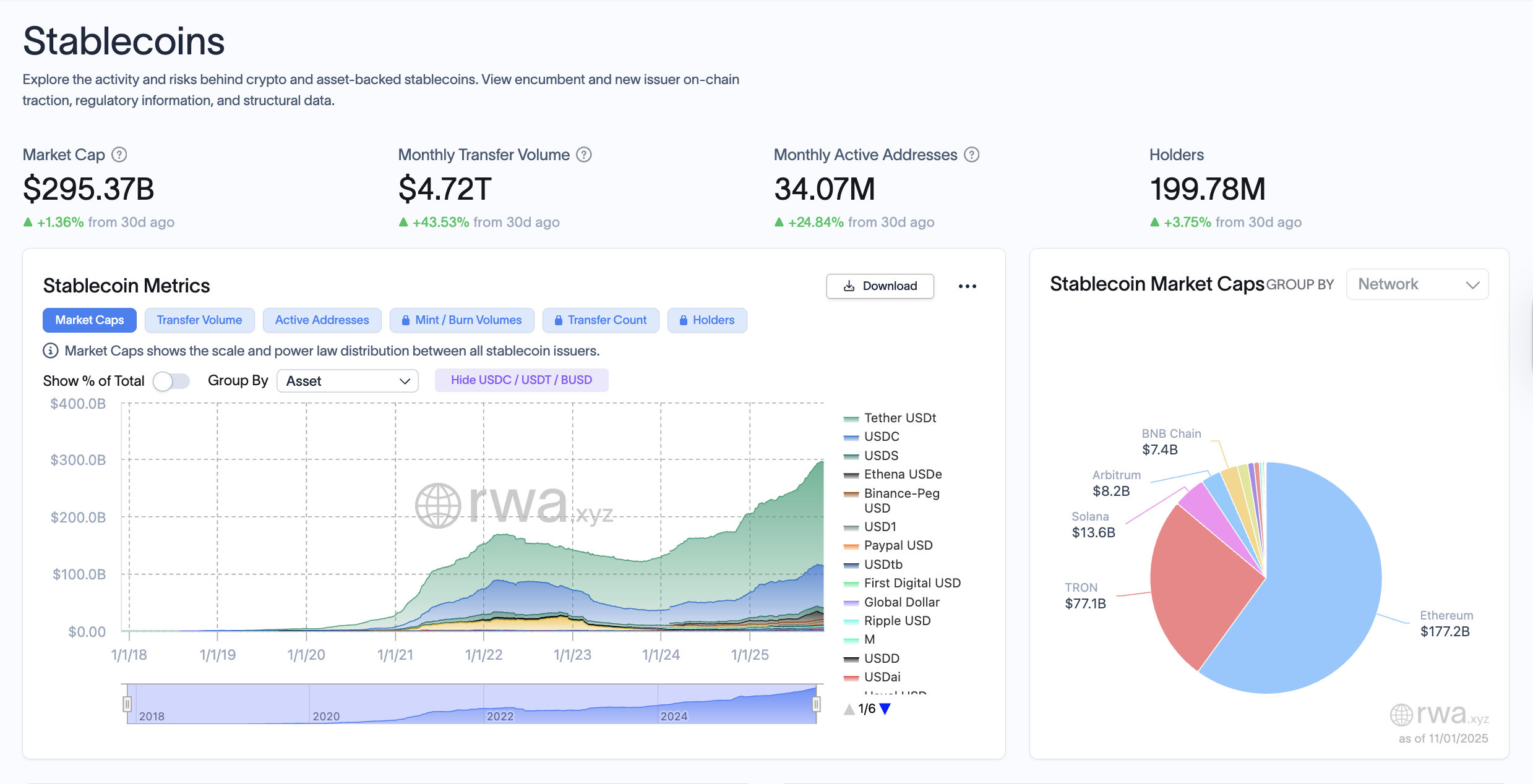

Banks and financial institutions have started experimenting with tokenized bank deposits, bank balances recorded on a blockchain, but the technology is doomed to lose out to stablecoins, according to Omid Malekan, an adjunct professor at Columbia Business School.

Overcollateralized stablecoin issuers, who must maintain 1:1 cash or short-term cash equivalent reserves to back their tokens, are safer from a liability perspective than the fractional reserve banks that would issue tokenized bank deposits, Malekan said.

Stablecoins are also composable, meaning they can be transferred across the crypto ecosystem and used in various applications, unlike tokenized deposits, which are permissioned, have know-your-customer (KYC) controls, and have restricted functionality.

Tokenized bank deposits are like a “checking account where you could only write checks to other customers of the same bank,” Malekan continued. He added:

“What’s the point? Such a token can’t be used for most activities. It’s useless for cross-border payments, can’t serve the unbanked, doesn’t offer composability or atomic swaps with other assets, and can’t be used in decentralized finance (DeFi).”

The tokenized real-world asset (RWA) sector, physical or financial assets tokenized on a blockchain, which includes fiat currencies, real estate, equities, bonds, commodities, art, and collectibles, is projected to swell to $2 trillion by 2028, according to the Standard Chartered bank.

Related: BNY explores tokenized deposits to power $2.5T daily payment network: Bloomberg

Stablecoin issuers will share yield one way or another

Tokenized bank deposits must also compete with yield-bearing stablecoins or stablecoin issuers that find ways of circumventing the yield prohibition in the GENIUS stablecoin Act, passing on the yield in the form of various customer rewards, Malekan argued.

The banking lobby has pushed back against yield-bearing stablecoins over fears that stablecoin issuers sharing interest with customers would erode the banking industry’s market share.

The current average yield offered on a savings account at a retail bank in the US or the UK is well under 1%, making anything above that attractive to customers.

The resistance to yield-bearing stablecoins from the banking lobby drew criticism from New York University professor Austin Campbell, who accused the banking industry of using political pressure to protect its financial interests at the cost of retail customers.

Magazine: Can Robinhood or Kraken’s tokenized stocks ever be truly decentralized?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Investors Turn to Blockchain as Meme Coins Struggle During Market Fluctuations

- Meme coins like SPX6900 face waning momentum as investors shift to blockchain projects like NB HASH, which integrates AI and decentralized infrastructure. - Fed Chair Powell's cautious stance on rate cuts (70% December cut probability) dampened tech stocks, while NatWest and SERES Group boosted earnings amid cost-cutting and EV growth. - Leidos and Summit Hotel Properties raised dividends, reflecting corporate strategies to balance shareholder returns with reinvestment amid market volatility. - Bitcoin's

ARK Redirects Portfolio Toward Cryptocurrency, Anticipates Blockchain to Propel Upcoming Innovation Surge

- Cathie Wood's ARK funds increased crypto exposure to $2.15B, with Coinbase (5.8%) and Robinhood (4.69%) as top holdings. - ARKF/ARKW/ARKK now allocate 29-17.7% to crypto, shifting from traditional tech stocks like Palantir and Shopify. - Investments expanded to Circle, ether/solana staking, and Tether stablecoins amid rising institutional crypto interest. - Crypto assets outperformed traditional tech holdings recently, though analysts warn sector volatility persists despite regulatory risks.

3D Printing Revolutionizes Medicine: How Personalized Implants Are Transforming Healthcare Worldwide

- 3D printing's medical sector grows rapidly, driven by demand for patient-specific implants and surgical tools, with Materialise NV reporting €33.3M Q3 revenue and 10.3% medical segment growth. - Saudi's NAMI secures $26M tungsten contract and partners with Lockheed Martin, advancing aerospace/defense 3D printing under Vision 2030's industrial diversification goals. - Global 3D printing gases market (critical for medical sterility) projected to grow at 6.5% CAGR through 2030, with healthcare applications

Mutuum's Innovative Lending Approach Seeks to Transform DeFi Following $18M Presale Boom

- Mutuum Finance (MUTM) secures $18.2M in presale, entering Phase 6 with 17,600+ investors and $0.035 token pricing. - Q4 2025 V1 launch will introduce ETH/USDT liquidity pools, mtTokens, and a hybrid P2C/P2P lending model for on-chain credit. - CertiK audit (90/100 score) and buy-and-distribute mechanism strengthen security and token demand, with 80% Phase 6 capacity sold. - Roadmap includes Layer-2 expansion, stablecoin development, and testnet validation ahead of 2026 mainnet deployment.