Key Notes

- Canary’s LTCC ETF recorded $1.64 million in net assets by October 31.

- Litecoin trails Solana and Hedera ETFs in investor inflows.

- Stake.com now accounts for roughly 16% of Litecoin’s daily on-chain transactions.

Litecoin price closed October at $99, gaining 3% as the U.S. welcomed its first Litecoin ETF. Canary’s LTCC fund began trading on October 28, joining Solana and Hedera ETFs as the latest cryptocurrency derivatives assets listed for regulated trading in the US .

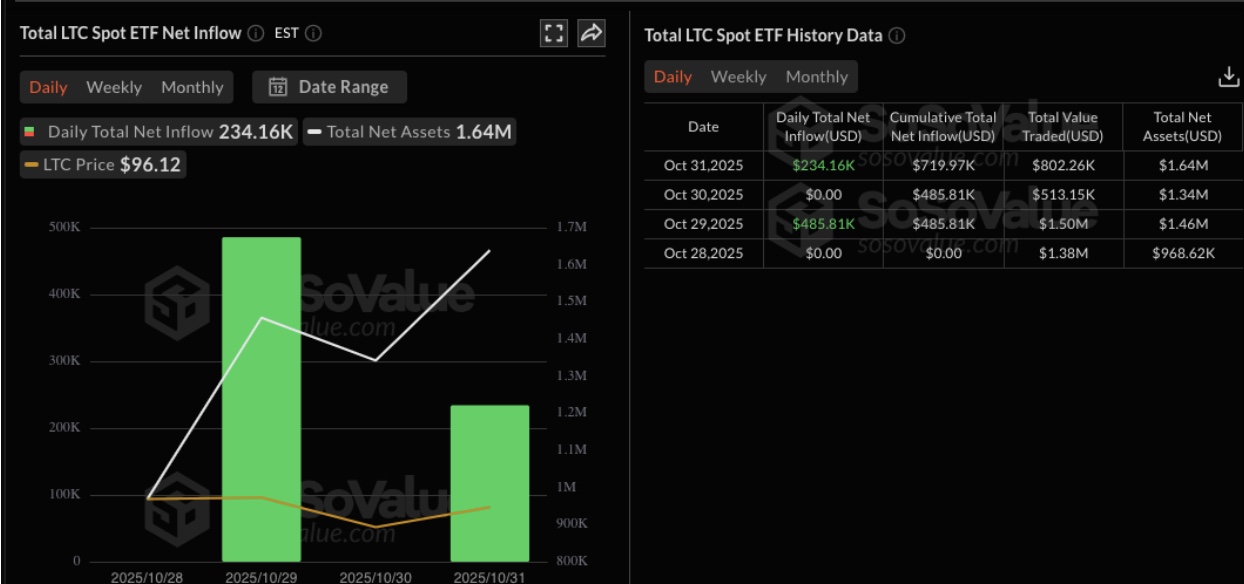

According to data from SoSoValue , LTCC’s cumulative total net inflow reached $719,970, with $802,260 in total traded value and $1.64 million in total net assets as of October 31.

Litecoin ETF market performance as of Nov 1, 2025 | Source: Sosovalue

Comparatively, Litecoin’s ETF performance trails behind the newly-launched funds. Solana’s fund amassed $199 million in inflows and $502 million in net assets, while Hedera’s ETF recorded $44 million in inflows and $45.93 million in assets. Litecoin’s correlation to Bitcoin (BTC) appears to have limited demand for LTC ETF this week. Net outflows of $191 million on Friday saw Bitcoin ETFs’ total withdrawals cross $1 billion in the last three days of trading.

Stake Now Accounts for 16% of Litecoin Transactions

Amid laggard ETF adoption, Litecoin continues to attract demand in online payment ecosystems. A report shared by community analyst bogdanoffig on X (formerly Twitter) revealed that Stake.com, a major crypto gaming platform, handles nearly 16% of daily Litecoin on-chain transactions.

Did You Know?

Litecoin accounts for a large percentage of crypto use at . In fact, Litecoin has been the number one crypto used there for at least two consecutive years!

Interestingly, @Stake accounts for about 16% of the daily Litecoin on-chain…

— boglee Ⓜ️🕸 (@bogdanoffig) October 30, 2025

Litecoin’ official X account reposted the statement, which further showed that Litecoin records average daily on-chain transactions around 200,000, boosted by the Stake.com payments integration.

The median Litecoin transaction fee remains below $0.0005, positioning LTC as one of the cheapest and fastest networks for high-volume microtransactions. This real-world usage aligns with the broader trend of altcoins regaining ground in payment utility markets, particularly in regions adopting low-fee payment rails. On Friday, Square, a payments platform affiliated with X founder Jack Dorsey, earmarked $50 rewards for 20,000 users to enable Bitcoin conversations in-app.

Litecoin Price Prediction: Can LTC Sustain Momentum Above $100?

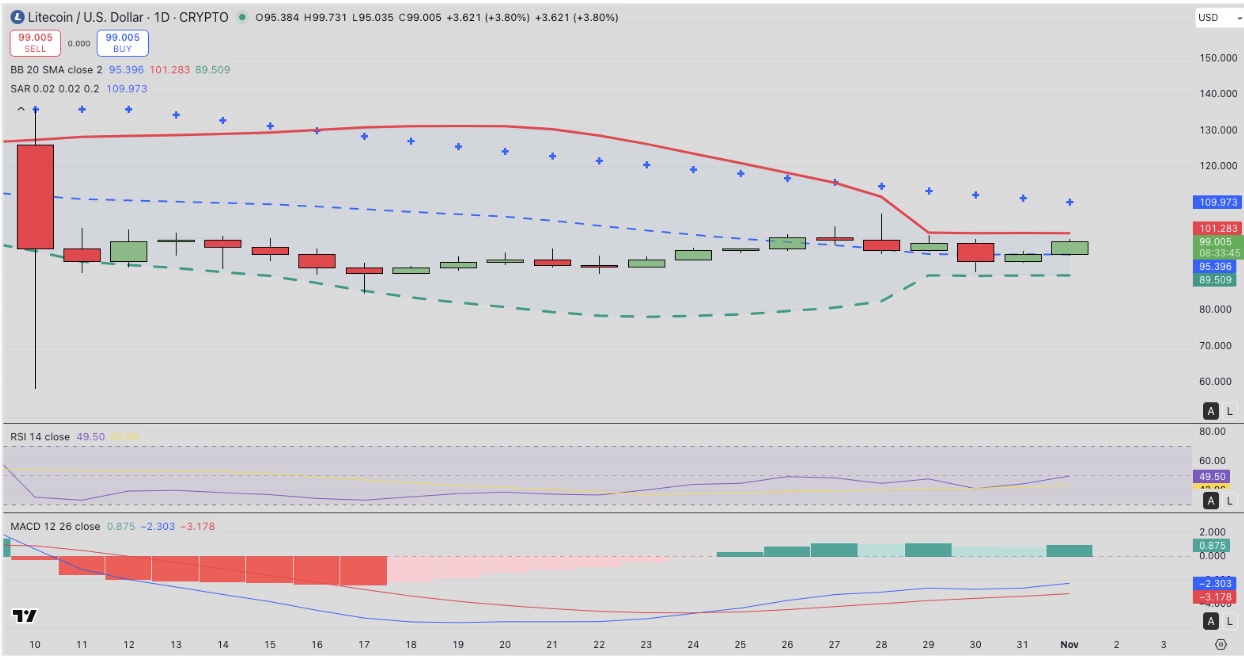

Litecoin’s latest rally toward $99.00 reflects improving sentiment after weeks of turbulence. On the daily chart, LTC/USD trades just below the upper Bollinger Band (at $101.28) while the middle band sits at $95.39, marking this zone as a key short-term support base.

The Parabolic SAR dots above the price at $109.97 indicate a lingering bearish sentiment. The Relative Strength Index (RSI), trending upwards to 49.5, shows sellers ceding control as market momentum approaches neutral territory.

Litecoin (LTC) price prediction | TradingView

The MACD line has crossed above the signal line (-2.30 vs -3.17), signaling a potential bullish reversal. With the histogram now turning positive, LTC price appears poised for an attempt to reclaim the $100 psychological mark, followed by resistance at $109.97.

Conversely, failure to hold the $95 support level could trigger a mild retracement toward $89.50, aligning with the lower Bollinger Band.

next