Bitcoin Updates: Fed's Interest Rate Reduction Triggers Caution While Bitcoin Teeters on the Edge

- Fed's 25-basis-point rate cut stabilized Bitcoin above $108,000 despite $550M liquidations, with traders adopting defensive positions ahead of policy statements. - Zcash surged 14.8% to $6.22B market cap, surpassing Shiba Inu and Monero, driven by privacy-focused interest and Solana integration plans. - Ethereum's ZKSync Atlas upgrade targets 15,000 TPS and $0 fees, aiming to enhance layer-2 programmability and network efficiency through security audits. - BlockDAG raised $434M in presale with 1,400 TPS

The cryptocurrency sector experienced a significant week after the Federal Reserve implemented a 25-basis-point rate reduction.

At the same time,

The Ethereum ecosystem also made notable progress, as co-founder Vitalik Buterin spotlighted the

Despite Bitcoin's recent dip to the $111,000–$115,000 range, market sentiment remained optimistic. MicroStrategy's Michael Saylor and Robert Kiyosaki both projected that Bitcoin could reach $150,000–$200,000 by the end of the year, according to

As these events unfolded, French legislator Éric Ciotti suggested creating a national Bitcoin Strategic Reserve, proposing the acquisition of 2% of the total Bitcoin supply over seven to eight years, as mentioned in

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Hampshire Delays Crypto Mining Bill After Backlash

New Hampshire postpones crypto mining bill following Senate split and strong public opposition.Public Concerns Lead to PauseLawmakers Seek More Clarity

Bitcoin falls to $110 while TAO and ZEC surge.

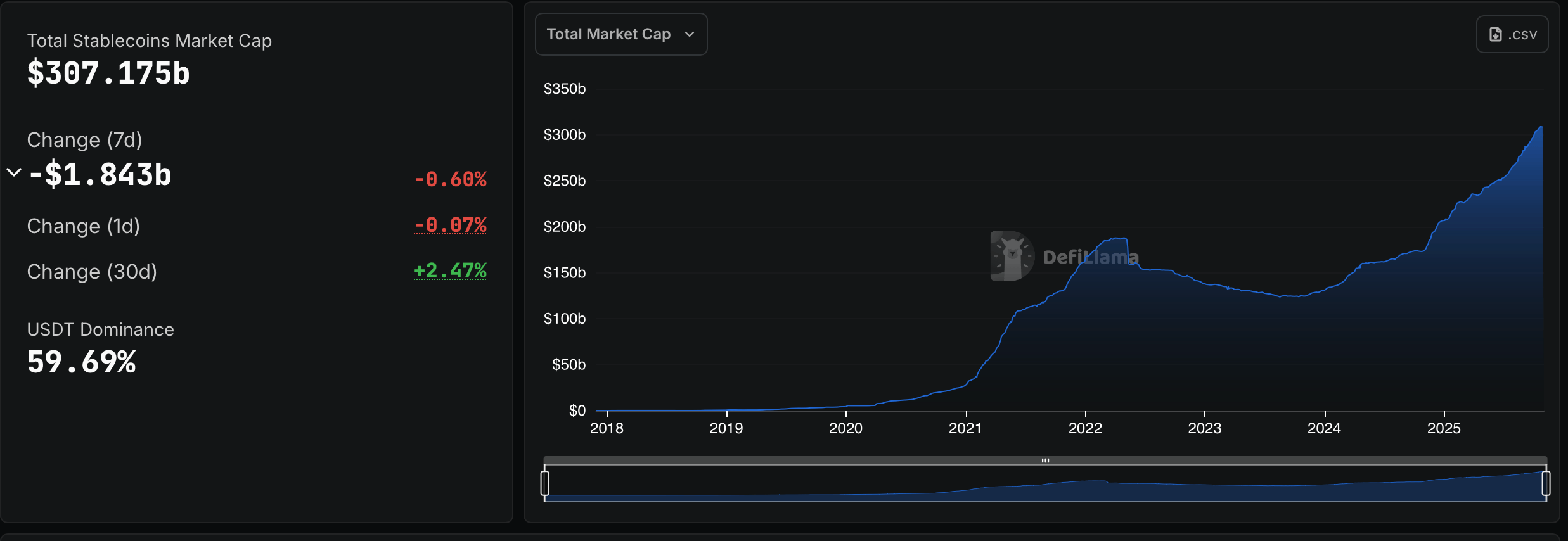

Billions on the Move: October’s Winners and Losers in the Stablecoin Market

Gen Z Overtakes Millennials as India’s Largest Crypto Investor Group: Report