Privacy Takes the Throne: Zcash Overtakes Monero with a $6.2 Billion Market Value

- Zcash (ZEC) surged 16% to $435, hitting an eight-year high with a $6.2B market cap, surpassing Monero and Shiba Inu. - High-profile endorsements from Arthur Hayes and Mert Mumtaz, plus Grayscale's $151.6M Zcash Trust, fueled retail and institutional demand. - Privacy-focused zk-SNARKs and the Orchard protocol drove 30% shielded supply adoption, aligning with global regulatory debates over digital surveillance. - Upcoming November halving and $10,000 price predictions contrast with risks of retracement be

Zcash (ZEC) has jumped 16% in the past day, reaching $435—a level not seen in eight years—and outpacing other privacy coins. Renewed enthusiasm for privacy-centric cryptocurrencies and endorsements from industry leaders have propelled ZEC’s market cap beyond $6.2 billion, overtaking Monero (XMR) and

The rally accelerated after influential figures in crypto spotlighted ZEC’s potential. BitMEX co-founder Arthur Hayes projected

Zcash’s privacy capabilities, powered by zero-knowledge proofs (zk-SNARKs), enable users to conceal transaction information—a feature that has become more attractive as concerns about digital surveillance grow worldwide. The shielded pool on the network now represents the bulk of recent expansion, driven by the Orchard protocol, which is considered the most advanced version of Zcash’s privacy tech, per the TradingView report. Analysts point out that the growing use of shielded transactions indicates active privacy adoption, as users choose to protect their transactions rather than simply holding the coin, according to the same report.

Broader market trends have also played a role, including Zcash’s upcoming halving in November, which will cut block rewards by half and emulate Bitcoin’s scarcity mechanism—a detail noted in coverage of Grayscale’s Zcash Trust. At the same time, ongoing regulatory discussions about privacy tools have reinforced ZEC’s appeal. The U.S. Treasury’s recent request for feedback on privacy technologies and the EU’s controversial “chat control” proposals have heightened interest in assets that resist censorship, analysts observe.

Despite the bullish outlook, there are still risks. Zcash’s sharp price rise leaves it exposed to corrections, with a fall below $320–$330 possibly leading to a retreat toward $280–$300, according to a

The privacy-coin market as a whole is now valued at $22.7 billion, with ZEC leading the charge.

As Zcash nears the $500 mark, attention will turn to whether the appetite for privacy can maintain this upward trajectory. With institutional involvement on the rise and regulatory attention increasing, the next few months will reveal if Zcash’s “digital privacy premium” can deliver lasting value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Hampshire Delays Crypto Mining Bill After Backlash

New Hampshire postpones crypto mining bill following Senate split and strong public opposition.Public Concerns Lead to PauseLawmakers Seek More Clarity

Bitcoin falls to $110 while TAO and ZEC surge.

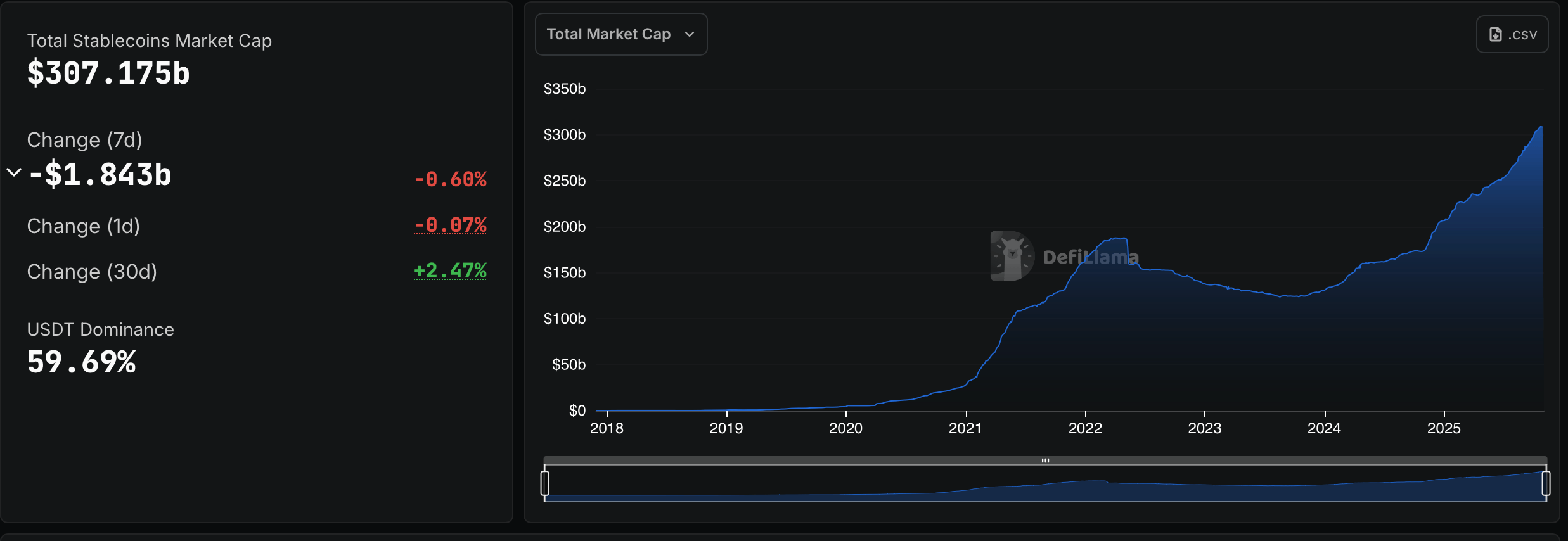

Billions on the Move: October’s Winners and Losers in the Stablecoin Market

Gen Z Overtakes Millennials as India’s Largest Crypto Investor Group: Report