Cardano Whale Holdings Rise To 5-Month High Even As Price Falls To $0.60

Cardano’s price dip hasn’t deterred large investors—whales have added 70 million ADA, pushing holdings to a five-month high and hinting at a possible recovery from the $0.60 support zone.

Cardano’s price has struggled to find a footing over the past few days, failing to sustain recovery attempts and slipping toward the $0.60 mark.

Despite the decline, on-chain data suggests optimism may be brewing. Large holders, known as whales, appear to be quietly accumulating ADA, potentially signaling confidence in a rebound.

Cardano Whales Are Buying

As Cardano’s price continues forming lower lows, whales have stepped in to accumulate. Addresses holding between 1 million and 10 million ADA have added roughly 70 million tokens over the last 48 hours, valued at around $42 million. While modest compared to past accumulations, the move indicates growing confidence among large investors.

This buying spree has pushed whale holdings to a five-month high, suggesting they view the current price as a strong entry point. Their activity often serves as a precursor to broader market optimism.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Cardano Whale Holdings. Source:

Cardano Whale Holdings. Source:

From a technical perspective, the Moving Average Convergence Divergence (MACD) indicator shows signs of improving momentum. The red bars on the histogram are receding, indicating bearish pressure is easing. This shift aligns with the recent whale activity and suggests Cardano could be nearing a potential reversal zone.

Over the past two months, Cardano has come close to forming a bullish MACD crossover but failed to sustain momentum each time. However, with strong accumulation from major holders and fading bearishness, ADA could finally confirm a bullish crossover, signaling a possible short-term uptrend.

Cardano MACD. Source:

Cardano MACD. Source:

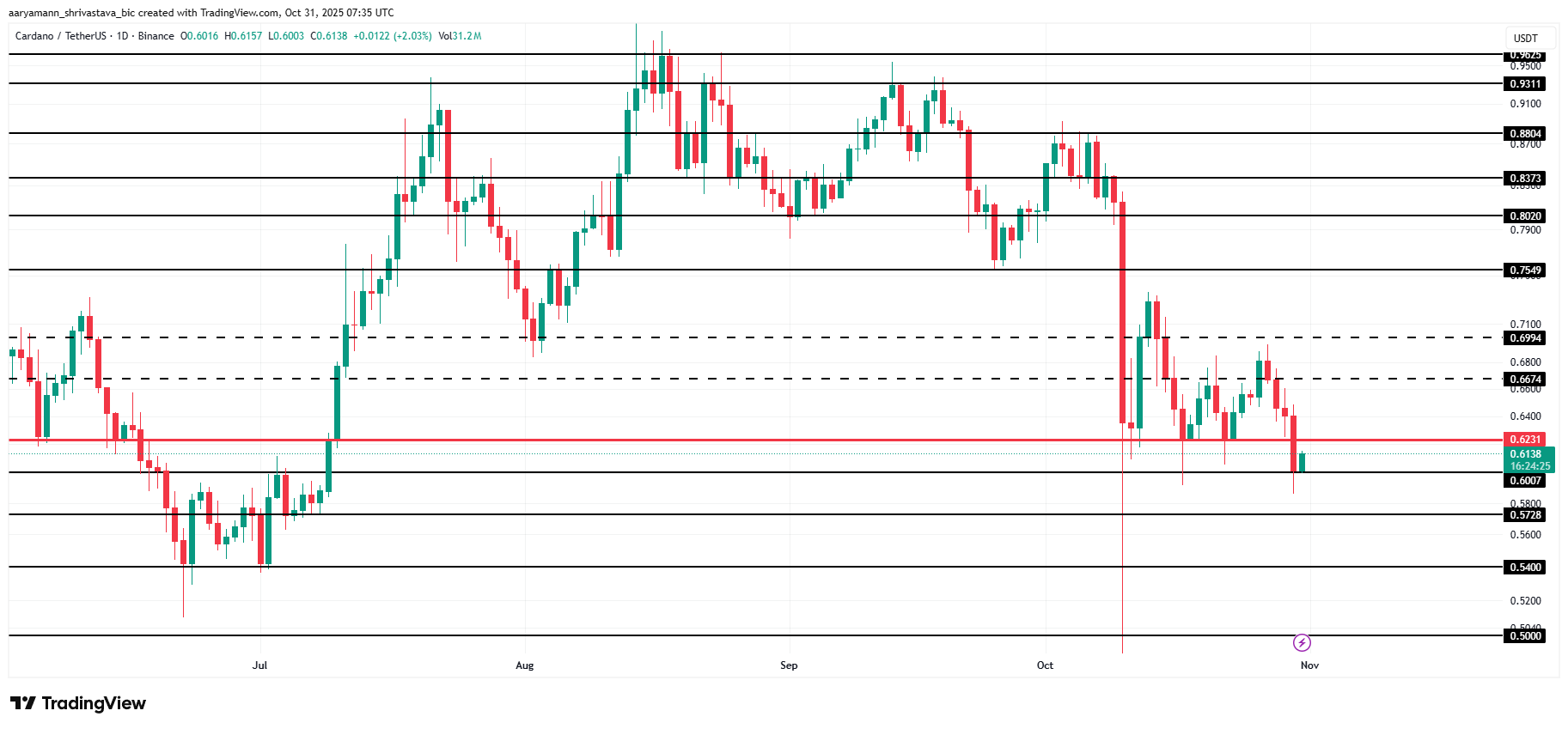

At the time of writing, Cardano’s price stands at $0.61, holding slightly above the crucial $0.60 support level. The recent stabilization coincides with renewed buying from whales, hinting that downside pressure might be weakening.

If ADA maintains this level, it could bounce off $0.60 and rally toward $0.62 before targeting $0.66. A break above these resistance zones would likely attract stronger inflows, reinforcing a bullish reversal.

Cardano Price Analysis. Source:

Cardano Price Analysis. Source:

However, if whale accumulation eases and selling pressure returns, Cardano’s price could lose its $0.60 support. Such a move may push ADA down to $0.57 or even $0.54, invalidating the bullish thesis and extending the correction phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum’s Liquidity Foundation Transformed: ZKsync Atlas Integrates Layers for the Age of Institutions

- ZKsync's Atlas upgrade triggered an 88% surge in ZK token and 43% gains in L2 tokens like MINA and STRK. - The upgrade enables real-time Ethereum liquidity access for L2s, praised by Vitalik Buterin for redefining institutional settlement standards. - With 15,000 TPS and one-second finality, Atlas reduces latency between Ethereum and L2s while attracting $19M in institutional funding for ZKsync-based projects. - By unifying liquidity pools and enabling L2-to-L2 settlements, the upgrade positions Ethereum

Ethereum Updates Today: Major Whale Invests $9.96M—Aggressive Leverage Signals Anticipation of Market Recovery

- Ethereum whale "Smart Money" added $9.96M in ETH (25x leverage), boosting its long position to $62.35M amid market uncertainty. - High-profile trader "Buddy" rebalanced its portfolio, trimming HYPE exposure while increasing ETH longs with $890K unrealized gains. - Market analysis highlights Ethereum's critical $41–$42 support level and growing institutional involvement via SEC filings and large ETH orders. - Whale activity and leveraged trading strategies underscore market fragility, with unrealized gain

Bitcoin Updates: Massive Whale Sell-Off and Federal Reserve Uncertainty Drive Bitcoin Price Down Under $110k

- Bitcoin fell below $110,000 amid fading investor confidence, macroeconomic pressures, and aggressive selling by large holders. - Early adopter wallets offloaded $290M in BTC while spot ETFs saw $471M outflows, signaling shifting market sentiment. - Fed policy uncertainty and unresolved U.S.-China tensions exacerbated declines, with $1.1B in crypto derivatives liquidated post-Fed meeting. - DeFi projects like Ether.fi DAO launched $50M buybacks to stabilize prices, contrasting broader market weakness. - R

Dogecoin News Today: Is Dogecoin's $0.18 Level the Key to Unlocking a Surge Toward $0.33?

- Dogecoin (DOGE) hovers near $0.18 support, critical for sustaining its bullish trend toward $0.33, per Gate.io analysts. - A successful hold above $0.18 confirms upward momentum, while a breakdown risks deeper corrections and invalidated patterns. - Broader crypto optimism sees altcoins like SEI and XRP showing bullish signals amid Bitcoin's consolidation phase. - Macro risks including U.S. interest rates and ETF launches could disrupt DOGE's trajectory despite favorable technical indicators.