On-Chain Economy Set to Generate $19.8 Billion in Fees in 2025, Report Finds

The blockchain economy is maturing fast—on-chain fees are climbing to record highs as DeFi, wallets, and real-world applications drive genuine network demand and reshape crypto’s revenue landscape.

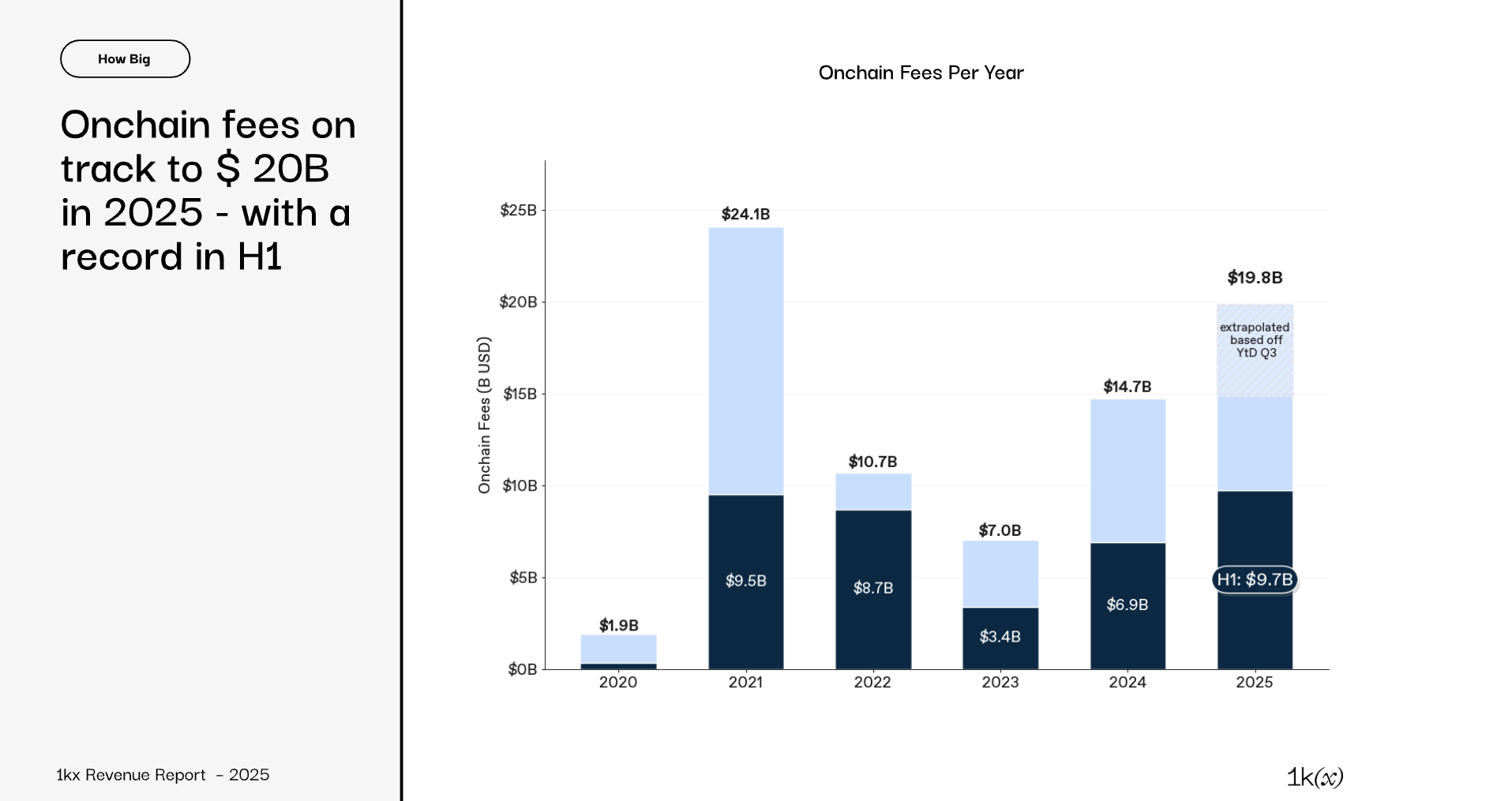

As the blockchain sector transitions from speculative booms to sustainable growth, on-chain fees have emerged as a critical barometer of economic maturity. According to a recent report, the on-chain economy is on track to generate $19.8 billion in fees for 2025.

This indicates a shift toward sustainable, usage-driven economics across decentralized finance (DeFi) and Web3 ecosystems.

The State of the On-Chain Economy in 2025

In a recent report, 1kx.capital revealed that on-chain fees in 2025 are more than 10 times higher than in 2020, representing a compound annual growth rate (CAGR) of about 60%.

Users spent $9.7 billion during the first half of 2025. This marked the highest first-half total on record and a 41% rise from the prior year. This figure even surpasses 2021, when fees reached $9.5 billion in the same period.

“Back then fee generation was driven by billions of dollars in user-incentives, related speculation and a few costly PoW blockchains. Today fees are generated primarily by applications, led by financial use cases but expanding rapidly into DePINs, Wallets, and consumer apps (each with >200% YoY growth),” the report read.

On-Chain Fee Growth in 2025. Source:

1kx.capital

On-Chain Fee Growth in 2025. Source:

1kx.capital

1kx.capital added that the average transaction fee dropped by 86%, driven mostly by Ethereum (ETH). The network accounted for over 90% of the decline. As transaction costs fell, participation in the ecosystem accelerated.

Average daily transactions rose 2.7 times compared to the second half of 2021. The number of wallets making monthly transactions also surged to 273 million in the first half of 2025, a 5.3-fold increase. In parallel, the range of fee-generating protocols expanded, climbing from just 125 in 2021 to 969 in H1 2025.

“Based on end of Q3 data, 2025 fees are projected at $19.8 billion – up 35% YoY, but still 18% below 2021 levels. The base-case forecast projects $32+ billion in on-chain fees for 2026, 63% YoY, continuing the application-driven growth trajectory,” 1kx.capital forecasted.

DeFi and Finance Lead On-Chain Activity

DeFi and broader financial applications continued to dominate the on-chain space, accounting for 63% of all fees in H1 2025, or roughly $6.1 billion. This represented a 113% year-over-year increase.

Of this, approximately $4.4 billion came from core categories including decentralized exchanges (DEXs), perpetual and derivatives platforms, and lending protocols.

“When overall onchain fees resurged in 2024, Blockchains lost that lead position to DeFi/Finance Applications, which is on track for $ 13.1B / 66% of total in 2025,” 1kx.capital stated.

On Solana, protocols such as Raydium and Meteora have led the growth, cutting Uniswap’s market share from 44% to 16%. Jupiter emerged as a major player in the perpetual and derivatives segment, increasing its share of sector fees from 5% to 45%. Additionally, newcomer Hyperliquid contributed 35% of all fees in this category.

Within lending, Aave remains the dominant protocol. However, Morpho has quickly expanded its footprint, capturing a 10% share of the fees.

Beyond DeFi, blockchains themselves accounted for 22% of total fees, primarily from Layer 1 transaction costs and MEV capture. Meanwhile, fees from Layer 2 and Layer 3 remained relatively marginal.

Wallets accounted for 8%. This trend was led by Phantom, which generated roughly 30% of all wallet-related fees. Consumer applications contributed 6% of total fees, with launchpads making up more than 80% of that segment (driven largely by Pump.fun).

Other contributors included casinos (8%) and the creator/social economy (4%). Finally, DePINs (decentralized physical infrastructure networks) and middleware each represented 1% of total fees.

Beyond On-Chain Fees: Expanding Digital Asset Revenues

The report emphasized that blockchain-related revenues are not limited to on-chain fees alone. A significant portion of income also comes from off-chain and network-level sources, which together comprise the broader digital asset economy.

Off-chain fees totaled $23.5 billion, with centralized exchanges (CEXs) accounting for the largest share, approximately $19 billion. 1kx.capital also identified about $23.1 billion in additional income, mainly from block rewards earned by miners and stakers, and from stablecoin yields.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Filecoin Reaches Critical Juncture: Surpassing $2.30 May Lead to Value Doubling

- Filecoin (FIL) approaches $2.30 resistance, with a breakout potentially doubling its value to $4.60 amid broader crypto optimism. - Bitcoin sees $8B ETF inflows and could reach $140,000 by November if Fed easing and institutional adoption continue. - Ethereum forms bullish patterns near $4,080 support, aligning with crypto market recovery and altcoin momentum. - Crypto infrastructure growth (e.g., Bitcoin miner investments) and macroeconomic factors drive sector confidence despite lingering volatility ri

Zcash's Approach to Balancing Privacy and Regulation Draws Institutional Interest

- Zcash (ZEC) surges to $409 amid strategic upgrades and institutional adoption, with 971.1% annual gains and $7B market cap. - ECC’s Q4 2025 roadmap prioritizes privacy upgrades (ephemeral addresses, hardware wallet integrations) and regulatory compliance via optional viewing keys. - Institutional demand grows as Grayscale manages $137M in ZEC assets, while Arthur Hayes predicts $10,000 potential during an "altseason" driven by fixed supply and adoption. - Technical indicators show bullish momentum ($529M

Solana News Today: "Solana ETFs See Growth as Token Declines: Higher Staking Returns Drive Investors to Switch"

- Solana ETFs gained $44.48M in inflows, defying broader crypto market weakness as Bitcoin and Ethereum ETFs saw combined $290M outflows. - Bitwise Solana ETF (BSOL) surged 4.99% with $222.8M in assets, driven by staking yields and novel narratives despite SOL token's 8% weekly price drop. - On-chain data revealed 1.1M SOL transfer from Jump Crypto to Galaxy Digital, fueling speculation about Bitcoin rotation amid profit-taking pressures. - Bitcoin ETFs maintained $931M weekly net inflows ($30.2B annual to

Bitcoin Updates: $717 Million in Bitcoin Moved to New Wallet, Owner and Purpose Remain Unknown

- A $717M Bitcoin transfer from Coinbase to a new anonymous wallet has triggered market speculation about institutional activity or security measures. - Analysts highlight whale behavior implications, though anonymity complicates identifying motives like portfolio rebalancing or cold storage moves. - CoinW's BankrCoin (BNKR) listing on October 29 aims to boost short-term interest through $8,000 USDT bounties and promotional campaigns. - Market observers caution against overreacting to single large transfer