Key takeaways

- BTC is trading above $109k, down 5% in the last seven days.

- The demand for spot Bitcoin ETFs has declined as Powell said another rate cut in December is uncertain.

Demand for spot Bitcoin ETFs declines

The demand for spot Bitcoin ETFs has declined over the past few days amid the current financial climate. Fed Chair Jerome Powell revealed earlier this week that it remains unclear if there will be another rate cut in December.

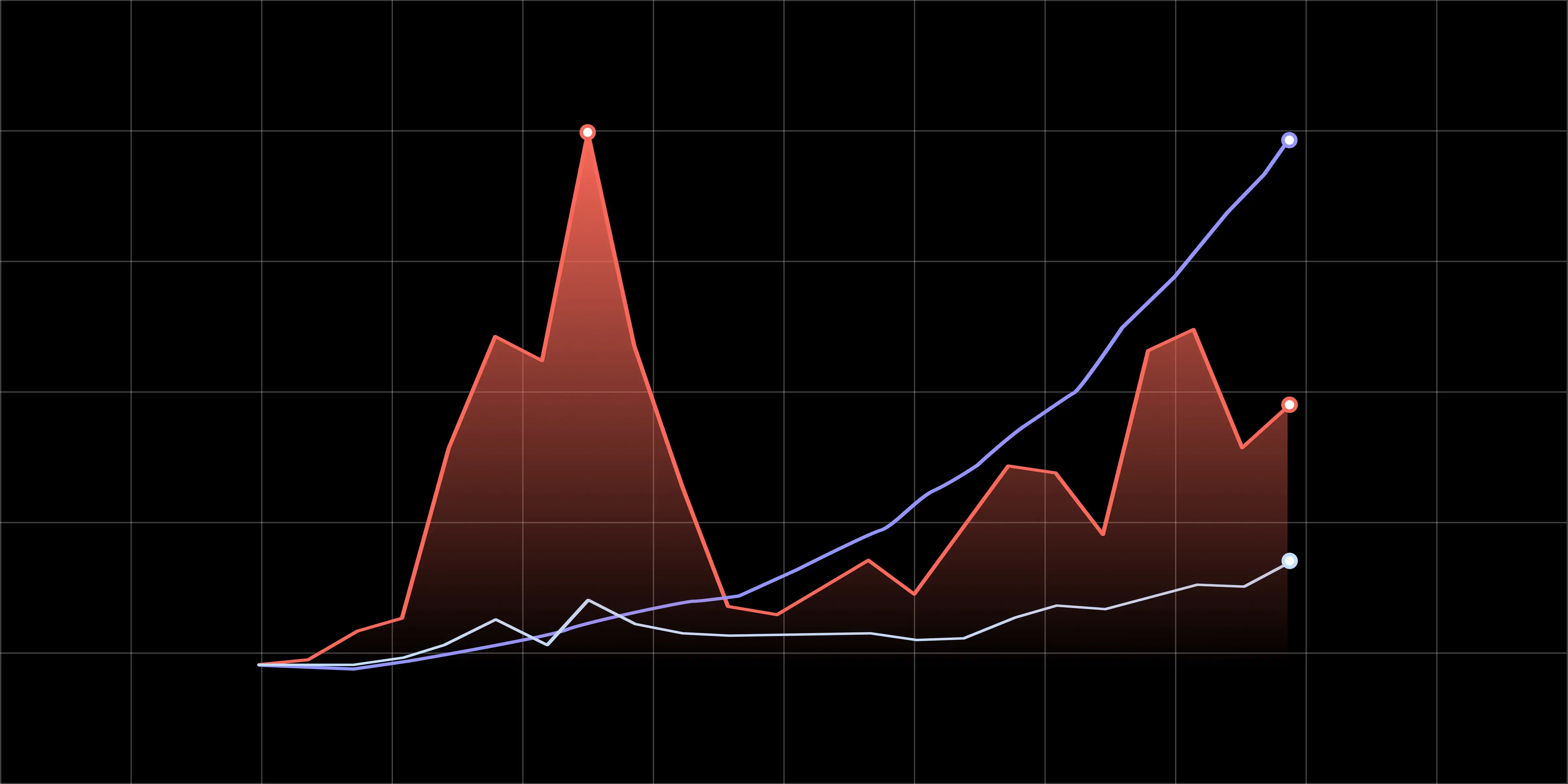

Data obtained from CryptoQuant’s latest weekly report shows that U.S. investor demand for spot Bitcoin ETFs has cooled sharply. Spot bitcoin ETFs posted a seven-day average outflow of 281 BTC, one of the weakest readings since April. Meanwhile, Ether inflows have stalled over the last seven days.

The report added that Coinbase premiums for BTC and ETH have flattened to near zero, and the CME futures basis has dropped to multi-year lows. These data show that institutional and retail traders alike are taking profits rather than adding exposure.

According to Glassnode, Bitcoin continues to struggle below the short-term holders’ cost basis of around $113,000, with the coin’s long-term holders still distributing roughly 104,000 BTC per month.

Transfer volumes from whale wallets to exchanges have surged to $293 million a day, suggesting that investors are taking profit rather than increasing exposure to the market.

Bitcoin could dip to $102,000 if it closes below key support

The BTC/USD 4-hour chart remains bearish and efficient as it is down 1% in the last 24 hours. The monthly candle will close in a few hours and could indicate how the market will react in the near term.

If Bitcoin continues its correction and closes the candle below the 61.8% Fibonacci retracement level at $106,453, it could extend its dip towards the October 10 low of $102,000.

The RSI of 46 is below the neutral 50, indicating bearish momentum is gaining traction. The Moving Average Convergence Divergence (MACD) lines are also converging, suggesting a bearish trend.

However, if Bitcoin holds the support level at $106,453, it could rally towards the 50-day EMA at $112,872 over the next few hours and days.