Four.meme Connects Blockchains via deBridge, Advancing DeFi's Cross-Chain Integration

- Four.meme integrates deBridge to enable direct token swaps to BSC assets like BNB, enhancing cross-chain efficiency. - The update eliminates intermediaries, reducing friction and security risks in multi-chain asset transfers. - This aligns with industry trends prioritizing interoperability, strengthening BSC's role as a DeFi hub. - Other DeFi platforms like BenPay also focus on security through non-custodial models and third-party audits.

Four.

This update, which took effect on October 31, represents a major enhancement of Four.meme’s cross-chain functionality, making it possible for users to move assets between chains effortlessly and without intermediaries. The addition of deBridge streamlines asset management within Four.meme’s ecosystem, offering a more convenient way for users to distribute their assets across different blockchains. In the past, cross-chain transfers often involved several steps and the use of third-party bridges, which could complicate the process and introduce security concerns. Now, with deBridge, users are able to exchange tokens from supported networks—such as

This partnership reflects a broader movement in the industry toward greater interoperability. As blockchain technology becomes more widely adopted, there is a growing focus on cross-chain solutions to improve scalability and the overall user experience. Four.meme’s integration with deBridge highlights the significance of connecting different blockchain ecosystems, especially as BSC continues to establish itself as a center for DeFi and decentralized applications. Experts point out that such advancements help decrease dependence on centralized exchanges for cross-chain transfers, further promoting decentralized asset management.

Although the article centers on Four.meme’s latest integration, it’s important to mention that the DeFi sector is also advancing in areas of security and user autonomy. For example, platforms like BenPay DeFi Earn focus on non-custodial asset management and undergo third-party audits to reduce the risks linked to unverified protocols, according to a

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Base Tokens Set for $34B Valuation — Here Are the Altcoins to Buy Next

New Hampshire Delays Crypto Mining Bill After Backlash

New Hampshire postpones crypto mining bill following Senate split and strong public opposition.Public Concerns Lead to PauseLawmakers Seek More Clarity

Bitcoin falls to $110 while TAO and ZEC surge.

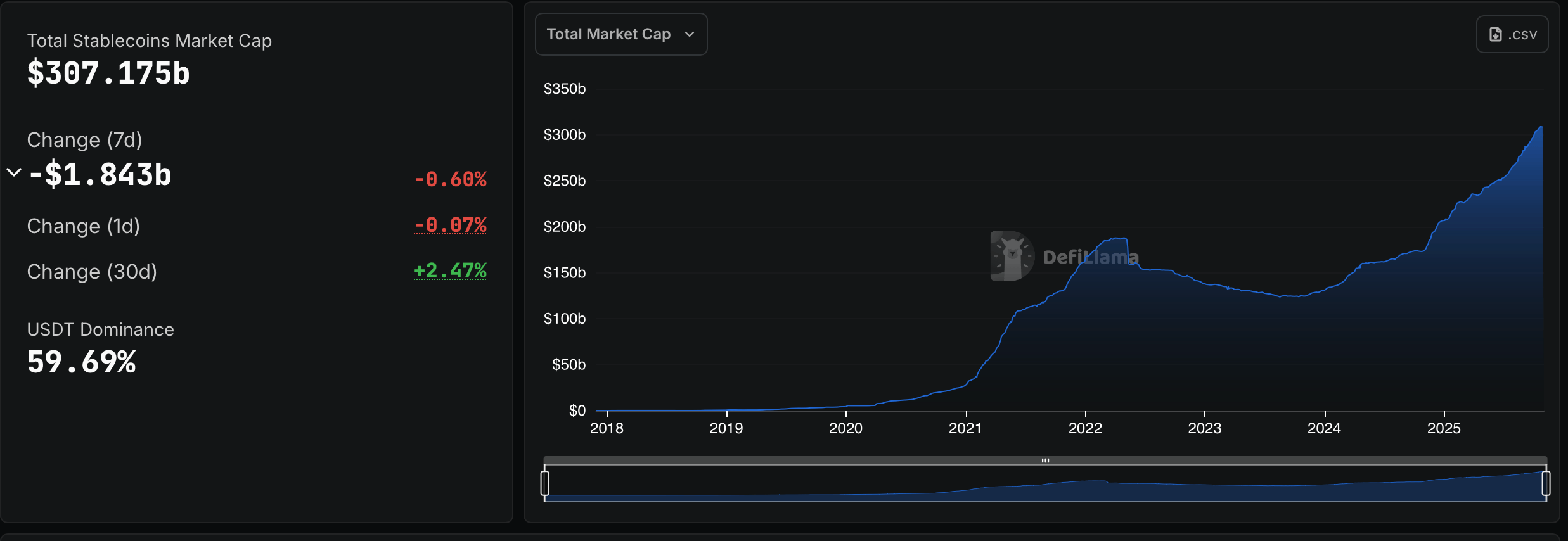

Billions on the Move: October’s Winners and Losers in the Stablecoin Market