Key Market Information Discrepancy on October 31st, a Must-See! | Alpha Morning Report

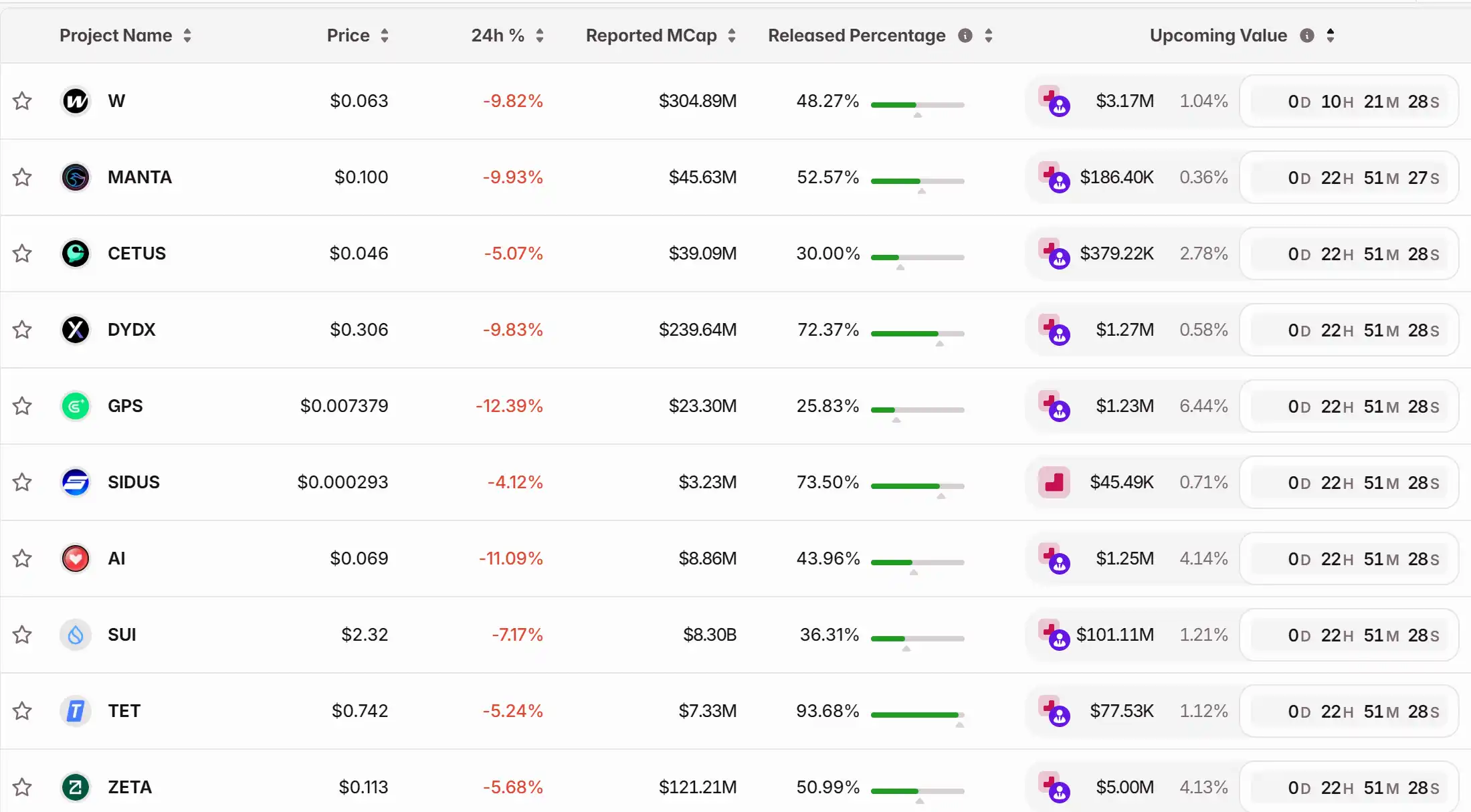

1. Top News: Ethereum's next major upgrade "Fusaka" is scheduled to go live on December 3rd 2. Token Unlock Schedule: $W, $MANTA, $CETUS, $DYDX, $GPS, $SIDUS, $AI, $SUI, $TET, $ZETA

Top News

1.Ethereum's Next Major Upgrade 'Fusaka' Scheduled to Go Live on December 3

2.Bitcoin Surges Past $110,000

5.$1.134 Billion Liquidated Across the Network in the Last 24 Hours, Mainly Long Positions

Articles & Threads

1. "Making Money While Giving Away Money: Recent Developments in Top Perp DEXs"

According to the latest on-chain data, the market landscape of decentralized perpetual contract exchanges (Perp DEXs) has become relatively clear. In terms of 24-hour trading volume, Aster leads with $121.2 billion, followed by Lighter at $86.16 billion in second place, Hyperliquid at $59.58 billion in third, with edgeX and ApeX Protocol ranking fourth and fifth with $50.6 billion and $21.22 billion, respectively. For investors and traders looking to delve deeper into the Perp DEX track, monitoring the developments of these top five platforms should provide a good sense of the overall direction of the industry.

2. "A Mysterious Team That Dominated Solana for Three Months Is Going to Launch a Coin on Jupiter?"

An anonymous team without a website or community that consumed nearly half of the transaction volume on Jupiter in 90 days. To better understand this mysterious project, we need to first delve into an on-chain transaction revolution quietly happening on Solana.

Market Data

Daily Marketwide Funding Rate (as reflected by funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Seven-Year Uptober Run Concludes Amid Dominance of Global Economic and Political Factors

- Bitcoin's seven-year "Uptober" rally collapsed in October 2025, dropping 10% below $110,000 amid profit-taking and macroeconomic risks. - Trump's China tariff threats triggered a $15,000+ selloff, wiping $500B in crypto value and exposing leveraged position vulnerabilities. - Miner profitability stabilization near $115,000 offers potential support, but below $110,000 risks renewed capitulation amid ETF and liquidity shifts. - The market now prioritizes fundamentals over seasonality, with BNB's 4.2% gain

Crypto Plunges Amid Conflicting Fed Messages and Concerns Over Data Breaches

- Crypto prices fell amid conflicting Fed signals and U.S.-China trade deal uncertainty, despite eased trade restrictions and a 25-basis-point rate cut. - A UK data breach case highlighted crypto's vulnerability to insider fraud, with regulators expanding enforcement against data misuse in financial crimes. - Market volatility intensified as Fed's halted quantitative tightening created liquidity uncertainty, echoing 2019's 35% Bitcoin drop after QT ended. - Analysts remain cautiously optimistic about long-

Stellar News Today: Major Institutions Place Significant Bets on Stellar’s Real-World Blockchain Expansion

- Stellar's XLM token stabilized near $0.30 as Q3 2025 saw 700% surge in smart contract invocations and $5.4B RWA volume. - Partnerships with Chainlink and PayPal USD expanded Stellar's cross-chain interoperability and stablecoin adoption in daily transactions. - Institutional investments and $2T RWA market projections position Stellar as a leader in compliant blockchain solutions for global finance. - Technical analysis shows XLM trading in a tight range with potential volatility if buyers control $0.35 r

Hong Kong's Stablecoin Regulations Balance Innovation and Investor Protection

- Hong Kong mandates stablecoin issuance by SFC-licensed providers to strengthen investor protection and market stability. - Regulators reject DAT structure conversions for listed firms, warning against inflated valuations exceeding crypto holdings' value. - The framework aligns with global trends but contrasts with U.S. permissiveness, balancing innovation against mainland China's stricter crypto controls. - Stablecoin transaction volumes hit $4.65T in late 2025, yet regulators stress education to mitigat