FourMeme Surpasses Pumpfun With $43 Million in Monthly Revenue

Mutlichain memecoin launchpads continue to pop up, and with BNB Smart Chain (BSC) activity taking off, the chain’s go-to memecoin launchpad, FourMeme, is now earning more revenue than Solana-based pumpfun.

Over the last 30 days, FourMeme has earned $43 million in fees, outpacing pumpfun by 13%, making it the fourth-largest revenue generator in DeFi, trailing only Hyperliquid, Circle, and Tether.

While memecoin trading activity has fallen off significantly from the beginning of the year, memecoin trading infrastructure continues to rake in profits, with FourMeme, Pumpfun, Jupiter, Axiom, and PancakeSwap accounting for five of the top ten revenue generators in DeFi over the last month.

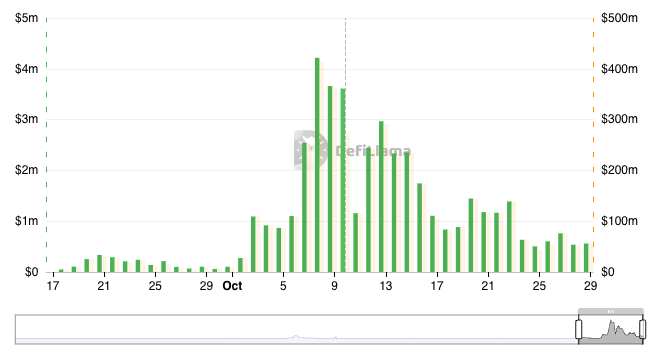

The rotation to Binance memecoin trading was potentially catalyzed by two token launches, ASTER and STBL, which both released on BSC and rallied more than 10x after traders bridged to the network to buy them. Aster furthered its hold on the BSC ecosystem through its post-TGE airdrop farm, which concluded in the first week of October, right when FourMeme volumes began to rise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Plunges Amid Conflicting Fed Messages and Concerns Over Data Breaches

- Crypto prices fell amid conflicting Fed signals and U.S.-China trade deal uncertainty, despite eased trade restrictions and a 25-basis-point rate cut. - A UK data breach case highlighted crypto's vulnerability to insider fraud, with regulators expanding enforcement against data misuse in financial crimes. - Market volatility intensified as Fed's halted quantitative tightening created liquidity uncertainty, echoing 2019's 35% Bitcoin drop after QT ended. - Analysts remain cautiously optimistic about long-

Stellar News Today: Major Institutions Place Significant Bets on Stellar’s Real-World Blockchain Expansion

- Stellar's XLM token stabilized near $0.30 as Q3 2025 saw 700% surge in smart contract invocations and $5.4B RWA volume. - Partnerships with Chainlink and PayPal USD expanded Stellar's cross-chain interoperability and stablecoin adoption in daily transactions. - Institutional investments and $2T RWA market projections position Stellar as a leader in compliant blockchain solutions for global finance. - Technical analysis shows XLM trading in a tight range with potential volatility if buyers control $0.35 r

Hong Kong's Stablecoin Regulations Balance Innovation and Investor Protection

- Hong Kong mandates stablecoin issuance by SFC-licensed providers to strengthen investor protection and market stability. - Regulators reject DAT structure conversions for listed firms, warning against inflated valuations exceeding crypto holdings' value. - The framework aligns with global trends but contrasts with U.S. permissiveness, balancing innovation against mainland China's stricter crypto controls. - Stablecoin transaction volumes hit $4.65T in late 2025, yet regulators stress education to mitigat

Bitcoin Updates Today: How Bitcoin Mining Supports Grid Reliability Amid Japan’s Green Energy Transition

- Canaan Inc. partners with Japanese utility to deploy 4.5MW hydro-cooled Bitcoin miners for grid balancing, marking Japan's first government-backed "digital load balancer" initiative. - Avalon A1566HA-488T servers use smart control chips to dynamically adjust mining operations, enhancing grid stability while consuming 8,064W per unit at 16.8J/TH efficiency. - Project aligns with Japan's crypto regulatory reforms and global "clean crypto" trends, leveraging surplus renewable energy for mining without strai