A key watershed breached: The Fed's "hawkish shadow" may reignite market volatility

Bitcoin is showing signs of weakness, and market confidence is being put to the test.

Bitcoin's weakness is becoming apparent, and market conviction is being tested.

Written by: Chris Beamish, CryptoVizArt, Antoine Colpaert, Glassnode

Translated by: AididiaoJP, Foresight News

Bitcoin's struggle below key cost basis levels reflects weakening demand and continued selling by long-term holders. Although volatility has cooled and options positioning is relatively balanced, the market now hinges on expectations for the Federal Reserve meeting, where any hawkish surprise could reignite volatility.

Summary

- Bitcoin rebounded over the weekend from the $107K to $118K supply cluster, mimicking previous short-lived rebounds after all-time highs, but ongoing selling pressure from long-term holders has capped further upside.

- The market continues to struggle above the short-term holder cost basis (around $113K), a key battleground between bullish and bearish momentum. Failure to reclaim this level increases the risk of a deeper pullback toward the realized price for active investors (around $88K).

- Short-term holders are exiting at a loss, while long-term holders remain the main source of heavy selling pressure (around -104K BTC/month), indicating weakening conviction and ongoing supply absorption.

- Implied volatility has sharply cooled after the October crash, skew has flattened, and options flows reflect controlled upside and measured downside hedging.

- The current calm in volatility depends on the Fed’s next decision. A dovish outcome will keep things steady, but any hawkish surprise could reignite volatility and demand for downside protection.

On-chain Insights

Familiar Rebound Pattern

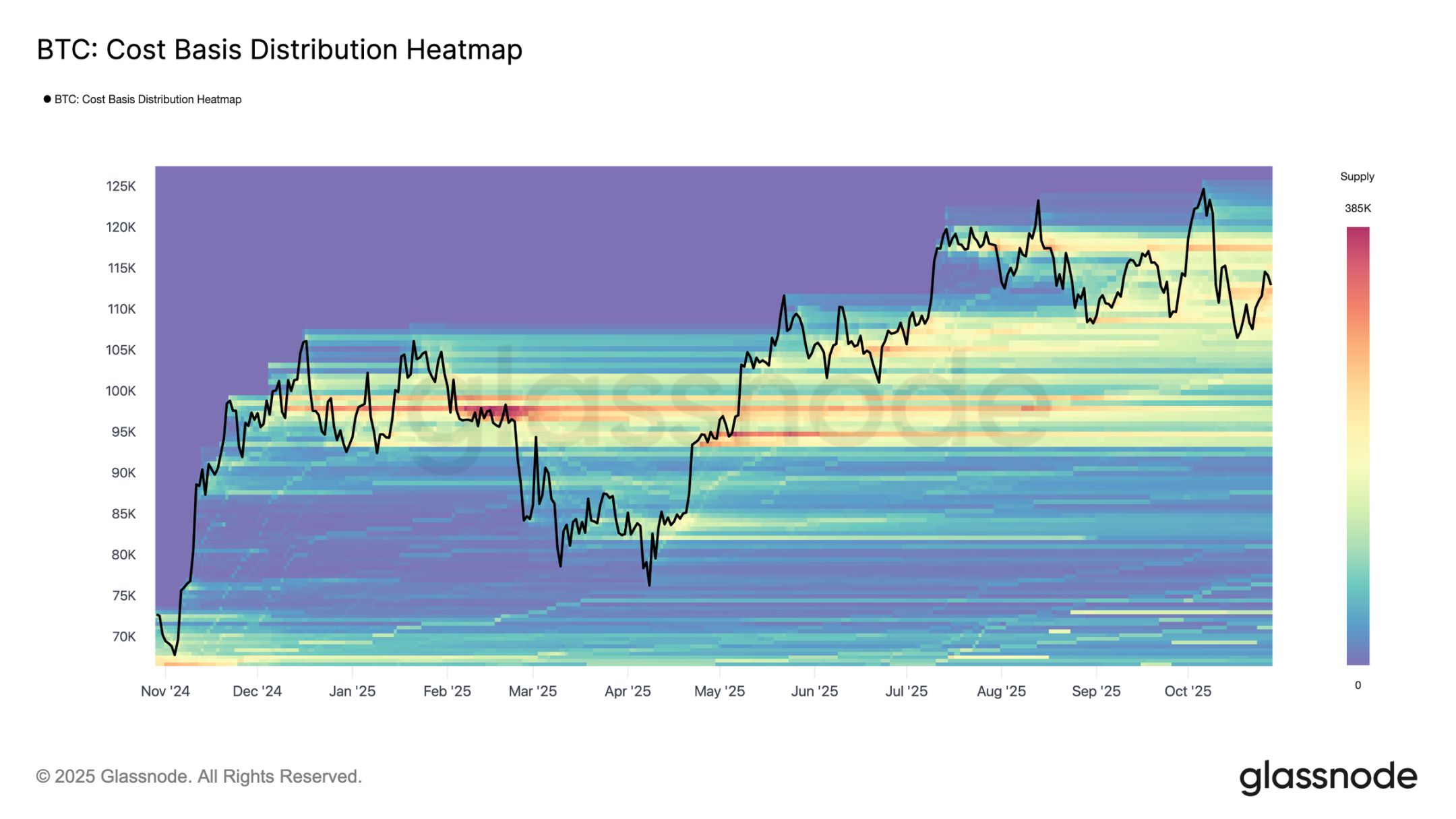

Last weekend, after briefly dipping to the lower boundary of the top buyer supply cluster ($107K to $118K), Bitcoin staged a short-lived recovery. According to the cost basis distribution heatmap, the price rebounded from near the $116K median before falling back to around $113K.

This structure closely mirrors the rebound patterns observed after all-time highs in Q2-Q3 2024 and Q1 2025, where temporary rebounds occur but demand is quickly absorbed by overhead supply. In the current scenario, a new wave of selling by long-term holders further amplifies resistance in this supply zone, highlighting how profit-taking at highs continues to limit upward momentum.

Struggling to Hold the Line

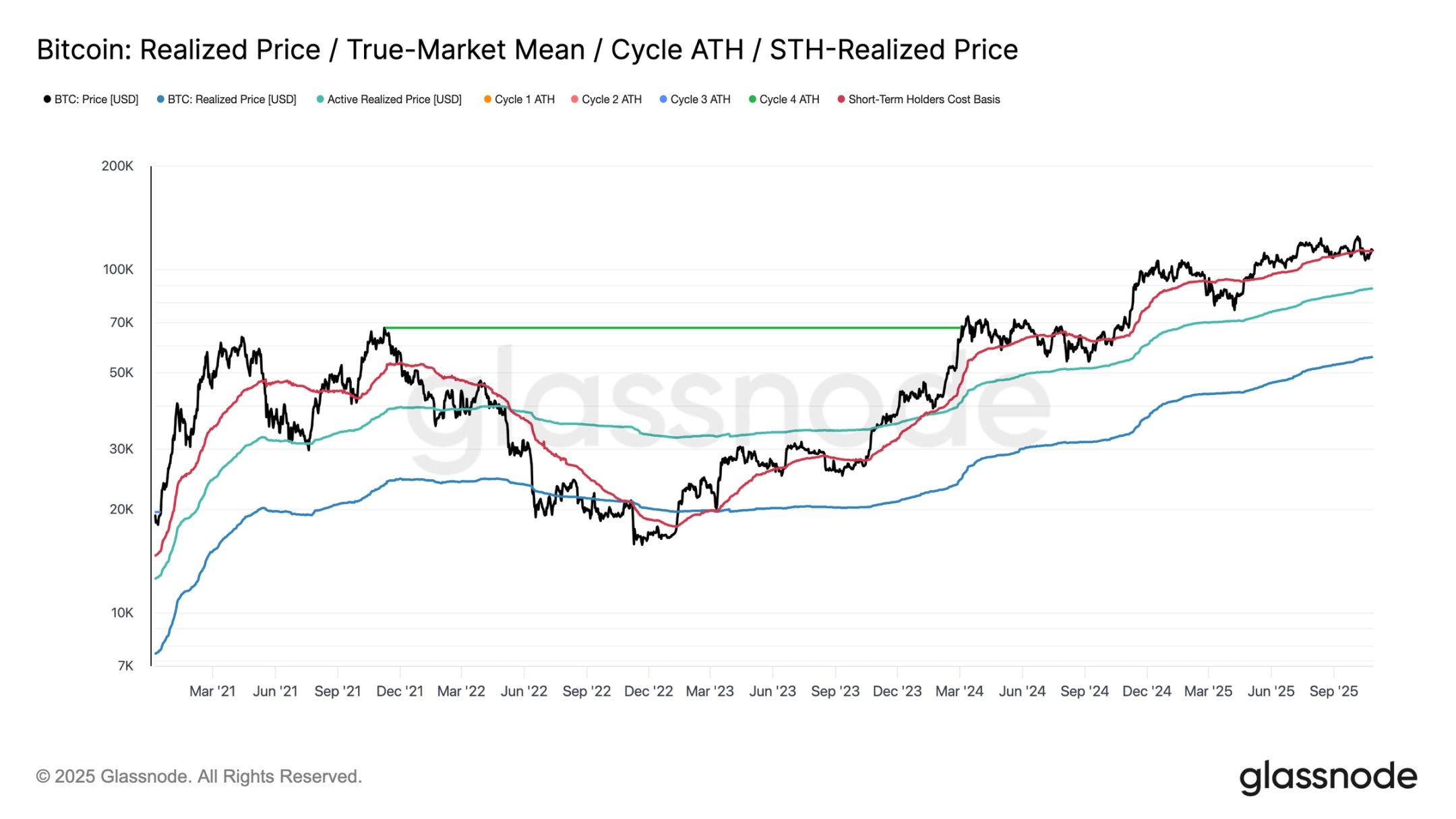

After the weekend rebound, Bitcoin briefly reclaimed the level near the short-term holder cost basis of about $113K, a threshold often seen as the dividing line between bullish and bearish momentum. Maintaining this threshold typically signals demand is strong enough to absorb ongoing selling pressure. However, failure to stay above this level—especially after trading higher for six months—suggests demand is weakening.

Over the past two weeks, Bitcoin has struggled to close weekly candles above this key level, increasing the risk of further weakness ahead. If this phase persists, the next significant support lies near the realized price for active investors at around $88K. This metric reflects the cost basis of actively circulating supply and has typically marked deeper correction phases in previous cycles.

Short-term Holder Pressure

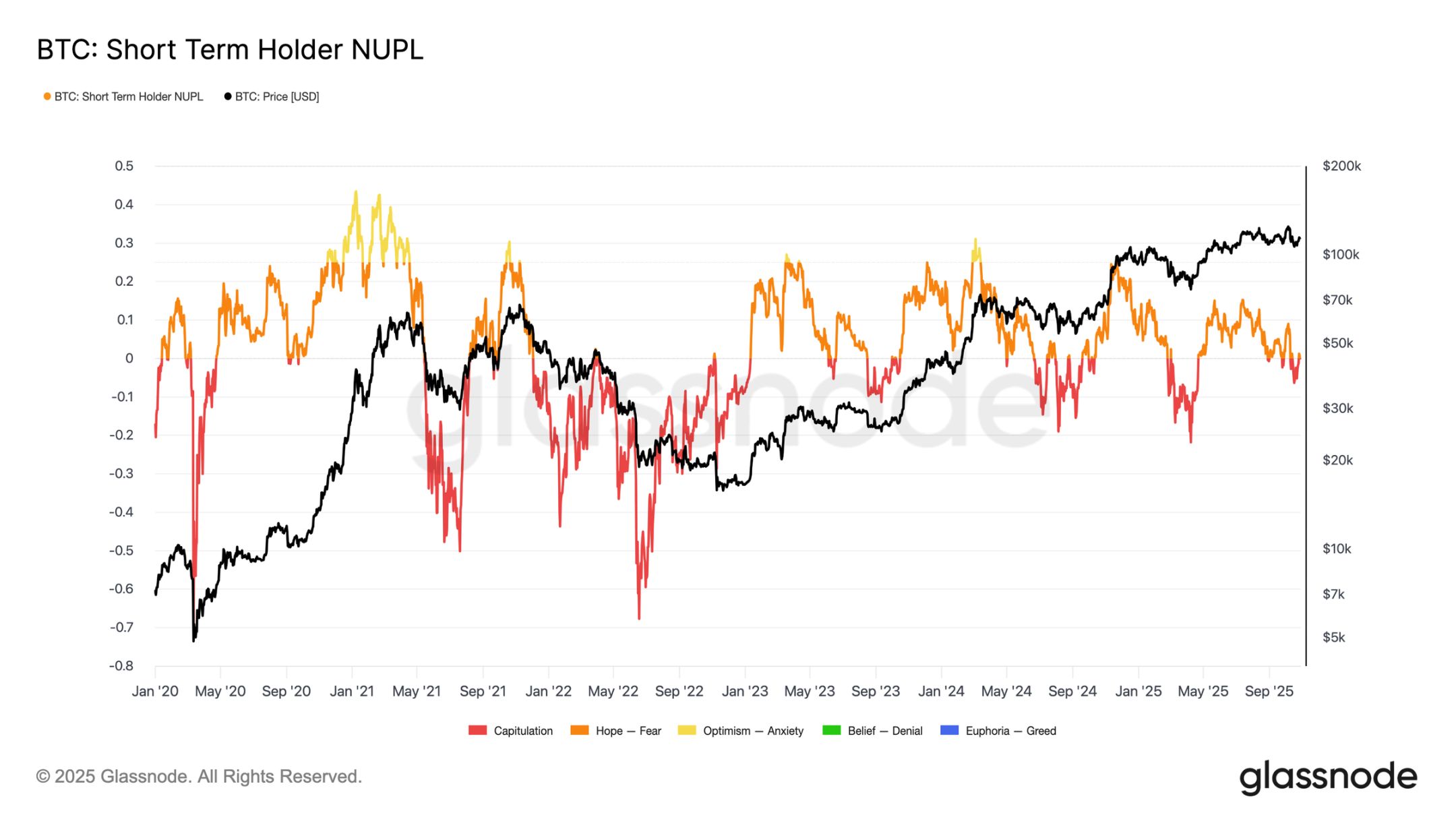

Extending the analysis to investor sentiment, further market weakness is likely to be driven by short-term holders, who are now top buyers exiting at a loss. The short-term holder Net Unrealized Profit/Loss (NUPL) indicator helps assess this pressure by measuring the proportion of unrealized profit or loss relative to market cap.

Historically, deeply negative values coincide with capitulation phases before market bottoming ranges form. The recent drop to $107K pushed short-term holder NUPL to -0.05, a mild loss compared to the typical -0.1 to -0.2 range during mid-cycle bull market corrections or below -0.2 at deep bear market lows.

As long as Bitcoin trades within the $107K to $117K top buyer cluster, the market remains in a delicate balance—not fully capitulated, but with conviction gradually eroding, increasingly unfavorable for the bulls.

Long-term Holder Selling

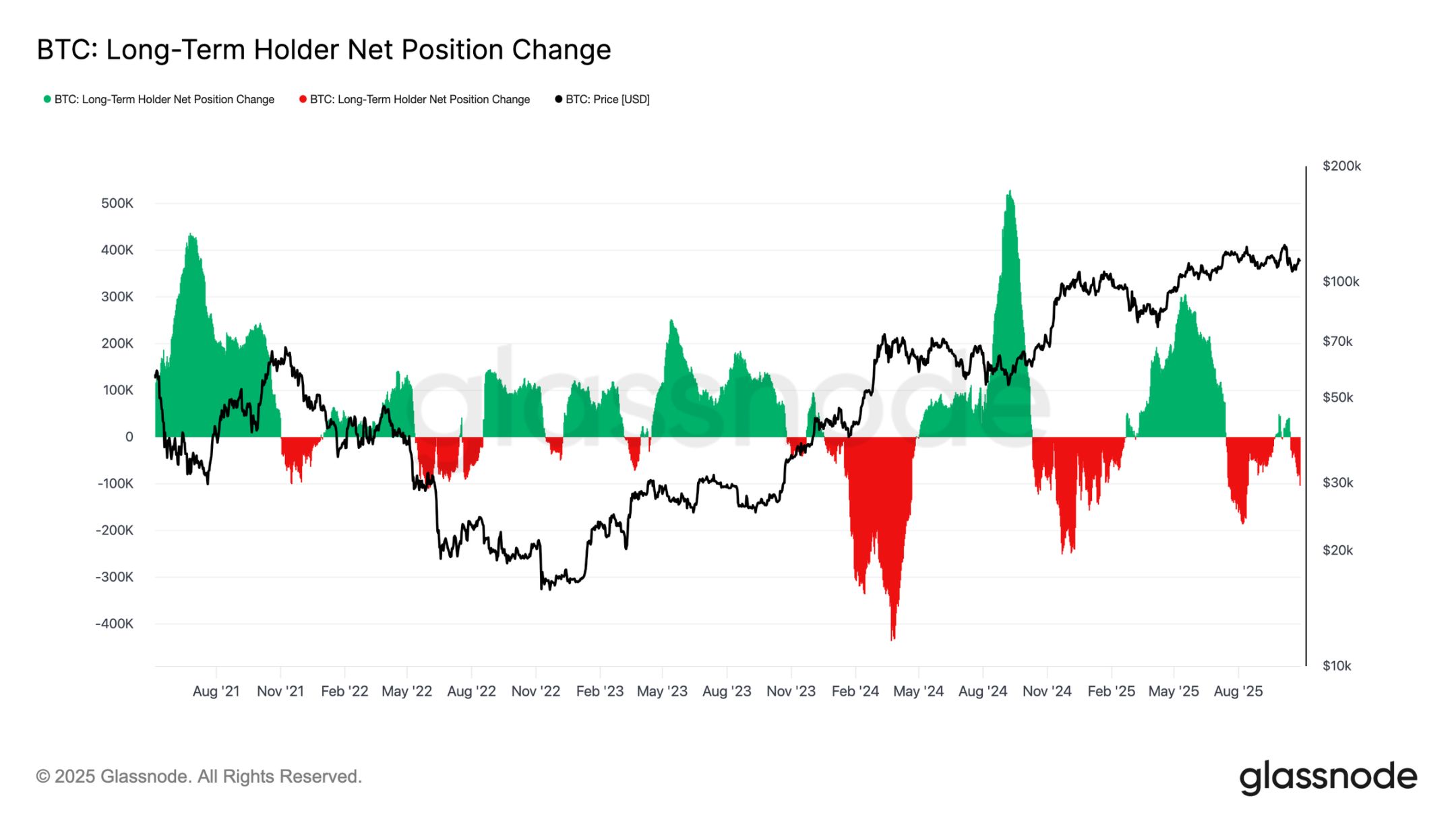

Based on previous observations, ongoing selling by long-term holders continues to weigh on market structure. The long-term holder net position change has dropped to -104K BTC per month, highlighting the most significant wave of selling since mid-July.

This sustained selling pressure aligns with broader signs of exhaustion in the market, as experienced investors continue to realize profits amid weakening demand.

Historically, major market expansions have only begun after long-term holders shift from net selling to sustained accumulation. Thus, a return to net positive inflows for this group remains a key prerequisite for restoring market resilience and laying the foundation for the next bull phase. Until this shift occurs, long-term investor selling is likely to continue weighing on price action.

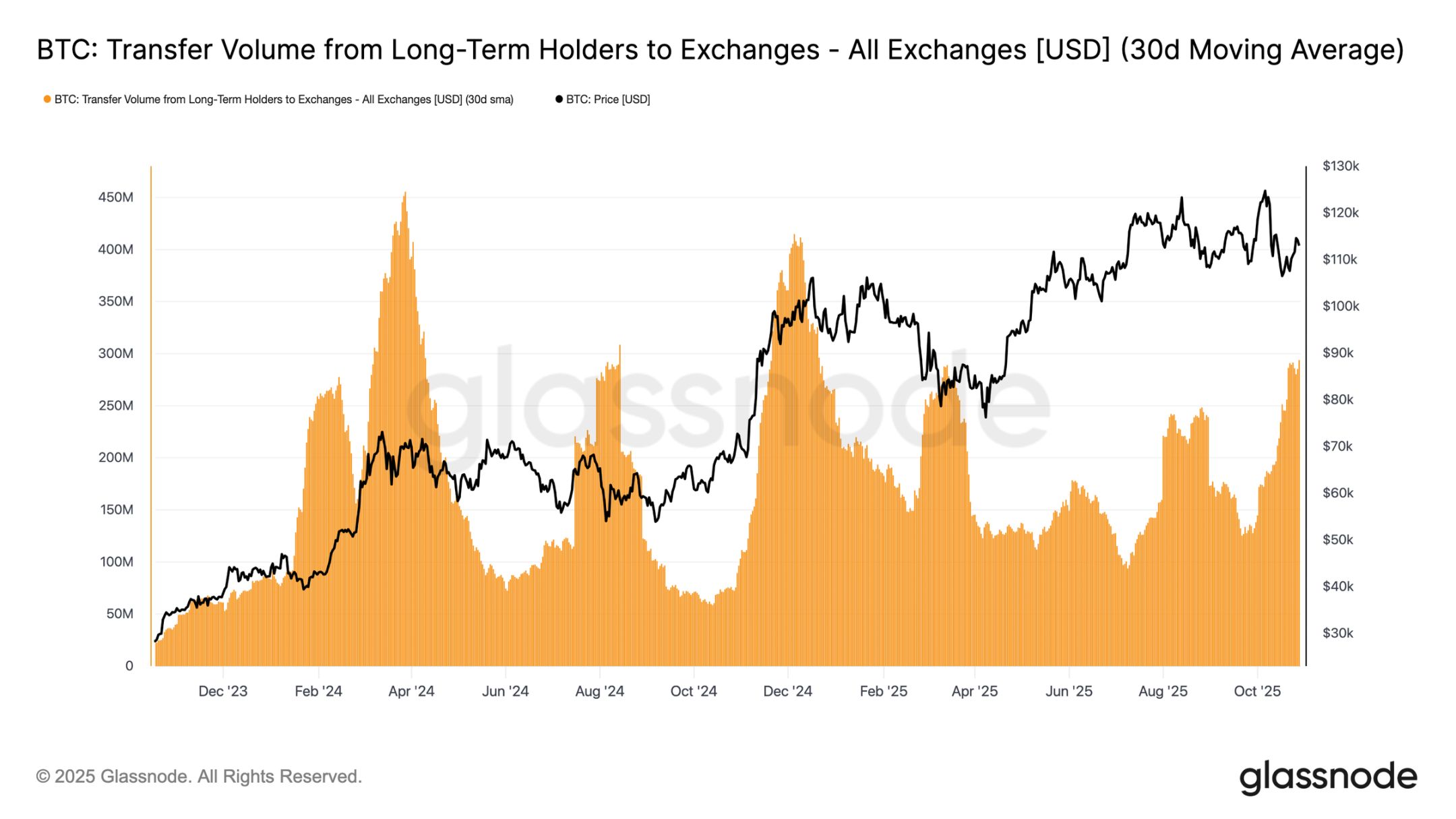

To gauge the intensity of long-term holder selling, we can look at the volume of long-term holder transfers to exchanges (30-day simple moving average), which captures the value of tokens moved by experienced investors for potential sale. This metric has surged to about $293 million per day, more than double the typical $100 million to $125 million benchmark seen since November 2024.

Such high transfer activity indicates long-term investors are consistently realizing profits, adding to ongoing selling pressure. The current pattern is very similar to August 2024, a period marked by aggressive long-term holder spending while price momentum was slowing. Unless this transfer flow subsides, spot demand will struggle to absorb the ongoing selling, leaving the market vulnerable to further cooling in the coming weeks.

Off-chain Insights

Options Market Cools Down

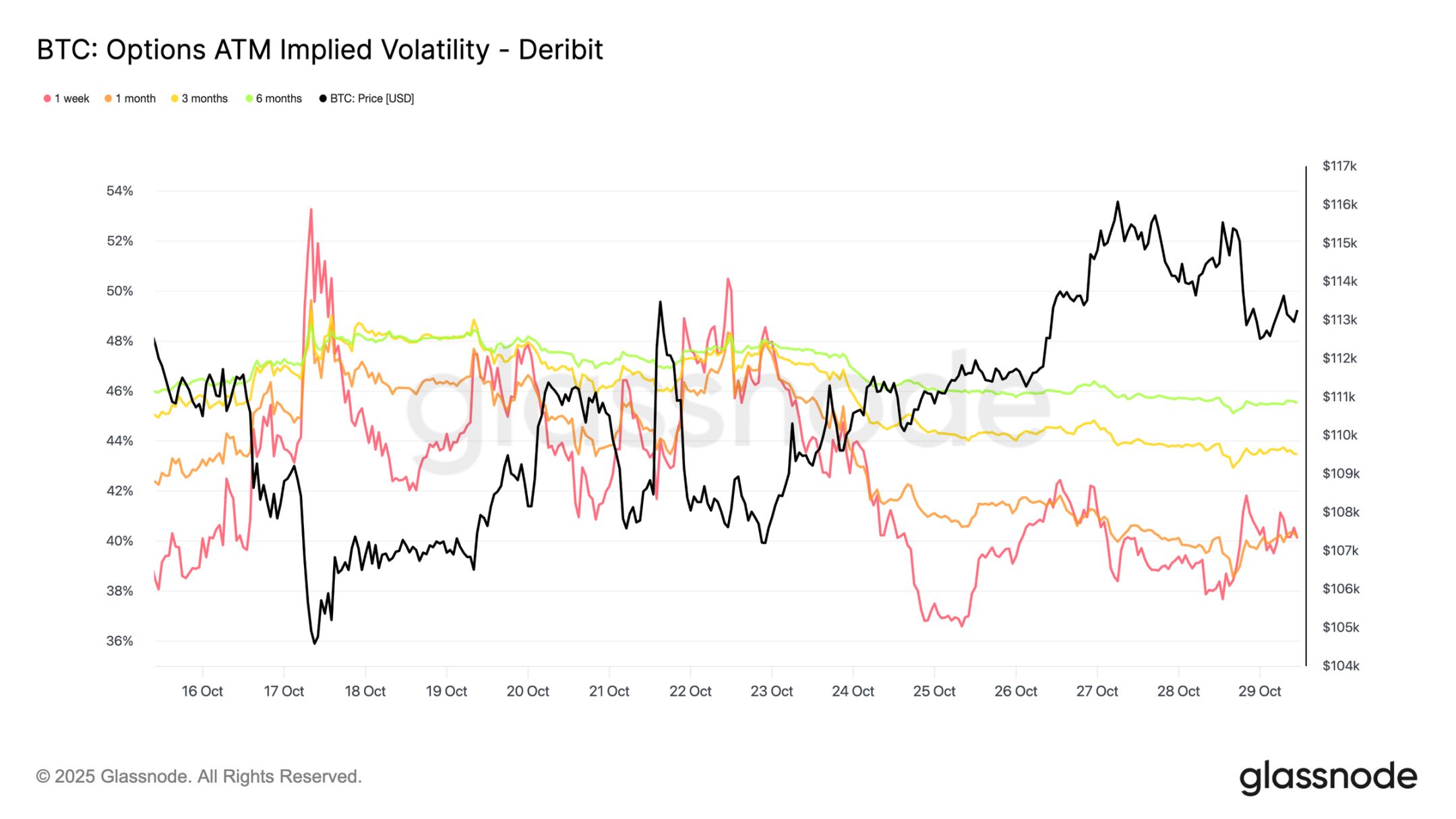

Turning to the options market, recent data shows that volatility pressure has continued to ease since the October 10 crash. Bitcoin's 30-day realized volatility has dropped to 42.6%, down slightly from last week's 44%, reflecting calmer price action. Meanwhile, implied volatility, representing trader expectations, has fallen even more sharply as participants unwind downside hedges and reduce protection demand.

Shorter-dated contracts have seen the largest adjustments, with 1-week at-the-money implied volatility dropping by more than 10 volatility points to around 40%, while 1-month to 6-month tenors have only slipped 1-2 points, holding near the mid-40% range. This flattening of the term structure suggests traders expect fewer near-term shocks.

The curve also suggests that expected volatility will slowly climb to around 45% over the coming months, rather than spike abruptly.

Skew Resets Lower

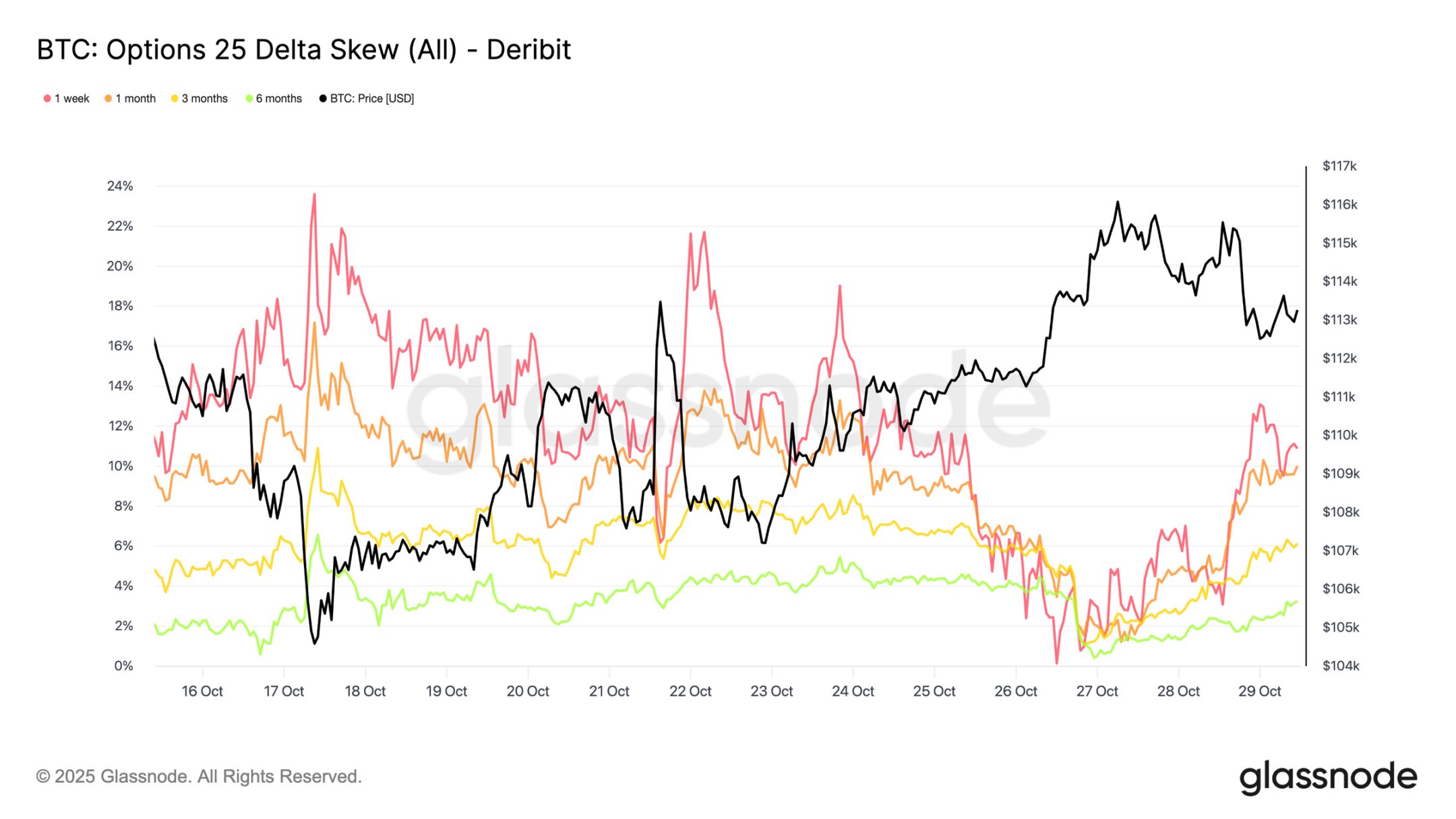

The easing in implied volatility has also translated into a significant shift in 25-Delta skew, which measures the relative cost of puts versus calls. Positive skew indicates a premium for put options. After the October washout, 1-week skew spiked above 20%, signaling extremely strong demand for downside protection. Since then, it has collapsed to neutral levels, with only a slight rebound but much less intensity.

Longer-dated contracts, such as 1-month and 3-month tenors, have also sharply reset, showing only modest put premiums. This shift suggests traders have removed most of their downside hedges. Positioning is now closer to "mildly bullish/two-way" rather than "panic new lows," consistent with the broader stability seen in Bitcoin's recent price action.

Selective Bullish Positioning

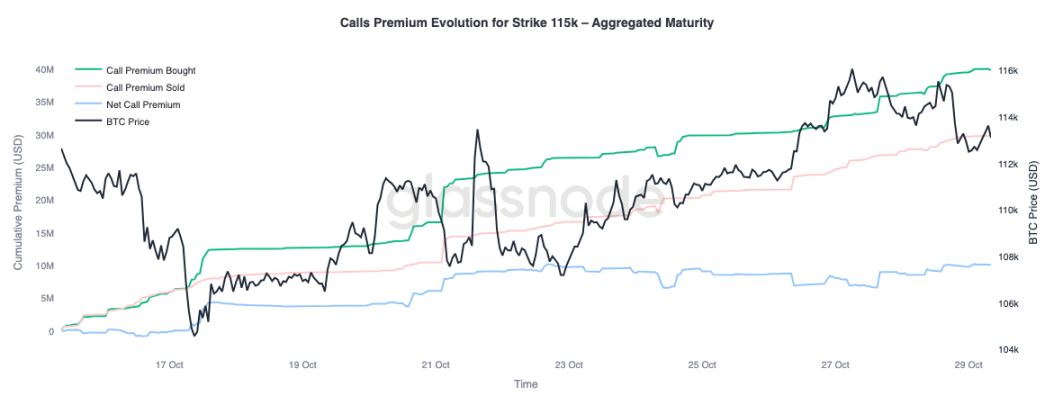

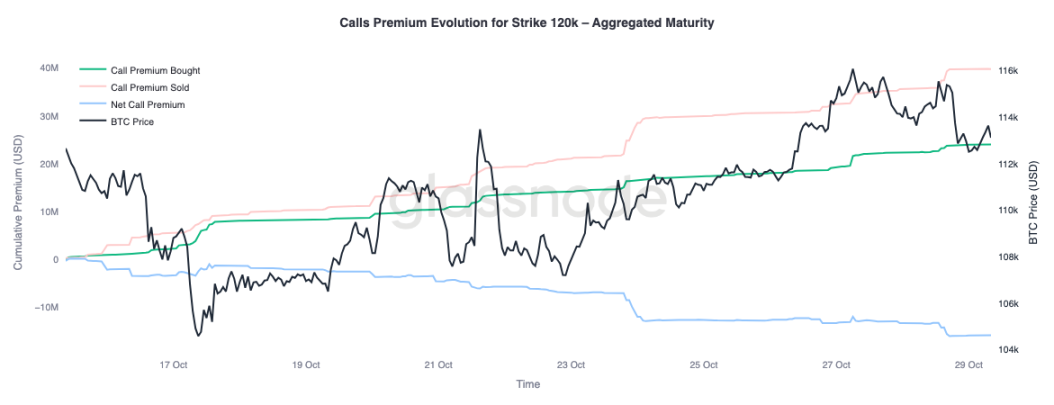

As skew normalizes, attention turns to where traders are allocating premium. Call option activity now varies significantly by strike price. At the $115K strike, net call premium remains positive, indicating traders continue to pay for near-term upside as prices have recovered over the past two weeks. In contrast, at the $120K strike, sold call premium exceeds bought, resulting in a net negative premium.

This setup reflects a "mild rebound, not a full breakout" stance. Traders are willing to pay for gains closer to spot, but finance these positions by selling calls at higher strikes. The resulting bullish call spread structure suggests a cautiously optimistic view—seeking to participate in further upside but lacking conviction for a full retest of all-time highs.

Market Prices in Controlled Pullback

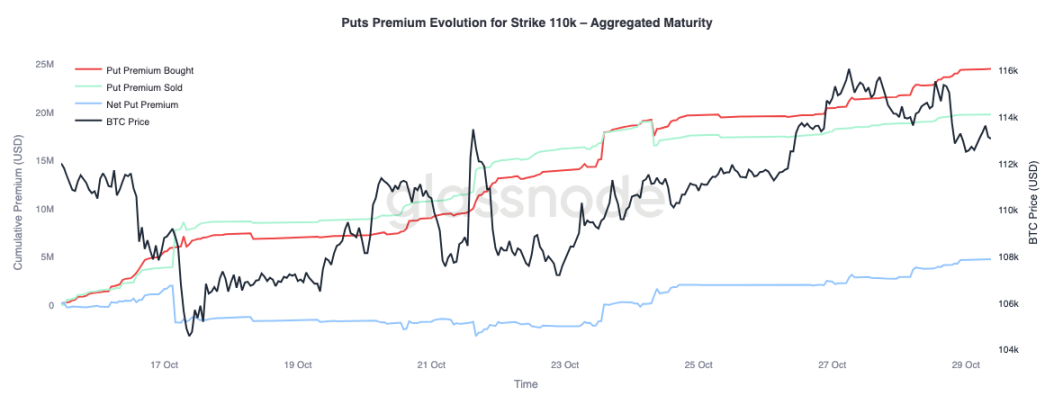

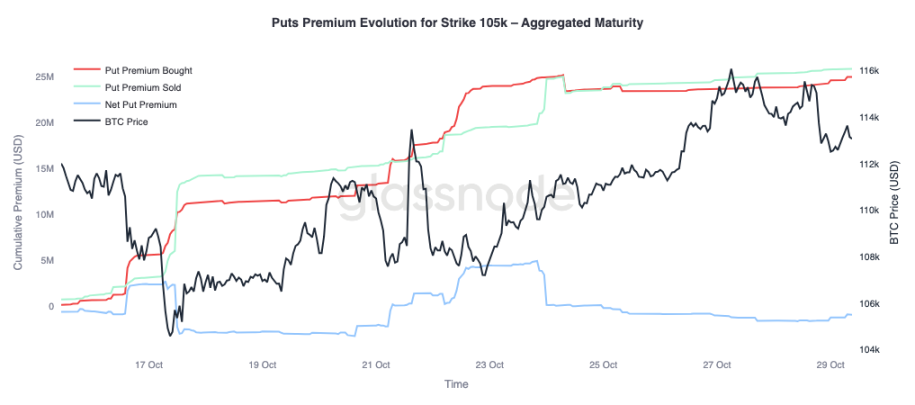

To complete the overall picture, we can turn to the put side of the market. Since October 24, as Bitcoin pushed higher, traders have been buying $110K puts, indicating a demand for near-term downside protection. Meanwhile, $105K puts have been more aggressively sold, suggesting participants are happy to collect premium by providing insurance at this deeper strike.

This contrast highlights a market expecting a shallow pullback rather than another major liquidation wave. Traders seem to believe consolidation near current levels is likely (hedging at $110K), but see a full break below $105K as less probable. Overall positioning supports the view that the worst of October's deleveraging is over, with the market now focused on range trading and volatility harvesting rather than defensively hedging against another sharp selloff.

Conclusion:

The on-chain landscape continues to reflect a market in correction and recalibration. Bitcoin's failure to hold above the short-term holder cost basis highlights waning momentum and continued selling pressure from both short- and long-term investors. Increased long-term holder selling and high transfer volumes to exchanges underscore a phase of demand exhaustion, suggesting the market may need extended consolidation to rebuild confidence. Until long-term holders shift back to accumulation, upside recovery may remain limited.

Turning to the options market, front-end implied volatility has dropped sharply, skew has normalized, and options flows now reflect controlled upside exposure and measured downside hedging. Structurally, the crypto options market appears to be transitioning from crisis mode to rebuilding mode, indicating improved stability.

However, the next major catalyst is imminent—the Federal Reserve meeting. Rate cuts are largely priced in, meaning a dovish outcome will likely keep volatility suppressed and skew balanced. Conversely, if the Fed delivers a smaller cut or maintains a hawkish tone, short-term implied volatility could spike again, and 25-Delta skew could widen as traders rush to buy back protection. In essence, the current calm is conditional—stable for now, but fragile if the Fed deviates from expectations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Payroll: The Future of Salary Payments

XRP Pattern Resembles Pre-2017 Surge, Hinting at Breakout Potential

Bitcoin Faces Sell Warning, but Market Bulls Aren’t Backing Down

Ethereum Price Analysis: Traders Eye Breakout Toward $5,000 as Momentum Builds