Fed's One-Two Punch: Continues 25 Basis Point Rate Cut + Ends Balance Sheet Reduction in December, Two Voters Dissent Rate Decision

Trump's "appointed" board member Milan, like last time, advocated for a 50 basis point rate cut, while another committee member, Smith, supported holding steady.

Original Title: "Fed Unleashes Combo: Continues 25 bps Rate Cut + Ends Balance Sheet Runoff in December, Two Voters Dissent on Rate Decision"

Original Author: Dan Li, Wall Street News

Key Points:

· The Fed has cut interest rates by 25 bps for the second consecutive time, in line with market expectations.

· The Fed's balance sheet runoff, which lasted for three and a half years, has come to an end. Starting in December, it will replace maturing MBS holdings with short-term Treasury bills.

· Of the two FOMC voters who dissented on the rate decision, one was Milian, a newcomer "handpicked" by Trump, who advocated for a 50 bps rate cut like in the previous meeting, while Esther George, President of the Kansas City Fed, supported keeping rates unchanged.

· The statement reiterated that the decision to cut rates was due to a "shift in the balance of risks," changing the wording from "recent" data indicators to "available" ones. It also added that recent labor market indicators were in line with pre-government shutdown trends and mentioned that the downside risks to employment have "increased over the past few months."

· "The New FedSpeak": The Fed continues to work to prevent the recent moderation in job growth from worsening, but the lack of economic data has made the future rate path murky.

The Fed, as expected by the market, continued its rate-cutting actions while deciding to abandon quantitative tightening (QT) and ending the balance sheet reduction plan a month ahead of schedule.

On Wednesday, October 29, in the post-FOMC meeting statement, the Fed announced that it would lower the target range for the federal funds rate from 4.00% to 4.25% to 3.75% to 4.00%, a 25 bps cut. Following the first rate cut earlier this year at the last meeting, this is the Fed's first consecutive second rate cut in a year.

The rate cut decision was completely in line with investor expectations. As of the close of this Tuesday, CME tools showed that the futures market predicted a 99.9% probability of a 25 bps rate cut by the Fed this week and a 91% probability of another 25 bps cut at the December meeting. This indicates that the market has almost entirely priced in expectations for a total of three rate cuts this year. The rate outlook announced after the September FOMC meeting showed that most Fed policymakers expected the number of rate cuts this year to increase from the two announced in June to three.

Similar to the previous two meetings, at this meeting, the Fed's decision-making body still did not reach a consensus on rate actions. Two FOMC voters, including the newly appointed Milian, a Federal Reserve Board Governor appointed by US President Trump, dissented on the 25 bps rate cut decision, highlighting the ongoing internal divisions within the Fed. Unlike before, this time there were disagreements on both the magnitude of the rate cut and whether to continue the action.

The Federal Reserve has announced this time that it will end its balance sheet reduction, or QT, from December, but this was not unexpected. Two weeks ago, Federal Reserve Chair Powell hinted at stopping the balance sheet reduction, stating that banks' reserve levels remain plentiful, and the reduction might come close to the necessary level in the next few months. An article from Wall Street News this week mentioned that most Wall Street banks such as Goldman Sachs and JPMorgan expect the Fed to announce the end of the balance sheet reduction this week due to recent signs of liquidity stress in the money markets.

Following the release of this decision statement, senior Fed reporter Nick Timiraos, known as the "new Fed communication agency," wrote:

"The Fed once again lowered interest rates by 25 basis points, but the lack of data has made the future direction unclear."

"The Fed has cut interest rates for two consecutive meetings, continuing efforts to prevent the recent slowdown in employment from worsening. In the process of undoing the Fed's aggressive rate hikes, the easiest part may have already been done, and Fed officials are discussing the magnitude of the next rate cut. Due to the government shutdown causing data gaps, this tricky task has become even more complex."

Three and a Half Years of Balance Sheet Reduction Comes to an End Short-Term Treasuries to Replace Maturing MBS Holdings

The main difference in this post-meeting decision statement compared to the previous one is the adjustment to the balance sheet reduction.

The statement no longer reiterates that the Fed will continue to reduce its holdings of U.S. Treasuries, agency debt, and agency mortgage-backed securities (MBS), but explicitly states:

"The (FOMC) Committee has decided to end the reduction of its aggregated securities holdings as of December 1."

This means that the Fed's balance sheet reduction will come to an end after three and a half years.

The Fed began its balance sheet reduction on June 1, 2022, and last June began to slow the pace of reduction, lowering the maximum monthly reduction of U.S. Treasuries from $350 billion to $250 billion. In April of this year, it further decelerated, lowering the monthly reduction cap for Treasuries to $50 billion and keeping the redemption cap for agency debt and agency MBS at $350 billion per month.

The monetary policy decision execution notice released by the Fed on Wednesday shows:

For U.S. Treasuries held that mature in October and November, the Fed will extend the principal amount exceeding the $50 billion monthly limit through sales, starting from December 1, all principal amounts of held Treasuries will be extended through sales.

For agency debt and agency MBS holdings maturing in October and November, the Fed will extend the principal amount exceeding the $350 billion monthly limit, starting from December 1, all principal payments for these agency securities will be reinvested in Treasury securities.

This means that, following the December halt to the balance sheet reduction plan, the Fed's MBS principal redemptions will be reinvested in short-term U.S. Treasuries, replacing maturing MBS holdings with short-term Treasuries.

Regarding the decision to halt the balance sheet reduction, Timiraos notes that Fed officials have long stated that they would stop the balance sheet reduction once signs emerged in the overnight loan market that banks' excess cash holdings were no longer significantly abundant. Over the past week, these signals have become more apparent. The Fed will begin replacing maturing bond holdings with short-term Treasuries starting in December.

Voting Dissent: Mester Pushes for 50 Basis Point Cut, Schmid Supports Status Quo

The second significant difference in this Fed decision statement is the FOMC voting results. The number of dissenting votes in this round is one more than the previous one, matching the count from the meeting before the one in July.

The voting results show that Chairman Powell and ten other voting members supported another 25-basis point rate cut. Among the two dissenters, temporary Fed board member Mester, who was appointed shortly before the September FOMC meeting, stuck to the aggressive rate-cutting stance from the previous meeting and still advocated for a 50-basis point cut. Kansas City Fed President Schmid dissented because he supported keeping rates unchanged.

This is a stark contrast to the voting scenario in the FOMC meeting at the end of July. At that time, two members dissented against the decision to pause rate cuts. The two dissenters—Fed board member Waller and Trump-nominated Vice Chair for Banking Supervision Bowman—both favored a 25-basis point rate cut.

Bob Michele, Global Head of Fixed Income at J.P. Morgan Asset Management, commented that Powell is losing control of the Fed. A "persuasive" leadership figure is needed at the Fed. Trump may have to insert Treasury Secretary Mnuchin into the Fed to advance Trump's own rate policy views.

Labor Market Indicators Align with Pre-Shutdown Trends, Employment Downside Risk Increases "In Recent Months"

Another difference in this Fed decision compared to the previous one is reflected in the description of the economic situation. The adjustments mainly reflect the delayed release of various economic data due to the ongoing federal government shutdown since October.

The previous statement began by reiterating that "recent indicators point to slower growth in the first half of the year," while this time it replaces "recent" with "available" and states:

"Available indicators suggest that economic activity is expanding at a moderate pace."

The previous statement stated, "Job gains have been slowing, the unemployment rate has inched up but remains low, and inflation has been rising but is still somewhat below high levels." This time, the statement adds a time limit to the description of the labor market and inflation trends, and additionally points out that recent labor market indicators are consistent with trends reflected in data released before the government shutdown. The statement reads:

「This year, job growth has slowed, the unemployment rate has ticked up slightly, but remains low as of August; more recent indicators are also consistent with these trends. The inflation rate has risen since the beginning of the year, remaining somewhat elevated.」

The above new statements are in line with Powell's remarks from two weeks ago. At that time, he stated: 「Based on the data we have seen, it is fair to say that since our meeting in September four weeks ago, the employment and inflation outlook appears to have changed little.」

Similar to the previous statement, this statement also indicates that the decision to cut rates was made 「in light of the shift in the balance of risks.」

This statement once again reiterates that the FOMC is focused on the two aspects of risks facing its dual mandate of achieving full employment and price stability, roughly following the assessment of increased downside risks to employment from the previous statement, with the only difference being the addition of a time qualifier for this risk change.

This statement no longer states, as it did last time, that the FOMC 「judges that the risk of employment downturn has increased,」 but rather states that 「(FOMC) committee is monitoring the risks to its dual mandate and has judged that the risk of employment downturn has increased in recent months.」

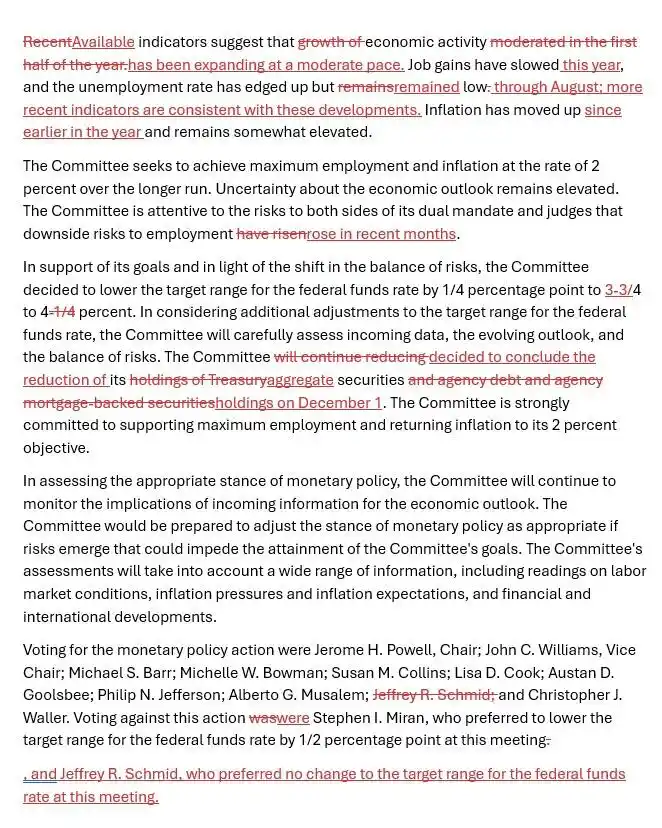

The following highlighted text shows the deletions and additions in this decision statement compared to the previous one.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump Calls Xi Meeting “Amazing” After Tariff Talks in Seoul

Institutional Bitcoin Sales Top $398M, Market Watches Closely

Brazil Central Bank Eyes Bitcoin Reserves in Policy Shift

Michael Saylor’s Bitcoin Profit Tops $1.77 Billion