Ethereum LTH Selling In October Hits 3-Month High — What’s Next for Price?

Ethereum’s long-term holders offloaded major positions in October, triggering selling pressure and stalling price growth as ETH hovers near $4,000 awaiting a breakout signal.

Ethereum closed October with limited price growth as long-term holders (LTHs) significantly reduced their positions, triggering bearish pressure across the market.

As November begins, the market awaits signs of renewed confidence among ETH holders.

Ethereum Holders Show Skepticism

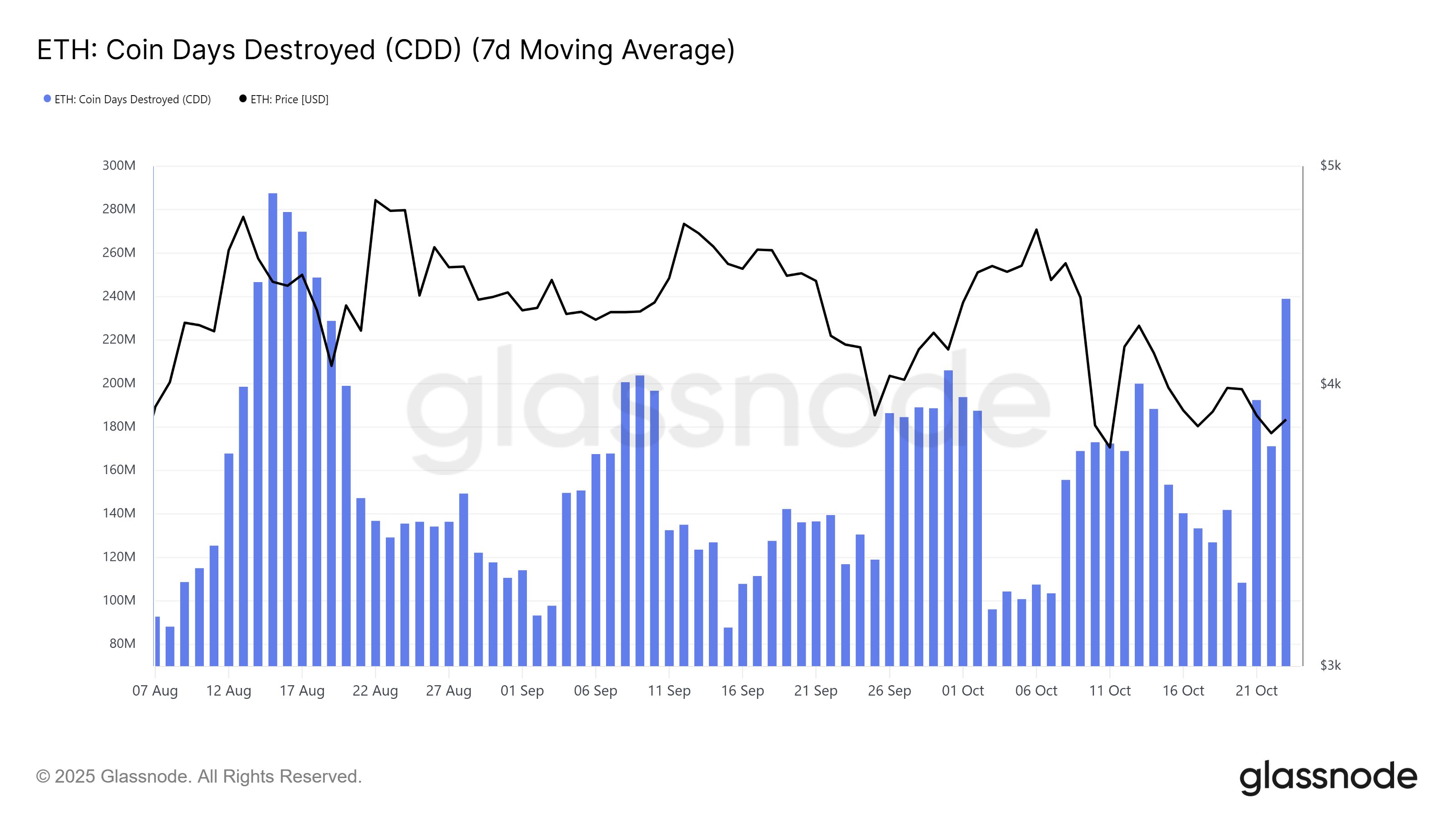

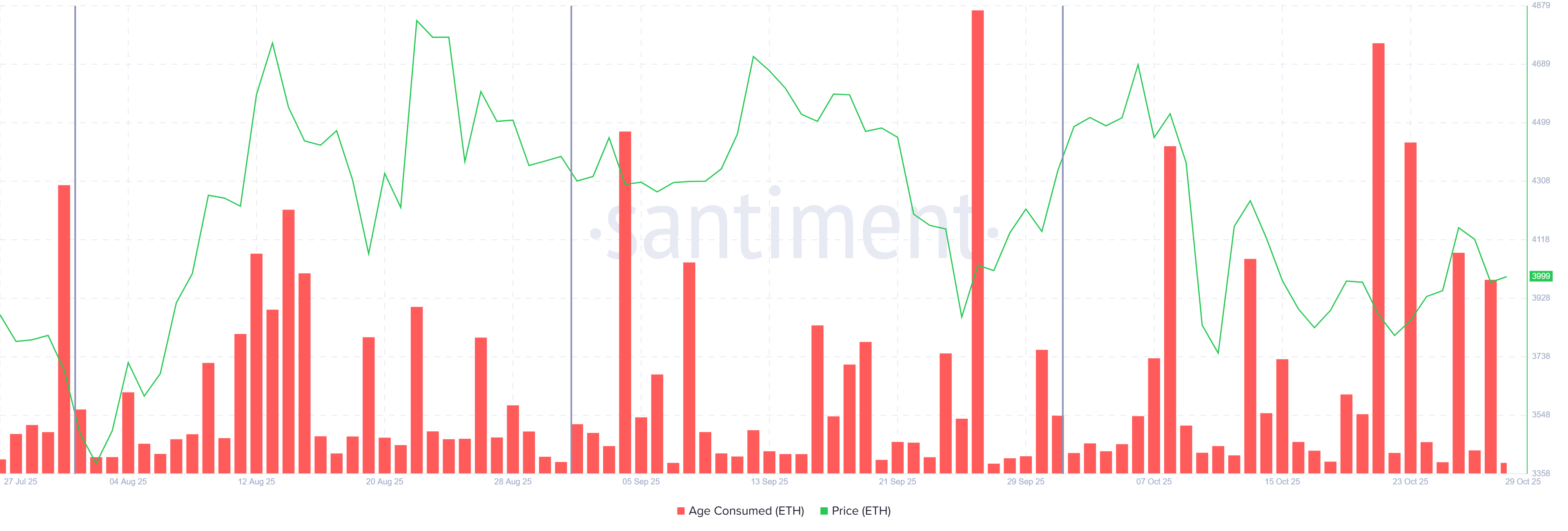

The Age Consumed metric reveals that October witnessed Ethereum’s largest wave of long-term holder activity since July. Spikes in the metric indicate that older coins were moved or sold, often signaling increased selling pressure from experienced investors. The cumulative activity in October far exceeded that of the prior two months, highlighting a notable lack of conviction among LTHs.

This sharp rise in selling reflects growing uncertainty over Ethereum’s near-term performance. Many holders appear to have taken profits amid stagnant price action, likely contributing to the lack of upward momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Ethereum CDD. Source:

Glassnode

Ethereum CDD. Source:

Glassnode

On-chain data shows that Ethereum’s network activity followed a similar pattern. The number of new addresses grew steadily through most of October but dipped sharply during the final week.

This decline suggests that investor interest weakened as prices failed to move decisively higher, highlighting short-term market fatigue. However, this slowdown may prove temporary. If new addresses and network participation rebound in November, Ethereum could see renewed inflows of liquidity.

Ethereum Age Consumed. Source:

Santiment

Ethereum Age Consumed. Source:

Santiment

ETH Price Needs Investor Support

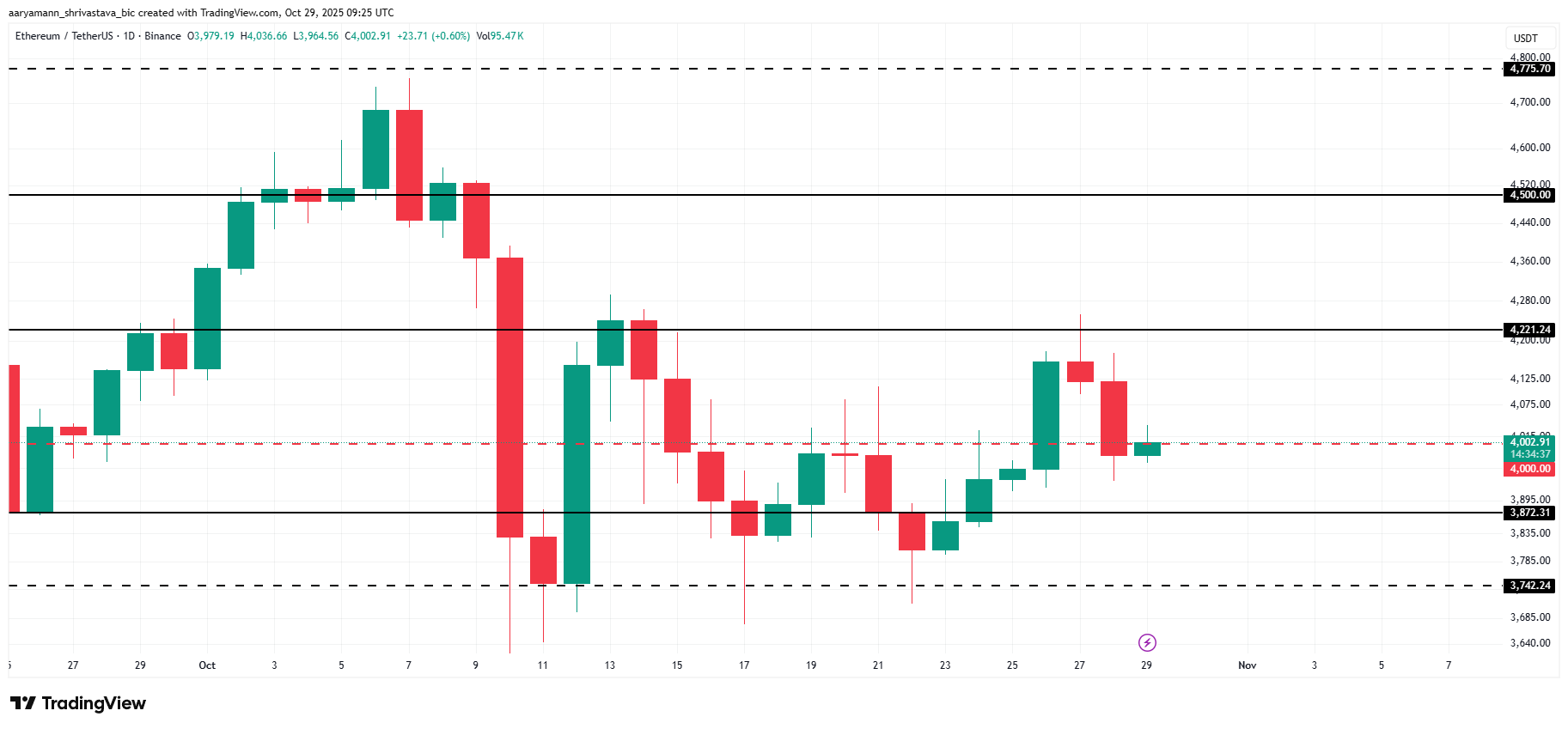

At press time, Ethereum price is at $4,002, maintaining a narrow range around the psychological $4,000 level for nearly three weeks. The inability to reclaim higher levels highlights the impact of ongoing selling and weak investor confidence.

In the near term, ETH could attempt to test the $4,221 resistance level. Yet, without stronger market conditions, it may remain confined between that resistance and the $3,742 support.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

Should the broader environment improve, Ethereum could break above $4,221 and target $4,500. A sustained rally toward $4,956—its previous all-time high—would invalidate the bearish outlook and restore market optimism.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Trending news

MoreBitget Daily Digest (Nov 24) | Total Crypto Market Cap Rebounds Above $3 Trillion; Michael Saylor Posts “Won’t Surrender,” Hinting at Further Bitcoin Accumulation; Bloomberg: Bitcoin’s Decline Signals Weak Year-End Performance for Risk Assets, but 2026 May Have Growth Momentum

Following the attack, Port3 Network announced it would migrate its tokens at a 1:1 ratio and burn 162.7 million PORT3 tokens.