Federal Reserve Lowers Interest Rates, Ends Balance Sheet Reduction

The Federal Reserve cut rates by 25 bps to 3.75–4.00% and ended QT early, signaling cautious easing amid rising labor market risks.

The Federal Reserve lowered its benchmark interest rate by 25 basis points to 3.75–4.00% on Wednesday, marking its second rate cut this year.

The central bank said economic growth remains moderate while job gains have slowed and unemployment has edged up. Inflation, however, remains “somewhat elevated,” keeping the Fed cautious about further policy easing.

Fed Balances Inflation and Labor Market Risks

The decision also confirmed that the Fed will end quantitative tightening on December 1, effectively pausing its balance sheet reduction earlier than expected.

The statement highlighted growing downside risks to employment, a shift from prior meetings that focused mainly on inflation.

The Fed said it will assess future policy “based on incoming data” and the “balance of risks” to its dual mandate.

Chair Jerome Powell and most committee members backed the move, while two dissented. Stephen Miran supported a deeper 50 bps cut, citing weaker job data.

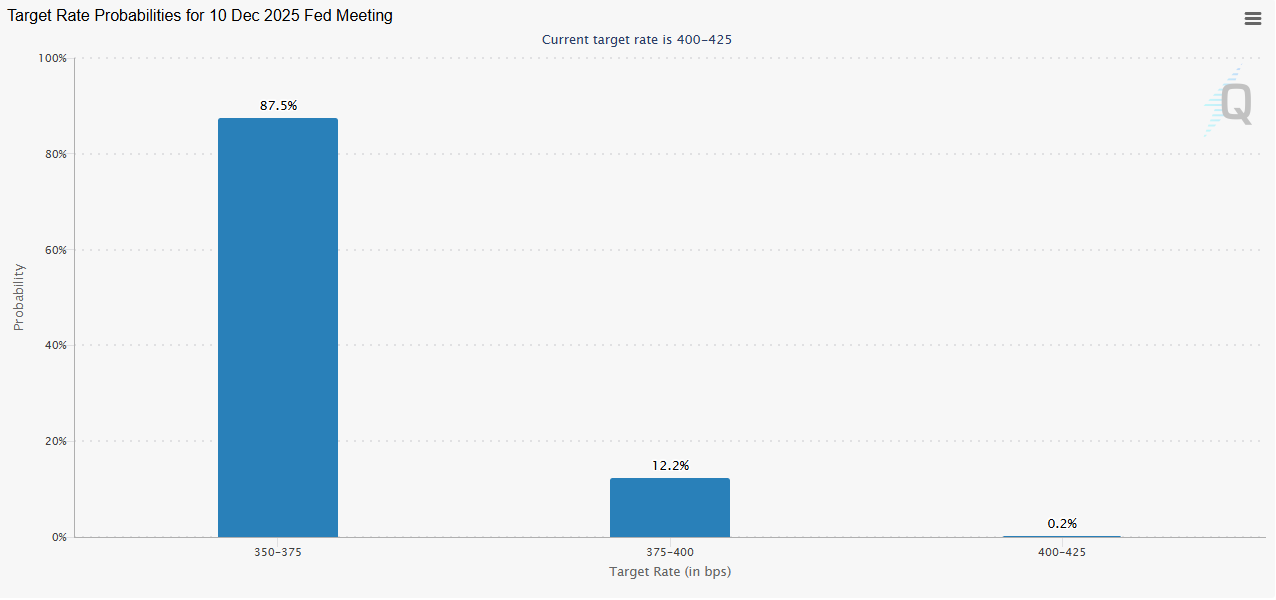

Market Expectations For December Rate Cuts. Source:

Market Expectations For December Rate Cuts. Source:

Economic Context

Available indicators show that growth continues at a moderate pace, but key labor measures are softening. The unemployment rate remains low, though the Fed acknowledged it has risen slightly since the summer.

Inflation has picked up since early 2025, reinforcing concerns that prices could stay above the 2% target longer than expected.

Futures markets now price a 70% chance of another 25 bps cut in December.

However, Powell is expected to stress a data-driven approach at the press conference.

Outlook for Crypto Markets

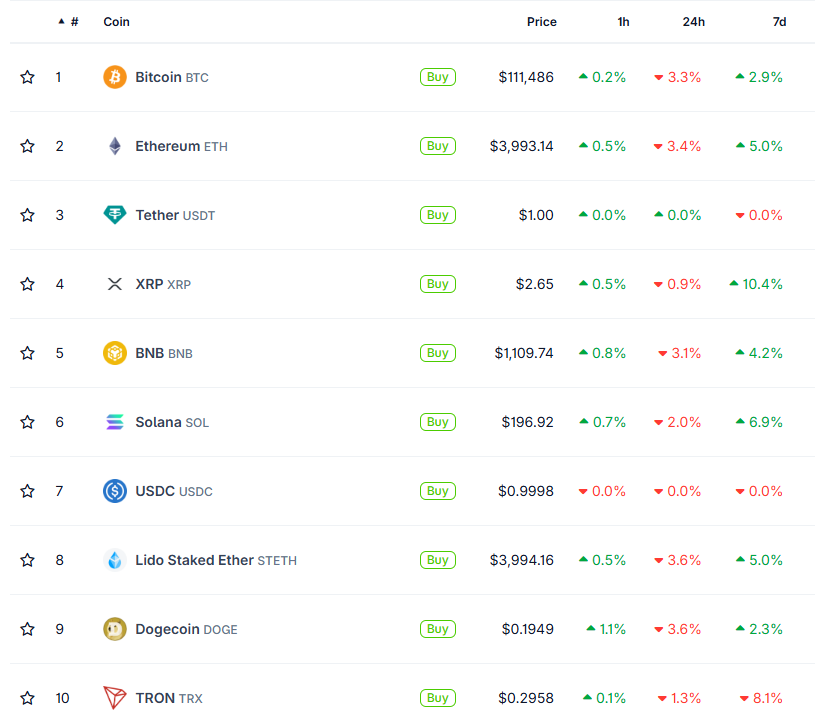

The policy shift may bolster risk appetite in the short term. Bitcoin and major altcoins often benefit when liquidity expands and bond yields fall.

Major KOLs such as MicroStrategy’s Michael Saylor and Robert Kiosaki earlier predicted Bitcoin price to go beyond $150,000 by the end of 2025.

However, persistent inflation could limit broader enthusiasm. If inflation expectations rise again, risk assets—including crypto—may face renewed pressure from stronger dollar flows.

Crypto Market Remains Unresponsive To the Expected Rate Cuts. Source:

Crypto Market Remains Unresponsive To the Expected Rate Cuts. Source:

Analysts say the balance between easing and inflation will define the next phase of the crypto market.

Sustained liquidity support could lift Bitcoin above key resistance levels, while a hawkish tone in December may reverse those gains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hotcoin Research | Fusaka Upgrade Approaching: Analysis and Outlook on Ethereum Long and Short Positions

This article will review Ethereum's recent performance, provide an in-depth analysis of the current bullish and bearish factors facing Ethereum, and look ahead to its prospects and trends for the end of this year, next year, and the medium to long term. The aim is to help ordinary investors clarify uncertainties, grasp trends, and provide some reference to support more rational decision-making during key turning points.

Crypto Market Surges as Bitcoin Rebounds and Privacy Coins Shine

In Brief Bitcoin rebounded over the weekend, testing the $86,000 mark. Privacy-focused altcoins Monero and Zcash showed notable gains. Total market value surged, crossing the $3 trillion threshold again.

Trending news

MoreBitget Daily Digest (Nov 24) | Total Crypto Market Cap Rebounds Above $3 Trillion; Michael Saylor Posts “Won’t Surrender,” Hinting at Further Bitcoin Accumulation; Bloomberg: Bitcoin’s Decline Signals Weak Year-End Performance for Risk Assets, but 2026 May Have Growth Momentum

Following the attack, Port3 Network announced it would migrate its tokens at a 1:1 ratio and burn 162.7 million PORT3 tokens.