TeraWulf seeks $500 million in new private offering for HPC expansion.

- Company expands funding for HPC infrastructure.

- The offer includes convertible bonds until 2032.

- Google increases exposure to TeraWulf.

Bitcoin mining company TeraWulf Inc. (WULF) announced a new private offering. The plan involves a $500 million issuance of senior convertible bonds maturing in 2032. The structure also allows initial purchasers to acquire up to an additional $75 million in bonds, increasing the total potential fundraising. The proceeds will be primarily used to develop a new data center complex in Abernathy, Texas, as well as to meet general corporate needs.

These convertible bonds allow the company to attract capital without a direct and immediate impact on shareholder dilution. However, they increase financial leverage, especially during tighter market periods. TeraWulf highlighted that the expansion in Abernathy will be one of the largest ever undertaken by the company in the United States, complementing its current low-carbon mining and high-performance computing (HPC) operations in New York and Pennsylvania.

Despite the news, WULF's shares fell by about 5% after the announcement, reflecting investor concerns about rising debt. Even so, the company continues to strengthen its strategy of transitioning from exclusively Bitcoin mining to a hybrid infrastructure model focused on artificial intelligence.

Earlier this month, TeraWulf revealed a $9,5 billion joint venture with Google-backed Fluidstack to provide advanced computing capabilities focused on AI. The announcement triggered a roughly 25% increase in the company's stock price on the day of the disclosure. Previously filed documents indicate that Google's pro forma stake in TeraWulf has increased to 14%, resulting from a $3,7 billion, 10-year deal.

The company also expanded its large-scale financing strategy with plans to raise $3 billion in debt, revealed in September, to accelerate the expansion of data centers in North America. The growing market interest in AI computing infrastructure has supported TeraWulf's positioning as a relevant player in this segment.

Despite reporting a net loss due to high investment, the mining company showed a 102% year-on-year increase in revenue in May, demonstrating that its investment in the HPC sector is helping to expand its revenue streams beyond Bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Hampshire Delays Crypto Mining Bill After Backlash

New Hampshire postpones crypto mining bill following Senate split and strong public opposition.Public Concerns Lead to PauseLawmakers Seek More Clarity

Bitcoin falls to $110 while TAO and ZEC surge.

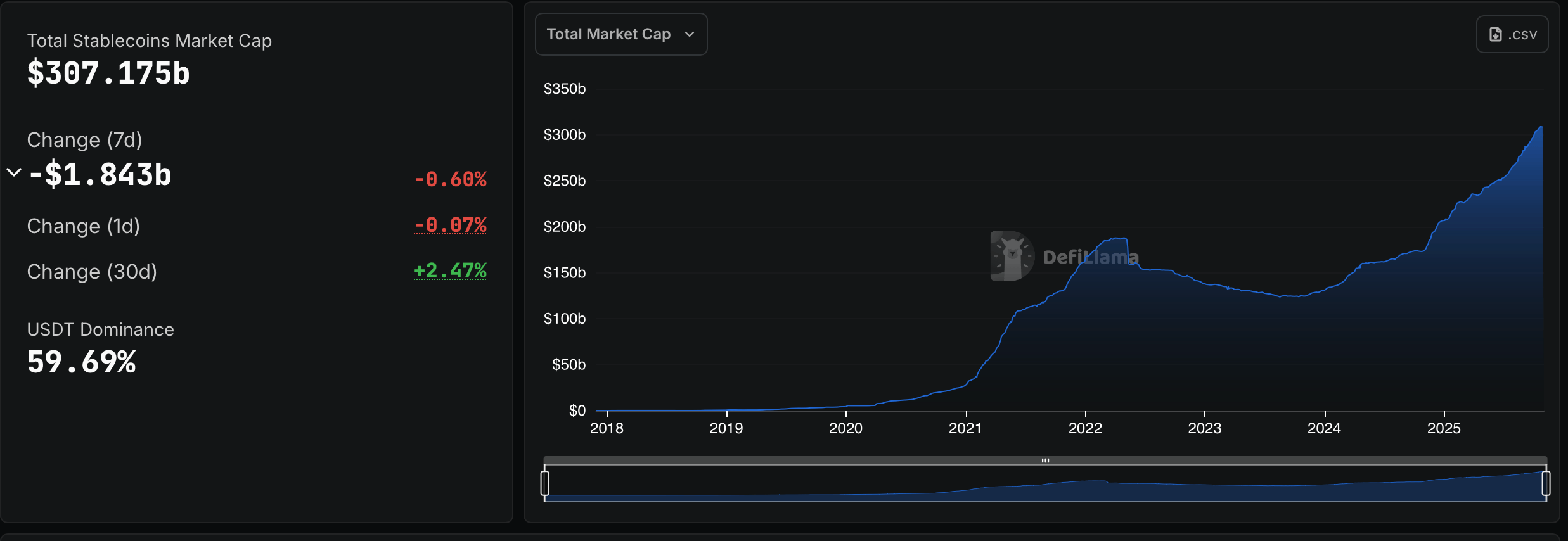

Billions on the Move: October’s Winners and Losers in the Stablecoin Market

Gen Z Overtakes Millennials as India’s Largest Crypto Investor Group: Report