Institutional traders now drive 80% of Bitget’s volume: Report

Singapore-based crypto exchange Bitget has seen an uptick in institutional participation, with institutional traders now accounting for roughly 80% of total volume as of September, according to a report by Bitget in collaboration with blockchain analytics platform Nansen.

The report noted that institutional activity on Bitget’s spot markets climbed from 39.4% of total volume on Jan. 1 to 72.6% by July 30. Futures trading saw an even more dramatic shift, with institutional market makers growing from just 3% of activity at the start of 2025 to 56.6% by late July.

The study identified liquidity as the key measure of institutional adoption in crypto, noting that Bitget’s order-book depth, spreads and execution quality now match peers such as Binance and OKX across major trading pairs.

In financial markets, liquidity refers to how quickly and easily an asset can be traded without causing a significant change in its price.

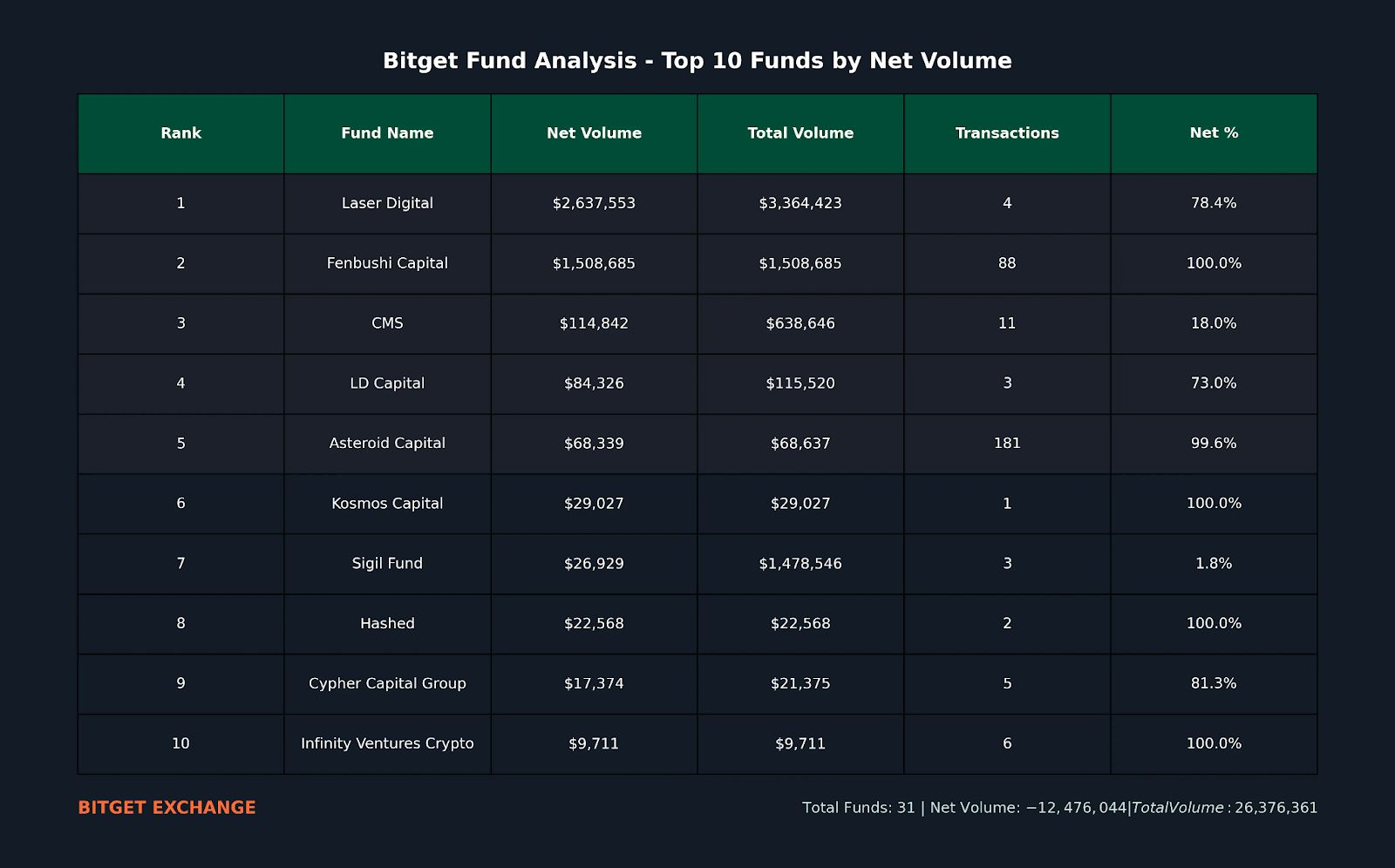

Laser Digital and Fenbushi Capital led institutional inflows on Bitget, accounting for the majority of positive net flows to the exchange, according to onchain data from Nansen.

During the first half of the year, Bitget averaged around $750 billion in monthly trading volume, with derivatives accounting for about 90%. According to the report, institutions make up roughly half of derivatives activity.

In comparison, Binance, the world’s largest centralized crypto exchange, saw its spot trading volume climb to $698.3 billion in July from $432.6 billion in June, an increase of 61% month over month, data from Coingecko shows.

Related: Binance Wallet partners with Bubblemaps to help fight insider crypto trading

Exchanges cater to institutional investors

As institutional adoption of crypto has surged throughout 2025, crypto exchanges are competing for market share in a variety of ways.

In January, Crypto.com announced an institutional trading platform featuring over 300 trading pairs and support for advanced trading strategies tailored to institutional investors, signaling the company’s deeper push into Wall Street.

In September, Binance unveiled a “crypto-as-a-service” platform for licensed banks, stock exchanges and brokerages, giving traditional finance institutions direct access to its liquidity, futures and custody infrastructure.

OKX announced in October a partnership with Standard Chartered to launch a collateral-mirroring program in the European Economic Area, enabling institutional clients to store their crypto assets directly with Standard Chartered’s custody arm.

Magazine: Solana vs Ethereum ETFs, Facebook’s influence on Bitwise: Hunter Horsley

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP's Lack of Movement Spurs Digitap and Avalon X to Emerge as New Payment Challengers

- XRP struggles to recover despite Evernorth's $1B treasury plan, trading 27% below 2025 highs amid bearish technical indicators. - Digitap (TAP) and Avalon X (AVLX) emerge as XRP alternatives, offering faster payments and real-estate tokenization with presale growth exceeding $1M and 100% respectively. - Institutional XRP adoption faces regulatory risks from SEC lawsuits, while Ripple's RLUSD stablecoin gains $789M market cap as a liquidity alternative. - Market shifts toward innovative use cases like TAP

ICP faces the $3.00 psychological threshold: Can this support level remain intact?

- ICP dropped 3.2% to $2.9891 after failing to break above $3.15, triggering technical sell-offs and heightened volatility. - Trading volume surged 290% during the selloff, with prices consolidating below $3.04 support amid bearish momentum. - Market focus remains on $2.97–$3.15 range, with analysts warning of further declines if key support levels collapse. - Broader crypto markets face macroeconomic uncertainties, contrasting with positive earnings in semiconductors and financial sectors. - Traders empha

Hyperliquid News Today: BlockDAG Buzz Faces Questions—Will Presale Triumph Lead to Real-World Adoption?

- BlockDAG's $430M presale and hybrid DAG+PoW architecture position it as a 2025 crypto contender, with 312K token holders and planned Binance AMA fueling listing speculation. - Critics highlight transparency gaps, delayed timelines, and limited security audits (only vesting contracts reviewed), despite 20K+ miners and "Genesis Day" adoption goals. - Competitors like Hyperliquid (ETF filing) and Chainlink ($30 price forecasts) emphasize institutional traction, contrasting BlockDAG's speculative hype-driven

Solana News Update: BONK Faces Turning Point as Bullish Signals Meet Strong Bearish Barriers While Solana Trading Volume Soars

- Solana-based meme coin BONK stabilizes near $0.000014 support, with 71% surge in trading volume above seven-day average amid market rebound. - Technical indicators show conflicting signals: RSI near 40 suggests fading bearish momentum, while MACD bullish crossover sparks short-term optimism. - BONK's Solana infrastructure and $3B ecosystem revenue position it as a key meme coin, contrasting with FLOKI/PEPE's similar but less institutionalized trajectories. - Market remains divided on $0.0000143 breakout